Summary:

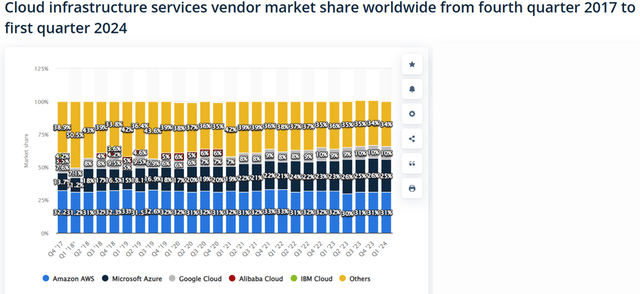

- Amazon.com, Inc.’s AWS continues to dominate cloud infrastructure, driven by enterprise migration to the cloud for cost and performance benefits, especially for AI applications.

- Amazon’s capital investments in AWS and custom silicon chips are expected to support strong revenue growth and improved margins through scaled operations.

- AMZN’s strategic focus on high-quality, customizable cloud services and expanding data center capacity as customer demand presently outstrips supply.

Eoneren

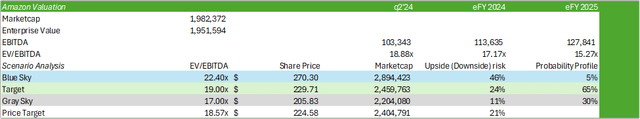

Amazon.com, Inc. (NASDAQ:AMZN) continues to dominate the cloud infrastructure market as enterprises migrate more workloads from on-prem to the cloud to capitalize on costs and GPU availability. As more enterprises seek to leverage GenAI and other AI applications in the workplace, I have reason to believe more data and applications will make the move. This is to realize lower latency and improved performance no matter the geographical region. Aside from Amazon’s accelerated growth in AWS, the hyperscaler may face headwinds as consumer confidence diminishes paired with more cost-conscious spending as it relates to budgetary constraints. Given that demand for compute capacity outstrips GPU & CPU availability, I believe Amazon’s capital outlay will support quality revenue growth with scaled operations. I recommend AMZN shares with a BUY rating with a price target of $22/share at 18.57x eFY25 EV/EBITDA, providing investors an upside potential of 21% from the current trading range.

Amazon Operations

AWS

Amazon is increasingly focusing on providing the highest quality and most customizable cloud service for customers through their diverse CPU & GPU offerings. These span Advanced Micro Devices (AMD) MI-series GPUs, Nvidia (NVDA) Hopper GPUs, and Intel (INTC) x86 CPUs while also scaling their custom silicon chips, including Graviton CPUs and Trainium & inferential for training and inferencing AI models. Management doesn’t necessarily see their own custom silicon as a competitor to these world-class chip designers, but rather an additional option for customers to choose from.

One of the biggest selling points for Amazon’s custom silicon chips is that the processors are designed with a singular purpose: being placed in Amazon’s data centers. This means that Amazon’s engineers were able to optimize the chip design for the needs of AWS servers to realize significant price performance and energy efficiency for AI/ML workloads when compared to competing chip designs. For example, Graviton4 is suggested to outperform the best x86 processors by 40-50% at a price that is 20% lower than the competition.

Trainium2 is expected to be released at the end of CY24. According to the preannouncement press release, Trainium2 is designed to be up to 2x more energy efficient and deliver up to 4x the training speed as its predecessor and will be capable of being deployed in EC2 UltraClusters of up to 100,000 chips.

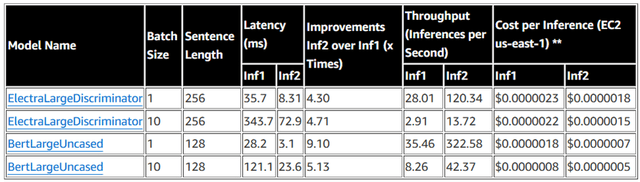

Inferentia2 also offered customers a significant step-up from Inferentia1 in which it provides 50% better energy efficiency, up to 4x higher throughput, and up to 10x lower latency.

It is clear that Amazon’s provision of custom silicon to customers comes with a number of performance and pricing benefits. In addition to these, Trainium2 and Inferenium2 may provide some easement to the tight supply chain, given the historical constraints for sourcing Nvidia’s H100 GPUs. Though the supply chain has loosened up, making the GPUs more readily available and having the additional price-performance competitive option available may manage down costs for enterprises.

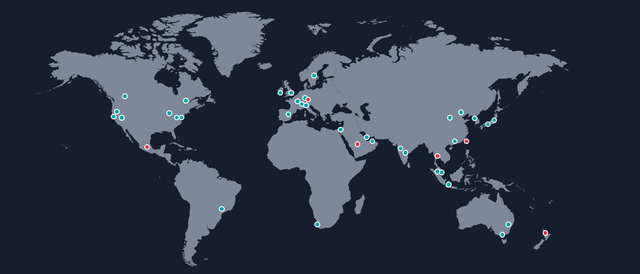

Mr. Jassy, CEO of Amazon, voiced similar capacity headwinds as Mr. Nadella of Microsoft (MSFT) in Amazon’s q2 ’24 earnings call in which demand has outstripped compute capacity. Accordingly, Amazon has 108 availability zones, which management noted are equivalent to a data center, serving 34 geographic regions. The hyperscaler is planning to launch 18 additional availability zones across 6 AWS regions, including Mexico, New Zealand, Saudi Arabia, Thailand, Taiwan, and the AWS European Sovereign Cloud.

In terms of growing capacity, Amazon invested $17.62b in Q2 ’24, which was primarily allocated to AWS-related infrastructure to serve the strong demand for both GenAI and non-GenAI workloads. Though management did not provide firm figures for Q3 ’24, they noted that capital investments will grow sequentially with the objective of building out AWS capacity. I’m forecasting capital investments for Q3 ’24 to sum to $20.5b and $75b for all of eFY24 as the firm catches up with customer demand to support cloud-based workloads.

Management noted one interesting factor relating to the growth story for cloud architecture that may drive growth in the coming years.

About 90% of the global IT spend is still on premises. If you believe that equation is going to flip, which I do, there’s a lot of growth ahead of us in AWS.

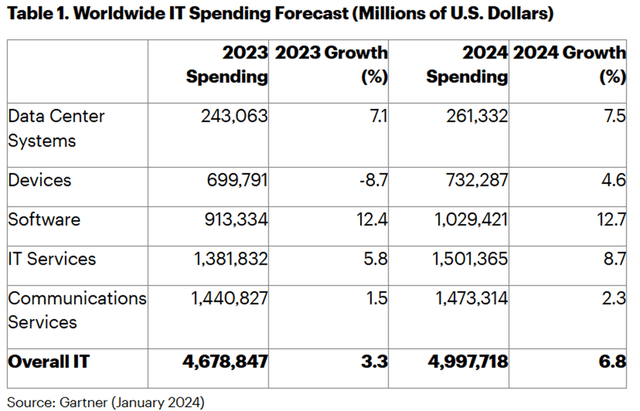

According to Gartner, global IT spend is expected to sum to $5T in 2024.

Though I do not anticipate a massive migration from on-prem to the cloud to happen, I suspect at least a portion of workloads will migrate to the cloud as CIOs seek to minimize IT spend. I believe the driving factor will inevitably come down to where the AI-related data and applications are hosted, whether on-prem or in the cloud. Given that the majority of AI applications are hosted in the cloud, I suspect that enterprises may opt to migrate more data into cloud-hosted environments.

There are significant headwinds out of the tech sector that may impede the growth opportunity for hyperscalers. Power constraints have become one of the greatest challenges in scaling compute, and this challenge may persist through the end of the decade. The Wall Street Journal reported in March 2024 that Amazon acquired a data center powered by an on-site 2.5GW nuclear power plant. I suspect that this trend may persist, as reliable power will be required to light up these massive AI factories. It may potentially lead to hyperscalers to either opt for natural gas-fired power plants or stand their ground for renewables and await commercialization of small modular reactors.

I expect that hyperscalers will co-invest in power plants with partner utilities to manage onsite power to guarantee the appropriate baseload. Though it is not my intention to bring politics into the mix, I believe that this will alleviate some pressure as hyperscalers may take precedence over residents in the case of a natural disaster. Dedicated power sources will disassociate any challenges faced by local residents and allow for the hyperscalers to operate on a standalone basis.

Amazon Prime

Amazon’s consumer-facing services will likely be impacted by the current state of the economy. Management’s verbiage aligned with other retailers in which consumers are trading down on price, resulting in lower ASPs for Amazon. Management also mentioned that discretionary items, such as electronics, computers, and TVs have been growing at a faster clip compared to competitors in the retail market; however, growth is noticeably slower when compared to a more robust economy.

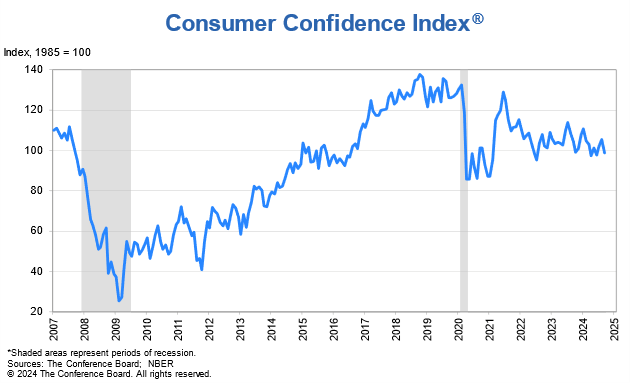

Retail may become a challenge in the coming quarters for Amazon as consumer confidence weakens, and more consumers fear a weakening labor market. Though this may not necessarily impact staples, I believe Amazon may realize more pressure on bigger ticket items as consumers face increasing costs for everyday items, such as food & beverage, electricity, and housing.

NBER

If unit volumes were to face pressure, headwinds may trickle into Amazon’s advertising services with slower growth.

Despite the potential headwinds at the consumer level, management has been taking steps to control costs with additions to the same-day facility network and the regionalized inbound network. There is also chatter that Amazon may further leverage robotics in the warehouses, which would substantially reduce costs and improve efficiencies. If Amazon were to partner with Tesla (TSLA) in using Optimus, I would only hope that Amazon would use the codename Optimus Prime for the program.

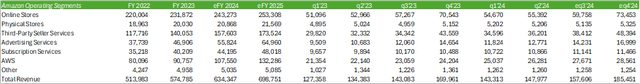

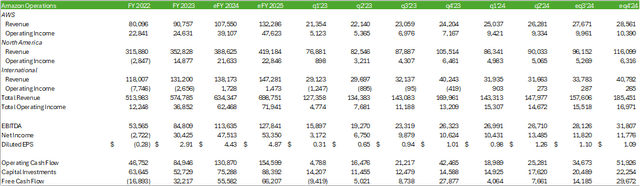

Amazon Financials

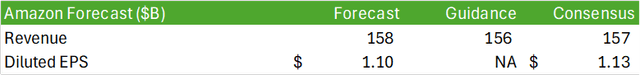

Looking to financials, I’m forecasting Amazon to generate $157b in total revenue for q3 ’24 with AWS and advertising leading the way in terms of year-over-year growth. This will translate to $1.10/share in diluted EPS for the quarter. For all of eFY24, I’m forecasting total revenue to come in at $634b with a diluted EPS of $4.43/share.

I believe AWS will realize continued growth acceleration for the duration of eFY24 and further acceleration in eFY25 as the firm scales out their CPU & GPU capacity. I’m expecting retail to grow at a slower pace as consumers remain cost-conscious.

Risks Related To Amazon

Bull Case

The market for GenAI has accelerated beyond Amazon’s and peer hyperscalers’ capacity, providing a strong runway for supporting capital investments that will turn to high-margin free cash flow. Despite the consumer headwinds Amazon is faced with, advertising will likely remain resilient across brand-sponsored ads on their retail site as well as advertising on their CTV Prime Video platform.

Bear Case

If the global economy were to continue to slow down, investments for GenAI may slow, resulting in Amazon being caught flatfooted with their large GPU & CPU expansions. Slower consumer demand may lead to lower unit volume sales across retail platforms and may trickle into fewer advertising dollars allocated to Amazon’s platforms.

Valuation & Shareholder Value

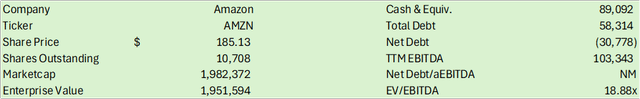

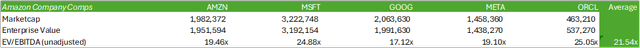

AMZN shares trade discounted to its peer average of 21.54x TTM EV/EBITDA, providing the shares room for mean reversion in terms of valuation.

Given the long runway for growth in AWS paired with strength in advertising, Amazon’s growth will likely push through the potential headwinds posed by the challenged consumer. Despite the relatively challenged price action for AMZN shares post-Q2 ’24 earnings, I believe AMZN shares will remain resilient as the firm continues to invest in AWS, leading to strong cash flow generation. Using an internal valuation model based on my eFY25 EBITDA forecast and the ticker’s historical valuation range, I believe shares should be priced at $224/share at 18.57x eFY25 EV/EBITDA, providing investors a potential upside risk of 21% from today’s trading range. I recommend AMZN shares with a BUY rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.