Summary:

- I am upgrading Abercrombie & Fitch from sell to hold due to strong growth momentum and potential to beat and raise guidance.

- Despite a poor consumer spending environment, ANF achieved solid comparable store growth, with Abercrombie at 26% and Hollister at 17%.

- Management’s positive outlook and August sales data suggest ANF will significantly exceed 3Q24 guidance.

tupungato

Investment summary

My previous investment thought on Abercrombie & Fitch (NYSE:ANF) (published in April) was a sell rating because the stock was trading at a premium valuation, making the risk/reward situation very unattractive. I upgrade my view from sell to hold as I see potential for ANF to beat and raise its guidance, thereby supporting its current elevated multiple. This could fuel a strong momentum for the stock as sentiments turn more positive.

Growth momentum continues to be strong

Unlike what I had expected previously, the demand momentum for ANF continued for longer than expected, and with the new data points available, I have changed my views. I now see the potential for ANF to continue meeting consensus near-term expectations, which should lend support to the premium valuation it is trading at today.

Despite the poor consumer spending environment, ANF printed solid comparable store growth [CSG] across both its banners, where Abercrombie saw 26% CSG and Hollister saw 17% CSG. Notably, both of them saw incremental strength in the quarter, where Abercrombie brand two-year stack CSG accelerated by 100 bps to 44% vs. 1Q24’s 43%, and Hollister saw continued sequential acceleration of growth with continued expansion in unit sales (i.e., volume) following the positive turnaround in 1Q24. While I had said before predicting the next fashion trend is never a guaranteed process, I must give credit to ANF’s management as they apparently spotted and executed on the right trend, and notably, it was across regions, brands, channels, and genders.

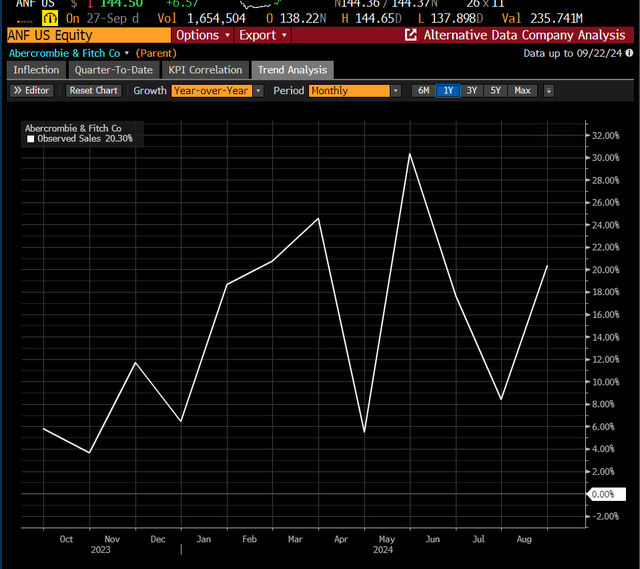

Looking ahead, management guided for 3Q24 reported sales growth of low-double-digit percentage y/y. Based on the alternative data available (that tracks ANF sales) and management’s very positive comments and guidance, I believe ANF is set to beat its 3Q24 guidance. Firstly, according to Bloomberg data, ANF’s August sales are on track to grow by 20%. Note that this is substantially higher than the 11% growth that consensus is expecting. Secondly, management commented that they are “thrilled with the start to August” and they continue to see solid momentum to date.

After a historic success in the first half, our teams are energized and we’ve entered the second half ready to deliver for our global customers. I am thrilled with our start to August and we are raising our full-year sales growth and profitability expectations.

Shifting to our expectations for the rest of fiscal 2024. We’ve had a strong start to the year, delivering record net sales in the first half, and the momentum has continued in the first few weeks of the third quarter. 2Q24 earnings transcript

As such, my opinion is that ANF will beat its 3Q24 guidance by a sizeable margin, and consensus will need to revise their estimates upwards. This brings me to my next point: that management seems to be too conservative on their FY24 guide. Despite the strong 3Q24 guide (and data pointing to a strong beat), management kept the FY24 guidance unchanged. Suppose ANF sees 15% growth for 3Q24 (not hard to believe since August is up ~20% based on Bloomberg tracked data); this implies 4Q24 revenue to be flat. This doesn’t make a lot of sense considering the strength seen on a year-to-date basis and that ANF is going to see a lot more marketing activations in 2H24. Moreover, there are growth levers that ANF could pull to further juice growth, which could result in an even bigger guidance beat. For instance, management noted there is still plenty of room in the international business where there remains ~$400M revenue recapture opportunity relative to pre-pandemic and that ANF exposure to Europe and APAC is significantly underpenetrated relative to the Americas.

We continue to prioritize customer acquisition in Abercrombie, funding effective marketing campaigns across digital and social channels. We’re excited to enter the back half with more customer activations planned. 2Q24 earnings transcript

Lastly, just to remind readers, ANF has significantly outperformed its 1H24 revenue guidance by >900 bps. So unless we see a substantial fall in demand trend for the remaining months, it is hard to believe ANF will not beat its guidance. On this point, consensus is modeling FY24 revenue to be $4.84 billion (high end of the guided range), so there is a lot of upside potential in terms of consensus estimate revision.

Valuation

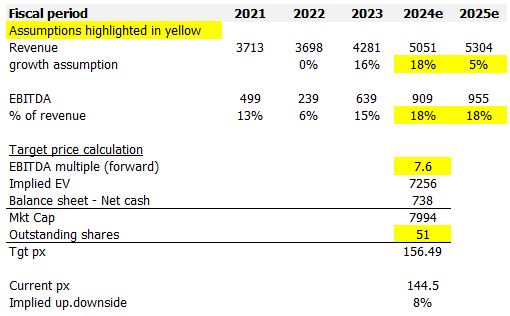

Redfox Capital Ideas

Based on what I am seeing, consensus FY25 EBITDA estimate is ~$875 million, which implies ~39% y/y growth based on 13% top line growth. If my view is correct, ANF should grow top line by high teens (I assumed 18% for modeling purposes)—1H24 grew >20% and 3Q24 should grow by 15% (as discussed above), which should translate to FY24 EBITDA of ~$910 million (using consensus FY25 EBITDA margin estimate). In FY25, growth should slow down given the two very strong preceding years, making it a tough comp for ANF to continue printing double-digit growth. Therefore, for FY25, I assumed growth to slow down to mid-single-digits (the growth CAGR from FY19 to FY23). For EBITDA margin, I maintained 18% in FY25 as well, as ANF benefits from a larger revenue base and as freight costs normalize.

Giving the benefit of doubt that ANF will beat and raise guidance, fueling a very positive stock sentiment and momentum, I assumed the stock to continue trading at its current premium multiple (vs. history) of 7.6x forward EBITDA.

In my revised model, the stock has an 8% upside. Personally, this upside is not attractive for me, and hence, I am only upgrading my recommendation from sell to hold.

Risk

I think the current risk stems from the poor consumer spending environment. While ANF did perform well so far, if consumers continue to pull back on spending, it will drag down demand for ANF. Remember that ANF is trading at a fairly elevated multiple vs. the past. If it fails to beat guidance or even meet guidance, this could result in a huge derating.

Conclusion

My view for ANF is a hold rating. Despite the challenging consumer spending environment, ANF has demonstrated its ability to navigate the market and capitalize on the right fashion trends. In the near term, ANF is likely to outperform its guidance and consensus estimates given the strong momentum, August sales performance, and expected ramp up in marketing activations. My view is this will drive a very strong positive sentiment around the stock. As such, I am no longer advocating a sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.