Summary:

- I upgrade Nike to a ‘Buy’ rating with a one-year target price of $98 per share, reflecting current stock price challenges.

- Nike’s Q1 results show -9% revenue growth, with wholesale and Nike Direct revenue dropping by 7% and 12%, respectively, due to weak consumer sentiment and China market.

- NKE is accelerating product innovation with new launches like Pegasus 41 and Air Max Dn, aiming to boost growth despite near-term challenges.

- Projecting 6% organic revenue growth from FY26 onwards, driven by new products, restructuring, and leadership changes, despite a cautious outlook for FY25.

code6d

Back in June 2023, I presented my ‘Strong Sell’ thesis on Nike (NYSE:NKE), and since then, the stock price has dropped by more than 17% compared to 30% return of S&P 500 (SPX) during the same period. In my latest article published in April 2024, I highlighted that their growth engine from China had essentially disappeared. While the company continues to face tremendous challenges in new product innovation and weak China market, I think these near-term challenges are now reflected in the current stock price. Conversely, I upgrade to a ‘Buy’ rating with a one-year target price of $98 per share.

Quarterly Update

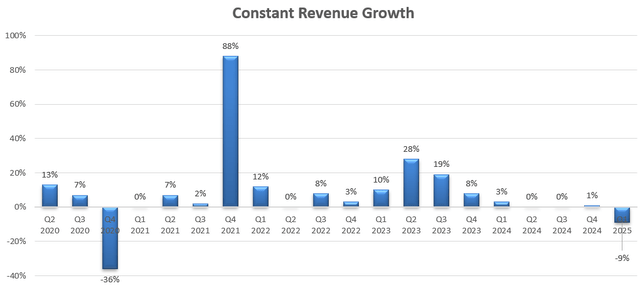

Nike released their Q1 FY25 result on October 1st after the bell, reporting -9% growth in constant revenue. The company also announced to postpone their Investor Day due to CEO change.

Nike Quarterly Result

Their wholesale business declined by 7% year-over-year, and Nike Direct revenue dropped by 12%. The weak growth was caused by the sluggish consumer sentiments, inventory destocking and weak China growth. My biggest takeaway from the quarter is Nike’s turnaround might take more time. The company needs to focus on addressing their new product innovations, stabilizing their senior management team and revitalizing their Direct-to-Consumer business.

Speed Up Product Innovations

To some extent, Nike’s sluggish growth was caused by their slow product innovation cycle in recent years. Over the past few quarters, the management has indicated plans to reinvent their product design strategy and accelerate new product launches. Here are some examples:

On July 18th, Nike unveiled their technology advances in the Pegasus 41, featuring a full-length foam midsole made from ReactX foam.

On March 26th, Nike launches the Air Max Dn, a shoe designed to create a more dynamic heel-to-toe transition.

In addition, Nike will launch their Pegasus Premium and Zoom Vomero in Spring 2025, as communicated over the earnings call. I am encouraged to see the management accelerating their new product design cycles, which could potentially boost Nike’s business growth in the near future.

Outlook & Valuation Update

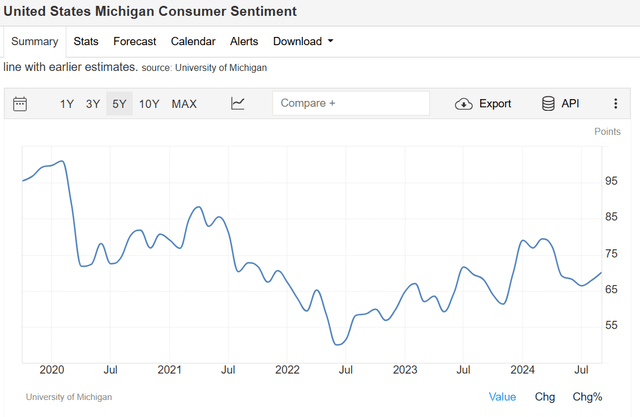

While the Fed has begun to cut interest rates, the US consumer sentiment remains weak this year, as shown in the chart below. In addition, Nike will still face inventory destocking challenges in FY25; therefore, I think FY25 would be a transitional year for Nike.

Trading Economics

Nike has implemented several major changes in leadership, organization structure, and product innovation strategies. While I am encouraged by these changes, the restructuring and product innovation cycles might take a long time to translate into business growth.

In addition, over the earnings call, the management expressed a cautious view on China’s growth and the highly promotional activities in FY25. Considering all these factors, I anticipate Nike’s revenue will decline by 8% in FY25, assuming 10% decline in developed countries and 5% decline in emerging markets.

For the normalized growth from FY26 onwards, I anticipate the revenue in developed regions including North America and EMEA will grow by 5% in revenue, driven by 2% volume growth, 1% pricing growth and 2% new product launches. In developing countries, I project Nike’s revenue will increase by 8%, aligned with their historical trends.

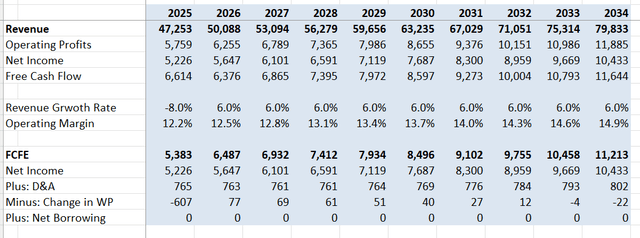

As such, I calculate that Nike will deliver 6% organic revenue growth from FY26 onwards. On the margin side, I project 30bps annual expansion, driven by 15% from gross profits due to new products, 10% from SG&A operating leverage and 5% from reducing restructuring costs. With these assumptions, the DCF model can be summarized as follows:

Nike DCF

The cost of equity is calculated to be 11.5% assuming: risk-free rate 3.6%; beta 1.13; equity risk premium 7%. After discounting all the free cash flow from equity (FCFE), the one-year target price is estimated to be $98 per share.

Key Risk

- On September 19th, Nike announced that Elliott Hill will become CEO, effective 14 October 2024. At this moment, it is unclear what new strategy the incoming CEO will pursue. Typically, a CEO change is accompanied by senior management reshuffling. I anticipate Nike will experience some senior leadership change in the near future.

- The Chinese central bank has injected more liquidity into the financial system to boost their deflation economy. The local equity market rallied due to this stimulus. However, I am not sure if this liquidity stimulus could potentially boost consumption sentiments. Nike is a premium brand and their growth is heavily reliant on financial conditions among middle-class in China.

End Note

Overall, I think Nike is in the midst of a turnaround under the new leadership. The current stock price has priced in their near-term growth challenges. As such, I upgrade to a ‘Buy’ rating with a one-year target price of $98 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.