Summary:

- Ford Motor Company has lost 11% of its market value in 2024. Long-term investors, including yours truly, continue to bet on a recovery amid challenging market conditions.

- Chinese EV makers, led by BYD Company, are expanding aggressively in global markets with high-tech, cost-effective vehicles, challenging Ford’s competitive edge.

- Ford’s strategic plan to mitigate this threat includes leveraging government support, forming supply chain partnerships, and launching affordable EV models.

- Ford is taking the China threat seriously, which is a good start. However, now is not the time to double down on Ford stock.

Vera Tikhonova

Ford Motor Company (NYSE:F), one of the very few auto stocks I own, has disappointed investors yet again this year by losing 11% of its market value so far. Last July, when Ford stock plummeted following the Q2 earnings report as investors punished the company for increased warranty costs, I remained bullish with a long-term view. I believe that Ford was well positioned to see a major reduction in warranty claims starting next year. Unfortunately, there has not been any shortage of negative developments since then.

One of the biggest threats facing Ford is the rise of Chinese automakers. In many parts of the world, including Dubai where I reside, Chinese automakers are aggressively taking market share from traditional automakers. This does not come as a surprise given the high-tech features offered by Chinese automakers at a fraction of the cost of established auto giants. Ford, despite being a household name, is no longer immune to threats from Chinese automakers.

A Reality Check From China

Chinese automakers led by BYD Company Limited (OTCPK:BYDDF) are dominating the global EV market, particularly in developing regions such as Brazil, Mexico, and Southeast Asia. Data collected by ABI Research for Business Insider shows that in Q1, Chinese automobile manufacturers controlled 88% of the EV market share in Brazil and 70% in Thailand. This highlights their strong presence in key markets that are expected to grow at an above-average pace in the coming years.

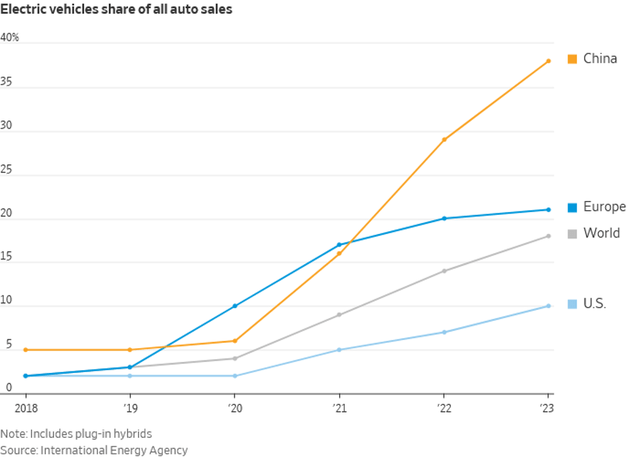

China, as a consumer, has made stellar progress in embracing EVs as well. According to the latest data from the International Energy Agency, almost 40% of all vehicles sold in China are now electric or plug-in hybrid vehicles. As depicted below, this is substantially above the global average.

Exhibit 1: EV share of all auto sales

Both the U.S. and the European Union imposed heavy tariffs on Chinese carmakers in mid-2024 to insulate their domestic carmakers from the growing competition from China. Tesla, Inc. (TSLA) CEO Elon Musk has also acknowledged that the Chinese are the most competitive car builders in the world and that they can demolish many Western brands if there are no trade barriers to protect them. Despite the adoption of some protectionist policies, Chinese EV makers remain unchallenged in all markets except for North America and Europe, forcing American automotive companies including Ford to reconsider their business strategies.

Jim Farley, the CEO of Ford, recently noted that automakers need to keep up with Chinese standards to stay competitive in the global market. There’s a genuine sense of urgency, particularly from Ford, to keep up with Chinese automakers.

Ford’s First-Hand Experience Was Concerning

When Ford CEO Jim Farley and CFO John Lawler were on a visit to China in early 2023, they took a test drive of a Chinese electric sport utility vehicle, and they were shocked by the performance of the vehicle. The SUV, manufactured by Changan Automobile, a state-owned company and a long-term business partner of Ford, had a finishing quality that was well above their expectations.

After his second visit in May, concerns regarding China as a competitive threat only intensified for Farley. According to the Wall Street Journal, the CEO said to Ford’s board member John Thornton that Chinese EVs may become an existential threat to Ford and other legacy brands. He noted that the smoothness, noise suppression, and quality of Chinese electric cars are superior to what is available in the market today.

China Is Acing The EV Game

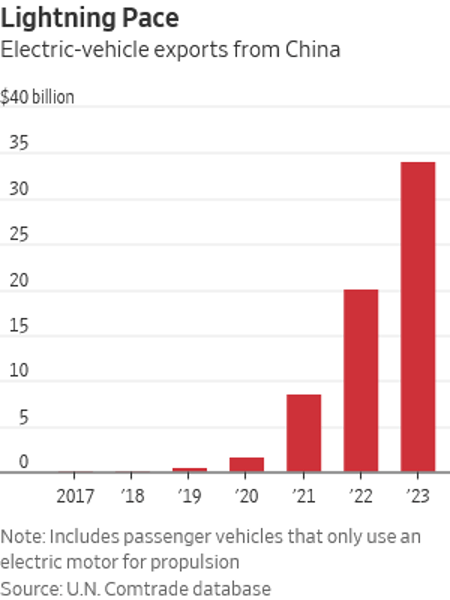

The Chinese auto manufacturing sector has seen significant growth and the country’s exports outnumbered the imports last year. A number of new nimble local EV companies are now expanding to the European, Asian, African, and South American markets. The Wall Street Journal reported that 20% of automobile sales in Mexico this year were from Chinese automakers, an indication of the progress the country has made. With no clear ceiling on such expansion, it’s reasonable to believe that China’s automotive strengths will only grow further from here.

Exhibit 2: EV exports from China

WSJ

Several key reasons cause this trend. The low restrictive regulations in the Chinese market allow emerging automakers to experiment with new technologies, including AI. The low wage costs in China mean cheaper production costs, thus creating a favorable cost advantage. This is being further strengthened by a substantial amount of government subsidies. Bloomberg points out that almost $230 billion was given in EV-related state aid through the last 15 years.

The strategic move of China to take possession of rare earth mineral assets has raised China’s automotive ambition by providing a steady supply of lithium and other key components for low-cost electric vehicles. However, established manufacturers based in Europe, the U.S., and Japan have not been able to establish their own lithium-sourcing chains, which has caused delays in EV manufacturing. Furthermore, the lack of a coherent and well-supported charging network in Europe and the U.S. compared to Chinese urban areas has further slowed down the uptake of electric vehicles in the Western world.

Ford’s Action Plan

Shortly after one of his visits to China, CEO Farley decided to bring Chinese electric vehicles including Xiaomi’s SU7 EV and Li Auto L6, a luxury minivan, to Michigan for examination, highlighting Ford’s determination to match the Chinese standards. Farley draws parallels between the rise of Chinese automakers with the rise of Japanese brands like Toyota in the 1980s and 1990s and South Korea’s Hyundai and Kia in recent decades. He sees the current situation as both a challenge and an opportunity to improve Ford’s strategic vision.

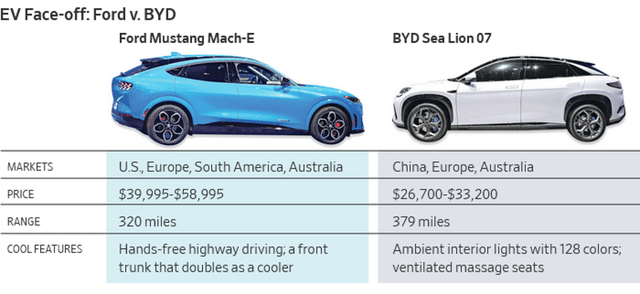

Exhibit 3: Ford vs. BYD

Ford’s strategic action plan to mitigate the threat of Chinese EV makers is centered around a few key pillars.

First, the company is trying to leverage government support to compete with low-cost Chinese EVs. The proposed tax credits of up to $7,500 for EV purchases and the planned incentives for domestic production of EVs and EV batteries are at the center of Ford’s competitive strategy. Continued policy support from the federal government will be key for the company to remain competitive in the global EV market.

Second, Ford is forming strategic partnerships to ensure supply chain stability. For instance, the company created a partnership with China’s CATL, the largest battery manufacturer in the world, to build a new battery plant in Michigan. At the time of this announcement early last year, Ford pledged to invest $3.5 billion to build the battery plant. Manufacturing specialized EV batteries locally with CATL’s expertise is the right long-term strategy to avoid production delays in the future.

Third, to compete directly with Chinese EV makers, Ford is planning to launch more affordable EV models for both the passenger and commercial markets. Last month, Ford confirmed this strategic directive in a press release and wrote:

The plan includes adjusting the company’s North America vehicle roadmap to offer a range of electrification options designed to speed customer adoption – including lower prices and longer ranges. In its fully electric portfolio, Ford will prioritize the introduction of a new digitally advanced commercial van in 2026, followed by two new advanced pickup trucks in 2027 and other future affordable vehicles. Ford also realigned its U.S. battery sourcing plan to reduce costs, maximize capacity utilization, and support current and future electric vehicle production.

In addition to these measures, Ford CEO Jim Farley has pledged to keep innovation at the center of the company’s business strategy to ensure new Ford EV models compete with Chinese EV makers in a global setting.

As a long-term-oriented investor, I believe it is too early to determine the potential outcome of Ford’s strategic action plan to combat China’s threat. If executed well, this action plan should help Ford emerge as a leading global EV maker, dominating the market alongside a few peers such as Tesla and BYD. For now, despite the seemingly cheap valuation of Ford, I will not invest any more in the company, but I certainly do not plan to trim my long position either.

Takeaway

Ford is facing a major threat from Chinese EV makers that are aggressively expanding into Europe, Latin America, and the Middle East. The company’s global EV strategy hinges on its ability to be competitive on the big stage, and protectionism policies are unlikely to take the company too far when it comes to dominating the global EV sector. With a strategy centered around innovation, low-cost EV production, and leveraging government support, Ford is trying to mitigate the threat from Chinese automakers.

In the upcoming months, I will closely monitor new developments in the global EV space to determine whether Ford’s cheap valuation is delusional. For now, I appreciate the company taking the China threat seriously, as failure to address this threat may lead to irrevocable losses.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.