Summary:

- Pfizer’s stock has delivered a 5% total return since early July, outperforming the broader U.S. market, reinforcing my bullish stance.

- The latest quarterly earnings showed YoY revenue growth, marking the first growth since FQ4 2022.

- My dividend discount model suggests that Pfizer’s stock is extremely undervalued.

- Patent expirations by 2027 pose a significant risk, but continued R&D investments and recent insider inactivity suggest cautious optimism about the stock’s future.

georgeclerk

Investment thesis

My previous bullish thesis about Pfizer’s stock (NYSE:PFE) (NEOE:PFE:CA) aged well as the stock delivered a 5% total return since early July. The stock outperformed the broader U.S. market over the same period.

Today I want to update my thesis and explain why I remain bullish. PFE remains dirt cheap with a $49 fair share price per my valuation analysis. Fundamentals are improving as the company returned to the revenue growth path, which helps in driving profitability as well. Apart from positive top line trends, I have to give credit to the management as their cost efficiency initiatives are working, which I see from the notable gross margin improvements. The pipeline is expected to remain robust as PFE is positioned well financially to continue pouring billions in developing new products. Seasonality trends also look quite favorable for the stock for the remainder of 2024. All in all, I reiterate my “Strong Buy” rating for PFE.

Recent developments

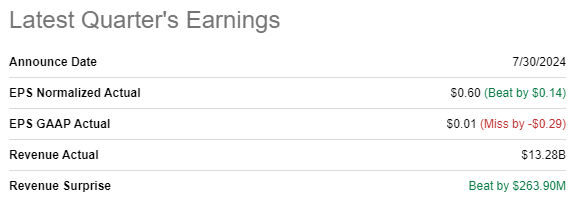

The latest quarterly earnings were released on July 30 when PFE surpassed Wall Street’s revenue and adjusted EPS estimates. The latest reportable quarter was the first one since FQ4 2022 when Pfizer recorded revenue growth on a YoY basis. The operational revenue grew by 3% YoY, which is a good sign after several quarters of revenue decline explained by the revenue spike of prior years related to COVID-19 vaccines. Excluding COVID-19 products, revenue grew by an impressive 14% YoY.

Seeking Alpha

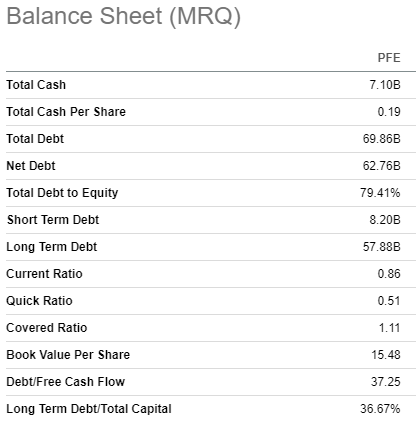

The management’s cost efficiency initiatives appear to be working well as Pfizer’s profitability metrics improved YoY. The adjusted gross margin expanded YoY from 76% to 79%, which is a solid improvement. Solid profitability profile helps PFE to maintain its healthy balance sheet with a $7 billion cash pile and moderate leverage. Pfizer’s improvements in the P&L and the solid balance sheet bolster my confidence in the stock’s solid forward 5.8% dividend yield.

Seeking Alpha

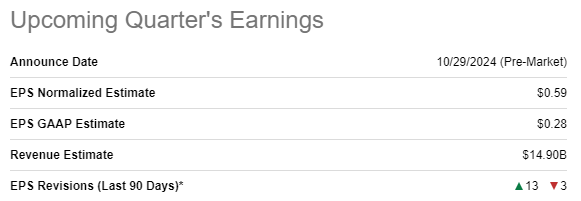

The upcoming quarter’s earnings release is scheduled for October 29, and I see several positive signs as well. Wall Street analysts expect Q3 revenue to be $14.9 billion, which indicates a solid 12.6% increase on a YoY basis. This is a solid growth acceleration compared to Q2, which is always a bullish indication. Another positive information is that the adjusted EPS is forecasted to expand from -$0.17 to $0.59. Last but not least, I like the analysts’ sentiment as there were 13 upward EPS revisions over the last 90 days with only 3 downgrades.

Seeking Alpha

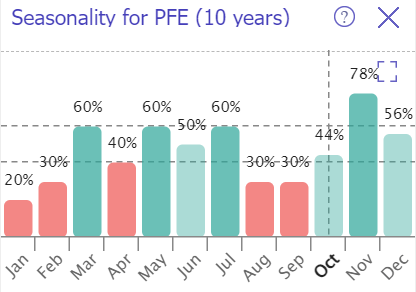

Another indication that we can expect strong Q3 post-earnings stock movement is that November is the stock’s historically by far most successful month. Overall, historical patterns suggest that the remainder of 2024 is likely to be positive for PFE investors.

TrendSpider

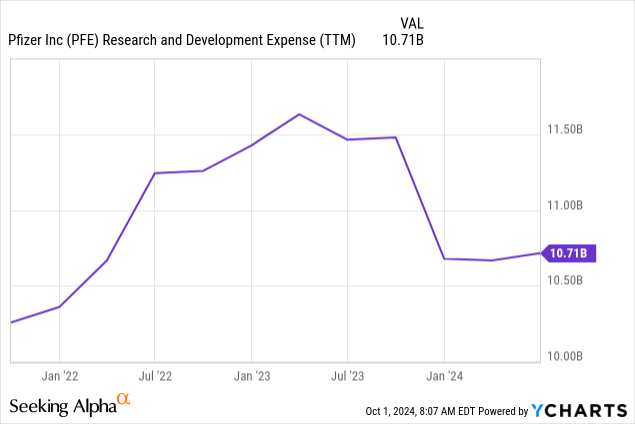

A healthy financial position together with the improving income statement are vital factors for Pfizer since its long-term success significantly depends on the ability to roll out new products. The potential to develop new compelling products is robust considering Pfizer’s massive $10.7 billion TTM R&D spending.

As of 30 July 2024, Pfizer has 113 candidate products in the pipeline, and the breakdown by product means that Pfizer is ready to launch six candidates when all the final regulatory approval comes. These include marstacimab, an anti-tissue factor pathway inhibitor for hemophilia, and NGENLA, a human growth hormone agonist for adult growth hormone deficiencies. These products are slated to have a large impact on the biologics market, which will expand at an annual CAGR of 7.6% in the next several years with increasing demand for new therapeutics.

In addition, Pfizer has its ADCETRIS product in the registration phase for new enhancements aimed at cancer treatment. Beyond this product enhancement, there are several products in Phase 3 clinical trials that are new molecular entities. Expanding and enhancing Pfizer’s portfolio in the oncology segment is crucial, as this is a rapidly growing industry. According to Fortune Business Insights, the global oncology market size is expected to demonstrate an 11.3% CAGR by 2032. This represents a solid secular tailwind, and Pfizer’s promising pipeline in this field suggests that the company is working hard to capture these positive trends.

To sum up, I remain extremely bullish here. The top line returned to the growth path, which is expected to accelerate in the upcoming quarter. The pipeline looks promising in terms of the potential new products or enhancements. What is crucial is that Pfizer’s vast R&D spending is likely to remain high as the company boasts a solid financial position. Last but not least, the management is committed to keeping costs under control, which is the key for sustainable value creation for shareholders.

Valuation update

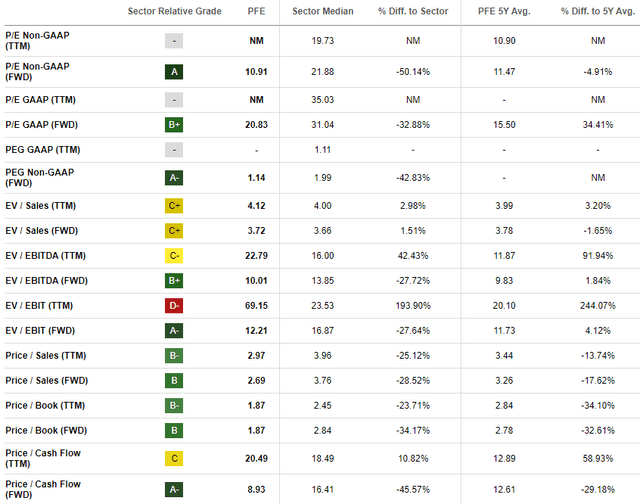

The stock lost 15% of its value over the last twelve months, lagging behind the broader U.S. market. YTD performance is flat with a shallow 0.5% share price increase. Pfizer’s valuation metrics look very attractive as most of them are significantly lower compared to the sector median.

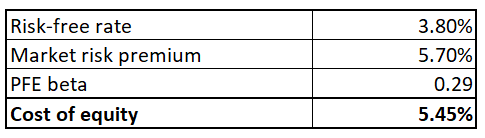

Since PFE is a pure dividend play, I am proceeding with the dividend discount model [DDM]. The Cost of equity is the discount rate for this approach, which is figured out in the below table. The CAPM approach suggests that PFE’s cost of equity is 5.45%. All variables are easily available on the Internet.

Author’s calculations

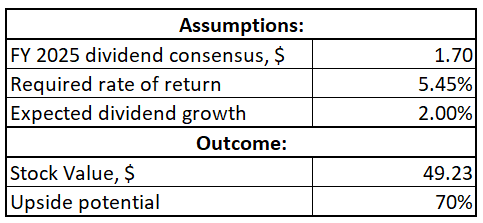

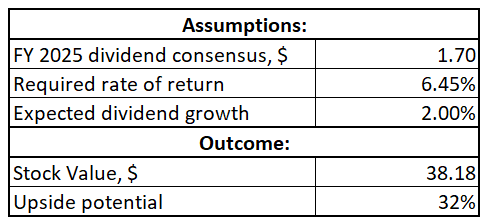

Dividend estimate from consensus for FY 2025 is $1.70, which is the first assumption for my DDM analysis. I have already mentioned above that the required rate of return for my DDM is 5.45%. To be conservative, I incorporate a modest 2% dividend growth rate, which aligns with the long-term U.S. inflation averages.

Author’s calculations

Even with a 2% dividend CAGR assumption, the stock’s fair value is 70% higher than the last close. I can conclude that the upside potential is compelling, especially considering a 5.8% forward dividend yield.

I want to simulate another scenario because a 5.45% required rate of return might be considered too low, especially compared to the dividend yield. For my sensitivity check, I add one percentage point to the discount rate with all other assumptions unchanged. Even with a 6.45% required rate of return, PFE is still very attractively valued with a 32% upside potential.

Author’s calculations

Risks update

From this fundamental point of view, I think the main risk still is the patent expiration of the major products by 2027. Patents of several of the company’s top-selling products of recent years will expire in the next few years, and, hence, losing the exclusivity. In FY 2023, PFE derived more than $20 billion from products with patent expiration years in the next few years. I think that’s the main reason why investors are still very wary of PFE. And patent expiration, indeed, is a big risk for any company. At the same time, as I said in “Recent Developments,” PFE keeps investing billions in R&D and the more PFE invests in R&D, the higher the chances to find successful substitutes for the patents expired products.

TrendSpider

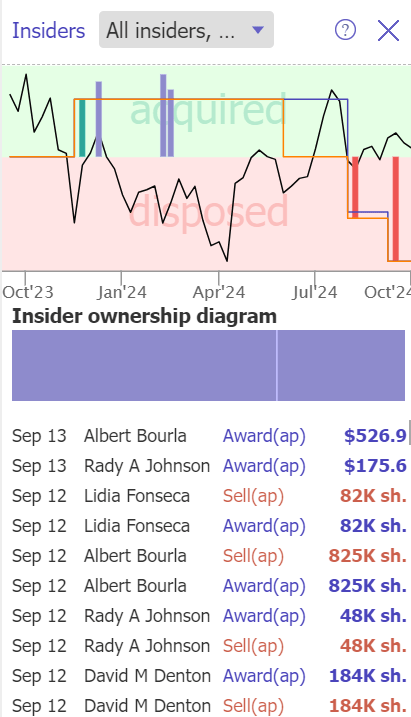

Recent insider buying does not bode well. While the stock is again quite cheap and the dividend yield attractive, insiders have not been buying as of late – none, in fact, since late 2023. It’s not that they’re dumping the stock, instead the decision of insiders not to invest more of their own money in their company at their advantageous prices very well might mean they don’t think the stock is a bargain.

Bottom line

To conclude, PFE is still a compelling high-dividend yield investment opportunity. A solid 5.8% forward dividend yield is supported by the healthy financial position and improving financial performance. The pipeline looks promising, and a 70% discount looks unfair for this dividend machine.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.