Summary:

- JinkoSolar’s financial growth, innovative technology, and global reach make it a compelling investment in the solar panel manufacturing industry.

- The company has demonstrated impressive financial performance, with significant revenue growth and improved margins.

- JinkoSolar’s technological edge, particularly with its N-type TOPCon cell and Tiger Neo module, reinforces its position as a leader in the industry.

Editor’s note: Seeking Alpha is proud to welcome Alexander Gordon as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

KE ZHUANG

Background

I believe that JinkoSolar Holding Co., Ltd.’s (NYSE:JKS) financial growth, innovative technology, and global reach serve to reinforce my “Buy” rating, while the geopolitical importance of their industry will serve to insulate the stock from “China-shocks” seen in other Chinese equities. Jinko Solar demonstrated a strong Q3 financial result, with earnings and profits up considerably, yet without a corresponding increase in share value. Despite an initial focus on China, the company produces a wide variety of high-efficiency residential and commercial solar panels with a diverse production base located across China, Malaysia, Vietnam, and most recently, America.

JinkoSolar has also extended its technological edge over the competitors following a highly successful and lucrative N-type TOPCon cell and Tiger Neo module the company’s expansion into diverse markets, particularly the U.S. and Africa, highlights its ability to take advantage of global opportunities while also maintaining market share in its domestic Chinese markets. Investing in JinkoSolar does pose certain risks, particularly in relation to the rapidly changing technological nature of the industry, geopolitical risks relating to Sino-US disputes, as well as arbitrariness among Chinese regulators. However, I believe these risks to be mitigated due to JinkoSolar’s proven technological edge over their competitors, political friendliness towards solar panel manufacturers in the US as a result of the green energy tradition, and a history of Chinese state support to solar panel manufacturers such as JinkoSolar.

Based on these technological and political factors, I am confident that JinkoSolar’s technological edge, strategic positioning, and consistent financial performance greatly outweigh the risks, making Jinkosolar a compelling investment in the rapidly growing renewable energy industry.

Current Financials

JinkoSolar has demonstrated impressive financial performance and growth, with current revenue generation and future opportunities not reflected in the current stock price. The company reported an EPS of $3.31, surpassing expectations by $2.39, and a revenue of $4.36 billion, a remarkable 59.01% year-over-year increase. JinkoSolar delivered substantial growth in Q3. For example, module shipments increased by 107.9% YoY, and net income rose by 140.7% to $181.4 million. JinkoSolar simultaneously improved its margin from 15.7% to 19.3% despite price cuts, highlighting efficiencies in production and distribution. This financial health is supported by a large increase in demand, particularly in the domestic Chinese market. Installations reached 128.9 gigawatts, representing a nearly 50% YoY increase. This financial robustness is within the context of a rapidly growing sector, with the solar panel projecting a 6.9% CAGR through 2029.

Despite this growth, JinkoSolar maintains a P/E ratio of only 2.83, 87% below the sector median. This incredibly low PE ratio despite sustained and growing profitability indicates company-specific concerns, concerns which I believe are primarily as a result of geopolitical tremors and a general “China-aversion”. While Chinese equities do possess unique risks, I will explain why I believe JinkoSolar to be uniquely insulated from these risks, and why the company deserves a valuation more in line with the US average.

Technological Edge

In addition to their global market reach and diverse production base, JinkoSolar deserves a higher valuation due to its leading role in developing solar technologies, technologies that operate at greater efficiency, reliability, and reach than other currently available products. This technological edge is showcased by successes with its N-type TOPCon cell and the Tiger Neo module. For reference, a typical conversion efficiency for solar panels into energy is around 15-20%. Jinko Solar’s newest N-type cell has an operational efficiency of 25.1%. Meanwhile, Jinko Solar’s Tiger Neo Module is designed to synchronize with the N-type cell, offering a complete, multi-stage product. The Tiger Neo Module is far more reliable than competing competitors, allowing 87.4% of rated power within a 30-year time frame.

Combining these innovative pieces of technology allows Jinko Solar to offer a wide range of services to clients, providing more value at a lower cost to a diverse customer base. The company is on track to exceed its module shipment guidance of 70 to 75 gigawatts by the end of 2023, with N-type modules accounting for about 60% of total shipments. The Tiger Neo module has also gained significant market share, especially in China and the Middle East. Despite a reduction in prices, JinkoSolar has successfully expanded their innovative product offerings into new markets. One notable achievement is the 3.6 gigawatt supply agreement with ACWA Power, leveraging the Tiger Neo’s efficiency and performance under a variety of market conditions. JinkoSolar’s technological edge, product compatibility, and widespread market access further supports a buy rating. In particular, the greater efficiencies and reliability of the new N-type TOPCon cell and the Tiger Neo Module, as well as its presence near growing customer bases serve to position JinkoSolar for future growth and profitability.

Global Reach

I believe JinkoSolar’s physical position well-poses the company for future growth while minimizing geopolitically related risks, with particularly lucrative opportunities in the post-Inflation Reduction Act U.S. market and increasing solar demand in the Middle East. JinkoSolar’s addition of manufacturing sites in the United States with their new facility in Jacksonville, Florida further solidifies the company’s position as a leading player in the solar industry given protectionist measures within America.

In addition to their reach inside the large-and-growing American market, JinkoSolar’s diverse international presence and ability to adapt to local markets is further highlighted by BNN’s article “JinkoSolar: Revolutionizing Solar Technology in Africa“. This article showcases JinkoSolar’s reach into an often-opaque African market, as highlighted by their N-type 66-cell solar panel in 2024 being deployed in places such as Ethiopia, Nigeria, Kenya, South Africa, and Djibouti. Boasting 600W power output and 22.72% efficiency, these developments highlight JinkoSolar’s ability to provide value for an underserved market, as recognized by an award for top solar provider in South Africa by EUPD research.

These developments not only solidify JinkoSolar’s standing as a technological leader but also demonstrate their ability to adapt and innovate in response to regional needs, particularly in a continent with as many unique challenges as Africa. This combination of technological edge and market adaptability underpins my confidence in JinkoSolar as a valuable investment and undeserving of their current price discount.

Potential Risks

Jinko Solar faces several unique risks due to its market and positioning, including rapid technological changes, geopolitics-induced market disruptions, and concerns about the arbitrariness of the Chinese government. However, in JinkoSolar’s case, I believe these risks to be mitigated by several key factors. For example, the solar industry is currently undergoing rapid technological change, potentially leading to disruptions in market-leading positions and unpredictable streams of revenue. However, JinkoSolar’s impressive investments in new innovations, as well as its proven history of developing, marketing, and delivering the most cutting-edge technology places them in a good position to navigate these rapid future changes. In addition, JinkoSolar’s diverse manufacturing and consumer base serves to better insulate it from fluctuating raw material costs.

JinkoSolar also faces unique risks from Sino-US trade disputes, and rising economic nationalism and protectionism across the globe. However, I believe geopolitical risks to be mitigated by the emphasis national governments place on adapting to climate change. For example, President Biden vetoed a bill in May 2023, that would have eliminated tariff waivers for solar panels from four Southeast Asian countries, directly harming solar manufacturers like JinkoSolar. The tariff waivers apply to products made in Vietnam and Malaysia, two countries where JinkoSolar currently has production facilities. The Chinese government has also placed a strong emphasis on promoting renewable energy development, with significant subsidies for solar panel production. Despite significant disagreements between the American and Chinese governments on a wide variety of issues, they have formulated a common policy when it comes to supporting solar panel manufacturers, highlighting the emphasis that both governments place on supporting this growing industry while facilitating the green energy transition.

I also believe investor-related concerns about plant spending to be overblown, especially considering that JinkoSolar must invest in new plants to meet growing demand and expand into new markets. For example, according to this August 2023 Bloomberg article, JinkoSolar stock fell 12% after outlining plans to invest in new plants. However, the same article highlights an incredibly 325% surge in profit due to lower raw material costs and higher demand. Rather than decrease firm value, I believe these new investments will further enhance the company’s ability to provide long-term value for customers, workers, and shareholders.

Despite the risks that come with investing in a China-based company in a geopolitically strategic industry, I believe JinkoSolar’s unique positioning and critical nature mitigates the aforementioned risks, furthering my confidence in the company as a long-term investment.

Valuation

The current average P/E valuation for S&P 500 companies in the Solar sector is 18.26, 645% above JinkoSolar’s current 2.83 ratio. However, JinkoSolar is exposed to unique risks, such as a slight weakening of demand in its domestic market, and the prospect of a less friendly political administration following the 2024 US presidential election. However, even assuming these risks necessitate an extreme discount of 50% from the US average, JKS would still trade at 323% of the current stock price of $28.57, resulting in a conservative target price of approximately $92. This is an estimate still lower than the Even given the average P/E ratio for equities on the Shanghai Stock Exchange of 11.35, these results would still produce a share value of approximately $114. I believe that current price targets that place JKS stock around the $30-$33 range are unfairly penalizing a company with healthy financials and solid growth prospects simply because it is a Chinese company, even considering unique geopolitical and market factors that serve to somewhat insulate JinkoSolar.

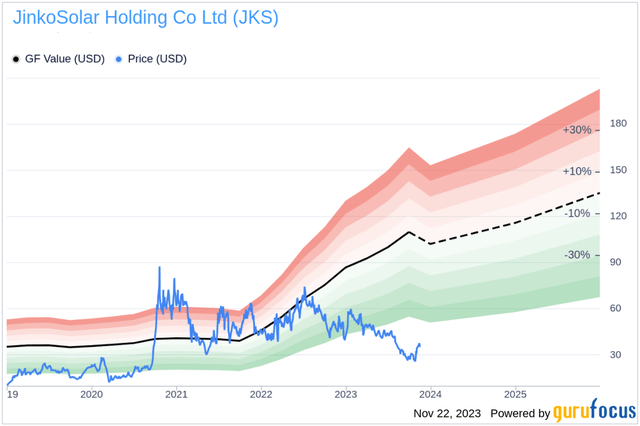

JinkoSolar Projected Share Price (GuruFocus Research)

As a result, I am confident in a long-term valuation of $90-$100 that would place JKS more in line with both the solar sector in the US and domestically traded Chinese equities. JKS was trading at $75 as recently as July 2022 before China-related concerns served to drag down the share price; I remain confident that as the solid financial position and unique technological and political ground occupied by JinkoSolar become more widely appreciated, the share price will revert to my target of $90 per share.

Conclusion

I believe that JinkoSolar’s strong financial performance, cheap valuation, innovative technology, widespread market penetration, and relative resistance to geopolitical risks all serve to solidify my buy rating for JinkoSolar. Current industry growth projections of 6.9% CAGR, as well as highlighting the company’s successful track record of maintaining a technological edge N-type cells and Tiger Neo Module, further reinforce my confidence in this long-term target price. Despite the risks associated with the geopolitically fraught solar industry and occasionally opaque Chinese equities, JinkoSolar’s consistent financial performance and ability to navigate complex and rapidly changing market conditions reinforces my confidence in its long-term growth. I believe that JinkoSolar represents an opportunity for investors seeking a valuable, high-growth equity at a bargain price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.