Summary:

- Despite a 19% decline in VALE stock since February 2023, I believe China’s recent robust monetary stimulus will boost demand for iron ore, benefiting Vale.

- Vale’s Q2 financials show strong operational performance with a 15% QoQ rise in EBITDA (despite a YoY decline), and increased shipments.

- Vale maintains a disciplined capital allocation strategy, reducing net debt and returning capital to shareholders through dividends and share repurchases, yielding in total of ~9.56%.

- Vale is a clear beneficiary of China’s efforts to turn around its economy – this makes its forwarding EV/EBITDA multiple of ~3.5x very attractive and safe, in my view.

- I’ve decided to update my “Buy” rating today and recommend investors who bought Vale a few months ago (like me) to average down here. Vale may be a great value pick in today’s markets.

gorodenkoff/iStock via Getty Images

My Thesis Update

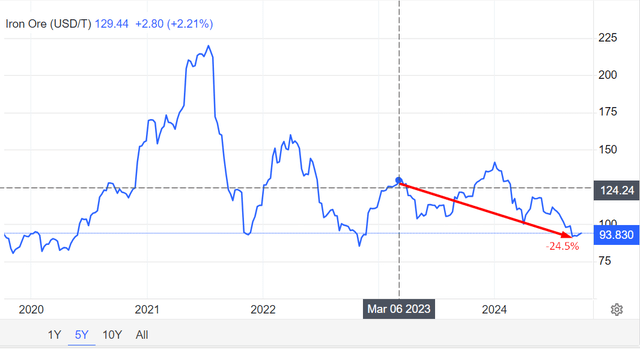

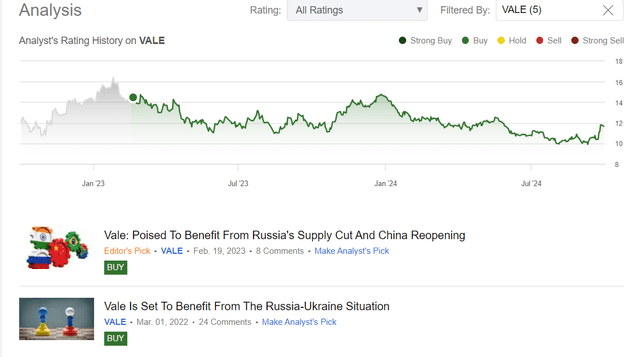

The last time I wrote about Vale S.A. (NYSE:VALE) was on February 19, 2023, when I assumed that the company was poised to benefit from Russia’s supply cut and China’s reopening activities. As it turned out (against my bullishness), the reopening was accompanied by a downturn in the Chinese economy, which led to a more serious real estate crisis than many initially assumed (myself included). The fall in real estate demand also affected demand for iron ore, to Vale’s detriment – prices for this commodity have fallen by >24% since I resumed my buy recommendation on the stock.

Trading Economics, Oakoff’s notes

I use this dynamic to explain the price performance we have observed in the VALE stock – since mid-February 2023, it has lost >19% on a total return basis (nominally over 30%).

Oakoff’s coverage of Vale stock

However, today, I think the cycle should turn in favor of buyers again. Despite the negative result of my last bullish call, I think it’s time to double down on VALE today.

My Reasoning

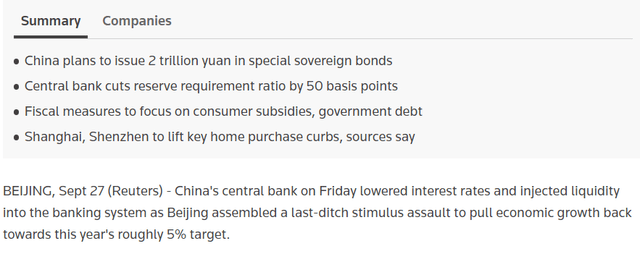

Things changed quite rapidly in China over the past few weeks. As we all may see, China’s policy approach now is shifting towards a robust monetary stimulus’ that should allow the official growth target of around 5% to be met for the year. The new emphasis on stimulus began in mid-September, with a spate of measures announced on 24 September. These included cuts in both the reserve requirement ratio and the borrowing rates (by 50 basis points and 20-30 basis points, respectively, across tenors) by the People’s Bank of China (aka PBoC) and state support for the capital market.

These measures were followed by a meeting of the Politburo on 25 September that was chaired by President Xi and included his closest allies and trusted subordinates. At the meeting, top officials committed to supporting the property sector and increasing fiscal spending – these steps quickly and naturally led to a major rally in Chinese assets as the CSI 300 and the Hang Seng indices posted the best weeks since at least 1998; the Chinese yuan also appreciated against the US dollar.

The UBS analysts team (proprietary source, September 2024) noted that the policy surprise has rekindled hopes that China’s growth trajectory might be on the cusp of turning around:

We think that rapid policy easing will lift short-term sentiment and enhance Chinese equity valuations – which in turn could lead to further market gains.

The property sector is being targeted as well: the PBoC is lowering mortgage rates by 50 basis points for existing homebuyers and hiking the loan-to-value ratio for affordable housing projects. Looking forward, the UBS team expects fiscal policy to be a key pillar in sustaining growth. The analysts see room for large-scale fiscal stimulus of CNY 5-10 trillion to improve long-term demand, with the funds likely to be allocated to affordable housing and other social welfare improvements.

In my opinion, based on banal logic, this can only be a positive catalyst for everything to do with China and its construction sector. Iron ore prices in Asia are already reacting to the new CCP’s stimulus announced:

And here we come to Vale, the largest iron ore producer in the world. According to the Brazilian report, “of the 388 million tons of iron ore exported by Brazil last year, 64% went to China, with 76% coming from Vale” Now let’s imagine that the new measures to stimulate China lead to a real increase in demand for iron ore (without this, there will be no expansion in the region’s construction sector) – Vale should therefore, in theory, be one of the main beneficiaries.

Now a few words on the recent financials and operations of Vale.

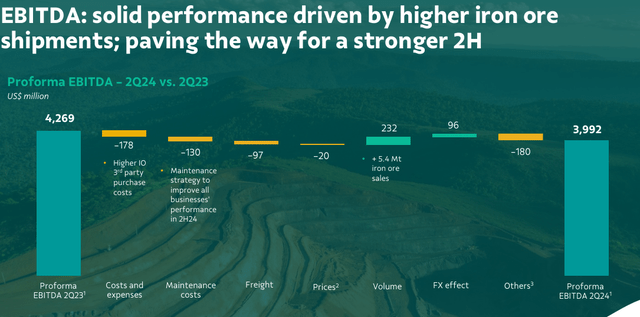

In Q2 2024, the company reported pro forma EBITDA of $3.9 billion, which is down ~6.5% YoY, but up 15% on the previous quarter, largely due to “strong operational performance across all commodities”, driven by a 25% YoY increase in shipments (which was partly offset by higher operating costs and lower realized prices for iron ore).

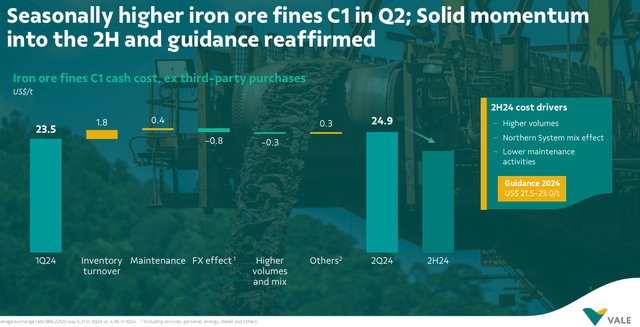

Vale’s iron ore production for the quarter was the highest in the second quarter since 2018. The C1 cash cost for the iron ore unit economics was $24.9 per ton (inventory turnover effects in the second quarter), while for the full year, the firm expects to hit $21.5 to $23 per ton, with production costs already down to $22 per ton by June thanks to better cost dilution, more production in the Northern System and less maintenance. Vale’s Energy Transition Metals business registered lower all-in unit costs for nickel (down 12% year-on-year to $15,000 per ton) and higher unit costs for copper (up 18% to $3,600 per ton, due to maintenance activities).

On a consolidated basis, VALE’s sales increased 7% YoY, further underpinning confidence in the company’s ability to deliver on the top end of the 2024 guidance. Vale’s realized all-in premiums were slightly negative at 10 cents/t and 7% of the portfolio was sold above the benchmark, mostly high-silica products, which were sold directly in the market.

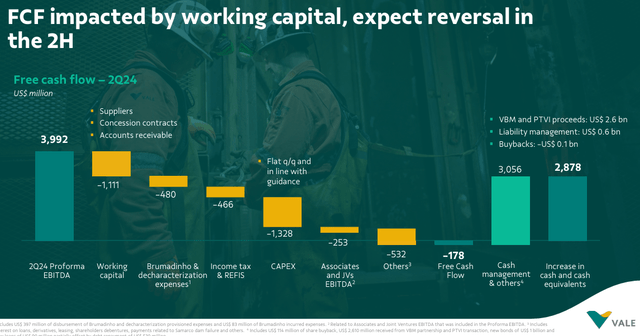

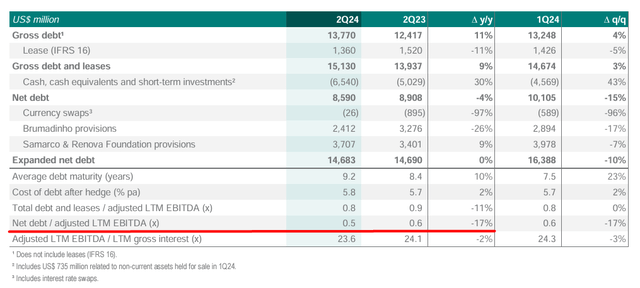

In the balance sheet, Vale’s cash and cash equivalents rose by $3.1 billion in Q2, thanks to $2.5 billion in proceeds from the Vale Base Metals partnership and $1 billion from a bond issuance. However, in the statement of cash flows, free cash flow was negative $0.2 billion, due to higher supplier payments and concession contract obligations. CapEx remained steady at $1.3 billion, in line with the annual CapEx guidance of $6.5 billion. Nevertheless, the management expected a reversal in 2H 2024:

Management seems to be bullish about the near-term outlook as they now expect a reduction in high-silica products in the sales mix in the second half of 2024 on the back of expected higher production in the north and growth projects coming online, like Vargem Grande and Capanema.

As it was noted during the Q2 earnings call, the management team remains confident in achieving the top end of their iron ore production guidance of 310 to 320 million tons for 2024. Vale’s ambition “to be a top supplier of pellets and concentrates for low carbon steel production” seems well-supported:

The joint venture for the Sohar concentration partnership in Oman has attracted interest from several potential investors and has the potential to generate attractive returns. Given these positive developments, we believe that Sohar… is a good prototype of the Mega Hubs.

What I like about Vale is that the company maintains its disciplined capital allocation strategy no matter what. In Q2, it paid an additional distribution of $1.6 billion in capital interest, reaffirming Vale’s commitment to returning capital to shareholders.

They also managed to reduce their net debt balance by 4% YoY, therefore, lowering the net debt-to-EBITDA to 0.5 from 0.6 last year.

VALE’s Q2 financials, Oakoff’s notes

Going forward, Vale should keep focusing on asset-light growth opportunities now being able to expand the net debt balance within policy targets. With assumingly higher selling prices now and heightened demand from China, Vale is likely to continue to return value to shareholders through its dividend and share-repurchase program. It’s important to mention here: throughout FY2024 Vale paid out $0.9149/sh in dividends, which translates to ~7.8% of the current stock price, so with the $862.4 million of stock repurchased on a TTM basis, the total shareholders yield is actually close to 9.56% as of today.

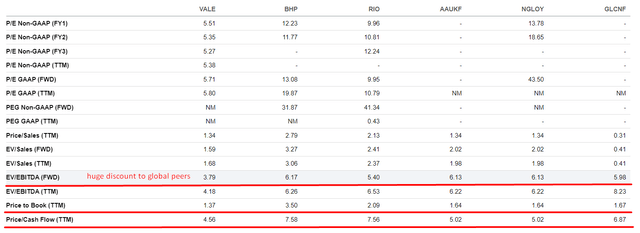

In my opinion, Vale is one of the most interesting large-cap mining value plays in the global mining market because a) its operations are almost exclusively in one or two regions and there are no other geographical risks apart from Latin America, b) it has a large asset base, c) it has a generous shareholder return policy and d) its valuation is very cheap. Regarding the last point, we can verify this using the comparison table provided by Seeking Alpha – VALE is the cheapest among its peers in terms of EBITDA generation potential (EV/EBITDA), assets on the balance sheet (P/B), and cash flows (P/CF):

Note: I’d like to say that Vale is the cheapest in terms of P/E as well, but I don’t have enough data on hand to say so, as you may see above.

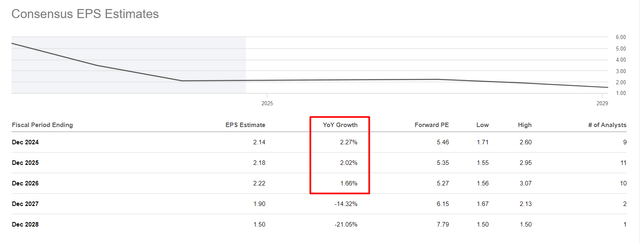

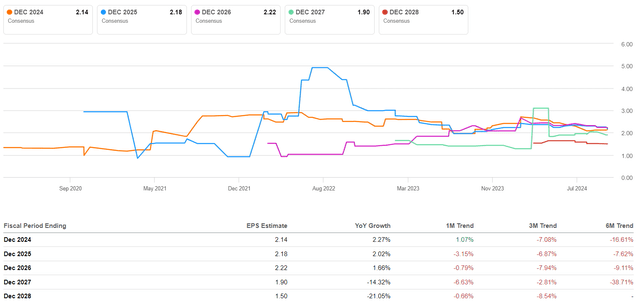

I would also note that the consensus estimates for EPS point to a slight expansion over the next few years. I do not think these forecasts factor in the potential growth in China because according to Seeking Alpha’s revision data, we haven’t seen any major upward revisions in recent months (the opposite has been the case).

Seeking Alpha, Oakoff’s notes Seeking Alpha

I believe Vale’s strategic initiatives and operational results have put it in a solid position for long-term growth and value creation in the years ahead, so given that it returns ~9.5% of its market cap to investors (on a TTM basis) and trades at just 3.8x of forwarding EV/EBITDA with an expectation of rising earnings in 2025 and above, I conclude that Vale deserves to be called a “Buy”.

Risks To My Thesis

While I am bullish about the recent Chinese policies designed to boost growth, there’s a chance that they might not be as effective. The Chinese economy is facing structural issues, with high leverage and demographic transition that will likely make monetary and fiscal easing less efficacious. If the property sector remains depressed or the general economy doesn’t accelerate, the expected surge in demand for iron ore might not be as large as expected.

Furthermore, the majority of Vale’s activities are carried out in Brazil and the company is therefore at risk of regional shocks such as political instability, regulatory changes, and environmental problems. Any disruption in production caused by natural disasters, accidents, or interference by authorities might undermine Vale’s ability to fulfill its production goals and, consequently, its financial performance.

While I highlight Vale’s desirable valuation ratios, market sentiment can be influenced by macroeconomic factors, the risk appetite of investors, and sector dynamics. If investors become more risk-averse or the mining sector becomes unpopular, Vale’s stock might underperform despite its strong financials.

Your Takeaway

Despite the obvious risks to my thesis, I believe it’s very likely that the cyclicality will turn in Vale’s favor in the medium term. As a major player in the iron ore market, the company is a clear beneficiary of China’s efforts to turn around its economy.

Even with today’s EPS growth forecasts only marginally covering inflation growth in the developed world, I believe Vale is in a position to continue paying good dividends and buying up its stock from the market. This makes the current FWD EV/EBITDA of ~3.5x a very attractive and safe multiple.

For this reason, I’ve decided to update my “Buy” rating today and recommend investors who bought Vale a few months ago (like me) to average down here.

Good luck with your investments!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.