Summary:

- Luminar’s solid-state LiDAR technology offers high-resolution, long-range capabilities, but faces significant competition from other LiDAR vendors and alternative sensors like cameras and imaging radar.

- The company expects revenue to ramp over the next few years as LiDARs are deployed into consumer vehicles.

- While Luminar should see significant growth, the company’s losses are large, and it has a relatively weak balance sheet.

- My primary concern is the long-term importance of LiDAR as the capabilities of alternative technologies continues to improve.

Just_Super

Luminar (NASDAQ:LAZR) is a LiDAR vendor that has developed solid-state LiDAR technology, enabling long-range and high-resolution systems for the automotive industry. While Luminar’s losses are large and its balance sheet is weak, the company expects production to ramp in the near future.

Economies of scale should help to drive down costs, facilitating broader adoption of LiDAR both as a safety feature and as an enabler of self-driving vehicles. While the opportunity could be large, competition is likely to be fierce, both from LiDAR peers and alternative sensors (cameras and imaging radar).

An argument could be made that Luminar’s stock will perform well over the next few years as its revenue begins to ramp, but I question the ability of LiDAR vendors to capture value longer term. It seems likely that LiDAR technology will become commoditized in coming years, with the value of self-driving technology more likely to accrue at the software layer. In addition, the importance of LiDAR is likely to decline over time as imaging radar and perception from cameras improve.

Market

Lidar systems are used in the automotive industry to detect objects, both for collision avoidance and to help guide self-driving vehicles. While there is potentially a large opportunity in autonomous vehicles longer term, the near-term opportunity is being driven by driver assist and safety systems.

There are roughly 1.2 million annual fatalities from vehicle collisions globally, and the annual cost of motor vehicle crashes in the US is $1.4 trillion. Swiss Re analysis suggests that vehicles equipped with Luminar systems will be involved in 27% less accidents, with accident severity reduced by up to 40%. Vehicles equipped with current camera/radar systems experienced collisions in 70% of pedestrian Autonomous Emergency Braking scenarios. These tests assess the ability of an AEB system to detect and avoid pedestrians in a range of scenarios. While data demonstrates AEB systems are effective, reducing pedestrian crashes by 27%, they tend to perform better during the day than at night. Lidar should be able to improve the performance of AEB systems, particularly at night.

There is also a regulatory push at the moment that will likely lead to greater adoption of LiDAR, starting in 2029. For example, a new Federal Motor Vehicle Safety Standard requires automatic emergency braking systems on light vehicles. AEB systems can use a range of sensor technologies to detect when a crash is imminent and automatically apply the vehicle’s brakes. While the use of LiDAR hasn’t been stipulated, companies are pushing for nighttime testing to increase the likelihood of LiDAR being adopted.

Lidar provides an accurate distance measurement using the time-of-flight of laser pulses. It is this direct measurement that enables LiDAR to accurately and rapidly provide a point-cloud of distance measurements. In comparison, camera-based technologies must try and infer distance by extrapolating from 2D images. Lidar’s performance is also independent of external light, enabling superior performance at night and in inclement weather conditions compared to camera-based systems. As a result of these advantages, there is a consensus that most, if not all, Level 3 vehicles will be equipped with LiDAR.

Radar provides an alternative distance measurement, and a direct measurement of velocity using the Doppler effect. Lidar generally uses lasers with wavelengths in the 900-1550 nanometer range, which is approximately 2,000 times shorter than radar wavelengths (>3mm). This provides greater resolution, although it can make LiDAR susceptible to interference. Radar is usable in nearly all weather and environmental conditions (except for heavy snow) and works at all times of the day. Traditional radars provide poor resolution, though, particularly vertically.

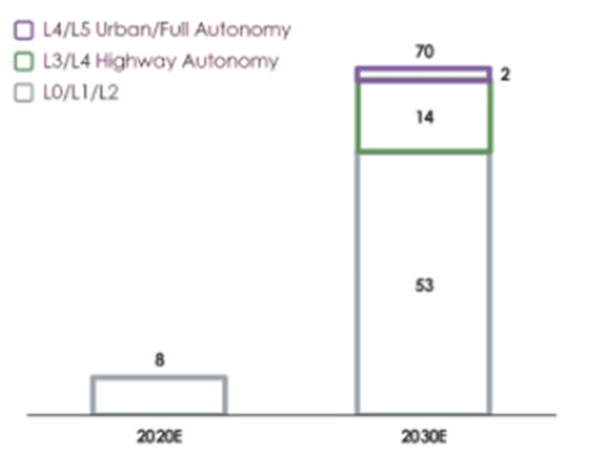

Luminar estimates that the ADAS and autonomous driving technology TAM will grow from less than $5 billion currently to $150 billion or more in 2030. More than 100 million new passenger vehicles are expected to be manufactured annually through 2030 and beyond, and Luminar anticipates roughly a 4% vehicle penetration rate across the industry.

There are also potential opportunities in adjacent markets, although it is unclear if Luminar will pursue these. Adjacent markets include delivery bots, mapping, smart cities, aerospace and defense. Some of these markets are highly competitive, though, with entrenched incumbents and low-cost production from China.

Figure 1: Global New Vehicle Market – millions of units (source: Luminar)

While there is a large opportunity, and Luminar has a solid solution, there are competitors developing advanced LiDARs. This includes companies like Argo, Aurora Innovation (AUR), Ouster (OUST), Innoviz (INVZ) and Aeva Technologies (AEVA). There are also Chinese competitors, like Livox, RoboSense and Hesai (HSAI).

Lidar vendors compete across a range of capabilities, including:

- Range > 200m

- Resolution > 200 pt / sq deg

- Frame Rate – 1-30 Hz speed correlated

- Field of View > 100 degrees

- Limited Interference

- Doppler – velocity measurement

Luminar believes that its systems offer a favorable combination of performance (high-resolution / long-range) and low-cost. ADAS Lidar must be low cost, with most LiDAR companies target a price below $250 per unit.

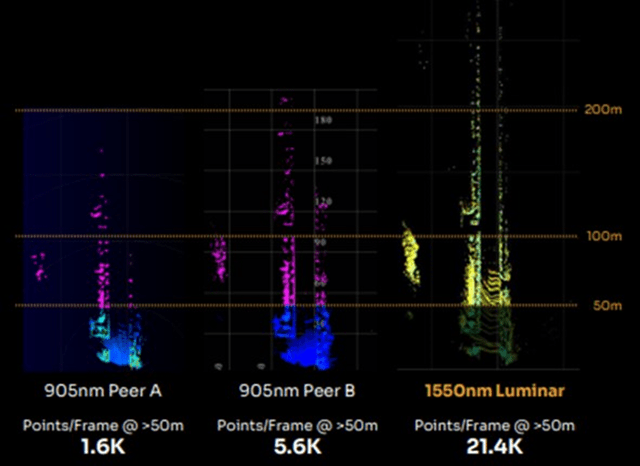

Luminar’s LiDARs utilize 1,550 nm light, compared to 905 nm for most LiDARs. This provides long range and less weather interference. Velodyne, Aeva and Innoviz are all beginning to leverage 1,550nm lasers though. Luminar also uses low-mass, encoded mirror scanning (scanning of an isolated field of view, low noise and rejection of uncontrolled light).

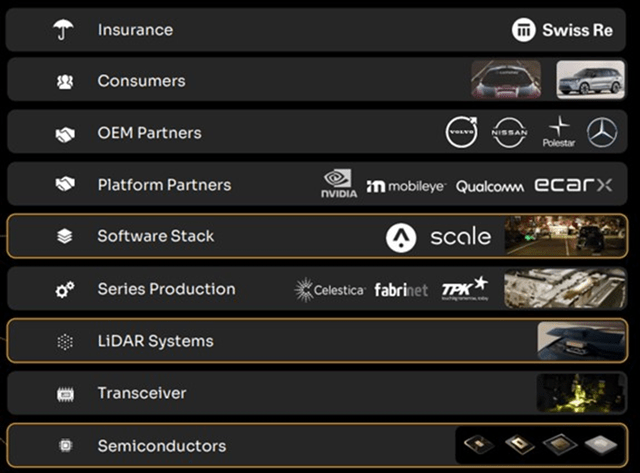

Figure 2: Lidar Ecosystem (source: Luminar)

Outside of LiDAR, Luminar will also face competition from more advanced camera perception systems and imaging radar. Imaging LiDAR provides higher resolution, dynamic range, and accuracy than conventional analog radar, helping to close some of the performance gaps with LiDAR. Mobileye (MBLY) recently suggested that improvements in areas like computer vision perception and imaging LiDAR were behind its decision to stop developing a FMCW LiDAR. Cruise and Waymo have both developed their own imaging radar solutions.

Tesla (TSLA) is probably the most prominent example of a company abandoning LiDAR and pursuing a camera only perception system. Mobileye is also working on a camera only system, although doesn’t appear to have plans to eliminate LiDAR in the short-term.

Luminar

Luminar is a LiDAR technology company that was founded in 2012 to capitalize on the opportunity that self-driving vehicles are creating. Its LiDAR has been designed from the chip-level up and features a number of technological breakthroughs. As a result, Luminar’s LiDAR provides long range, high point density, and dynamic scanning capability that is well suited to higher speed driving. The company has also developed perception and decision-making software.

Luminar offers:

- A LiDAR hardware-only solution

- An integrated LiDAR hardware and software solution for proactive safety systems

- An integrated hardware and software solution for highway autonomy systems

Luminar’s system operates at 1,550nm, compared to the 905nm wavelength lasers typically used in competing systems. 905nm systems utilize wavelengths near the visible spectrum, which can cause eye damage, whereas 1,550nm systems have no eye safety limitation, enabling them to operate at higher power. The 1,550nm wavelength is also less affected by solar and weather conditions. As a result, Luminar has suggested that its maximum range can be extended to as much as 600 meters. Many other LiDARs can only reliably see objects up to 100 meters away.

Figure 3: Birds Eye Point Cloud Illustration of Luminar versus 905nm Peers (source: Luminar)

While 1,550nm lasers may provide superior performance, the technology involved is far more complex. For example, indium gallium arsenide materials are required for the photo receivers, compared to a normal silicon photo receiver for 905nm lasers. This is a specialized niche, with Luminar vertically integrating through acquisitions to gain the necessary expertise:

- Black Forest Engineering (2017) – central processing ASIC

- OptoGration (2021) – indium gallium arsenide receiver chip

- Freedom Photonics (2022) – laser chip

- EM4 (2024) – optoelectronic components and laser modules

These acquisitions formed the basis of Luminar Semiconductor, which supplies components like the laser, ASIC and receiver. LSI now has over 100 unique customers and is reportedly breakeven. While LSI’s focus is on supplying Luminar so that it can capitalize on the automotive opportunity, it is also expanding into aerospace and defense.

Luminar’s LiDAR range includes:

- Model G Series – built for proof of concept

- Hydra – built for test and development

- Iris Family – built for series production

- Luminar Halo – built for scale and mass adoption

Luminar’s Hydra LiDAR sensors are dual-axis scan sensors that detect objects up to 500 meters away over a horizontal field of view of 120 degrees and a software configurable vertical field of view of up to 30 degrees. Hydra is designed for highway scenarios, with road tracking out to 80 meters, lanes to 150 meters, and objects to 250 meters.

Luminar’s Iris LiDAR sensors leverage the same core technology components as Hydra, but Iris is optimized across parameters like size, weight, cost and power to meet the requirements of series production. Iris provides camera-like resolution of more than 300 points per square degree and high data fidelity

Halo represents an improvement in performance, size and cost and is expected to be the product that enables adoption at scale. The new sensor is expected to enable a 4x improvement in performance, a 3x reduction in size, a 2x improvement in thermal efficiency, and more than 2x improvement in cost. Design-wise, it is expected to be under 1 inch in height, under 1 kilogram in weight, and consume approximately 10 watts of power. A Halo proof of concept has been demonstrated and sample builds are expected to begin in the second half of 2024, with delivery to select automakers by the end of the year.

In addition to LiDARs, Luminar offers compute units and software that potentially will allow the company to capture for value and improve its competitive positioning. Luminar’s electronic compute unit is designed to accelerate the development of perception systems. Raw point-cloud data from up to four LiDAR sensors is sent through a pipeline of processing layers to provide the outputs required for fusion and path planning.

Luminar also offers a range of software. This includes core sensor software, perception software and high-level vehicle function software (highway autonomy, proactive safety). Luminar recently launched its Sentinel software suite, with initial shipments to customers expected prior to the end of the year.

Luminar’s software is targeted at automakers that lack the in-house capabilities to develop their own software. Lidar is just one of several perception technologies though, and as a result, I question whether customers will see value in LiDAR software versus a more comprehensive solution.

Luminar has also partnered with Applied Intuition to develop a joint hardware and software solution that helps automakers to virtually test-driving perception systems. This is an area of unmet need given that existing 3D engines struggle to accurately model behavior from a sensor input perspective. Competition in this area is likely to be stiff though, with many companies developing similar solutions, including Nvidia (NVDA).

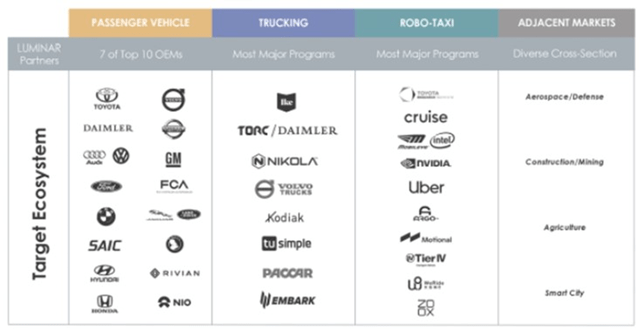

Luminar has around 50 commercial partners, which together represent approximately 75% of the target passenger vehicle, trucking and robotaxi ecosystem. The company’s near-term focus is on introducing LiDAR systems that enhance the performance of drivers as a standard feature on production vehicles.

Figure 4: Luminar Commercial Partners (source: Luminar)

Luminar’s primary commercial relationship is with Volvo (including Polestar) and this relationship should be a growth driver in coming years. Luminar entered into a series production contract with Volvo in March 2020. This contract was for Luminar to embed its products into Volvo’s next-gen vehicle platform (SPA2).

The EX90 is expected to be the first global production consumer vehicle with LiDAR. In April, Luminar achieved EX90 SOP for Volvo, with the company subsequently ramping production, beginning in June. Series production is expected to continue increasing in coming quarters. As a result, Luminar expects to ship more sensors in the second half of the year than all of its prior years as a public company combined. Volvo recently suggested that the ramp will be slower than initially expected though.

Luminar’s partnership with Polestar is also progressing, with Polestar on track to launch the Polestar 3 next year. Polestar also have additional vehicles in which they plan to incorporate Luminar’s technology. For example, the Polestar 4 will feature Mobileye’s Chauffeur and Luminar’s LiDAR technology. It appears that the vehicle will feature cameras, a front-facing LiDAR and Mobileye’s imaging radar.

Kodiak Robotics is also leveraging Luminar’s LiDARs in its self-driving trucks. Luminar’s sensor suite includes four ZF radars, two Hesai 360-degree scanning LiDARs, two Luminar Iris LiDARs and 8 cameras. Given Luminar’s capabilities, autonomous trucks should be a target end market. Not all self-driving truck companies believe that existing solutions are sufficient though, with Aurora Innovation deciding to develop its own FMCW LiDARs.

Luminar’s relationship with Mercedes-Benz also continues to progress. This partnership began in 2022 and is now reportedly worth several billion dollars, with Mercedes-Benz expected to add Luminar’s LiDARs to a broad range of vehicles by the middle of the decade.

Luminar also has a technical collaboration with Nissan and the companies are working out the scope of the next phase of their relationship. There is potential for LiDAR to be standardized across all Nissan’s vehicles, although meaningful revenue from this relationship is probably several years away. Nissan has been developing systems for autonomous driving and safety for a number of years.

Luminar has also suggested that it is anticipating an additional SOP in China before the end of the year which should help to drive future product sales.

Tesla is also a Luminar customer, although it is not clear that this relationship is important given Tesla’s attitude towards LiDAR. In the first quarter of 2024 Tesla was Luminar’s largest customer, accounting for more than 10% of the company’s $21 million revenue.

Luminar is far from having a monopoly in the market though. In fact, it is not even really clear that Luminar is the market leader. For example, Innoviz has a $4 billion deal with Volkswagen, one of the world’s largest auto manufacturers. This involves providing LiDAR sensors and perception software for self-driving vehicles and advanced driver-assistance systems. Innoviz’s order book is reportedly worth around $6.6 billion.

Aeva also has a $1 billion sensor supply deal with Daimler Truck. There has been no specification of deal length or number of sensors per vehicle though. Production is expected to start in 2026, with self-diving trucks expected on the road in 2027.

Luminar also plans on launching its own insurance business, to help drive adoption of LiDAR and capture some of the value created by LiDAR’s improved safety. Luminar has partnered with Swiss Re in support of this initiative. The first step in the partnership was quantifying the real-world safety impact of LiDAR, which will now be used to support lower insurance costs for consumers. Luminar plans on starting to write insurance policies by the end of 2024.

Financial Analysis

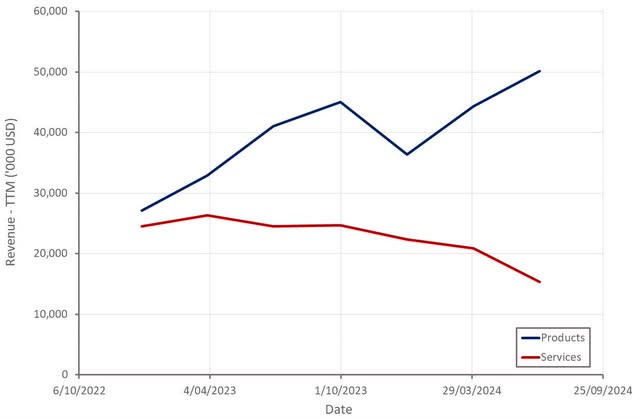

Luminar generated $16.5 million revenue in the second quarter of 2024, up 2% YoY. The $4 million QoQ decline in revenue was primarily due to the accounting treatment of a change in scope and increased engineering costs related to Iris+. There was a modest ramp of series production sensor sales at a lower ASP in the quarter though.

Luminar now doesn’t expect to reach a mid-$30 million quarterly run-rate until FY25. This is due to the slower than expected production ramp of Volvo EX90 and the renegotiation of a non-series production customer contract. Revenue is expected to be modestly higher sequentially in the third quarter with series production growth being partially offset by the renegotiation of non-series production customer contracts. Series production revenue is expected to increase through the second half of 2024 and into 2025

The company’s forward looking order book at the end of 2023 was $3.8 billion.

Figure 5: Luminar Revenue (source: Created by author using data from Luminar)

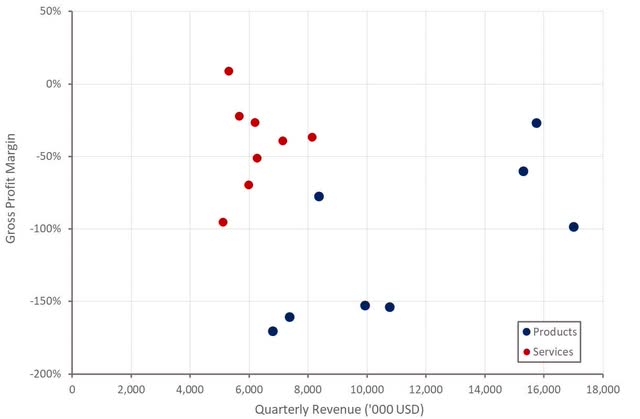

Luminar’s non-GAAP gross loss was $11.7 million in the second. There was a $10 million contract loss that negatively impacted Luminar’s gross margin in the quarter though. Gains were driven by reduced inventory reserves, write-downs and scrap due to process improvements. There were also fewer contract manufacturer charges and claim settlements.

Luminar is outsourcing future industrialization efforts, including TPK. The company also announced cost-cutting measures in May, including a 20% workforce reduction. In addition, Luminar has streamlined its Iris product family to reduce scope and improve cost and efficiency. Luminar believes that these efforts will reduce costs by around $80 million annually and expects to achieve this target by the end of the year. Luminar has largely completed its headcount reduction plans and continues to work on other initiatives, like contractor reductions and facility subleasing.

Luminar wants to reduce Iris material costs to below $500, with a long-term target of below $100, driven primarily by scale (higher yields, lower supply chain costs, improved overhead absorption). If the $500 target is achieved, Luminar anticipates having positive operating cash flow and operating income by 2024. The core cost of semiconductor components (laser chip, the photodetector, and the processing ASIC) is under $100. Luminar still needs to reduce of other more commodity components though.

Luminar’s gross loss is expected to increase over the next few quarters due to unfavorable sensor economics though. Positive sensor economics and gross margins are expected sometime next year, after Luminar ramps series production.

Figure 6: Luminar Gross Profit Margins (source: Created by author using data from Luminar)

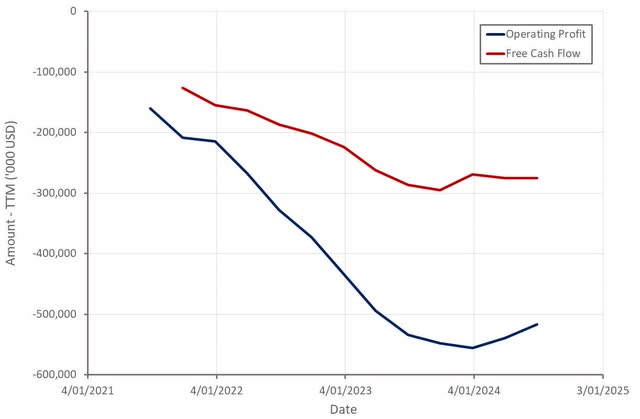

Luminar’s operating losses are currently large, which is both a function of poor gross margins, and the company’s current lack of scale. With revenue set to ramp significantly over the next few years, Luminar’s losses should narrow, but a large amount of cash will likely be consumed in the process.

Given the number of moving parts, it is difficult to estimate how Luminar’s losses will decline in coming years. I think the company will likely consume something like $300 million before achieving breakeven though. Analyst projections probably put this figure at closer to $150-200 million.

Figure 7: Luminar Operating Profit and Free Cash Flow Margins (source: Created by author using data from Luminar)

Luminar has roughly $211 million in cash and liquidity, including a $50 million line of credit that remains undrawn. This excludes proposed capital structure actions, including $100 million of new capital raised with convertible bond exchange. $18.7 million was also raised under the company’s equity financing program in the second quarter, and there is $132 million remaining on Luminar’s equity financing program. Luminar previously suggested that it would need around $200 million of additional capital to reach breakeven, or $100 million after the most recent raise. This is heavily dependent on how quickly Luminar’s revenue ramps going forward and the ability of the company to reduce COGS as it scales.

Luminar has been working to reduce and restructure its debt and push out maturities. While Luminar is making progress, it still has a large amount of debt and large losses. Over the next two years, the company will continue to try and reduce the remaining $200 million of convertible debt that is maturing in 2026.

Conclusion

Luminar’s results have been disappointing relative to guidance in recent quarters, with analyst expectations revised sharply lower as a result. This seems more likely a timing issue than a permanent impairment of the company’s prospects though.

With the introduction of Halo and the incorporation of LiDAR in mass market vehicles, Luminar’s revenue could ramp sharply in coming years. While Luminar’s share price could be expected to move higher as a result, competition will be critical. There are several LiDAR companies with broadly similar offerings, and there is a risk that imaging radar and improved camera and computer vision capabilities will reduce the importance of LiDAR over time.

Luminar believes that the complexity of the technology and the process of becoming a qualified supplier mean that barriers to entry are high and that its products will be sticky once embedded into the designs of OEMs. There is likely some truth to this, but I do not believe it will be sufficient to support high margins over a long period of time. While there is an enormous opportunity that is likely to come to fruition over the next few years, companies with more vertical integration and/or greater exposure to the software layer should be better positioned.

In addition, Luminar’s financial position could leave the company vulnerable if things do not go to plan. Luminar believes that it still needs to raise another $100 million so that it has sufficient liquidity to reach breakeven. This estimate does not seem unreasonable, but is dependent on how quickly production costs decline and how rapidly Luminar’s revenue increases.

Luminar’s revenue multiple appears high, but this is meaningless in some ways, as the company could be considered pre-revenue. Analyst projections have Luminar’s revenue in excess of $3 billion by the end of the decade. If Luminar can achieve this type of outcome, the returns should be strong. I think this projection is overly optimistic though. Alternative sensing technologies will likely limit the importance of LiDAR and competition is likely to ensure the LiDAR market is fragmented.

Figure 8: Luminar EV/S Multiple (source: Seeking Alpha)

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.