Summary:

- AMD has gained 21% in price since my August analysis, and I believe the stock is positioned for a further 20%+ market cap growth over the next 12 months.

- This strong growth investment can still deliver alpha even though it is overvalued. There may be even better entry points that occur over the next few quarters.

- Q3 earnings in October will reveal crucial insights on the ZT Systems acquisition, as well as reveal how AMD is developing in the GPU and CPU markets.

- Despite the strong medium-term outlook, investors should not undervalue the risks in the current geopolitical climate. Western leaders navigating current tensions are critical for success in technology’s capital markets.

Mike Hansen

After a 21% price gain following my August analysis of the company, AMD (NASDAQ:AMD) (NEOE:AMD:CA) is an overvalued growth stock with the potential for a 20%+ market cap growth in the next 12 months despite a likely contraction in its P/S ratio. Even though the near-term and long-term theses look strong leading into Q3 earnings, underlying geopolitical risk factors shouldn’t be undervalued. I believe it is prudent to hold AMD, but only in a well-diversified portfolio that is hedged against geopolitical risk in the current uncertain climate.

Key Points Leading Into Q3 Earnings

AMD’s Q3 earnings are expected at the end of October, and the company has been focusing heavily on AI-driven CPUs and GPUs, which is the core area to evaluate progress on at the time of the report. Particularly noteworthy is its MI300 series, which aims to compete with NVIDIA (NVDA). I’ll be looking for wins with hyperscale cloud providers, which could prove consolidatory for AMD. In addition, the consumer and enterprise PC markets have been weak but are currently showing signs of stabilization; AMD is positioned against Intel (INTC) in this space, and with Intel currently showing operational weakness, I expect this could be a strong quarter for AMD in this regard. Furthermore, accretion from the 2022 Xilinx acquisition will be crucial to monitor. This has positioned AMD formidably in the programmable chips and SoC markets.

AMD is also acquiring ZT Systems for $4.9 billion, which is part of an effort for AMD to consolidate its position in AI infrastructure. The company provides extensive expertise in designing and deploying data center AI computing and storage infrastructure at scale, complementing AMD’s existing silicon and software capabilities. This acquisition is another crucial catalyst that will help the company challenge Nvidia’s lead in the AI infrastructure market. The deal brings a large team of system engineers from ZT Systems, which, if integrated efficiently, could be significantly accretive to the company’s total ecosystem. However, AMD plans to sell ZT Systems’ data center infrastructure manufacturing business to a strategic partner—in my opinion, this is a strong move. It consolidates a core reason why I am bullish on AMD, which I mentioned in my August analysis. At this time, the company’s lack of manufacturing focus provides it with a high level of agility, an aspect of its operating model that, I believe, is strategic for management to maintain.

I am bullish on the prospects of AMD’s Q3 results, but there are also pockets of weakness to be aware of. These include a gaming segment decline amid the maturity of the current console cycle and lower demand for semi-custom SoCs. This includes Microsoft’s (MSFT) Xbox Series X|S and Sony’s (SONY) PlayStation 5, which are in their fifth year of the market cycle. Rationally, I expect this is a trend that has continued into Q3. This segment may not recover until 2025, when new console cycles might begin, or management might engage in more stringent price-adjustment tactics.

On a longer-term horizon, I’m also growing cautious of a developing geopolitical environment, including escalating tensions between China and the U.S. While an invasion of Taiwan seems unlikely to me, I believe we are going to see higher levels of supply chain disruptions and trade restrictions in the coming years, until the West has developed a more reliable moat economically after a weak macroeconomic environment in recent years, including debt exacerbation and inflation issues following the COVID-19 crisis. While these effects are likely to face many industries, some investments act as a hedge against current geopolitical tensions, but AMD is certainly not one of them, considering its valuation and close relationship with TSMC (TSM).

Overvalued, But High-Growth Potential Mitigates Concerns

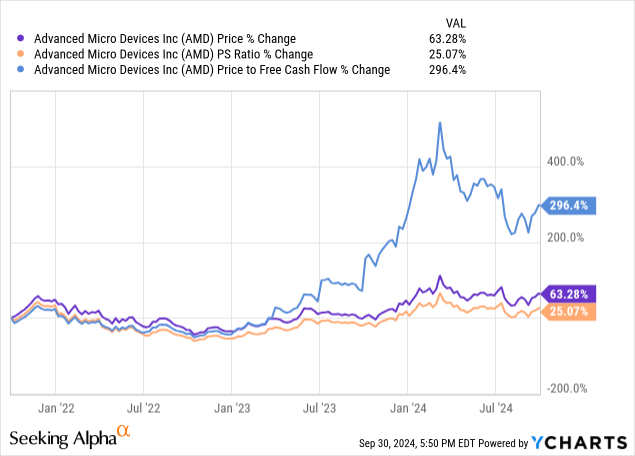

Since my August analysis of AMD, the stock has gained 21% in price. At the time, I mentioned that the valuation was appealing and hence put out a Buy rating. However, following the 21% price increase, I do not believe this is a suitable entry point unless one is willing to navigate near-term volatility before the company’s stock price stabilizes around its strong anticipated medium-term growth. I mentioned in my previous analysis that AMD should not be considered a value investment nor a growth-at-a-reasonable-price investment. Instead, this is a pure growth investment, and it should be positioned in portfolios with this risk tolerance in mind and carefully hedged with other international stocks of varying industries. I see no better way than this to protect from current macroeconomic uncertainty at the moment, which is being highly undervalued by the analyst community, in my opinion.

It’s worth being cautious about investing in AMD due to its valuation, but that still doesn’t detract from the fact that the company is exceptionally well-positioned in terms of growth. 45 analysts forecast on consensus 27.5% YoY normalized EPS growth for Fiscal 2024. For Fiscal 2025, 45 analysts forecast 59.5% growth. Therefore, this is a stock positioned at an inflection point. However, the market has been aware of this inflection point since late 2023. This caused immense overvaluation at the time in anticipation of the coming growth, and the volatility since has been somewhat of a reversion to a fairer valuation. The stock could fail to deliver alpha over the next year due to its valuation, but moments of downside volatility related to this could open up very strong medium-term entry points. However, many of AMD’s gains that warrant such a significant valuation ratio expansion are related to its recent strength in earnings estimates. On the other hand, its forward revenue growth has a historical five-year average of 25.9%, but the current estimates do not show much expansion here:

AMD Revenue Estimates (Seeking Alpha)

In my last thesis, I estimated that AMD’s P/S ratio would expand to 10 by the middle of Fiscal 2025. However, the P/S ratio has already risen to 11.4. Therefore, I am now expecting a P/S ratio contraction, and I still believe a ratio of approximately 10 would be fair for the stock during Fiscal 2025. If the company hits the December 2025 revenue estimate of $32.84 billion and trades at my predicted P/S ratio of 10, the market cap will be $328.4 billion. That is still a 23.5% growth even with valuation multiple contractions, and so I reaffirm my Buy rating at this time, as the company’s growth rates are likely to remain very strong for the next few years at least.

Growth Factors & Peer Analysis

While the Wall Street estimates give a good foundation, my independent perspective is on the higher end of the current spectrum of revenue and earnings estimates. Particularly, I believe its Data Center segment, driven by the demand primarily for EPYC CPUs, is going to be significantly accretive in FY25. While there is indication that AI expenditures will taper in the next 12 to 18 months, I still expect FY25 to be highly accretive on this front. The one caveat is that I believe there are underlying catalysts with companies starting to question the ROI of AI spending that could cause a downside later that is not currently reflected in the consensus estimates. Therefore, while FY25 is likely to deliver high growth, there is a moderate risk of volatility toward the end of the financial year if lower enterprise AI spending occurs across the technology industry. This is also likely to take effect if there is a recession in the next few years, further compounding the risk factor in the medium-term growth-oriented investment thesis. Furthermore, AMD’s Ryzen processors have shown robust growth recently, and management is expanding on these advanced technologies to support future growth; this is another area that could support my bull case for FY25.

It’s worth comparing the valuation and growth rates of AMD against its two primary competitors, Nvidia and Intel:

| AMD | Nvidia | Intel | |

| Forward P/E non-GAAP ratio | 47.2 | 41.2 | 87.8 |

| Forward diluted EPS growth | 15.5% | 128.8% | -14.9% |

| Forward price-to-operating-cash-flow ratio | 88.4 | 42.9 | 12.2 |

| Forward operating cash flow growth | 29.7% | 150.4% | 0.5% |

| Forward P/S ratio | 10.1 | 22.9 | 1.9 |

| Forward revenue growth | 11.7% | 87.1% | -3.5% |

Based on the above table, AMD does not seem excessively overvalued to me relative to its peers on a revenue basis. However, it certainly does on an earnings and operating cash flow basis. That being said, its profitability is an area that I expect to improve significantly in 2025. AMD has been heavily investing in its position in the AI markets in recent years, and while this has been short-term depletive, the company will be reaping many of the benefits of this in FY25 and beyond. As a result of these factors, I think a P/S ratio of 10 is sustainable for AMD over the next 12 months.

Broadcom Custom Chips & Deeper Geopolitical Insights

In the comments of my previous thesis, one reader mentioned the competition threat to AMD posed by Broadcom (AVGO) in custom chips. I thought this was a valuable observation, so I believe it would be prudent for me to do an analysis of that here. Broadcom is rapidly growing its custom Application-Specific Integrated Circuits (‘ASICs’), which is driven by the increasing demand from hyperscalers and enterprises seeking tailored solutions for AI and data center applications. Currently, Broadcom commands approximately a 55-60% market share of the custom ASIC market. This challenges AMD’s off-the-shelf products and means management may need to invest more heavily in developing more customized solutions. Broadcom has co-designed multiple generations of Google’s (GOOGL) (GOOG) Tensor Processing Units (‘TPUs’) and has secured contracts for future generations, including the TPU v7. These collaborations could generate $8 billion in revenue for Broadcom in 2024, with projections exceeding $10 billion by 2025.

Furthermore, I mentioned the geopolitical risk in my operational analysis above, and I believe this deserves more attention here. AMD, like many major tech companies, relies heavily on TSMC for its chip manufacturing. While I find an invasion of Taiwan highly unlikely, it cannot be ruled out. In addition, we should remember that the West is being attacked on three fronts right now: Iran, Russia, and, latently, China. A culminating war economy would be bad for major tech companies, and supply chain disruptions and trade restrictions look inevitable to me in the medium-term future. In my estimation, large-scale wars can be pacified through Western diplomacy and fiscal restraint at the federal level in the United States, but I still fear that too heavy a reliance on AI and growth investments is a vulnerable portfolio strategy to adopt at this time. There is a careful line to tread here between portfolio growth exposure to AI (a technology that could help the West retain a geopolitical leadership position) and too little portfolio protection from a worst-case large-scale hot war outcome. Certain investments like oil, gold, and holding diversified assets in India and other notable likely peacetime economies like Australia seem like valuable strategies to begin adopting to mitigate the risks of the current multipolar environment.

Conclusion

AMD is one of the best growth investments I know of at the moment. As a result, it is no surprise that the market is incredibly bullish on the stock. Ironically, the overvaluation I have outlined in this analysis does not detract from the near-term investment thesis, and it certainly doesn’t detract from the medium-term one. Based on my insights, AMD is still positioned as a Buy after a 21% price increase since my last analysis of the company. A reasonably weighted allocation in a hedged portfolio is prudent at the moment due to a heightened geopolitical risk environment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.