Summary:

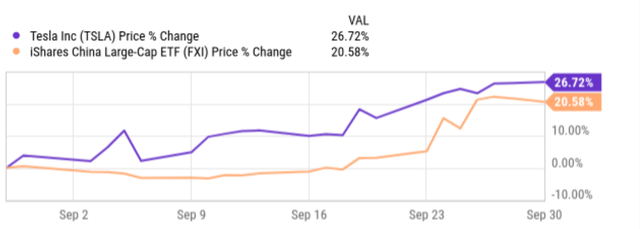

- Tesla, Inc. stock prices rallied in tandem with the China stock market, both advancing more than 20%, in the past month.

- China’s recently announced stimulus policies are the key driver for both in my view.

- However, the potential benefits from these policies for Tesla are overestimated and already priced in.

- At these price levels, TSLA investors are ill-prepared for the downside risks.

- Top downside risks include stiff competition from domestic producers like BYD, the persisting EV overcapacity, and uncertainties of TSLA’s AI-flavored products.

ronniechua

TSLA stock and China

My last article on Tesla, Inc. (NASDAQ:TSLA) focused on its battery issues. The article was published on Seeking Alpha on August 19 and titled “Tesla: What If 4680 Battery Team Fails To Deliver By 2024.” In that article, I caution investors about the following risks surrounding its battery:

Battery is a bottleneck issue for EV manufacturers and Tesla is no exception. Tesla’s 4680 battery cells aim to improve efficiency and reduce costs, but currently face both technical and cost issues.

Since that writing, there has been a major change in the global macroeconomics. China has recently announced a series of stimulus policies to support its economic development and also reported better-than-expected PMI data. More details are quoted below (slightly edited by me):

SA news: The Chinese stock market rose ~8% on Monday, marking its biggest rally since 2008… The moves come after China’s manufacturing activity slightly improved in September 2024 from August’s six-month low, surpassing expectations. The moves also come a day after, The People’s Bank of China said that it would order banks to reduce mortgage rates for existing home loans before October 31 amid efforts to support the property sector.

The Chinese stock market has rallied more than ~20% from the recent lows in the past month (see the next chart below), the technical definition of a bull market. For TSLA, China is both a key end market and also a manufacturing base. As a result, TSLA’s stock prices also rose in tandem, rallying almost 27% in the past month as seen.

Against this background, the thesis of this article is to argue that TSLA bulls have overestimated the potential benefits of China’s recently announced stimulus plan. Furthermore, with the large stock price rise in the past month, whatever the benefits there are, they have already been priced in. Looking ahead, TSLA faces stiff competition from China’s domestic producers, and I don’t see TSLA in an advantageous position.

TSLA stock vs. BYD

Allow me to digress a bit to pay tribute to Charles Munger first, from whom I’ve learned so much about life and investing. Shortly before he passed away (may he rest in peace), he made some very insightful remarks about TSLA and BYD Company, TSLA’s key rival in China. Quote:

Business insider report: Munger lauded BYD for growing rapidly in its home market and leaving Musk in the dust. “BYD is so much ahead of Tesla in China it’s almost ridiculous,” The billionaire investor pointed out that Tesla cut its car prices in China last year, while BYD was able to raise prices.

Munger also contrasted BYD’s CEO (Chuanfu Wang) to Elon Musk, praising the former man as “a combination of Thomas Edison and Jack Welch.” But I will leave the assessment of the CEOs for a different day to keep this article tightly focused and of reasonable length.

Now, let me get back to the issue of prices and profits, as Munger commented above. What Munger has commented on reflects several strategic advantages for BYD in my view. The top 2 in my mind are its better product lineup and the government support. BYD offers a wider range of vehicles, from budget-friendly options to premium models. This allows them to target different market segments and adjust pricing strategies accordingly. The Chinese government also favors domestic EV manufacturers in my view, including BYD, providing another competitive advantage that is difficult to change.

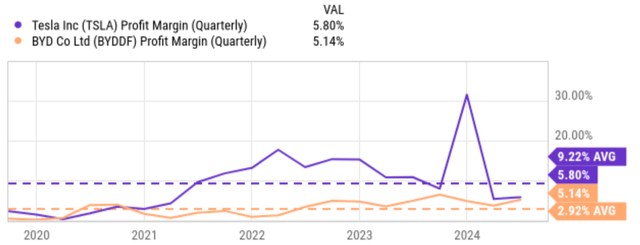

All these factors have made BYD fundamentally a more profitable business. As an example, the next chart shows that Tesla’s profit margin was systematically lower than that of BYD over the years. More specifically, BYD has been enjoying an average profit margin of 9.22% in the past 5 years since 2020 as seen. While in contrast, TSLA’s profit margin has only averaged 2.92% in this period, less than ½ of BYD’s.

And next, I will argue that TSLA’s automotive margin is even lower once its regulatory credits are considered.

TSLA stock Q2: the role of carbon credits

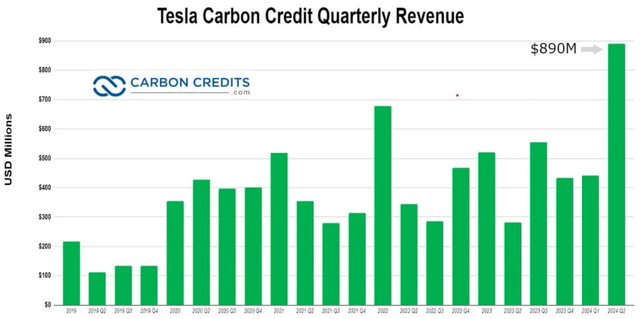

In TSLA’s business model thus far, the sales of carbon credits have been a significant source of income. As seen from the next chart, this income source has been on an upward trend overall in the past 5~6 years. The following specific statistics were quoted from Carbon Credits:

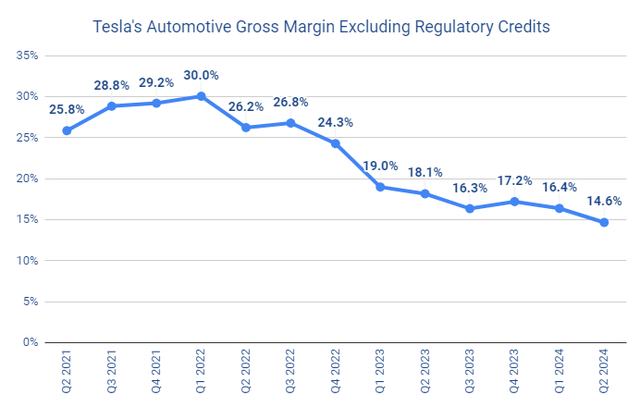

TSLA started selling these regulatory credits in 2017 and the proceeds from these sales just reached a record of $890 million in the past quarter. This revenue stream is up 216% from $282 million a year earlier and a 102% increase from Q1 ($442m). When excluding these regulatory credits, automotive gross margin was 14.6% for Q2.

In its more recent quarterly earnings report, TSLA reported an aggregated gross margin of around 18%. Based on the data above, the margin for its automotive after adjusting the carbon credits is considerably lower, by 340 basis points. To better contextualize things, the next chart displays its automotive gross margin after carbon credits are adjusted in 3 years between Q2 2021 and Q2 2024. As you can see, the trend is quite concerning. Its last automotive margin of 14.6% is only about ½ of its peak margins of around 29%~30% in 2022.

Other risks and final thoughts

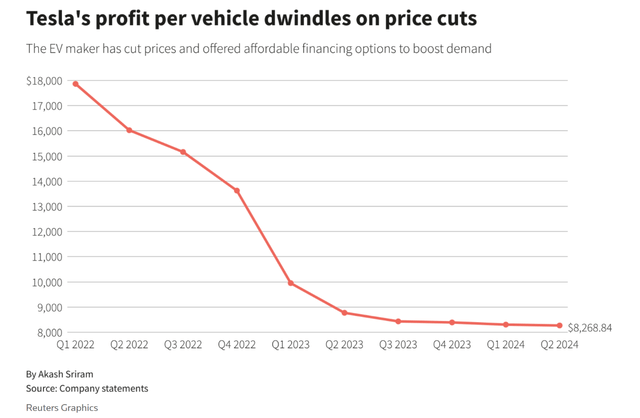

Now back to Munger’s remarks about profitability and price cuts. TSLA has been relying on price cuts as a key strategy recently. But unfortunately, its profit per vehicle has dwindled in tandem, as illustrated in the next chart below. It used to profit around $18,000 per vehicle at the beginning of 2022. The figure is only about $8,200 as of the most recent report. Looking ahead, China is very like to face persisting overcapacity issues in the EV sector, despite the government’s efforts to stimulate its economy. It is not clear to me how long TSLA can rely on its price cuts in an oversupplied market with key rivals like BYD who enjoy far better margins.

In terms of upside risk, the biggest one in my mind is Elon Musk’s ability to turn the company into a high-tech company. For years, Elon Musk has been trying – and quite successful in my view – to convince investors that TSLA is NOT a car company but a high-tech company pursuing earthshaking products like autonomous driving, robotaxi, etc. These futuristic products, of course, hold tremendous growth potential, which have helped (and are still helping) to support TSLA’s premium P/E (112x as of this writing) in contrast to a car company. For example, General Motors (GM) trades at 4.5x P/E as of this writing. However, there are also considerable uncertainties and the market has begun to show its skepticism. An example is quoted below:

Seeking Alpha report: Morgan Stanley downgraded the entire U.S. auto industry view to an In-Line rating after having the broad sector set at Attractive…”At a high level, our downgrade is driven by a combination of international, domestic and strategic factors that we believe may not be fully appreciated by investors,” warned analyst Adam Jonas… Jonas and his team also said the optimism around auto stocks getting credit for being AI enablers and beneficiaries is being countered by concerns over the significant capital commitment required to follow through on large-scale AI development, AI infrastructure, and building out AI cloud/datacenter hyperscalers.

All told, my verdict is that the recent rallies in TSLA’s stock prices are overdone. These rallies are largely driven by China’s stimulus plan, in my view. I am not optimistic that the stimulus plan can benefit TSLA as much as the market expects, given the competitive advantages from rivals like BYD with the macroscopic backdrop of EV overcapacity. Meanwhile, TSLA’s promise to be an AI enabler/beneficiary is highly uncertain and has little support from actual products in my view. With these considerations, I see more downside risks than upside risks at TSLA’s current price levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.