Summary:

- AbbVie’s high-growth investment thesis is undeniable indeed, despite Humira’s painful patent expiry and the erosion observed in its sales thus far.

- Our optimism arises from Skyrizi’s/Rinvoq’s promising double-digit growth, excellent ex-Humira portfolio sales growth, and the management’s raised FY2024/FY2027 guidance.

- ABBV’s balance sheet health remains reasonable as well, attributed to the projected expansion in its Free Cash Flow generation over the next few years.

- Combined with the robust capital appreciation prospects and secure dividend investment thesis, the stock remains a Buy at every dip.

PM Images

ABBV’s High Growth Investment Thesis Remains Promising, As The Management Raises Guidance

We previously covered AbbVie Inc. (NYSE:ABBV) (NEOE:ABBV:CA) in July 2024, discussing its continued stock price and financial outperformances, despite the Humira LOE issues and the uncertain macroeconomic conditions.

Thanks to the robust ex-Humira portfolio growth, the excellent M&A acumen, and the raised FY2024 guidance despite the multiple adjustments related to the acquired IPR&D and milestones expenses, we had upgraded the stock to a Buy then.

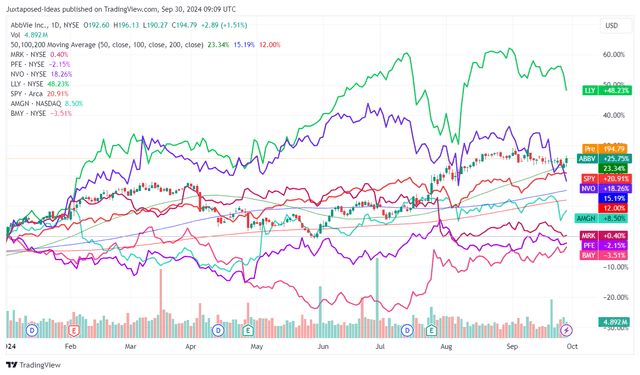

ABBV YTD Stock Price

Since then, ABBV has charted an impressive total return of +19.3% compared to the wider market at +3.6%, with it also well outperforming most of its pharmaceutical peers.

This outperformance is impressive indeed, despite the fact that its previous top-line driver, Humira, recorded a sustained erosion in the annualized sales to $11.25B by FQ2’24 (+23.9% QoQ/-29.8% YoY), compared to the peak annualized sales of $22.28B in FQ4’22.

Much of ABBV’s tailwinds are naturally attributed to two growth therapies, Skyrizi at $10.9B in annualized sales (+35.7% QoQ/+44.7% YoY) and Rinvoq at $5.72B (+30.8% QoQ/+55.7% YoY).

As a result of the two therapies’ rich double-digit growth prospects along with the ex-Humira overall revenue growth to an annualized sum of $46.56B (+15.9% QoQ/+18.1% YoY), it is unsurprising that the market remains highly optimistic about the pharmaceutical giant’s prospects thus far.

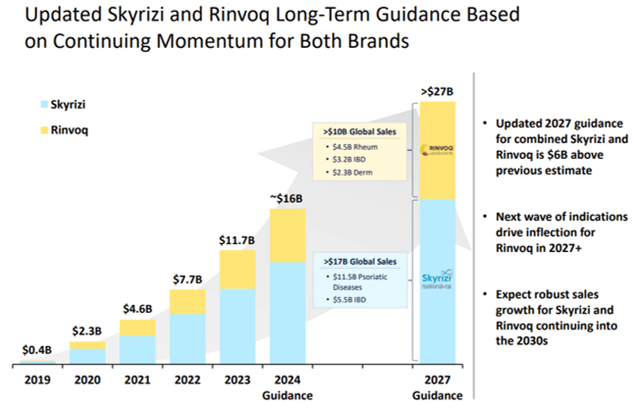

Raised Skyrizi & Rinvoq Long-Term Guidance

This is significantly aided by ABBV’s raised near/long-term guidance, with Skyrizi/Rinvoq expected to generate combined sales of $16.7B (+42.7% YoY) and the ex-Humira growth platform at “nearly $6 billion of sales growth in 2024.”

The raised guidance does not appear to be overly aggressive for now, based on the robust sales growth as discussed above and the growing prescription share in the US for:

- Skyrizi at 38% for psoriasis (+3 points QoQ/+6 YoY) and

- Skyrizi and Rinvoq at over 40% for Crohn’s disease (+15 points YoY from Skyrizi at 25%).

These developments have also contributed to ABBV’s raised FY2027 Skyrizi/Rinvoq sales guidance of over $27B, compared to the original guidance of $21B – with these numbers well exceeding Humira’s peak sales of $22B.

This is significantly aided by the projected new “wave of indications coming, think in terms of the ’26, ’27, ’28 time frame, covering vitiligo, HS, alopecia, lupus and GCA” for Rinvoq.

Combined with the management’s highly promising long-term commentary of “SKYRIZI and RINVOQ to grow very robustly through the early part of the next decade (until ’33),” we can understand why the market has gotten exuberant as observed in the ABBV’s YTD stock outperformance.

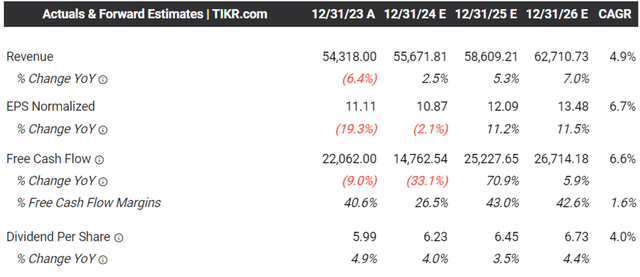

The Consensus Forward Estimates

If anything, the ABBV management has already raised their FY2024 adj EPS guidance from $10.71 (-3.6% YoY) to $10.81 at the midpoint (-2.7% YoY), despite the $0.60 unfavorable impact from the IPR&D and milestone expenses on a YTD basis.

While this number remains lower than the original midpoint guidance of $11.15 (inline YoY) offered in the FQ4’23 earnings call, we believe that the management’s execution during the uncertain Humira LOE has been highly promising indeed.

This is especially since ABBV’s net-debt-to-EBITDA ratio remains somewhat reasonable at 2.03x by the latest quarter, compared to 2.53x in FQ1’24, 1.83x in FQ2’23, and 1.65x in FY2019.

Its dividend investment thesis remains secure as well, based on the estimated LTM Free Cash Flow generation of $17.78B (-28.2% sequentially) and the annualized dividend obligation of $10.77B.

The same B+ grade has also been observed in the Seeking Alpha Quant Dividend Safety Rating, with the projected growth in its Free Cash Flow generation over the next few years allowing the management to consistently return great value to long-term shareholders while eventually deleveraging its balance sheet.

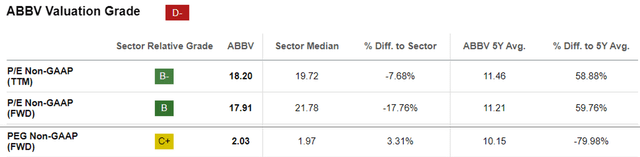

ABBV Valuations

And it is for this reason why we believe that ABBV at FWD P/E non-GAAP valuation of 17.91x remains reasonable compared to its 10Y mean of 11.76x.

The same premium has also been observed in its high growth pharmaceutical peers, including Novo Nordisk (NVO) at 35.40x and Eli Lilly (LLY) at 53.73x, against their 10Y means of 25.16x and 28.38x, respectively.

At the same time, ABBV is relatively cheap at FWD PEG non-GAAP ratio of 1.53x, based on the projected expansion in its adj EPS at a CAGR of +11.67% between the management’s FY2024 adj EPS guidance of $10.81 and the consensus FY2026 adj EPS estimates of $13.48.

Even when compared to the sector median of 1.97x, NVO at 1.84x, and LLY at 1.26x, we believe that ABBV continues to offer a rather compelling investment thesis at current levels.

So, Is ABBV Stock A Buy, Sell, or Hold?

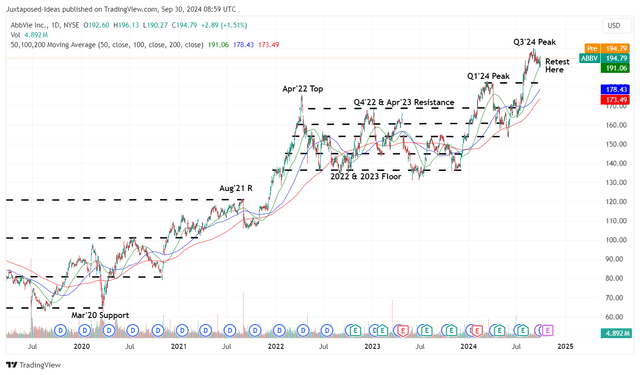

ABBV 5Y Stock Price

And these developments also explain the bullish support observed in ABBV’s uptrend price movement, after the sideways trading observed in 2022 and 2023.

Based on the management’s FY2024 adj EPS guidance of $10.81 and the FWD P/E non-GAAP valuations of 17.91x, it is apparent that the stock is trading near to our updated fair value estimates of $193.60.

Based on the consensus FY2026 adj EPS estimates of $13.48, we are looking at a decent upside potential of +23.9% to our long-term price target of $241.40 as well.

At the same time, we must remind readers that ABBV is likely to hike dividends in the upcoming earnings call, based on its historical pattern thus far. Based on the last hike by +4.7%, we are estimating a potential hike in its quarterly dividends to $1.62, with it implying a more than decent forward yield of 3.32%.

While the yields may be nothing to shout at compared to other high-yielding dividend stocks, we believe that long-term shareholders may enjoy either steady quarterly incomes and/or the chance to DRIP while accumulating additional shares on a regular basis.

As a result of the pharmaceutical giant’s robust growth prospects ex-Humira and the secure dividend investment thesis, we are reiterating our Buy rating for the ABBV stock.

Risk Warning

While ABBV may appear to be well-supported at the recent bottom of $190s, we urge readers to observe the stock’s near-term movement before adding, preferably at its previous Q1’24 peaks of $180s for an improved upside potential.

Our prudence arises from the relatively greedy market sentiments after the Fed recently pivots as the inflation cools and the labor market remains healthy, with the McClellan Volume Summation Index also hitting elevated levels of 1,769.44x compared to the Neutral point of 1,000x.

Combined with the higher CBOE Volatility Index, we believe that a near-term market wide correction may occur, with it triggering the more attractive entry points as discussed above.

At the same time, ABBV may face further Medicare negotiation headwinds beyond Imbruvica, which has previously triggered a -$2.1B charge in October 2023, attributed to the “estimated significant decrease in the estimated future cash flows.”

Assuming that the US government targets the company’s two growth drivers moving forward, namely Skyrizi and Rinvoq, we may see its bright prospects dampen from current levels – with it potentially triggering a painful stock valuation/price correction ahead.

As a result, investors may want to monitor the developing situation closely, since the price negotiation may negate Skyrizi’s and Rinvoq’s elongated patent expiry through 2033 and 2036, respectively.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.