Summary:

- I reiterate a “Buy” rating for Advanced Micro Devices with a fair value of $205 per share, driven by strong R&D and growth prospects.

- AMD’s upcoming Instinct MI325X and future MI350 and MI400 series, powered by CDNA architecture, promise significant advancements in AI and GPU markets.

- Oracle Cloud’s adoption of AMD’s MI300X accelerators validates AMD’s technology, enhancing its competitive position against Nvidia and expanding its customer base.

- Projected revenue growth of 25% in data center business and 12% overall in FY25, supported by strong Ryzen and Zen 5 processor sales.

JHVEPhoto

I upgraded Advanced Micro Devices, Inc.’s (NASDAQ:AMD) stock to “Buy” in my previous article published in July 2024, highlighting the acquisition of Silo AI was very positive for AMD’s growth. AMD is set to release their Instinct MI325X in Q4, with MI400 series, powered by CDNA “Next” architecture, expected in 2026. I think AMD has a solid R&D roadmap for the fast-growing GPU market. I reiterate a “Buy” rating with a fair value of $205 per share.

MI325X, MI350, MI400 With CDNA New Architecture

During their recent earnings call, AMD announced to launch their MI325X in Q4 FY24, featuring up to 288GB of HBM3E memory with 6 TB/s of memory bandwidth. According to their management, MI325X will deliver 1.3x better inference performance compared to Nvidia’s (NVDA) H100. MI325X will leverage the same architecture as MI300, but replace HBM3 memory with faster HBM3E. I think their Instinct MI325X will be more suitable for AI training and inference workloads. With the release of MI325X, I anticipate AMD will secure more orders from hyperscalers due to its better cost-performance ratio.

In addition, AMD presented a clear roadmap for their new CDNA architecture over the next two years. As discussed in my previous article, AMD’s CDNA is an important technology to reduce data movement overhead and enhance power efficiency through powerful packaging with chiplet technology. The CDNA architecture can enable engineers to optimize their code and leverage GPU’s best performance. As communicated by the company, the CDNA 4 will power their MI350 series set to be released in 2025, and CDNA 5 will be featured in the MI400 series in 2026.

In short, I am encouraged by their concrete roadmap for GPU and CDNA architecture over the next two years. As long as the company executes their product strategy effectively, I trust the company will continue to deliver rapid business growth, capturing more market share in the rapidly growing AI market.

MI300X On Oracle Cloud

On September 26th, AMD announced Oracle (ORCL) Cloud Infrastructure (OCI) chose AMD MI300X accelerators to power its newest OCI Compute Supercluster instance. According to AMD, their product has undergone extensive testing, which was successfully validated by OCI. I think it is an important milestone for AMD to win trust from hyperscalers.

Through the partnership, AI developers using Oracle Cloud Infrastructure could access AMD’s MI300X and CDNA architecture as a cost-effective alternative to Nvidia, which could potentially help AMD extend their customer base.

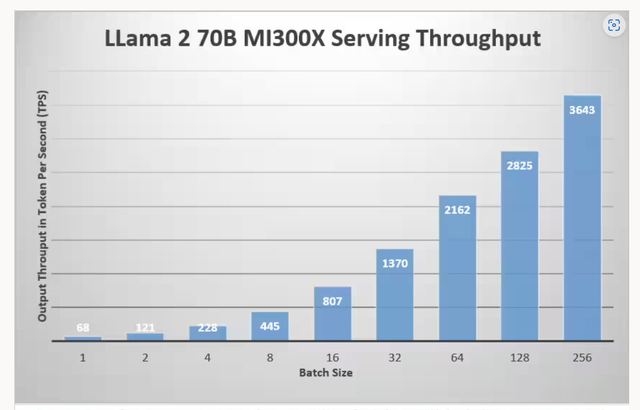

According to Oracle’s testing result, MI300X can scale linearly and generate a maximum of 3643 tokens across concurrent 256 user requests, as shown in the chart below. A key finding is MI300X that is capable of fitting the largest LLM models in a single node. It is evident that AMD has the potential to compete with Nvidia’s GPU technology in the future.

Recent Result, Outlook, And Valuation Update

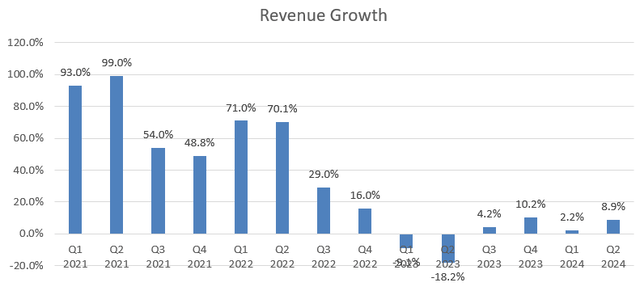

As shown in the chart below, AMD delivered 8.9% revenue growth and 18.4% adjusted operating profit growth in Q2 FY24, with a 115% year-over-year revenue growth in the data center business.

For their near-term growth, I am considering the following factors:

- Data Center: As discussed in my previous article, I anticipate the data center business will represent around 60% of AMD’s total revenue in the near future. I project their data center revenue will double in FY25, contributing nearly 25% growth to the top line.

- Client: Due to the strong sales of AMD Ryzen processors, the Client business is likely to grow significantly in FY25. In addition, AMD started to ship their Zen 5 processors during the quarter, which could potentially contribute additional growth to their Client segment. As a result, I project 40% revenue growth for FY25.

- Gaming: AMD will face the near-term challenges of weak semi-custom SoC sales. As indicated over the earnings call, the SoC demand remained soft, and the management anticipated even weaker growth in H2 compared to H1. I project the segment will decline by 50% in FY25.

- Embedded: I anticipate the segment will decline by 30% in FY25, aligned with their recent growth trends.

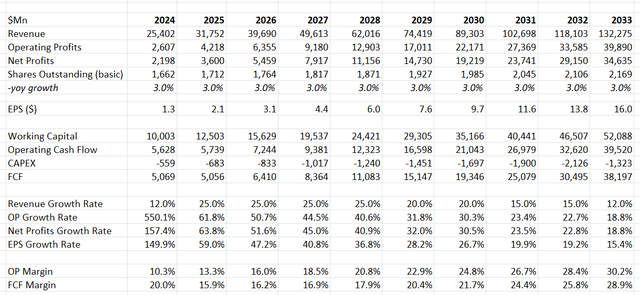

Putting together, I project their revenue will grow by 12% in FY25. For the normalized growth, I continue to forecast 25% revenue growth driven by 18% growth in the data center business, and 7% from other businesses. In addition, I project revenue growth to gradually moderate to align with overall industry growth, reaching 12% in FY33.

I model 170bps-300bps operating margin expansion, driven by 50bps from gross profits, 10-20bps from R&D, and the remainder from reducing amortization costs. With these assumptions, the DCF can be summarized as follows:

The WACC is calculated to be 12% assuming: A risk-free rate of 3.6%; beta 1.81; equity risk premium 7%; cost of debt 5%; debt balance $4.8 billion; equity $55.8 billion; tax rate 13%. The fair value of AMD’s stock price is calculated to be $205 per share, based on my DCF model.

Key Risks

Cerebras Systems (CBRS), a startup aiming to challenge Nvidia and AMD, recently filed for IPO. According to the IPO prospectus, Cerebras generated $78.7 million in the 12 months ending December 31st. When Cerebras goes public, I think some market capitals may flow towards the new stock, as the company can be viewed as a pure play in the GPU market, which could potentially pressure AMD’s stock price in the near term.

Conclusion

I think AMD has a concrete R&D roadmap for their GPU and CDNA New Architecture over the next two years. With the higher revenue mix toward the data center business, I anticipate AMD’s revenue growth will accelerate to 25% in the near future. I reiterate a “Buy” rating for AMD with a fair value of $205 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.