Summary:

- Lucid Group faces significant pricing disadvantages compared to competitors like Tesla and BYD, impacting its growth and market share in the luxury EV segment.

- Despite increased deliveries, Lucid’s price reductions are unsustainable, leading to financial strain and high production costs, unlike Tesla’s efficient production model.

- Lucid’s financial position is precarious, with high debt and reliance on external funding, making it challenging to achieve profitability and compete effectively.

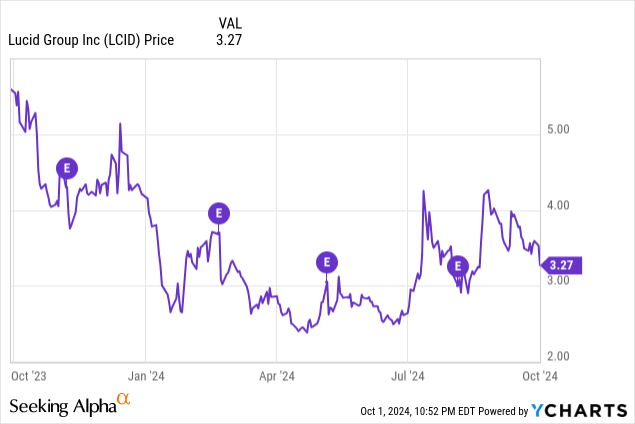

- Given the competitive EV market and Lucid’s financial and production inefficiencies, I recommend a bearish outlook with a 1-2 year target price of $1.3 to $1.6.

jetcityimage/iStock Editorial via Getty Images

Investment Thesis

Lucid Group (NASDAQ:LCID) is a next-generation electric vehicle automaker in the United States. The company designs, develops, manufactures, and sells its EVs. Its ground-breaking Lucid Air, a fully electric sedan, targets luxury consumers. “Luxury” is the key word here, since my analysis will be based on its pricing and consumption outlook of the general economy.

I am bearish on Lucid Group, where key price competition pressure slows the company’s future growth. Apart from price competition, I delve into macroeconomic factors such as interest rates slowing consumers’ buying power and limited incentives for the company compared to its competitors.

Pricing disadvantages has the most impacts on Lucid

Here, I focus on price competition, showing the company’s competitive disadvantage over its close rivals, Tesla and BYD. BYD has not yet entered the US, but EV buyers are considering value for money given BYD’s affordability and its similar and beyond qualities to US EVs.

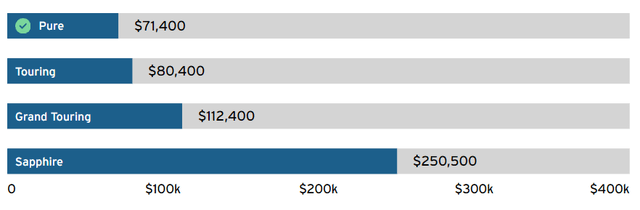

Take for example Lucid Auto model Lucid Air. This is the best-selling Lucid Auto EV, which sells at the current base price of $71,400 to $250,000, depending on the options and trim.

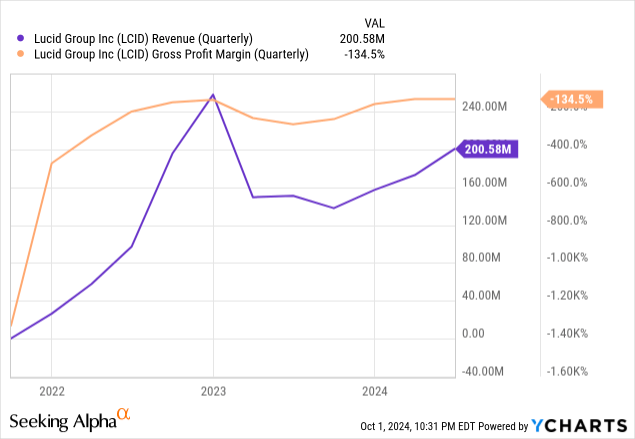

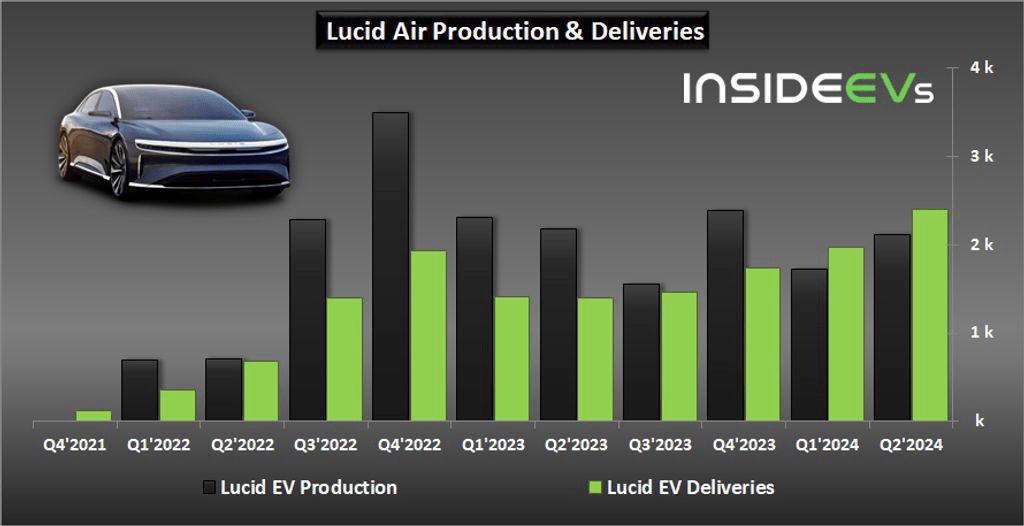

In the second quarter of 2024, the company recorded 2,394 deliveries of Lucid Air, 70% more than last year’s sales and a 22% increase from Q1’24 (1,967 sales). The company experienced this growth after the price reduction, resulting in more orders, but this is unsustainable.

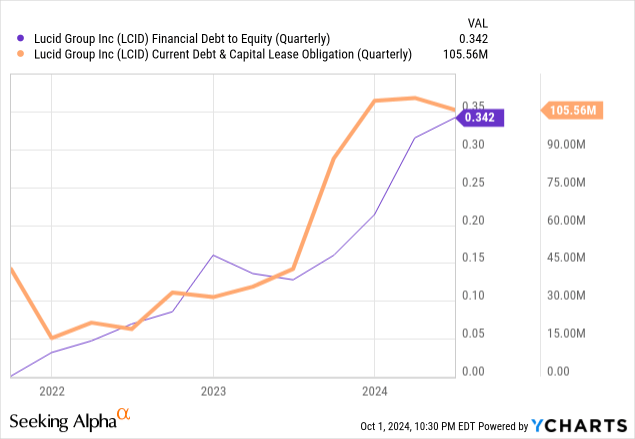

Reducing Lucid Air’s price came at the cost of maintaining its debt score at $2.39B, causing a sharp decline in cash and equivalent from $2.17B Q1’24 to $1.35B Q2’24. As a new player in the EV market, Lucid Auto is facing a high production cost. In Q2’24, the company increased its CAPEX from $203.7 Million to $234.3 million and is still recording low production volume. Overall, this shows that the company is still grappling with production costs compared to its competitors, such as Tesla and BYD.

Comparing Lucid Air with Tesla and BYD Han EV, the three models are luxurious.

|

Company |

Lucid Auto |

Tesla (TSLA) |

BYD (OTCPK:BYDDY) |

|

Make |

Lucid Air |

Tesla Model S |

BYD Han EV |

|

Price (From low upgrade to high upgrade) |

$71,400 -$250,000 |

$32,800 – $40,000 |

|

|

Sales (Q2’2024) |

2,394 units |

21,551 Units (Model S/X and Cybertruck combined) |

228,010 Units (BEV + PHEV) |

|

Range. |

Source: Table created by the author with information from each company

BYD has not yet sold its EVs in the United States (US), but I picked the BYD Han EV sedan due to its close features with Lucid Air. The Han EV is performing well in China, with 228,010 units sold in Q2’24 at a price range between $32,000 and $40,000. This should worry US EV luxury manufacturer Lucid Air model selling at a $71,400 base level, double that of BYD Han EV.

As noted in McKinsey Research, driving range is one of the major considerations in the EV market. Research shows that 40% of EV buyers are looking for an EV with a driving range above 400 miles or more to switch to an EV. Lucid Air has attained a 512-mile driving range ahead of its competitors. However, looking at the sales, Lucid lags behind Tesla and BYD, and we determine that price is moving luxury EV customers at a base price of $71,400 for Lucid Air and Tesla Model S at $68,490.

For example, when Lucid reduced the price of Lucid Air by $8,000 after disappointing sales in 2023 of just 6,001 cars, this boosted its sales in both quarters of 2024. The Q1’24 sales jumped by 40% QoQ with 1,967, and Q2’24 recorded a 9.3% QoQ increase, recording 2,394 units.

Delving into Lucid Air’s luxury competitors, Tesla reduced its Model S price in the US by 6.7%, one of its expensive models. Tesla is an EV pioneer who reduced prices and maintained a positive net income despite falling by 45% on weak EV sales. The company saw a net income loss of $790 million after Lucid Air’s model price reduction.

Also, we note that Lucid Air luxury car generates most of the company’s revenues and has a 0.40% US market share, facing Tesla’s 52.30% market share. At this point, Tesla’s price reduction of Model S and other vehicles saw a 36% sales increase. Tesla’s price reduction increased sales without hurting the company, compared to Lucid Air’s, which recorded a loss. Price reduction saw increased sales and market share, but the challenges of achieving profitability were seen in Q2’24, with a $0.29 loss per share over the expected loss of $0.27 per share at -20%.

This is to say that Tesla owns 52% of the US EV market share vehicles, while other competitors share the remaining 48%. On this basis, I am bearish on Lucid due to pricing disadvantages over its competitors as an EV start-up.

Challenges emerge in the company’s financials

Lucid is currently in a ditch, typically showing a better entry point. However, I do not recommend a buy; instead, I am bearish as the company has not yet made material investments that would conquer its rivals in the existing market forces. Tesla is an example of its stiff rival that has overcome most of the Lucid challenges, the key of which is achieving production efficiency. Tesla achieved efficiency through data analytics, flexible manufacturing systems, and leveraging automation, which explains its 54% market share in the US. This helps Tesla reduce its prices over its competitors. On the other hand, Lucid Auto is still scaling the production efficiency that Tesla has already achieved, such as Gigafactory’s cost-effective scale production.

Moving to the company’s financials, I think the recent financial boost by the Saudi Arabia Public Investment Fund of $1.5B, set to boost its 2025 production, will take time to reflect in its stock. I base my thoughts on the funding conditions: half of $1.5 will be a loan investment, and the remaining half will be used as convertible stock by Ayar Investment. Lucid’s financial position will be at risk with its dwindling equity capital and reserves. This will add to its current loan capital standing at $2B. With the cash and equivalent dwindling, it explains the recent low EV sales attributed to various challenges, such as limited charging points.

The recent sales revenue increases, typically influenced by hurting price reductions, are not yet sustainable enough to turn the company into profitability. Lucid is still working towards achieving volume production to afford price reductions.

Valuation

In my last analysis, I was reluctant to give a valuation and a target price to the company, since I think the share price is driven largely by company event, numbers, and financing activities, as shown above. However, as we are seeing improving EV deliveries from the company with Q2 numbers hitting a record high, we can have a look on its P/S ratio and do an educated estimate.

Inside EV

For FY2024, the management has provided a guidance of delivering approximately 9000 EVs in the year, which makes the revenue estimates for the year at the range of $700 to $750 million.

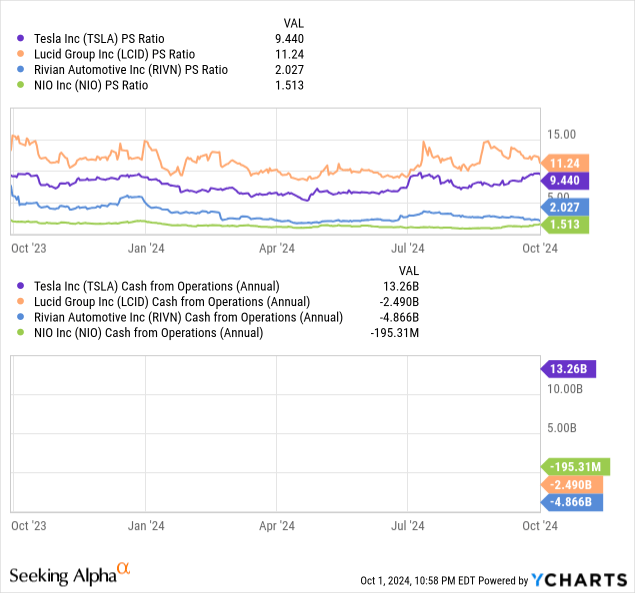

Currently, the company’s P/S ratio for valuation is at the high end in the industry, even above Tesla after its share price consolidation and also significantly above Rivian which is a peer in a similar stage of business journey. As such, in the long-run I think the valuation between Lucid and its peer will converge, making the company being valued at around 5x multiple.

With this, the 1 to 2-year target price of the company will be at around $1.3 to $1.6, making it a sell to us.

Investment risks

The company is still facing similar risks as suggested in our last analysis, coupled with some new risks:

- Market risks: The EV market where Lucid operates in is a highly competitive market with prices going down. Major players like Tesla have gained a strong foothold in the market and, in my opinion, Lucid might not be able to compete as a late-comer, in terms of pricing, quality, branding, etc.

- Technological risks: The company has proposed different new technologies, hoping to differentiate from its competitors. However, these new technologies face the risks of long research and development period, or even the failure of realizing the plan. This will have significant impacts on the company’s products

- Government dependency: The company relies on government policies and subsidies that protect domestic manufacturers against Chinese imports. Any changes to these protectionist measures, especially in the face of a presidential election, might impact the company

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.