Summary:

- Lithium Americas stock is rated a “Buy” with a 24-36 month horizon, driven by oversold levels and Thacker Pass asset potential.

- Macroeconomic headwinds are waning, with global interest rate cuts expected to boost EV sector growth and lithium demand.

- Thacker Pass promises significant cash flow, with fully financed capex and strong offtake agreements, positioning LAC for a substantial rally.

- The potential completion of financing from the U.S. DOE and General Motors by December 2024 is a major stock upside trigger.

Just_Super

Investment Overview

In the last few years, lithium stocks have been a good example of extreme euphoria that’s followed by extreme fear. With accelerated adoption of electric vehicles being the central theme, lithium skyrocketed and so did lithium miners.

However, big investments in lithium mining translated into oversupply. In addition to this, contractionary monetary policies impacted global growth and the EV industry faced growth headwinds. A big meltdown in lithium followed, and lithium stocks have plunged in the last 12 to 18 months.

I strongly believe that the correction in lithium stocks is overdone, and it’s a good time to consider exposure to quality lithium miners. Lithium Americas (NYSE:LAC) (TSX:LAC:CA) is among the best names to consider with an investment horizon of 24 to 36 months.

I initiate Lithium Americas with a “Buy” rating and I believe that the stock is poised for a meaningful rally in the given investment horizon. This thesis focuses on the company’s asset potential and growth financing status. Further, I have discussed the factors that can trigger growth acceleration for the EV industry and potential upside for lithium.

It’s worth noting that Lithium Americas stock has corrected by 58% for year-to-date. I, however, see early signs of the stock bottoming out, with LAC stock remaining largely sideways in the last 2.5 months. In my view, some consolidation is likely at lower levels, followed by a significant rally.

Macroeconomic Headwinds Likely to Wane

Besides the oversupply factor, lithium has plunged as EV adoption has been slower than anticipated. This has impacted the demand for lithium on a relative basis.

One reason for sluggish growth is tight monetary policies and global GDP growth deceleration. The International Energy Agency pointed out in their EV outlook for 2024 that “high interest rates and economic uncertainty” are key risks to EV sales growth.

The good news for the industry is that the world is shifting towards expansionary monetary policies. The Fed has initiated the first rate cut earlier this month, and it’s likely that multiple rate cuts are on the cards in the next 12 months. The European Central bank has also pursued two rate cuts in 2024 to support GDP growth. Additionally, China has unveiled a big monetary stimulus that has already triggered some rally in industrial commodities.

With expansionary monetary policies, it’s likely that loans will get cheaper and will support consumer spending. I must add that a positive impact on GDP growth is unlikely immediately. However, global GDP growth can potentially accelerate in the second half of 2025 or in the first half of 2026. This will be positive for the EV sector and will support demand growth for lithium.

In my view, it does not make sense to wait for demand to pick-up before considering exposure to the broad EV sector. The best time to buy is when sentiments are still significantly negative, and I believe that lithium stocks are deeply oversold.

Lithium Likely to Trend Higher From Oversold Levels

It’s worth noting that lithium prices are down almost 90% from the peak in 2022. I agree that lithium skyrocketing in 2022 was pure euphoria. However, it’s equally true that lithium prices currently reflect extreme panic and I believe that an uptrend is likely.

Of course, I don’t expect the lithium to trade anywhere near 2022 highs. However, a price between $20,000 to $30,000 per metric tonne seems likely in the next 24 to 36 months. This section of the thesis elaborates on the reasons to be positive from current levels.

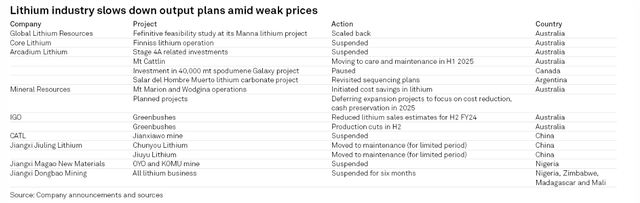

The first point to note is that investment in lithium mines is not sustainable at current prices. Given the supply glut, some of the major lithium miners globally are scaling-back on their investments. The same is indicated in the table below from S&P Global.

The recent decision by China’s largest battery maker, CATL, to scale-back its lithium operations in Jiangxi triggered positive price-action in lithium stocks.

It’s worth noting that even with the current glut, Benchmark Mineral expects lithium surplus to peak in 2027 with deficits by the end of the decade. This is relevant for Lithium Americas with the Thacker Pass project expected to commence first phase of production in 2027. It’s likely that when production commences, lithium prices will be significantly higher from current levels.

Another important point to note is that geopolitical factors are likely to have an impact on lithium supply. Even with the recent slowdown, U.S. demand for lithium is expected to increase at a CAGR of 29% through 2030.

According to Ashley Zumwalt-Forbes, the U.S. Energy Department’s deputy director for batteries and critical materials, “critical minerals are the oil and gas of our energy future.” To reduce dependence on imports, it’s likely that U.S. will continue to support lithium miners.

Recently, the Biden administration announced “awarding over $3 billion to U.S. companies to boost domestic production of advanced batteries and other materials used for electric vehicles.” The key objective is to reduce China’s dominance in battery production for “EVs and other electronics.”

Lithium Americas is also among the beneficiaries and in March 2024, the company announced a conditional commitment from the U.S. Department of Energy for a $2.26 billion loan. These investment commitments underscore my view that the long-term outlook remains bullish for lithium.

Thacker Pass Asset Potential

The bull thesis for Lithium Americas is based on two factors. First, lithium trending higher from oversold levels. Second, the company’s Thacker Pass asset that promises to be a cash flow machine.

I have already discussed the reasons to be positive on lithium over the long term. The focus of the discussion is now on what the Thacker Pass asset can deliver.

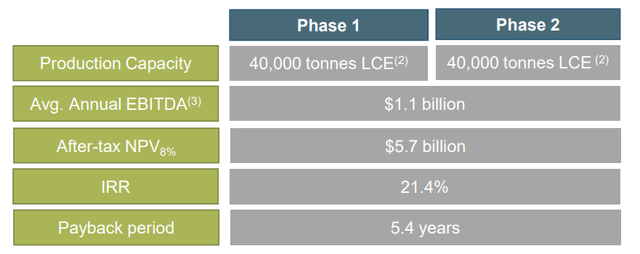

To put things into perspective, Thacker Pass has one of the largest measured and indicated lithium resource in the United States. The project life is 40-years with an after-tax net present value of $5.7 billion. I must add here that Lithium Americas currently trades at a market valuation of $580 million and this is indicative of the potential valuation gap.

I believe that there are two reasons for the deep valuation gap. First, the big meltdown in lithium prices. Second, the fact that the project will start delivering production and cash flows only in 2027 and beyond.

Coming back to the asset potential, and it’s expected that in the first four years, the average annual EBITDA will be $625 million. Further, between year 5 and 40, the average annual EBITDA is estimated at $1.1 billion. These estimates assume that lithium carbonate trades at $24,000 per tonne.

I see this scenario as realistic considering the industry factors discussed. The most important point being that the lithium surplus will peak in 2027 and deficits will return by the end of the decade. With the possibility of $1.1 billion in annual EBITDA, Lithium Americas is indeed a cash flow machine.

There are few more important points to note from a stock upside perspective.

First – Based on the feasibility study, Thacker Pass has a potential cost per tonne of $7,206. Being a low-cost asset, the cash flow potential is significant in a bull-case scenario after 2030 when lithium supply-demand gap widens. I therefore believe that the EBITDA potential beyond 2030 is higher than the current estimate.

Second – Based on revised estimates, the capex for phase one is expected at $2.9 billion. With the potential loan from the U.S. Department of Energy, second tranche of investment by General Motors (GM), and cash in hand, the capex is fully financed.

Third – Lithium Americas has an offtake agreement with General Motors for 100% of Thacker Pass phase one for 15 years. Additionally, GM has the Right of First Offer on Thacker Pass phase two production. The offtake agreement provides clear revenue and cash flow visibility as soon as production commences.

Fourth – The potential loan from the U.S. Department of Energy is at attractive terms. The interest rate will be U.S. Treasury rate with 0% spread. Further, the loan tenor will be 24 years from the first draw. Considering the asset potential, I don’t see concerns related to debt servicing.

Right Time To Buy LAC Stock

The most important question for investors would be why initiate Lithium Americas stock now? What has changed after a significant plunge in LAC stock?

I believe that there are few reasons to be bullish after a deep correction.

First – Interest rate cuts globally will support renewed growth in the global economy and at a lower cost of borrowing, the EV industry is likely to witness deliveries growth acceleration.

Second – After a crash of almost 90% from highs, I expect lithium to consolidate and trend higher. This is likely to be positive for deeply oversold lithium stocks.

Third – Lithium Americas anticipates that most of the capital investment for the first phase ($2.93 billion) will be incurred in 2025 when the project ramps-up to peak construction. If the progress through 2025 is as per the timeline, it’s likely that LAC stock will trend higher.

Fourth – In August 2024, Lithium Americas provided an update on the second tranche of investment by General Motors. According to the press release, the company “continues to work closely with the DOE and expects to close the DOE Loan and additional GM investment by the end of the year.” If the deal with the DOE and GM are closed by December, it’s likely to be a catalyst for a big rally.

Macroeconomic factors are therefore supportive, and Lithium Americas is moving towards construction ramp-up. Once the funds are received, LAC stock is likely to rally.

Concluding Views

From a valuation perspective, the best indicator is the after-tax net present value of $5.7 billion.

Investor Presentation May 2024

The current market valuation of $580 million looks miniscule. Of course, the reason is lithium price meltdown as the after-tax NPV is considering lithium carbonate price at $24,000 per tonne. However, my view is that when production commences in 2027, lithium is likely to be near the prices used to estimate the NPV.

It’s also worth noting that Lithium Americas stock trades at a forward price-to-book value of 0.63, which is lower than the sector median of 2.

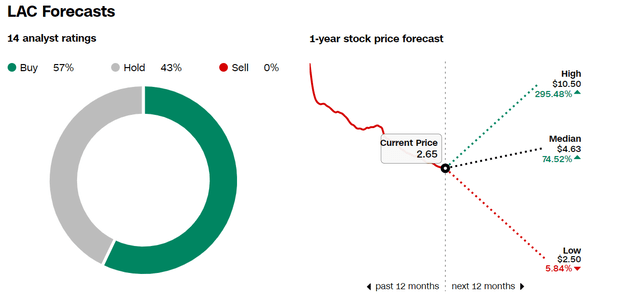

I strongly believe that the downside risk to the thesis is limited after a big correction. Besides the reasons outlined, it’s worth noting that 14 analysts have a 12-month median price target of $4.63 for LAC stock. This would imply an upside of 74.5% from current levels.

The most bearish price target is $2.5, which implies a correction of 5.84% from current levels. Therefore, the downside is capped, and the upside potential is significant.

I believe that there is some execution risk at this point. Lithium Americas is betting on closing the financing from the DOE and GM by December. If that’s delayed, the company’s plans to ramp-up construction in 2025 will be impacted. Further, there can be a potential impact on commercialization in 2027. Therefore, the closure of financing is the biggest catalyst in the next few months.

Overall, Lithium Americas stock is a potential value creator with an initial investment horizon of 24 to 36 months. Some exposure can be considered at current levels and it makes sense to increase exposure once the financing deal is completed by December 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.