Summary:

- Demand for solar has increased substantially in the last decade as the price of solar has become more competitive with other energy sources.

- Module prices have declined considerably this year and are expected to decline in Q4 as there is oversupply in some market segments.

- Although it has a low forward P/E, JinkoSolar is a ‘Hold/Sideline’ when factoring in the debt, and the potential for geopolitical tensions and oversupply.

pidjoe

JinkoSolar Holding Co., Ltd. (NYSE:JKS), also known as JinkoSolar, is one of the leading Chinese solar module makers in the world.

In the nine months of 2023, the company shipped over 52 GW of solar modules, ranking #1 in the industry with much of the company’s solar modules made in China.

In terms of guidance, JinkoSolar believes its 2023 module shipments will exceed 70 to 75 GW and that it will have integrated overseas capacity (as in outside of China) of 12 GW or more by the end of 2023.

Making a solar module in China is 50% cheaper than making one in Europe and 65% cheaper than manufacturing one in the United States given China’s manufacturing capability and other factors.

With its economies of scale compared to many competitors, JinkoSolar is pretty competitive, although tariffs make the company’s products more expensive in certain markets such as the United States.

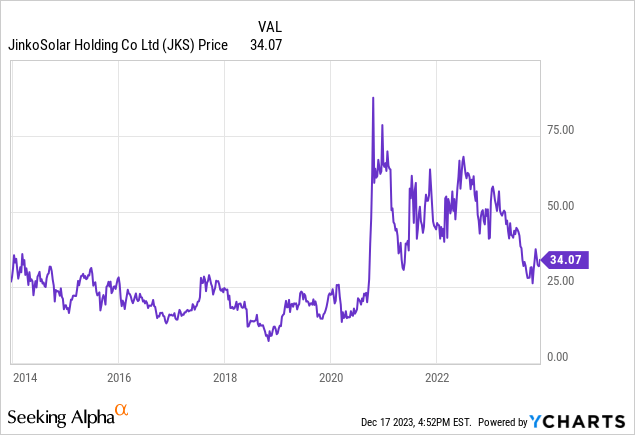

While demand has risen due to the increasing competitiveness of solar, JinkoSolar has faced headwinds given the decrease in the prices of solar modules. As a result, JinkoSolar stock has not performed that well in the last few years.

Solar Demand Growth But Module Price Declines

Thanks to decreases in solar production costs, utility-scale solar PV is the least costly option for new electricity generation in many places around the world.

With the increased competitiveness, the solar market has expanded.

In 2022, solar PV generation increased by 270 TWh, up 26% year over year.

In the first half of 2023, PV installations increased substantially in China by 153%, and in Germany by 102%. In the United States, PV installations rose 34% year over year.

To lower carbon emissions, solar is expected to be in demand in the future.

According to IEA predictions, solar PV’s installed power capacity could surpass coal by 2027 to become the largest energy source in the world. At that time, the IEA predicted solar energy could account for over 20% of all power capacity.

While solar demand has increased, solar module prices have decreased.

According to the SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight report released on December 7, 2023, the average global price of solar modules has decreased 30-40% from the first quarter to the third quarter of 2023.

There is more supply in the future coming online. According to Wood Mackenzie estimates, over 1 terawatt of water, cell, and module capacity will come online by 2024.

Some worry that the increases in supply will eventually cause oversupply.

Oversupply has been a problem in the past, and it could be a problem again at some point in the future if demand does not absorb the supply that’s coming online.

Q3 2023

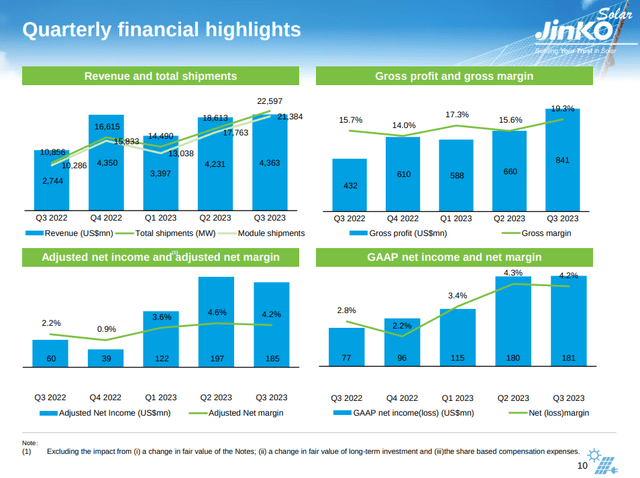

For the third quarter, JinkoSolar benefited from the strong demand for solar this year as quarterly shipments were 22,597 MW, with 21,384 MW for solar modules and 1,213 MW for cells and wafers. Shipments were up 108.2% year over year.

Revenue was $4.36 billion, up 63.1% year over year.

While module prices fell substantially in Q3, JinkoSolar was able to do relatively well in terms of margins. Gross margin was 19.3%, up from 15.6% in Q2 2023 and 15.7% in Q3 2022.

JinkoSolar Investor Presentation

For the quarter, the company had adjusted net income attributable to ordinary shareholders of $184.6 million, up 215.1% year over year. EBITDA was $607.4 million, up 145.9% year over year.

In terms of guidance, management expects module prices to trend lower in Q4 but that ‘the module price will be relatively stabilized’ next year.

Module prices are negatively affected by oversupply, although according to some estimates, market oversupply could affect older production lines more that produce lower efficiency products.

By the end of Q3, JinkoSolar’s mass-produced efficiency of N-type cells reached 25.6%, which is pretty competitive and allows the company to potentially capture more value than lower-efficiency cells.

In the nine months of 2023, N-type module shipments accounted for around 57% and N-type premium continued to exceed the market average.

For 2023, management expects N-type products to be 60% of total module shipments.

In terms of outlook, management expects gross margin to be possibly down quarter over quarter in Q4 given the company might have more exposure to the Chinese market.

In terms of geography, China accounted for around 40% of the company’s shipments in the quarter.

The Inflation Reduction Act should help increase demand in the United States, although there is still a relatively high inventory in Europe. The company is also optimistic about growing solar demand in Saudi Arabia and the Middle East.

Management has Q4 2023 guidance of module shipments of around 23 GW.

Interest Rates

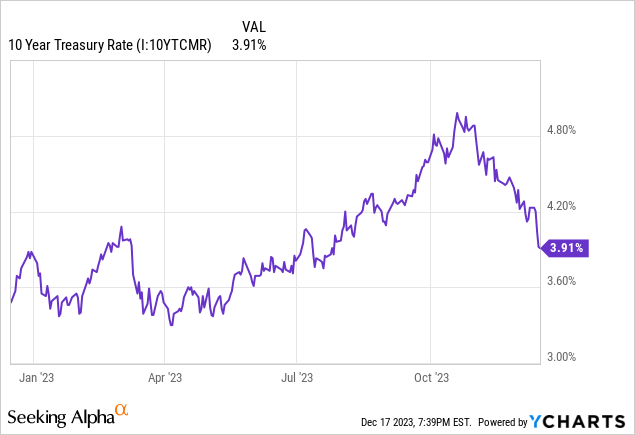

In the past, rising interest rates were a problem as it made developing some solar projects more expensive.

The good news is that many economists expect interest rates to decrease next year although by how much is unclear.

Given the 10-year U.S. Treasury bond reflects to a substantial degree the average interest rate expectation over the course of the bond, it seems interest rate expectations for the future are lower.

Decreasing interest rates I think would be a tailwind for JinkoSolar.

If interest rates decrease, demand for solar panels could increase, all else equal as financing is often a substantial percentage of the overall solar cost.

Valuation

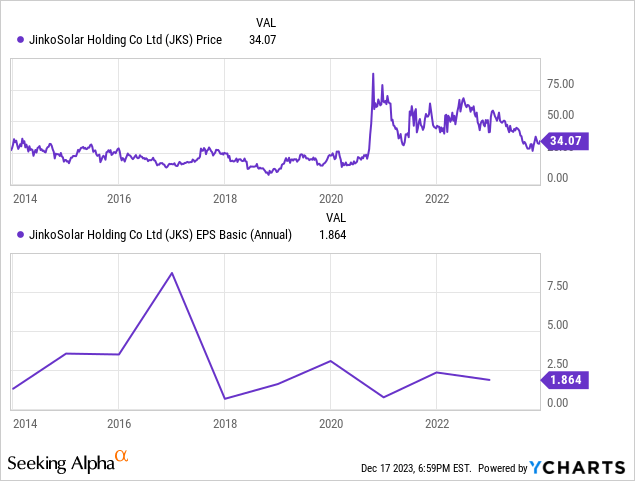

While JinkoSolar has a low forward P/E valuation of 2.8 as of December 17, the company does have debt which isn’t reflected by the forward price-to-earnings ratio estimate.

When incorporating the net debt of $2.29 billion at the end of the third quarter, JinkoSolar has a forward EV/EBITDA ratio of 6.53, which makes the company not as cheap as the forward P/E multiple indicates.

JinkoSolar ultimately makes a pretty commodity product, and as a result, it doesn’t really have much of a moat. Without much of a moat, it is hard to see the company trading for a premium valuation. While likely decreasing interest rates next year is a tailwind, the solar industry nevertheless faces potential oversupply as well.

I do see upside potential for JinkoSolar, however.

One way would be for the company to return capital back to shareholders through a buyback that reduces the shares outstanding considerably rather than just a buyback announcement.

Given China’s government likely wants as much solar production as possible to reduce carbon emissions, this scenario seems unlikely, however, as I think management will use much of the earnings for more capital investment.

JinkoSolar is already returning capital through a dividend where it announced for the first time in the company’s history a dividend of $1.5 per American Depositary Share in September. It remains to be seen if management will maintain the dividend, increase or reduce it.

Another way for management to create value would be to grow and succeed in the PV+energy storage business. JinkoSolar is already a well-known brand in the solar industry and many utilities that buy solar also need energy storage as well. Nevertheless, the energy storage business is a relatively new one, and it remains to be seen how well JinkoSolar can do.

The fact that JinkoSolar stock hasn’t really traded as a function of its earnings is interesting as it means other factors influence the stock arguably more.

One reason for the disconnect could be tensions between China and the United States. If tensions rise, there could be even higher tariffs on Chinese solar panels as a result.

Another reason could be the potential for oversupply that could decrease margins.

From a fundamental perspective, I would say JinkoSolar is trading at a fairly attractive valuation, but I think there is too much uncertainty at the moment.

As a result, I think the stock is a ‘Hold’ or ‘Sideline’.

Given the tensions between China and the United States, I would say it would probably be better to either be on the ‘Sideline’ or to own JinkoSolar as part of a diversified portfolio of stocks that ideally includes many ‘Magnificent Seven’ stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.