Summary:

- Salesforce’s stock is a Strong Buy with a 34% upside, driven by robust financials and innovative offerings like Agentforce.

- Agentforce enhances CRM’s AI capabilities, unlocking new revenue opportunities and reinforcing its reputation as an innovative leader.

- CRM’s profitability is improving, with a shift from net debt to net cash, enabling continued investment in growth and innovation.

- Despite competitive risks and cybersecurity concerns, CRM’s balanced approach to profitability and innovation makes it a compelling long-term investment.

John M. Chase

My thesis

Salesforce’s (NYSE:CRM) stock kept up well since my initial coverage dated July 4. The stock returned investors around 4.5% since then, justifying my Strong Buy recommendation.

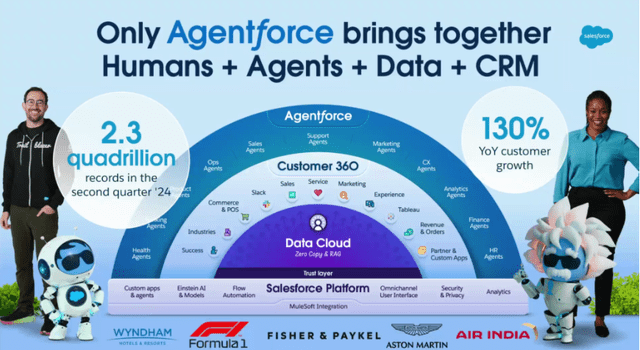

Good news is in and that the most recent developments are very compelling, and the valuation remains very attractive. Just that, the company recently announced a new product offering, dubbed Agentforce, and the feedback from several top-notch Wall Street analysts has been extremely positive. I share that enthusiasm, since Agentforce not only serves to leverage CRM’s potential to generate robust revenue growth, but simultaneously serves to reinforce the company’s image as one of the most innovative companies in the world to have developed the best-of-breed AI technologies. The company’s profitability profile in 2024 looks stellar, helping to accumulate resources to continue pouring billions in innovation. With the valuation still very attractive, CRM is undoubtedly a Strong Buy.

CRM stock analysis

The sentiment of the market and Wall Street analysts is crucial over the short term for any stock, even for high-quality names like Salesforce. From this perspective, recent developments around CRM look quite bullish. During the last week of September, CRM received quite positive feedback from Piper Sandler based on “a favorable risk-reward given the potential for FCF per share to double to $20+ by F2029 (CY28) from $9.65 in F2024 (CY23), even if top-line growth remains at subdued levels of 8-9%”.

Another prominent Wall Street name that reiterated its positive outlook for CRM is Wedbush. The firm’s analysts are optimistic about CRM’s revamped AI strategy, which creates numerous cross-selling opportunities for Salesforce’s latest offering, Agentforce. Another reputable name from Wall Street, Baird, was also quite positive about the Agentforce release.

Frankly speaking, I am also impressed by the new offering. There are various crucial areas for shareholder value creation from the Agentforce. The most obvious one is that adding another layer of AI capabilities increases the potential to unlock new revenue opportunities. But this not only increases short-term revenue growth potential by charging new fees or subscriptions, but also creates a sustainable fundamental pillar.

I think so because AI will help in streamlining interactions within the ecosystem, which will highly likely improve customers’ experience. Satisfied customers will likely be more loyal to CRM, which will create more cross-selling opportunities for the company. The more CRM’s offerings customers use, the higher switching costs become for them. Strong retention rates are vital to create long-term value for shareholders.

Apart from the potential direct financial impact, the Agentforce will also likely help in maintaining CRM’s image as one of the most innovative companies in the world. Expanding the AI exposure means that the company is still committed to innovation rather than over relying on its legacy offerings. A strong image of an AI-powered company will highly likely help CRM to capture its notable piece of the booming AI spending worldwide.

Seeking Alpha

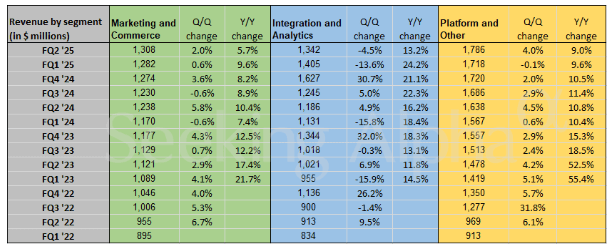

Apart from promising prospects of the new AI-powered offering, CRM also offers investors robust financial performance. CRM delivered a 9% YoY revenue growth in FQ2 2025, which was slightly higher than consensus expectations. When a company demonstrates revenue growth across all segments, it is a strong bullish sign for me. This means that the company’s business mix is robust and there is no business line that drags down the consolidated performance. Moreover, CRM also demonstrated revenue growth across all geographic areas it covers, which is also a clear indication that the company’s offerings are compelling worldwide.

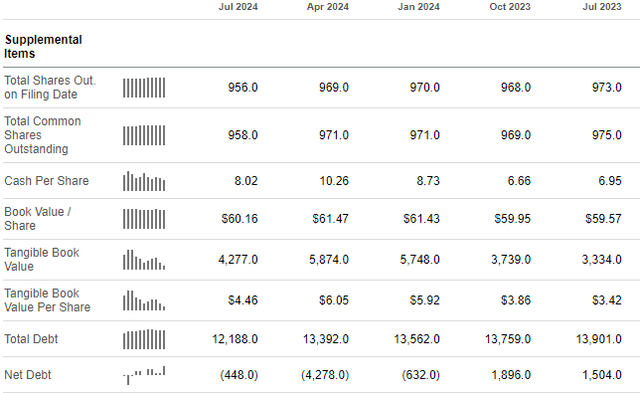

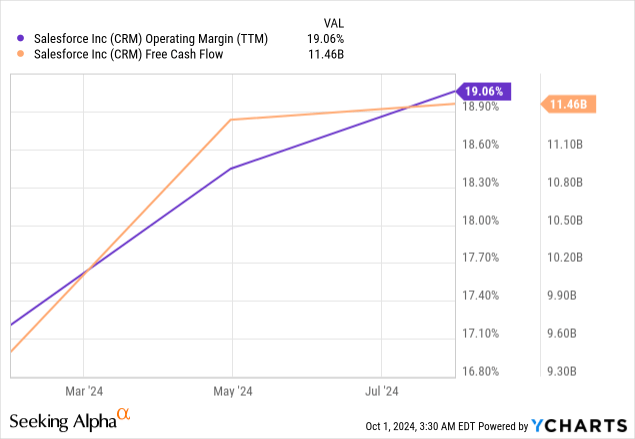

Profitability is another crucial factor for me as a long-term investor. The company’s profitability profile in 2024 is impressive. The TTM operating margin has shown improvements throughout the year, as has the free cash flow. This remarkable enhancement in profitability strengthens CRM’s balance sheet. Three quarters ago, the company had nearly $2 billion in net debt, but as of the latest reporting date, CRM is in a net cash position. Additionally, the outstanding share count has slightly declined, indicating low dilution risks for shareholders, which is always beneficial for investors.

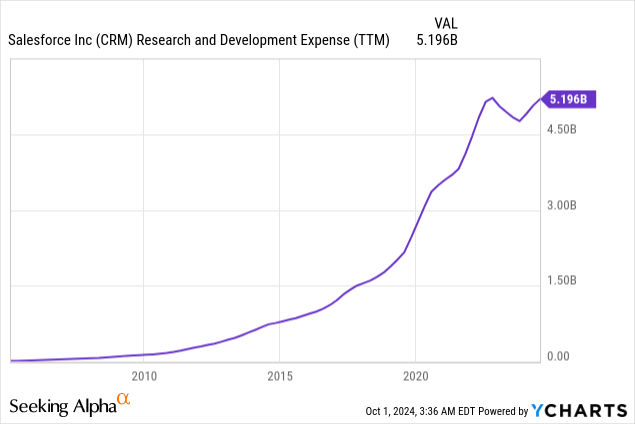

This kind of robust balance sheet is exactly what gives CRM the ability to continue its investment in growth and innovation as it spends billions. CRM’s current TTM RD spending exceeds $5 billion, and I think this is why in the coming quarters we will continue to see more new offerings or features released. The company also recently announced its acquisition of Zoomin, a long-term partner of CRM. Acquisitions have their inherent risks given their high degree of uncertainties, but not when the acquirer is buying a company it has had a long-term partnership with, which is the case here. The acquisition aims to further enhance the AI capabilities of CRM’s offerings.

In conclusion, I retain a positive outlook for CRM. The company’s improving profitability profile is building a stable financial base to sustain future growth and innovation. The recent introduction of the Agentforce offering looks like it has the potential to create new revenue growth opportunities, while cementing CRM’s reputation for being one of the best and most innovative companies in the world with a strong AI engine.

Intrinsic value calculation

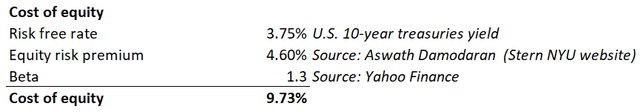

The Cost of equity is the discount rate for the discounted cash flow (DCF) approach. The CAPM formula below suggests that CRM’s cost of equity is 9.73%, which looks conservative enough.

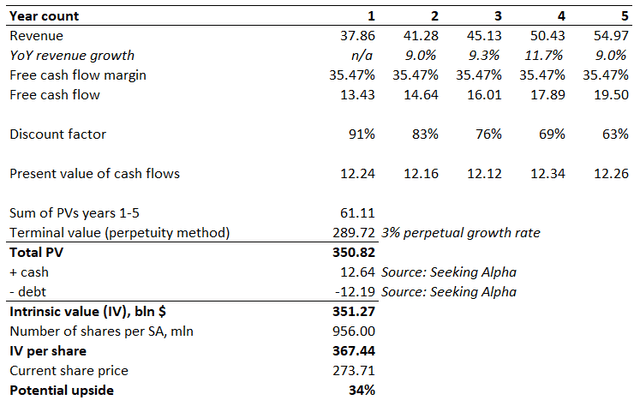

Consensus estimates appear conservative, as they observe a high single-digit revenue CAGR for the next five years. A 35.47% TTM levered FCF margin is already aggressive, and projecting expansion might be an overestimation. Therefore, I expect this FCF margin level to be stable. The perpetual growth rate is also very conservative at 3%.

The intrinsic value of CRM is $367 per share. That’s a 34% upside from the current share price. It seems like an excellent opportunity to me. The current $274 share looks like a no-brainer.

What can go wrong with my thesis?

Salesforce systems hold a significant amount of sensitive customer data, which heightens the risk of data breaches. Any unauthorized disclosure of this information can harm the company’s reputation and potentially result in legal conflicts with customers. As cybercriminals become increasingly sophisticated each year, it is imperative for CRM’s cybersecurity measures and partners to continuously advance and adapt.

appsruntheworld.com

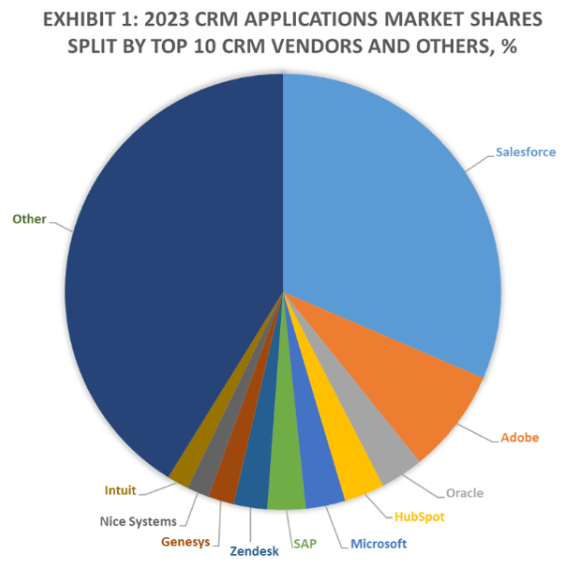

Although CRM is a dominant force in the industry, the competitive landscape remains formidable. The above pie chart highlights that there are competitors such as Adobe (ADBE), Oracle (ORCL), Microsoft (MSFT), and the European powerhouse SAP (SAP). I think that all these giants are potentially able to pose significant challenges.

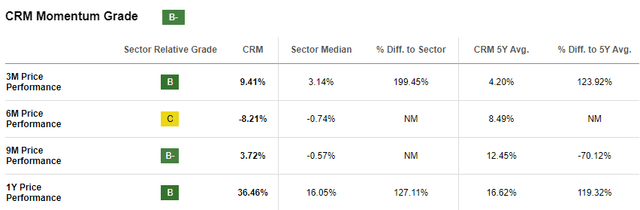

Investors should understand that CRM is not a kind of unstoppable momentum stock which will be spiking rapidly. The current momentum is somewhat average. Therefore, readers should rather expect a steady growth and be ready to hold the stock for longer.

Summary

CRM’s current share price looks like a no-brainer, with a 34% potential upside. The company continues successfully balancing between improving its profitability and investing heavily in innovation to roll out new offerings like the recent Agentforce release.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.