Summary:

- Occidental Petroleum’s South Texas Direct Air Capture Hub aims to capture carbon dioxide.

- Secondary recovery could enhance oil and gas production for decades to come while storing carbon dioxide permanently in the process.

- Current CO2 supplies come from wells, but DACs may replace these. Now CO2 will go from the air into the ground by using the DAC process.

- The industry’s challenge is achieving cost competitiveness without perpetual tax credits. This is crucial for its long-term viability and for reducing taxpayer burden.

- The tax credits and government aid for DACs is aimed at getting a low carbon idea “off the ground.”

bjdlzx

Occidental Petroleum (NYSE:OXY) announced that the project involving the South Texas Direct Air Capture Hub – DAC – received $500 million in funding to support the development of this hub. A previous article noted that secondary recovery of unconventional wells will likely use carbon dioxide. Under recent legislation, this secondary recovery can qualify for tax credits, as the carbon dioxide is intended to stay in the ground to maintain reservoir pressure that will increase the recovery of petroleum products. The current drive to capture carbon dioxide and store it in the ground is getting a supply ready for the day when much of the unconventional industry will need carbon dioxide to produce oil and gas.

That was probably not the intention, but the sheer number of secondary producers that are looking at currently available tax credits has convinced me that there’s a future investment opportunity in secondary recovery that’s a side effect of current intentions. In the beginning, the carbon dioxide that’s captured will likely be just stored. However, the unconventional industry is so young that many of the recovery rates are comparably low compared with conventional. That leaves a whole lot of opportunity to produce still more oil and other petroleum products from what still remains in the reservoir. The current carbon capture technology supplies a necessary ingredient for that step. There will probably be a lot more ideas when the time comes for this to be a necessary production method.

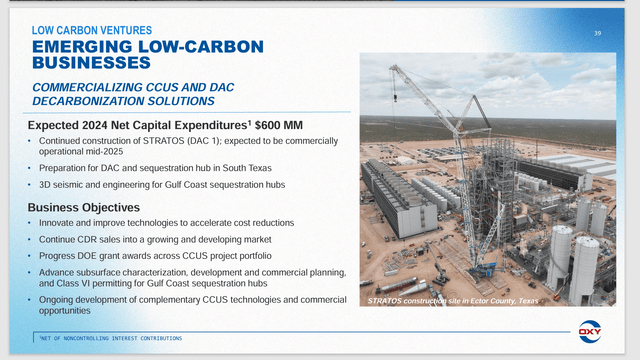

Occidental Petroleum Low Carbon Venture Emerging Business (Occidental Petroleum Second Quarter 2024, Corporate Earnings Presentation)

This project already was ongoing with the company seeking partners. Funding from the government that was announced just makes the whole process easier.

Originally, the company and its partners were looking for places to permanently store the carbon dioxide. That’s how the plant will likely begin to operate. But as the need arises for secondary recovery, there’s likely to be a whole lot of places to permanently store carbon dioxide in the future while producing oil and gas.

Currently, the secondary recovery industry gets its supplies from companies like Kinder Morgan (KMI) and Denbury (now a subsidiary of Exxon Mobil (XOM)) that actually have wells drilled to large carbon dioxide supplies. But that means that the industry gets carbon dioxide from the ground to use. That’s the exact opposite of what those worried about greenhouse gasses want to see happen.

What’s going to happen now is that these “DAC’s” will likely (over time) replace those carbon dioxide wells to supply the industry with needed carbon dioxide. What we’re doing now is getting the supply of carbon dioxide high enough so that when the need arises there’s an adequate supply to make secondary recovery a viable way to produce oil and gas.

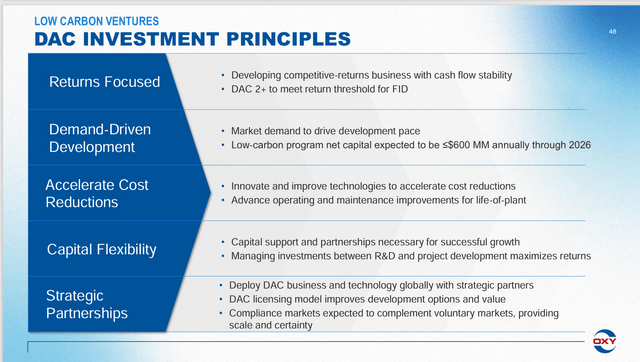

Occidental Petroleum Goals For Low Carbon Ventures (Occidental Petroleum Second Quarter 2024, Corporate Earnings Presentation)

The more daunting challenge for both taxpayers and the industry is for this venture to obtain “lift-off” to the point where it no longer needs tax credits to exist as an industry. Sometimes, when the government does this, the credits take on “a life of their own” and the taxpayers forever subsidize the industry (at least that is the fear).

The company expresses this fear by stating a goal of obtaining competitive returns. Otherwise, when secondary recovery demands for carbon dioxide climb, the industry will just drill a carbon dioxide well and then transport the carbon dioxide to the site needed. It will, therefore, be interesting to see exactly how this new industry develops and whether it will ever be cost competitive in its own right without tax credits or other government aid.

Enhanced Oil Recovery (EOR)

Occidental already has the largest EOR operation, probably in North America. This operation is responsible for a significant part of the total Permian production. In fact, this operation existed before the Permian unconventional business was even a thought for most investors.

” Oxy is the Permian’s leader in Enhanced Oil Recovery (EOR). In these operations, CO2 is injected and permanently stored in oil and gas reservoirs during production to improve efficiency, economics and environmental sustainability. With more than 40 years of carbon management experience, we are the Permian’s largest CO2 EOR operator. Oxy stores up to 20 million tons of CO2 annually underground.”

As unconventional wells age and production declines, demand for this considerable expertise will be growing in the future. Because Occidental already stores carbon dioxide as a means of producing oil and gas, it’s far ahead of much of the industry when it comes to the carbon capture business.

EOR is essentially a secondary recovery that this company has managed to make into a low-cost business. That’s not always the case, as secondary recovery is generally a higher cost business for many companies. Now tax credits will help keep this part of the industry at a lower cost for the time being.

But it’s obvious that continued technology advances and economies of scale are needed for the industry to not need government assistance.

What’s obvious is that we’re going to need oil and gas for a long time to come. As a country, we clearly have the reserves that will last, probably centuries. But the continuing challenge is to keep coming up with cost-effective technologies (like the unconventional business) that allow us to produce the remaining reserves in a cost-effective way. It would appear that DAC is the next step. Over time, more steps will be needed.

Summary

Occidental has a huge advantage in actual experience when it comes to carbon storage compared to much of the unconventional industry. This gets added to the continuing portfolio upgrades of the current unconventional business through acquisitions.

Last Article

The last article mentioned how the company met its goals of debt repayments promised as part of the CrownRock acquisition. Currently, Occidental and much of the industry are developing the Midland Basin as the latest example of low-cost unconventional production.

There has long been worries about a lack of Tier 1 acreage. But so far, technology advances have made sure that each year most companies report more Tier 1 acreage locations than the year before.

I suspect that what’s likely to happen is that eventually EOR will be the technology that is used when the time comes to get more Tier 1 acreage after the “traditional” unconventional business has exhausted all possibilities. It will either be that or we will continue to drill deeper and longer wells for a while.

But it does seem like eventually some form of enhanced recovery will be the order of the day. If that’s the case, then a whole lot of carbon dioxide will be needed for when that day comes.

So, the connection between the last article and the events in this article may be distant. But right now, they appear certain.

This is another growth area for Occidental Petroleum that does not get the coverage that the main business does. It’s also an area that a strong buy company like this one has a big lead over much of the unconventional industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY KMI XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies like Occidental Petroleum and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.