Summary:

- Pfizer’s acquisition of Seagen for $43 billion enhances its ADC technology, potentially expanding its oncology franchise and driving future growth.

- PFE’s development of the oral GLP-1 receptor agonist, Danuglipron, aims to capture the growing obesity and diabetes treatment market by 2028.

- The Company anticipates 11.4% revenue growth, driven by oncology investments, M&A activities, and manufacturing optimization, despite challenges from declining COVID-related revenue.

- I rate Pfizer a ‘Buy’ with a one-year target price of $40 per share, backed by strategic acquisitions and strong growth prospects in oncology.

georgeclerk

Pfizer (NYSE:PFE) has been strategically increasing their business exposure in the oncology franchise by developing more cancer drugs to drive their future growth. I think the acquisition of Seagen could strengthen their Antibody-Drug Conjugate (ADC) technology. I am initiating with a ‘Buy’ rating with a one-year target price of $40 per share.

Acquisition of Seagen

Pfizer completed the acquisition of Seagen, a global biotechnology company specializing in cancer drugs, for $43 billion in December 2023. I favor the acquisition for the following reasons:

- Seagen can bring world-class ADC to Pfizer, a new approach for discovering and developing cancer drugs. According to the announcement, ADC is a powerful tool across a broad range of cancers, selectively targeting and killing cancer cells while limiting off-target toxicities. The deal could potentially enable Pfizer to expand their oncology franchise and increase the revenue mix toward cancer drugs.

- In breast cancer, Seagen has ADC disitamab vedotin and the therapy of Tukysa. According to the media, Tukysa could offer additional tumor progression benefits over Roche’s (OTCQX:RHHBY) ADC Kadcyla in HER2-positive breast cancer.

- Global biotech and pharmaceutical companies have shown increasing interests in ADC technology, which can target and kill cancer cells while minimizing damage to healthy cells. For instance, Johnson & Johnson (JNJ) acquired Ambrx Biopharma for $2 billion to expand their ADC pipelines. AbbVie (ABBV) acquired ImmunoGen for their flagship ADC ELAHERE for more than $10 billion.

With Pfizer’s global distribution network and drug development expertise, Seagen could help Pfizer expand their oncology drug pipelines and capture a share of the fast-growing oncology drug markets. Evaluate projects the ADC market will grow to $31 billion by 2028.

Oral GLP-1 Receptor Agonist

In December 2023, Pfizer announced their progress in their formulation of Oral GLP-1 Receptor Agonist, a drug named Danuglipron, with phase 2b data. As announced, the company plans to conduct dose optimization studies in the second half of 2024. Pfizer’s CEO indicated that their GLP-1 drug was two years behind Lilly’s (LLY) oral candidate and two years ahead of AstraZeneca’s (AZN) program. Due to the effectiveness in treating obesity, the GLP-1 drugs have experienced tremendous demands.

Coherent projects that the global GLP-1 market will grow at a CAGR of 12.1% from 2024 to 2031, driven by growing population with obesity and diabetes. Danuglipron is designed as a needle-free alternative to popular weight-loss injections from Novo Nordisk (NVO). It is evident that the oral drug could offer greater convenience for patients.

During the earnings call, the management indicated that the company was working on the dose optimization and formulation in preparation for advancing to a Phase 3 study. I anticipate Pfizer’s oral GLP-1 Receptor Agonist will hit the market by 2028, based on a typical drug R&D cycle.

Recent Result and Outlook

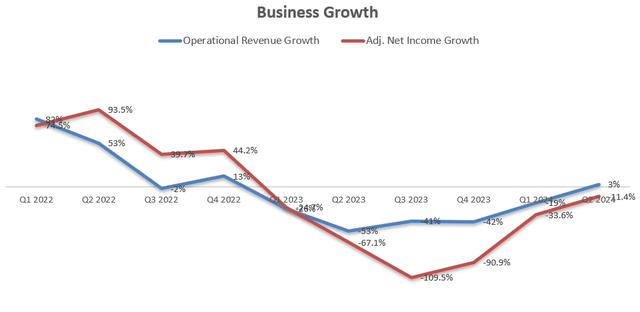

Pfizer released their Q2 result on July 30th and is set to publish Q3 on October 29th. As depicted in the chart below, Pfizer delivered 3% operational revenue growth and 11.4% decline in adjusted net income. The profit decline was primarily caused by their increasing SG&A expenses for recent new drug launches, spending on legacy Seagen businesses, as well as acquisition-related costs.

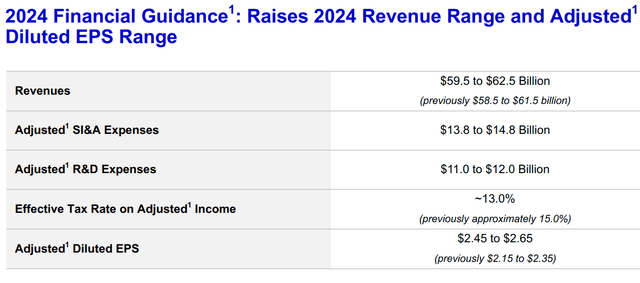

The company is guiding for 1.71%-6.84% revenue growth for FY24, as depicted in the table below. As there is a wide range of their revenue guidance, I do not expect their full-year performance to deviate significantly from the guidance.

For the normalized growth, key growth components include:

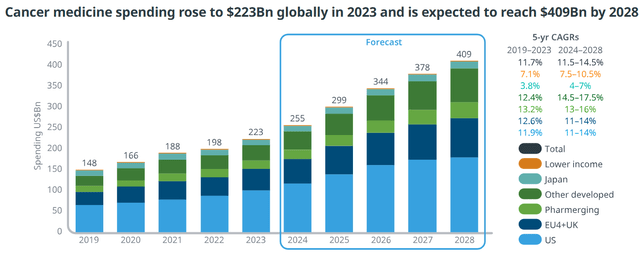

- Pfizer has strategically prioritized cancer drugs in recent years. IQVIA (IQV) projects that the total cancer drugs market will grow at a CAGR of 11.7% from 2024-2028, driven by cell and gene therapies, ADCs, and multispecific antibodies. I anticipate Pfizer will continue to invest in their oncology franchise, capitalizing on the wave of novel oncology mechanisms.

- During the earnings call, the management expected that the Covid-related revenue would be around $8.5 billion for FY24, including $5 billion for Comirnaty and $3.5 billion for Paxlovid. In the post-Covid era, I expect the Covid-related revenue will gradually fade away, creating some growth challenges for Pfizer.

- Pfizer has been implementing a Manufacturing Optimization Program, aiming to deliver $1.5 billion in total savings by the end of 2027. The cost reduction plan could potentially reduce their SG&A expenses and improve gross margin in the future, in my view.

- Pfizer exited the Duchenne gene therapy in July 2024, incurring a $230 million impairment charge and an additional $400 million related to the Abzena facility. The business discontinuation will create some near-term margin pressure for the company.

- I anticipate Pfizer will allocate 20% of revenues toward acquisitions, expanding their novel drug pipelines. As a result, these acquisitions could potentially contribute an additional 4.4% growth to the topline.

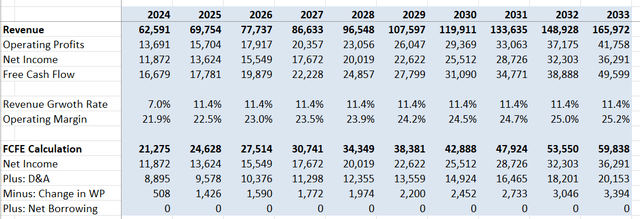

Overall, I calculate that Pfizer will grow their revenue by 11.4%, comprising 7% operational growth and 4.4% M&A growth. I anticipate 20-50 bps annual margin expansion, driven by 10bps manufacturing optimization, 10bps from SG&A optimization and 0-30 bps impact from depreciation/amortization costs resulting from acquisitions.

Stock Valuation

With all these parameters, the DCF and free cash flow from equity (FCFE) can be summarized as follows:

The cost of equity is calculated to be 9.2% assuming: risk-free rate 3.6%; equity risk premium 7%; beta 0.8. Discounting all the future FCFE, the one-year target price is calculated to be $40 per share.

Key Risks

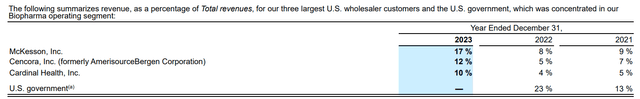

- Distributor Concentration: As detailed in the table below, three major wholesalers accounted for almost 40% of Pfizer’s total revenue in FY23. If any of these wholesalers were to discontinue their business with Pfizer, it would potentially cause significant distribution issues for Pfizer’s drugs, at least on a short-term basis.

- In September 2024, Pfizer announced to pull Oxbryta, a daily pill for patients with sickle-cell disease, off pharmacy shelves as there is no data showing Oxbryta’s benefits outweigh its risks. Pfizer noted that the withdrawal of Oxbryta won’t affect their full-year guidance for FY24. However, the withdrawal indicates that Pfizer’s acquisition of Global Blood Therapeutics (GBT) in October 2022 was a failed deal. Pfizer acquired all of GBT’s portfolio, including Oxbryta, for $5.4 billion, which is not a small acquisition.

- Pfizer is in the process of deleveraging their balance sheet due to recent acquisitions. They paid down a total of $2.25 billion in debt in Q2, and target to deleverage their debt level to 3.25x EBITDA in the near future.

- Lastly, as Seagen is a large acquisition for Pfizer, it might carry tremendous integration risks in the near future. Seagen could also increase Pfizer’s costs in R&D and sales & marketing areas, as these new ADC-based drugs require more advanced research staff and marketing resources.

End Note

I think Pfizer is well positioned in the fast-growing oncology drug market, and their acquisition of Seagen has enhanced their technology in ADC drugs. I believe the oncology franchise will drive Pfizer’s future business growth. I am initiating with a ‘Buy’ rating with a one-year target price of $40 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.