Summary:

- We previously shifted our stance on AT&T to neutral due to a balanced risk-reward.

- The sale of DirecTV, despite a significant loss, aids AT&T’s deleveraging and refocuses on its core business.

- AT&T offers an attractive earnings yield of 10% and free cash flow yield of 12%, but faces bigger risks in 2025.

hapabapa

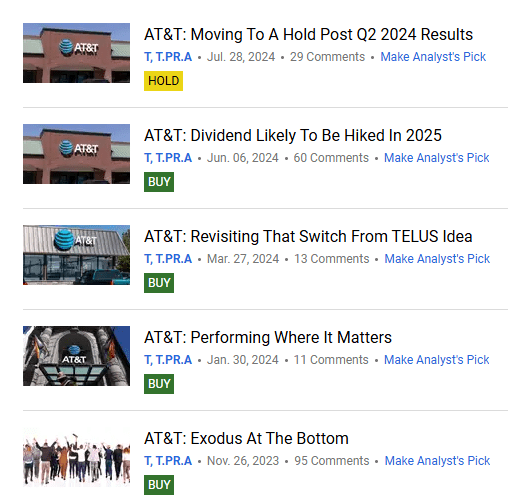

After a bunch of bullish articles, we shifted gears a bit on our last coverage of AT&T (NYSE:T).

Seeking Alpha

The rationale: There was finally a balance to the risk-reward scale, and when that happens, you cannot stay bullish.

We previously expected a dividend hike in 2025, but at this point, we think it won’t happen if the recession materializes on schedule. For an investor relying on the dividend, we think this is about as safe as it gets for now. From a total return standpoint, which is the only metric that we care about, this has moved to a relative neutral point. Here, the downside risks are about even currently with upside potential.

Source: Seeking Alpha

We look at the recent DirecTV sale and tell you how we see this playing out.

DirecTV

DirecTV, which was possibly one of the worst investments AT&T made (and that’s the top in a really long list), is now leaving the fold completely. AT&T announced that it entered into an agreement to sell its 70% stake in DirecTV to TPG Capital (TPG). The sum total was $7.6 billion. Some of these payments will be received in 2024 and the majority ($5.4 billion) will happen in 2025. The likelihood of this deal getting completed is extremely high, but it still needs regulatory approval.

There are two ways to look at it. In relation to how much AT&T paid for this, this is an absolute and unmitigated disaster. AT&T paid $67 billion for DirecTV and said this when the purchase was completed.

“Combining DirecTV with AT&T is all about giving customers more choices for great video entertainment integrated with mobile and high-speed Internet service,” said Randall Stephenson, AT&T chairman and CEO. “We’ll now be able to meet consumers’ future entertainment preferences, whether they want traditional TV service with premier programming, their favorite content on a mobile device, or video streamed over the Internet to any screen.

“This transaction allows us to significantly expand our high-speed Internet service to reach millions more households, which is a perfect complement to our coast-to-coast TV and mobile coverage,” Stephenson said. “We’re now a fundamentally different company with a diversified set of capabilities and businesses that set us apart from the competition.”

Source: AT&T

It sold a 30% stake to TPG for $16.25 billion, and now the sale of the remaining stake seals in a $44 billion loss.

That is still focusing on the sunk cost here. Crystallizing the loss really does not change the equation for AT&T. While that does show why AT&T stock has done so poorly for so long, the market was not giving any realistic value to this “asset.” We think the value paid is fair, and at least AT&T made the sale in the loosest financial conditions. With this sale, we see AT&T’s deleveraging to be really close to being completed.

Outlook

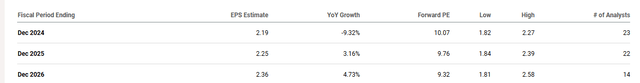

AT&T’s latest capital transaction brings back focus on the core business. That core business has been steady and likely to stay that way outside a moderate to severe recession.

Seeking Alpha

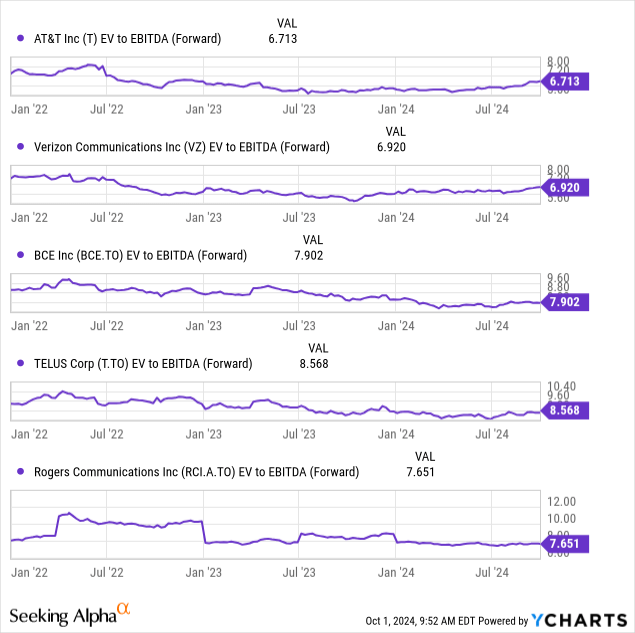

What you get here is a nice earnings yield of about 10% and that likely is more attractive today than it was six months back. The rate cuts in the pipeline and the lower bond yields help the valuation. The free cash flow yield is even better. We’re looking at close to 12% for 2024 and 2025 (based on estimates). On an EV to EBITDA basis, AT&T rings in as the cheapest amongst the telecom majors in North America.

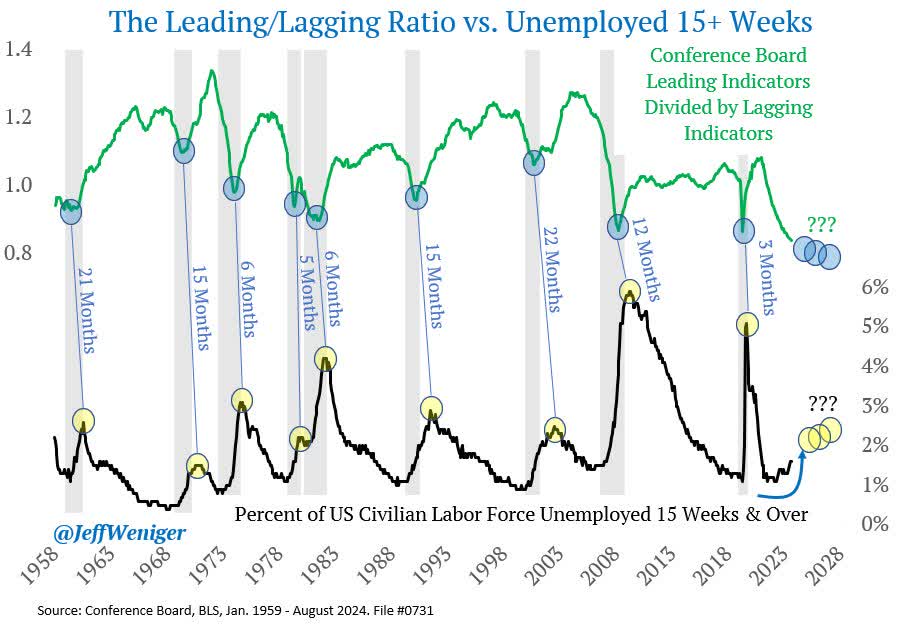

While there’s a massive gap (1-2 multiples of EV to EBITDA is far more than the same of P/E multiples), with TELUS Corp. (TU), BCE Inc. (BCE) and Rogers Communications (RCI), the gap with Verizon Communications (VZ) is extremely small. For AT&T, the question now is how it deploys that excess free cash flow yield over and above its dividend. In the past, it has made some really dubious choices. As long as the excess cash flow is spent in a shareholder-friendly manner, AT&T can continue to deliver decent returns. From our perspective, we see some bigger risks in 2025 than where consensus stands. The longest yield curve inversion is not something we would ignore simply because things look OK now. Historically, the leading/lagging indicator ratio has projected a pretty long jump in the unemployment rate.

Jeff Weniger As Shared on X

Is this time different? We don’t believe so.

Those risks are well-balanced with the valuation, and we’re once again coming down to the neutral side. We see a little bit more oomph in VZ here relative to AT&T as well. This is primarily as we see VZ as the better capital allocator. While we own shares in both, AT&T shares will be called away, should the current price hold.

Preferred Shares

AT&T also has two sets of preferred shares listed. These are:

1) AT&T Inc. 5% DEP RP PFD A (NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:T.PR.C)

Since our previous coverage, these have rallied strongly. They now have a stripped yield of about 5.7% on average. We consider these and most fixed income assets as expensive today. The reason is that we have priced in maximum rate cuts while pricing in the most benign outcomes for credit markets. This makes little sense, as the Federal Reserve is unlikely to maintain a breathtaking pace of rate cuts if there’s a soft landing. If those rate cuts do materialize, then it means that we have indeed dropped deep into recession territory. In that case, we would need far wider credit spreads for such securities. At present, there are few bargains available, and we are being very cautious with new purchases.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ, TU, BCE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

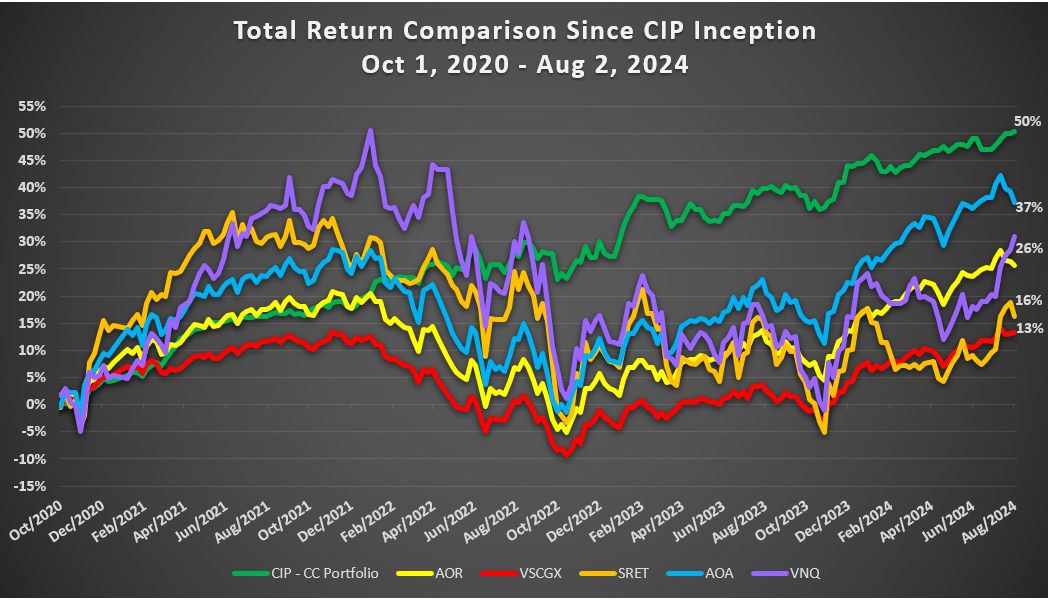

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11-month money guarantee, for first time members.