claffra/iStock via Getty Images

The Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE), which tracks the S&P 500 energy sector (SP500-10), was the only S&P 500 sector that fell 3.7% in the third quarter of 2024 compared to Wall Street’s benchmark index, S&P 500, which hit record highs, closing the quarter up 6%. U.S. markets witnessed a broadening of the rally in Q3, thanks to optimism surrounding a soft landing, Fed rate cuts, and encouraging inflation results.

One key reason for the sector’s underperformance has been a sharp downturn in oil prices, pressured by strong supplies, particularly in the United States and economic weakness, particularly in China.

US commercial crude oil inventories fell to 413M bbls, to the low end of the five-year range. Energy’s outsized fall comes as Crude Oil Futures (CL1:COM) and Brent Futures (CO1:COM), the international benchmark price, were trading near $68.36 and $71.90 per barrel, respectively, on Monday.

Industries performance:

Both the industries recorded negative growth, with Energy Equipment & Services (SP500-101010) and Oil, Gas & Consumable Fuels (SP500-101020) declining 7% and 3% during the quarter.

Fund Flows

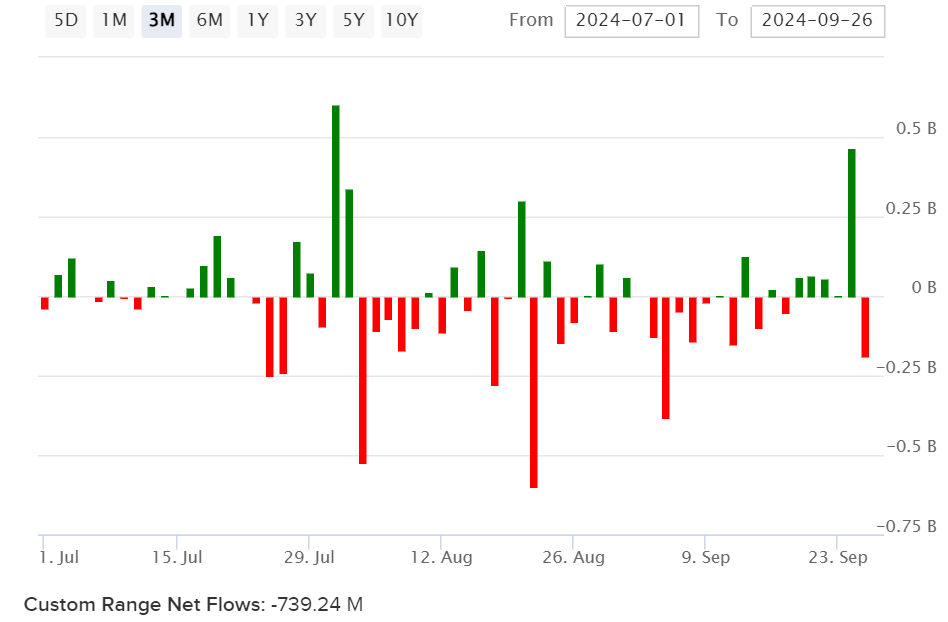

XLE reported fund outflow of $739M during the last quarter

Image source: etfdb.com

Top performers:

Targa Resources (NYSE:TRGP) +14.7%.

Kinder Morgan (NYSE:KMI) +14.1%.

ONEOK (NYSE:OKE) +12.9%.

The Williams Companies (NYSE:WMB) +9.4%.

Baker Hughes (NASDAQ:BKR) +5.2%.

Bottom performers:

Devon Energy (NYSE:DVN) -16.7%.

Occidental Petroleum (NYSE:OXY) -15.31%.

APA Corporation (NASDAQ:APA) -13.40%.

Valero Energy (NYSE:VLO) -12.98%.

Diamondback Energy (NASDAQ:FANG) -12.86%.

What Quantitative Measures Say

Seeking Alpha’s Quant Rating system gives Energy Select Sector SPDR Fund ETF (XLE) a Strong Sell rating, with a score of 1.41 out of 5, based on D- ratings on Momentum and Risk, A+ rating for liquidity, A- for dividends and A for expenses.

What Analysts Expect

Seeking Alpha analysts gave XLE a Buy rating with a score of 3.83. Five out of six analysts surveyed by Seeking Alpha in the last 90 days consider it a Buy, One gave Hold.

Energy ETFs