Summary:

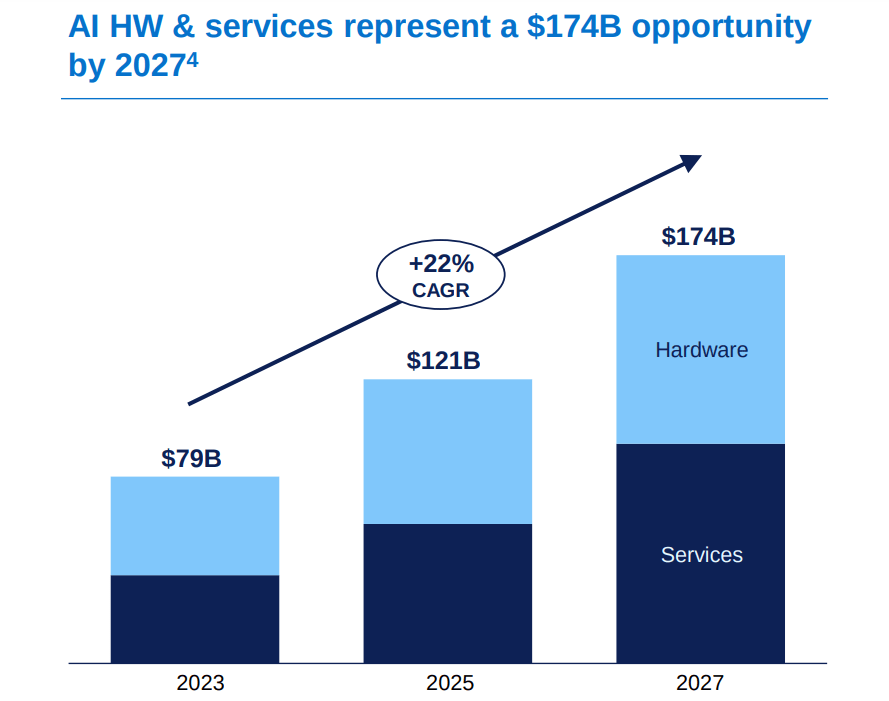

- Dell targets a $174 billion AI hardware and services market by 2027, growing at a 22% CAGR.

- ISG is now Dell’s growth driver, offering AI-focused products like PowerScale, APEX, and AI Factory.

- Dell’s PowerScale F910 offers 127% performance improvement, while PowerEdge XE9680L boosts GPU density by 33%.

- Collaborations with Hugging Face, Meta, and Microsoft streamline AI adoption, enhancing Dell’s competitive edge in the market.

- Commercial and consumer PC sales dropped year over year, with commercial PCs stagnating at 0% growth in Q2 fiscal 2025.

Thinglass

Investment Thesis

Dell Technologies (NYSE:DELL) presents a compelling opportunity, fueled by its strategic shift toward AI hardware and services within its Infrastructure Solutions Group (ISG).

With the AI market estimated to leap from $79 billion in 2023 to $174 billion by 2027, Dell is well-positioned to take an essential share of that market with its new-generation AI products, such as PowerScale and APEX. Deals with AI leaders like Hugging Face and Microsoft (MSFT) enhance this competitive edge.

However, with declining PC sales posing a potential risk, Dell’s focus on high-growth AI sectors sets a case for long-term revenue expansion and shareholder value.

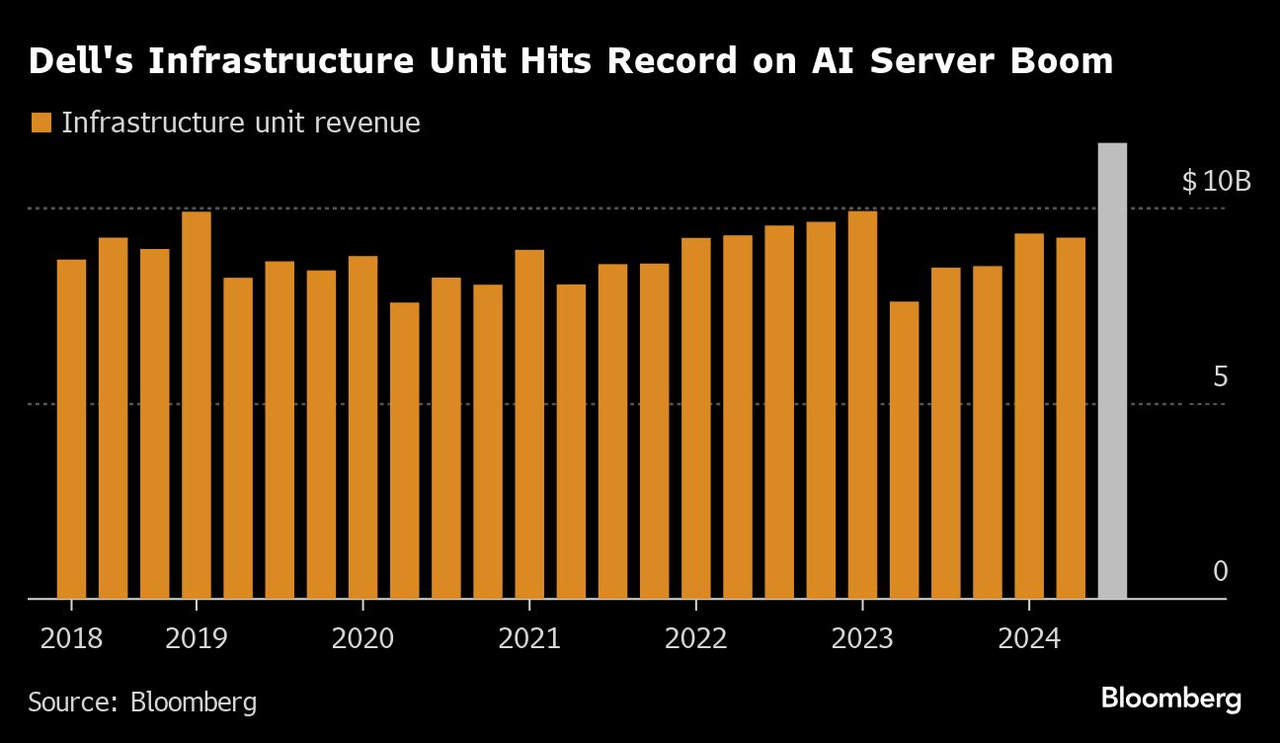

Dell’s AI-Driven Infrastructure Solutions May Continue to Soar

ISG is now a core driver of Dell’s top-line growth, based on a strategic emphasis on AI hardware and related services. Dell is leading into a rapidly expanding market by focusing on AI-driven solutions. The AI hardware and services market may grow from $79 billion in 2023 to $174 billion by 2027, representing a compound annual growth rate (CAGR) of 22%.

The CAGR significantly outpaces growth in many other tech sectors (obviously due to AI demand). Dell may seize a significant portion of this more than doubled market opportunity, which is a strong indicator of its top-line growth potential. The projected increase of $95 billion in AI hardware and services by 2027 signals massive potential revenue streams for Dell, assuming it can maintain a competitive edge through its advanced technological offerings.

Q2 fiscal 2025 Presentation

The product portfolio significantly positions Dell’s ISG as a powerful top-line growth engine as AI adoption accelerates. Companies across various industries increasingly rely on AI for data processing, automation, and enhanced client experiences. Dell’s advanced hardware, like the AI-enhanced PowerScale F910, is designed to optimize AI workloads, boasting a 127% improvement in performance compared to previous versions. This performance boost directly correlates to quicker AI-driven insights and faster AI training times, which is critical for enterprises adopting AI at scale.

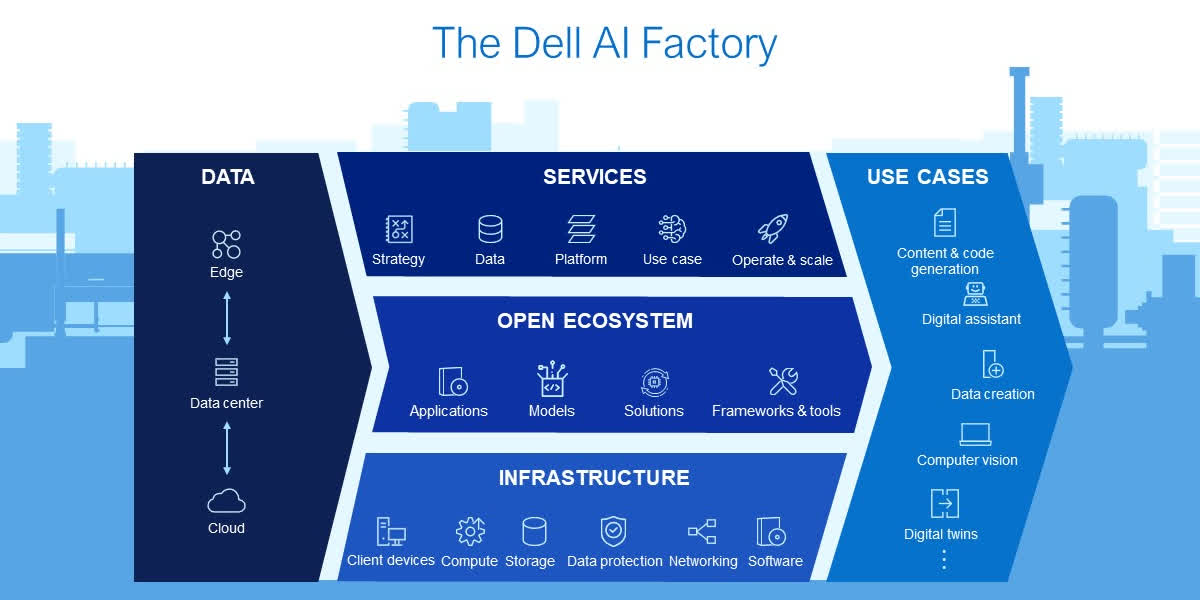

Another standout product is the Dell AI Factory. It offers cutting-edge AI technologies and services, like the Dell PowerEdge XE9680L server. This server is equipped with 8 GPUs in a 4U form factor, features direct liquid cooling, and offers a 33% increase in GPU density compared to the previous model, the XE9680. Such enhancements allow Dell to address the growing demand for high-performance AI systems, specifically training large machine-learning models.

Dell

Dell’s collaboration with AI leaders like Hugging Face, Meta (META), and Microsoft further bolster its competitive lead. These partnerships enable streamlined deployment and development of AI applications.

For instance, Dell’s integration with Hugging Face’s platforms and Meta’s Llama 3 model simplifies AI application development for enterprises (due to compatibility with existing infrastructure). This accelerates time-to-market for new AI advancement. In terms of enterprise IT spending, the ability to deploy AI applications up to 80% faster (with NVIDIA Inference Microservices) than do-it-yourself (DIY) alternatives through Dell’s AI factory ecosystem is a core value proposition for potential clients.

Moving deep into Dell’s portfolio, APEX offerings may derive solid top-line growth in the context of infrastructure management and automation. One of the core features of Dell APEX AIOps is its capability to resolve infrastructure issues 10 times faster than traditional approaches, which provides tangible operational savings and increases customer uptime.

Moreover, Dell’s PowerStore platform is a significant growth lever in data-intensive industries. The PowerStore system delivers a 30% software-driven performance boost and reduces latency by 20%. These performance improvements are critical in industries that depend on high-speed data processing. Dell targets financial services, healthcare, and manufacturing sectors with this platform. The 66% better hardware performance of PowerStore compared to its predecessors points to the system’s ability to handle demanding workloads more efficiently.

Additionally, PowerStore’s Prime QLC storage offering allows for greater data storage flexibility, and a 5:1 data reduction guarantee can significantly reduce storage costs for enterprise clients. These efficiency gains make PowerStore a compelling option for organizations seeking performance and cost savings.

Overall, Dell holds a product moat by offering enhanced performance and lower operating costs, PowerStore can derive higher margins for Dell while addressing the needs of data-intensive industries. The combination of cutting-edge hardware and software-driven performance enhancements positions Dell to capture more enterprise IT spending, especially as data volumes continue to explode across industries.

Dell’s PC Reliance: A Growing Threat to Sustainable Profitability

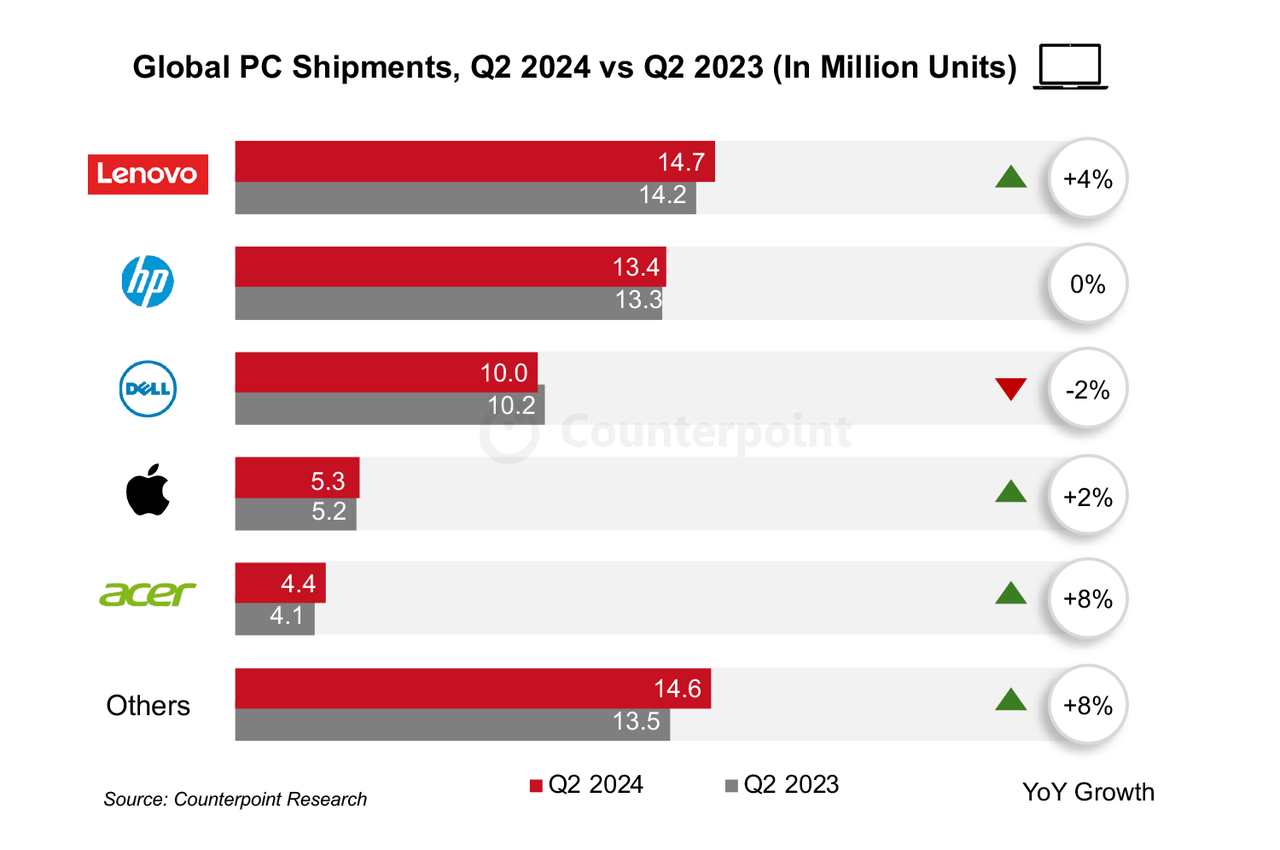

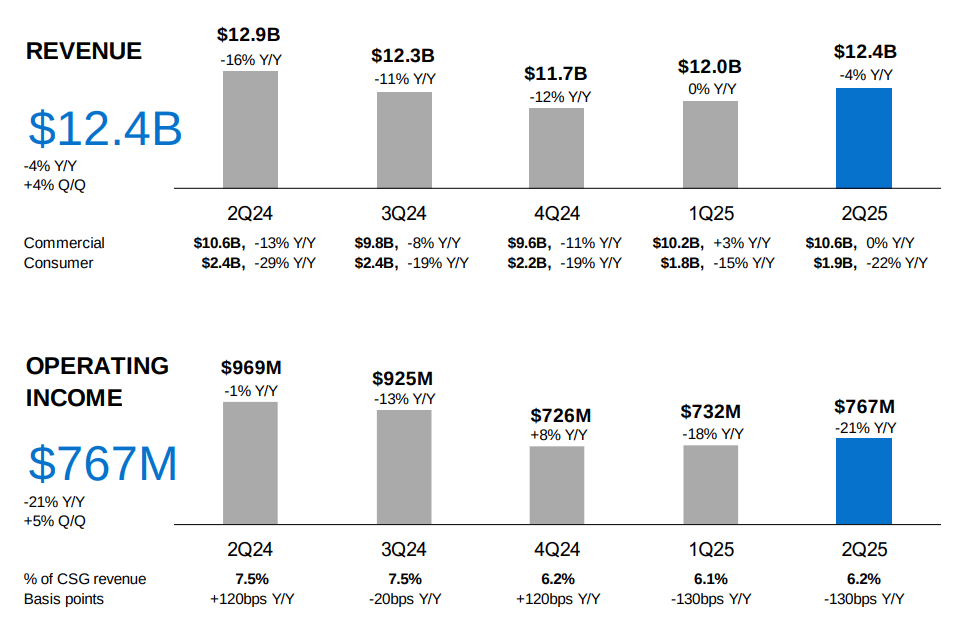

On the downside, Dell’s heavy reliance on PC sales is reflected in Dell’s sequential revenue trends from the Client Solutions Group (CSG), particularly for both commercial and consumer PCs. A detailed analysis of revenue figures across several quarters highlights this weakness.

In the figures, the commercial PC segment shows significant year-over-year (YoY) declines across three consecutive quarters. This is followed by minimal positive growth of +3% YoY in Q1 fiscal 2025 and stagnation at 0% YoY in Q2 fiscal 2025. While the +3% YoY revenue uptick in Q1 fiscal 2025 suggests some recovery, there is an absence of sustained growth momentum, as seen by the flat 0% YoY in Q2 fiscal 2025, which indicates underlying demand challenges in the commercial PC market.

Moreover, this cyclicality suggests a lack of growth catalysts outside of AI hardware, which implies Dell’s business could be constrained by fluctuating enterprise spending on PCs. A recovery in this segment may be hampered by prolonged replacement cycles when clients delay upgrades during economic uncertainty or increase interest in alternative IT investments.

The consumer PC segment exhibits an even sharper decline, with YoY revenue dropping as much as -29% in Q2 fiscal 2024 and not improving substantially in subsequent quarters. Although the rate of decline moderated to -15% YoY in Q1 fiscal 2025, it worsened again to -22% YoY in Q2 fiscal 2025. This points out that Dell may continue to struggle with slumping demand in the consumer PC market.

The demand for PCs has decreased (post-pandemic) based on a saturation of device-related market demand and shifts in consumer preferences toward smartphones and tablets. These declines concern the long-term outlook and point out that Dell may have difficulty retaining and expanding its consumer PC base amid the market intensity of cheaper alternatives. This can be observed in the flat YoY shipment growth for major PC vendors.

Furthermore, the relationship between these YoY revenue declines and overall top-line growth potential indicates Dell’s vulnerability to market cycles. As PC sales contribute significantly to Dell’s top-line, fluctuations in demand for PCs directly influence the company’s financial standing. The weakening consumer segment is a significant barrier when combined with the highly competitive nature of the PC market. Price competition often erodes margins, and if this trend persists, Dell’s dependency on PC sales could limit its growth trajectory.

Erosion in the operating income performance of the Client Solutions Group is already there. Despite an initial positive trend in operating income in Q2 fiscal 2024 and Q3 fiscal 2024, Dell’s operating income as a percentage of CSG revenue fell by 1.3% YoY from Q4 fiscal 2024 to Q2 fiscal 2025. This downward trend indicates compression in profit margins based on a mix of lower sales volumes and increasing costs.

The compression from 7.50% in Q2 fiscal 2024 to 6.20% in Q2 fiscal 2025 means that Dell finds it increasingly difficult to sustain profitability within its PC-dependent segment. As the gross margin of PC sales shrinks, Dell’s capability to generate substantial operating income diminishes, which could reduce its capacity to reinvest in growth areas like software, services, or next-generation hardware solutions. Overall, the consistency of these declines over time indicates that Dell’s operating margins are not stable against slowing PC demand.

Q2 fiscal 2025 Presentation

Takeaway

Dell’s strategic focus on AI hardware through its ISG presents a substantial growth opportunity, particularly as the AI market is expected to surge to $174 billion by 2027. With products like PowerScale and APEX and partnerships with leaders like Hugging Face and Microsoft, Dell is well-positioned to capture significant market share.

However, its heavy reliance on declining PC sales remains a notable risk. While its AI-driven offerings suggest promising top-line growth, Dell must address the challenges in its traditional PC segment to ensure a balanced and sustainable growth trajectory.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.