Summary:

- Lucid Group’s deliveries and revenue have grown, but they fall short of early guidance, reflecting a reset of expectations amid a challenging macro environment.

- The company faces significant cash burn, with a negative free cash flow of $41.3 million in the recent second quarter and a constricted liquidity runway.

- Continuous funding from Saudi Arabia’s PIF is crucial, but future infusions are at risk due to potential shifts in oil prices and Saudi economic policies.

- Despite a liquidity runway of over a year, I maintain a sell rating on LCID due to ongoing financial challenges.

Khosrork

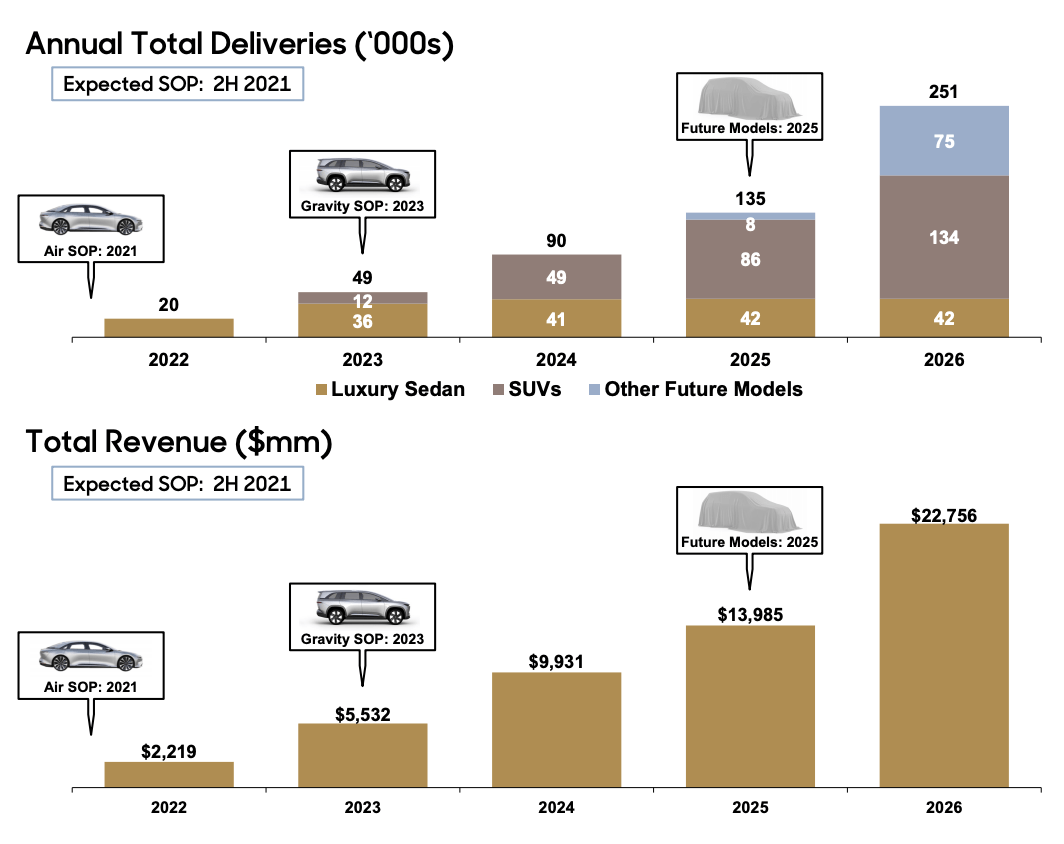

Lucid Group, Inc. (NASDAQ:LCID) went public in 2021 with the intent to dislodge Tesla, Inc.’s (TSLA) dominance of the then fast-growing market for electric vehicles in the US. I covered this, highlighting that the animal spirits that had driven the start-up to trade on a valuation that would grow to $104 billion, greater than the combined market cap of Ford Motor Company (F) and General Motors Company (GM), were unhinged. It’s not hard to see why enthusiasm was so strong when looking at LCID’s early guidance for deliveries and its future model roadmap. While the company’s fiscal 2024 second-quarter delivery figure at 2,394 vehicles was up 70.5% versus its year-ago comp, it’s a material divergence from this very early guidance of roughly 22,500 deliveries per quarter across two models.

Lucid Group 2021 SPAC Presentation

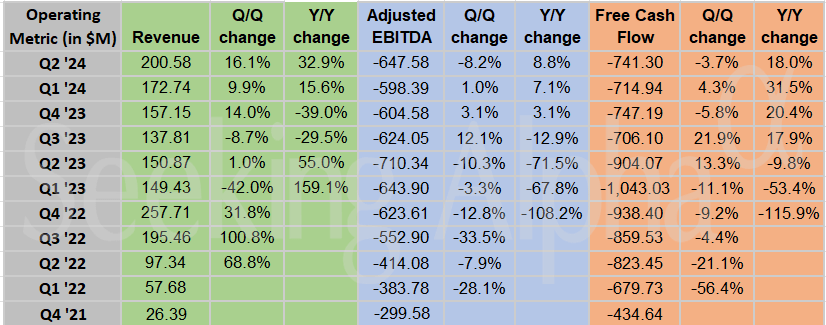

The go-public guidance was for 10x deliveries at this time, and LCID’s year-to-date dip fundamentally represents a reset of overall expectations to that of a loss-making EV upstart, burning through its liquidity balance and facing a macro environment where EV sales have slowed. LCID weighted-average shares outstanding at 2,310,360,525 places its market cap at roughly $8.3 billion. The company generated second-quarter revenue of $200.58 million, up 32.9% over its year-ago comp and a beat by $7.93 million on consensus estimates.

Seeking Alpha

Adjusted EBITDA was negative at $647.58 million, an improvement of 8.8% over a year ago. LCID is facing the same headwinds that have seen a raft of EV upstarts from Arrival (OTC:ARVLF) to electric bus company Proterra Inc. (OTCPK:PTRAQ), Electric Last Mile Solutions, Inc. (OTC:ELMSQ), and Lordstown Motors no longer remain a going concern. Canoo Inc. (GOEV) and Faraday Future Intelligent Electric Inc. (FFIE) are also facing extreme difficulty. I last covered LCID in December 2023 with a sell rating.

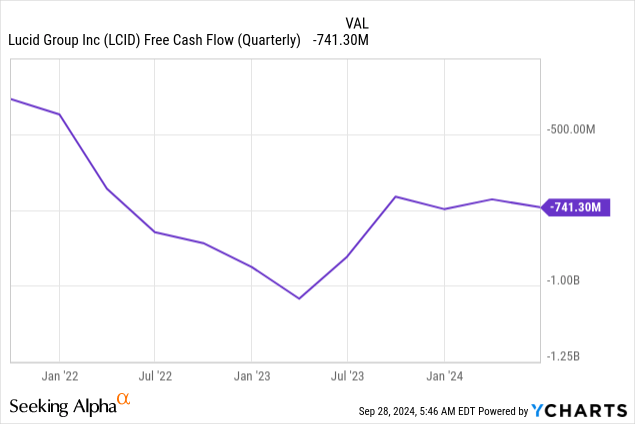

Free Cash Flow, Liquidity, And Dilution

A collapse of liquidity is the theme across all these EV tickers. Developing a new car is an incredibly capital-intensive process and LCID would join the public market just as the Fed would embark on a fight against inflation that would make ZIRP-era capital incredibly expensive. The company’s free cash flow (“FCF”) during the second quarter was negative at $741.3 million, an improvement from a negative FCF of $904 million a year ago but still a material level of burn. To be clear, LCID burnt through roughly 9% of its current market cap in a single quarter.

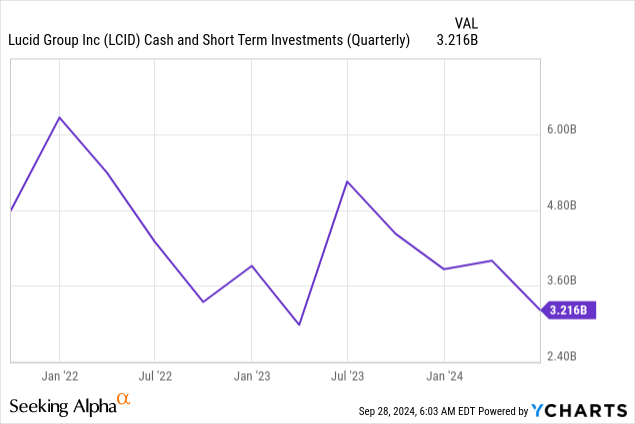

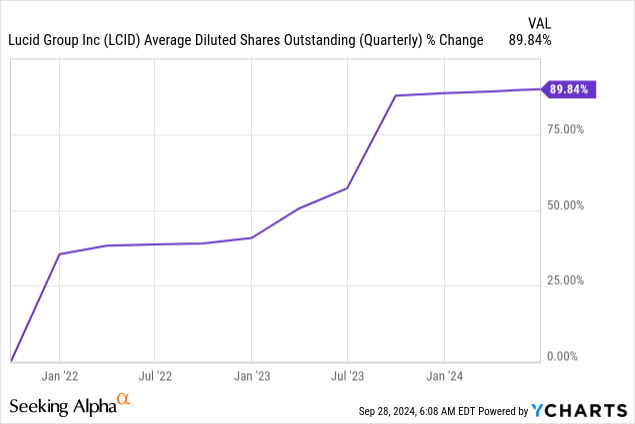

The significant depth of this cash burn against a cash, cash equivalents, and short-term investments position of $3.21 billion at the end of the quarter infers a more constricted cash runway than the company should be facing. LCID has another $687.64 million available in long-term investments with a total liquidity balance of roughly $4.28 billion at the end of the second quarter. The company is running low on short-term liquidity, with this balance down from around $6.26 billion at the start of 2022. Critically, dilution has been significant with LCID’s weighted average shares outstanding up 20.8% year-over-year at the end of the second quarter. Shares outstanding have been expanded by roughly 90% over the last three years.

The Saudi PIF, Oil Prices, And Risks

Dilution volume is set to be driven higher as LCID tapped Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (“PIF”), for $1.5 billion in funding post-period end. The new funding deal consists of two tranches valued at $750 million each. LCID will be provided with an unsecured delayed draw term loan facility that remains undrawn as of the issue of the press release announcing the funding. The company will also sell convertible preferred stock via private placement to PIF. The constant infusions of cash from PIF have been critical for LCID to plug a glaring liquidity gap driven by aggressive cash burn from its operations.

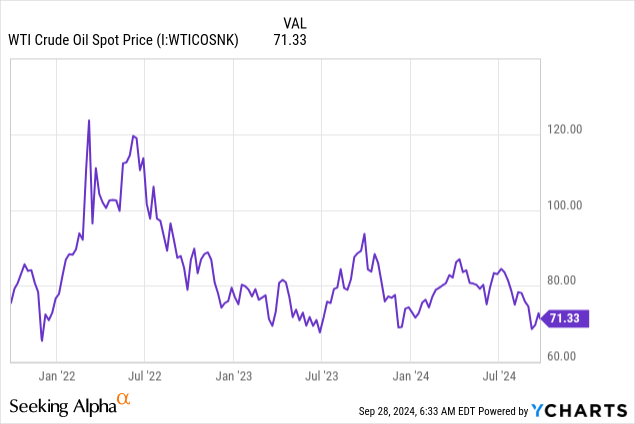

The future of this current zeitgeist of losses being underwritten by the PIF faces some risks with the dip in oil prices setting up Saudi Arabia to be more frugal. The Financial Times recently reported that the Kingdom is set to move forward with an increase in oil production in December, abandoning its $100 per barrel price target to win back market share. The risk for bulls here is that PIF is materially less forthcoming with future liquidity infusions with reports that the Kingdom is also looking to scale back some of its high-profile development projects. For bears looking to go short, LCID’s liquidity balance provides a runway of more than a year as Fed rate cuts of at least 50 basis points to end this year and a further 150 basis points through 2025, according to the CME FedWatch Tool look set to reduce the cost of capital for companies. This could also possibly drive renewed animal spirits in the commons. I think the commons are a sell, but I’m not shorting.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.