Summary:

- Meta Platforms, Inc.’s AR glasses could replace smartphones in 2030, driving future growth.

- The social media company continues absorbing heavy spending by Reality Labs, though the heavy investment in AI is starting to pay off.

- The stock trades at 23x 2025 EPS targets, while the Reality Labs spending normalization provides a quick boost to EPS.

grinvalds/iStock via Getty Images

My bold prediction entering 2024 was for Meta Platforms, Inc. (NASDAQ:META) to trade up to $500. The social media stock wasn’t far away from trading sub-$100 and the market wasn’t too convinced of the turnaround amidst ongoing wild spending on the Metaverse. My investment thesis remains very Bullish on Meta following a positive event where the company unleashed promising new technology, potentially an iPhone moment.

AR Glasses’ Future

Early in the year, Apple Inc. (AAPL) released the Vision Pro to overwhelming hype. The mixed reality headset costing $3,500+ got glowing reviews and appeared to question the whole AR/VR device future of Meta Platforms.

Fast-forward to last week, and the entire landscape has been altered. Meta released the Quest 3s virtual reality device at the Meta Connect Event, but most importantly the social media company displayed the prototype Orion AR glasses, on top of updated Ray-Ban Meta smart glasses.

The Vision Pro demand quickly abated after the early adopters, leaving Apple without a promising future in AR/VR devices. The tech giant is apparently working on a budget-friendly Vision Pro for next year using the M5 chip and AR glasses, possibly by 2027.

At the Connect event, Meta pushed forward a path toward both AR/VR devices and various smart and AR glasses with an unwavering push. CEO Mark Zuckerberg has even pushed the concept of future AR glasses being the “holy grail” device supplanting smartphones, like the iPhone, as the primary communication device.

Meta already has a successful program with Ray-Ban smart glasses, now capable of AI features such as AI assistants, without a display. The newly displayed Orion glasses promise to take smart glasses to the next level.

The Orion is what the Vision Pro hoped to be, a wearable computer with holographic visuals that are actually visually appealing, not a headset. The AR glasses are precisely the device that could replace the iPhone, especially if Meta can improve the current demo with lighter weight, better technology and a lower cost when officially launched to consumers in a few years.

The Verge even suggests the company will sell Hypernova glasses next year paired with the neural wristband needed to operate the AR glasses. If so, the move will further confirm how Meta has a strong roadmap of iterating new AR/VR devices and glasses.

The Orion isn’t ready for prime time yet due to costs to production estimated at up to $10K, and a lot can change the smart glasses market in the upcoming years. Still, Meta appears on the verge of building a computing platform capable of being worn to replace smartphones and computers.

Despite all the excitement, CEO Mark Zuckerberg mentioned the “holy grail” moment won’t take place until 2030, or beyond.

High Spending Pays Off

Suddenly, Meta spending wildly on the Reality Labs division is starting to make sense. The Metaverse hasn’t seen a massive upside, but the social media company now appears to have a viable path toward smart devices and glasses, opening up a promising future in computing.

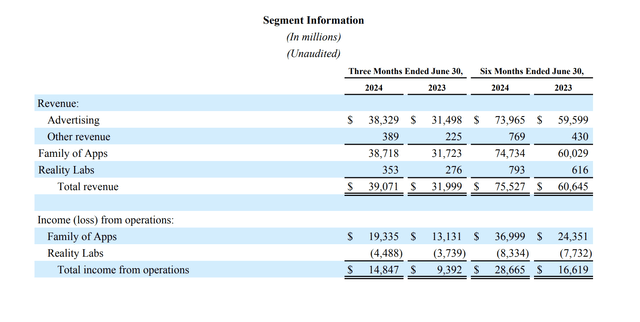

In Q4 alone, Meta lost $4.5 billion on the Reality Labs division. The division generated just $353 million in revenues, and the losses escalated from just $3.8 billion in the prior quarter.

Source: Meta Platforms Q2’24 earnings release

While the division isn’t generating the expected revenues from the Metaverse, Reality Labs has now built the technology allowing the company to have a potential iPhone moment with AR glasses. While, investments in AI are helping the company boost the legacy social media business, with revenues surging 22% in the last quarter.

Meta even produced an incredible 38% operating margin in Q2 despite the wild spending on the Metaverse and AR/VR devices. The company has achieved these margins due to keeping headcount virtually flat the last year at 71K employees. This is impressive considering the massive level of spending on Reality Labs and the investments in AI, leading to strong growth and promising new products.

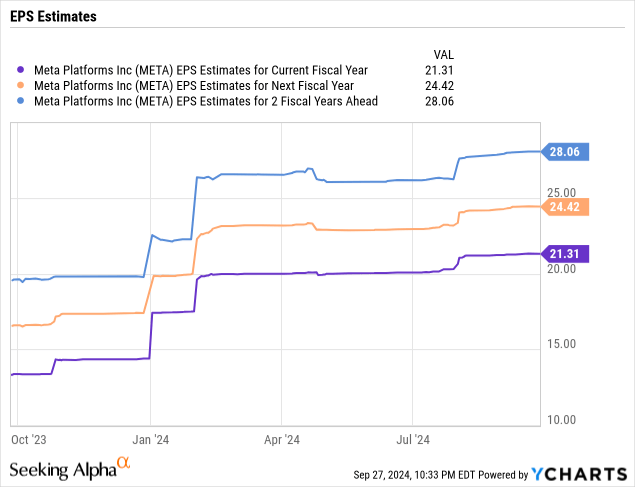

Meta still produced nearly $15 billion in profits last quarter alone. The consensus analyst estimates have the company producing a $21 EPS in 2024 despite losing upwards of $17 billion this year from Reality Labs.

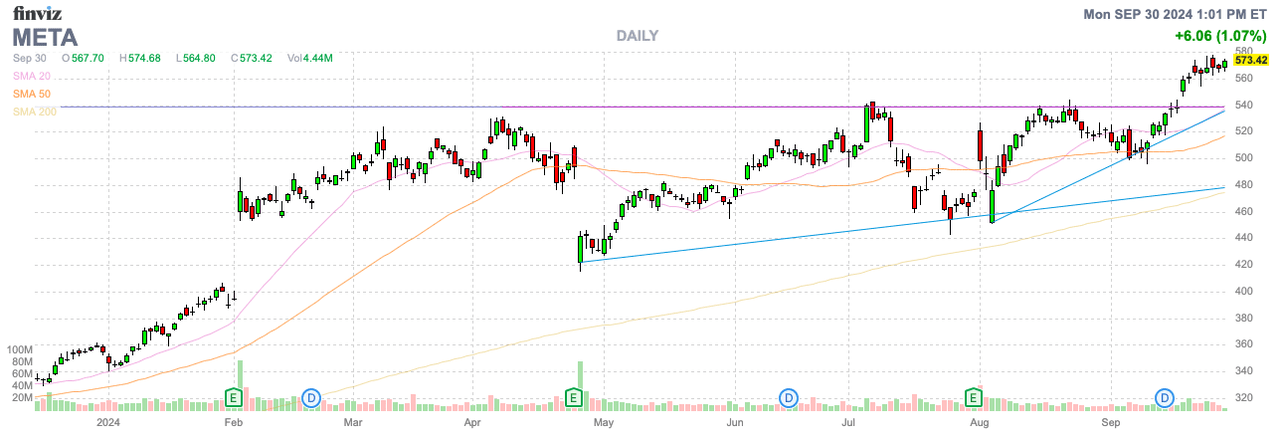

Remarkably, Meta has rallied from its lows around $100 in the depths of despair in late 2022 to $567 now, yet the stock isn’t exactly expensive. Meta only trades at 23x 2025 EPS targets of $24+.

Our view has constantly held that investors should virtually wipe out the ongoing losses from the Reality Labs business when valuing the stock. Meta is investing heavily for the future, and the ongoing Ray-Ban Meta smart glasses success and the prototype Orion AR glasses are prime examples of the future opportunity being far worth the spending.

The current smartphone market is worth some $500 billion. Even if the Orion AR glasses only end up replacing premium smartphones like the iPhone, Apple produces $200+ billion in annual sales from the iPhone.

Analysts are only targeting Meta reaching $184 billion in sales this year. The company could double revenues in the process of replacing the iPhone while acknowledging the iPhone is only a small portion of the global smartphone market.

If one just assumes the company eliminates the losses from Reality Labs, Meta adds another $5+ in EPS to reach a $29 target. The stock only trades at sub-20x these normalized EPS targets for 2025.

A 25x P/E multiple would place a stock valuation closer to $725. If Meta truly has the future AI/AR glasses that replace the iPhone, the stock probably deserves a far higher P/E multiple, but investors will have to be very patient for this scenario to play out.

Takeaway

The key investor takeaway is that Meta Platforms still has an appealing valuation despite an incredible run since the late 2022 lows sub-$100. If the stock could trade back down to the prior resistance around $540 and bounce, investors would again have an ideal entry point for the next run while patiently waiting for the long-term upside potential in AR/VR devices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.