Summary:

- AbbVie has transitioned beyond Humira’s exclusivity loss, with strong growth from Skyrizi and Rinvoq, targeting $27 billion in sales by 2027.

- The stock has surged to $200, now trading at 16x 2025 EPS targets, making it less of a bargain.

- AbbVie’s dividend yield is 3.1%, with a potential hike to 3.3% in October, but debt remains high at over $60 billion.

- Investors should wait for a dip to buy shares, as the stock seems to have peaked around $200.

thitimon toyai/iStock via Getty Images

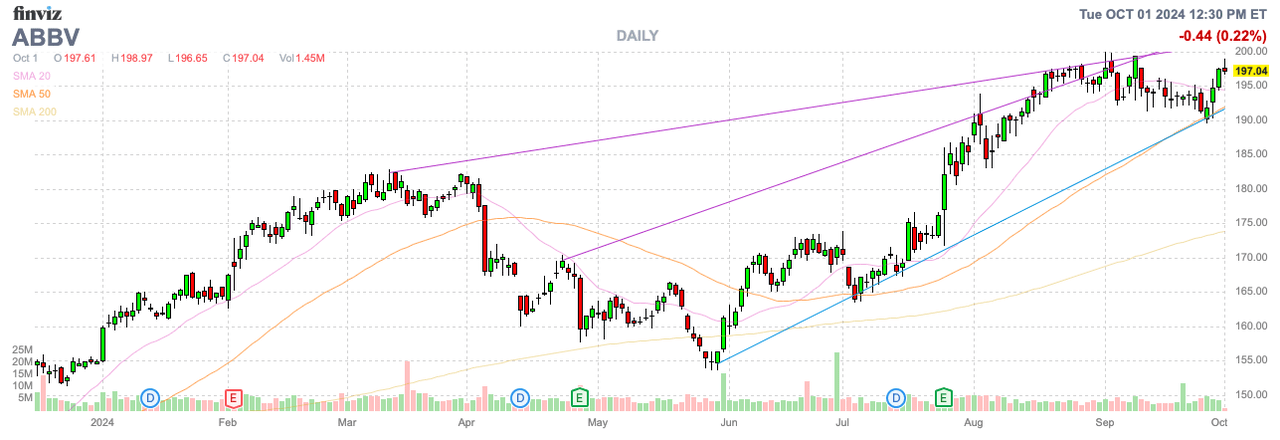

AbbVie, Inc. (NYSE:ABBV) has made another run at all-time highs of $200. The biopharma continues to make strong progress moving beyond the end of exclusivity on the key drug Humira leading to the big rally. My investment thesis is more Neutral on AbbVie with the stock fully pricing in the biopharma returning to growth.

Ex-Humira Boom

AbbVie has quickly moved beyond the loss of exclusivity on Humira and the company is projecting strong growth for the rest of the decade. The biopharma reported Q2’24 results beat guidance by $450 million with a return to growth.

Sales are now targeted to top original guidance by a whopping $1 billion due to the ongoing success of blockbuster drugs Skyrizi and Rinvoq. AbbVie is now growing at an 18% clip ex-Humira with quarterly sales of $14.5 billion.

The biopharma is only ~20% tied to Humira now at $2.8 billion in sales for Q2. The drug saw sales dip 30% YoY with AbbVie producing an ~$4.5 billion sales dip this year.

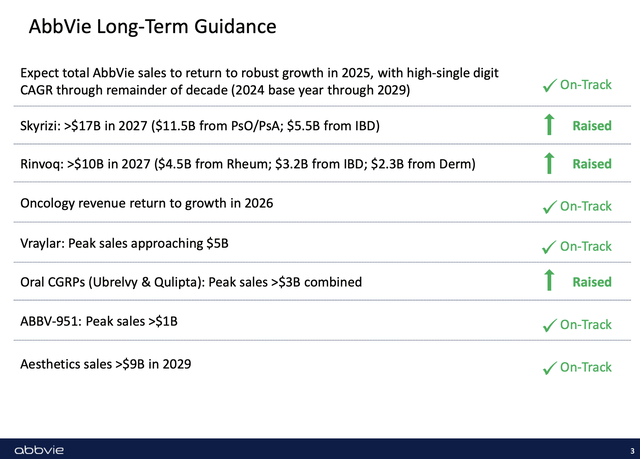

In essence, AbbVie has now successfully transitioned away from the LOE issue despite still taking a big sales hit from Humira. Both Skyrizi and Rinvoq are on pace for 2024 sales of just below $17 billion. The massive opportunity is that peak sales for these 2 drugs due to label expansion were targeted at $27 billion in 2027, or over $10 billion in additional sales over the next 3+ years.

Source: AbbVie Long-Term Guidance presentation

The long-term guidance from earlier this year includes other big drugs like $5 billion for Vraylar and $9 billion in cosmetic sales by 2029. In total, the biopharma is forecast to produce high-digit growth through 2029.

AbbVie has acquired all outstanding Cerevel common stock for $45.00 per share after previously completing the ImmunoGen deal. The acquisitions should even further boost sales with ImmunoGen alone targeted at reaching $1+ billion in sales by 2026, though EPS is cut by additional interest expenses for the ~$18.7 billion in additional debt from these 2 deals.

Approaching $200

The stock market has been hot for the last few years, so investors need to take into account the recent stock price before deciding whether to keep a stock. AbbVie has jumped from $155 at the end of May to approach $200 now.

The stock isn’t the same bargain anymore treading at 16x the 2025 EPS targets of $12. While investors can now have more confidence in EPS growth due to signs sales are going to grow in the 5-7% range going forward, investors have to keep in mind that sales will quickly top $60 billion annually and a biopharma adding billions in additional sales becomes relatively tough.

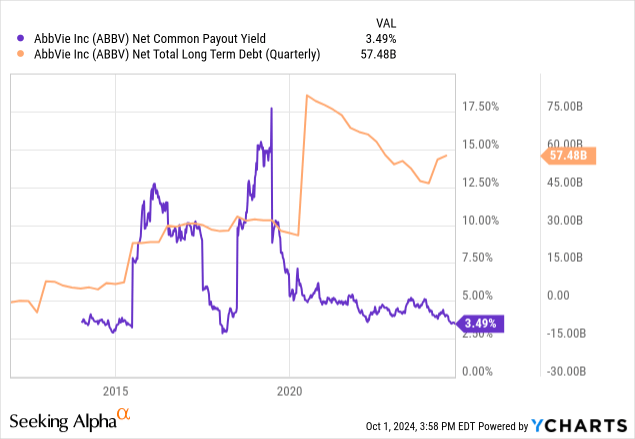

AbbVie now only offers a 3.1% dividend yield after the big rally. The company is due to announce the next dividend towards the end of October with recent quarterly hikes at $0.07 per share. Another similar hike moves the annual dividend to $6.48 and pushes the yield up to 3.3%.

While the dividend hikes remain solid, AbbVie hasn’t repurchased stock for years now due to the massive debt load still sitting at $57 billion, nearly double the pre-COVID level before the Allergan deal closed in May 2020. Since the deal closed, the company has seen the net payout yield (combination of dividend yield and share buyback yield) plunge while the focus is debt repayment.

AbbVie recently closed the above-mentioned deals that added nearly $19 billion to the debt level with nearly $9 billion from the Cerevel Therapeutics deal not included in the above debt chart yet. The stock has reached a valuation to where acquiring assets is more attractive than repurchasing shares.

The stock already trades at 16x 2025 targets with the EV hitting $400 billion, pushing the multiple even higher. With the net payout yield dipping towards 3% with the stock rising to $200, investors should probably avoid loading up on the stock here.

Takeaway

The key investor takeaway is that AbbVie has risen to the point where the stock is no longer a huge bargain. The biopharma has returned to growth mode, but the stock has already priced in future growth and the limited yield isn’t as appealing with the company loaded up with over $60 billion in debt now.

AbbVie shows signs of hitting a peak around $200. Investors should wait for a dip in order to purchase shares and nimble traders can look to sell shares here and repurchase at a lower price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.