Summary:

- Nikola surged 20% following the announcement that it wholesaled 88 units in Q3 2024.

- The significant increase in stock price reflects investor confidence in Nikola’s sales performance and future growth potential.

- The positive sales figures bolster the investment thesis that Nikola is gaining traction in the electric vehicle market.

- We need to couple a re-ignited excitement with the hard truth of Nikola’s financials.

Tramino

Nikola Shares Jump

Nikola (NASDAQ:NKLA) rallied 20% on the news that for Q3 2024 it wholesaled 88 Class 8 hydrogen fuel cell trucks, falling within its guidance of between 80 and 100 units. The next day, the stock retraced 6.5%. So far this year, Nikola has wholesaled 200 hydrogen fuel cell trucks. CEO Steve Girsky ended the news release by stating that Nikola is committed to pioneering solutions for a zero-emission world, one truck at a time.

Among truck manufacturers, I have explained why I have always liked other peers more than Nikola, even when considering electric trucks. In particular, even though the electric truck market is expected to be worth around $15B by 2030, I thought companies like Volvo Group, Paccar, or Daimler Truck were much better positioned to benefit from this growth, not to mention that they are already producing and selling electric trucks.

On the other hand, Nikola struggled to produce electric trucks, but last year it shifted its strategy, making it lean more towards Class 8 hydrogen fuel cell trucks. Here, the company is the only one manufacturing and delivering the product, with no competitor in the market. This kind of truck has the advantage of a shorter charging time (20 minutes) but needs a network of charging stations that will require time and money. Some estimates believe that by 2030, a kg of hydrogen will cost around $5. The U.S. government released an interesting article showing that with 1kg of hydrogen a fuel-cell vehicle can drive around 60mi versus the 25mi an ICE vehicle can drive with a gallon of gasoline.

But the question we have to tackle is easier: will Nikola be around in 2030? Let’s look at the numbers we have and make a few guesses on what the trajectory of this company could be. Let’s also leave aside any controversy around the company’s past. I personally consider them meaningful, but let’s just base our assumptions on the available financials.

Nikola’s Financials

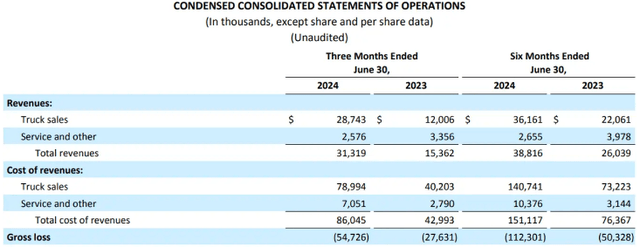

For the first six months of the year, Nikola reported $36.16M in truck sales and $2.66M in service revenues. The total is $38.82M, and it is a 49% increase YoY (1H23: $26.04M).

However, the company reported a gross loss of $112.3M, 77% more YoY (1H23: -$50.33M). Gross profit or loss comes from subtracting the cost of goods sold from total revenues. This means that Nikola spent a lot more money to build these trucks than what it earned. Now, pay close attention, in the income statement, gross profit comes before we consider the operating expenses (R&D; SG&A). This means that when Nikola reports a gross loss of $112M, we still have to add a lot of additional operating expenses. Anyways, while Nikola earned $36.16M from truck sales, it also spent $140.74M to build these trucks (raw materials and workers).

Since Nikola shipped 113 trucks in the same period, we can calculate that the average selling price was $320k, but that the average building cost was $1.25M. This means Nikola loses almost $1M per truck.

Moving down the income statement, we see opex decreasing at $164.19M (1H23: $295.83M). The net loss from continuing operations of the first half was more or less flat YoY: -281.4M vs. $285.26M in 1H23. This might be considered positive as the company is in growth mode and needs to stabilize its losses before turning into a profitable company.

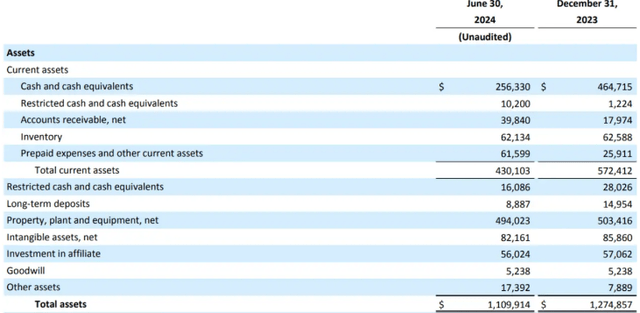

However, the last line of the income statement warns us: that the weighted-average shares outstanding have over doubled in one year: 45.62M vs. 20.99M. This means that the company issued and sold a lot of shares to finance itself. And yet, if we look at the balance sheet, we see that the company is depleting its cash position rather quickly. It reported $256.3M in cash at the end of Q2 2024, whereas six months before it had $464.7M. Since the company is not profitable, unless it issues some shares or raises debt, it should run out of cash between Q4 2024 and Q1 2025.

Nikola’s total assets have decreased in value by approximately $165M in six months, with the most valuable assets being property, plant, and equipment.

When we look at the company’s liabilities, we see that it only has $266.4M in LT debt. This makes sense because the company has a hard time being financed by banks. But what is worrisome is the accumulated deficit: $3.35B (FY23: $3.07B). The additional paid-in capital offsets this and amounts to $3.88B. But this represents the money above the share’s par value that investors have paid without receiving anything in return.

The cash flow statement confirms what we have seen: the company’s burning $250M of cash every six months. Currently, if it increases its sales, it will probably increase its losses, too. So, we are in a tough spot where more trucks means running out of cash sooner.

Let’s now make some educated guesses on the company’s future developments.

We have already seen Nikola’s cash issue. As of now, the company can finance its operations for 2-3 quarters. Tom Okray, Nikola’s CFO, addressed this issue during the last earnings call:

Right now we finish the quarter with 283 total, 255 unrestricted. And, yeah, I mean that would put us with our normal cash burn toward the end of the year. We’ll be getting close to being out of cash. We recognize that. We’re talking to the right people, and we’re confident that we will get to a place where we can achieve that goal of operating next year unencumbered without having to go to the market continuously.

So, Nikola expects to find new investors and it might do so. But these words don’t reassure me that much and paint the picture of a company that is still expecting to walk leaning on the financing arms of others.

Moreover, given Nikola’s incredibly high costs per truck produced, if the company wants to expand its production and ship more trucks (let’s assume a reasonable 300 units), we would have right away an increasing loss. In fact, given Nikola’s current cost structure, I see it unlikely for the company to reduce by $900k the cost per truck produced in less than one year. So, even though Nikola delivered 88 hydrogen trucks and seems to have a first-mover advantage in Class 8 hydrogen-fueled trucks, the road toward a financially healthy and profitable company is still long.

This is how I see it. Nikola needs around $500M per year to fund its operations. Every year it needs to find new investors to finance its operations. So far, either through share issuance or private investors, the company has been able to cope and survive. But to me, the financial profile of the company paints a risky picture, and therefore, I would not invest in Nikola.

We can also flip this reasoning in another way. Let’s assume Nikola will make it and will become a leader in hydrogen trucks. If its future is bright, then we will have plenty of time to profit from its success. This is a rule of thumb I use for my companies: I prefer to give up some early gains and be sure the company has found its way to run successfully its business. In fact, in this case, the company can compound over time and produce high and steady returns. Right now, it is still unclear how Nikola will keep running its operations, and this doesn’t allow me to believe it is a reasonable investment for me.

There is also another option, as the title mentions. If Nikola pulls it off and becomes a leader in hydrogen solutions, it will probably still lack the scale to compete worldwide. What could then happen? The likelihood of Nikola being acquired by a large peer (Paccar or Volvo Group, for example) would increase. In this case, it could be an interesting M&A play. But, so far, the run for hydrogen fuel-cell trucks is in its early innings and companies such as Paccar and Volvo would rather wait a couple of years before considering Nikola interesting and developed enough to be acquired.

So, right now, I see Nikola as still facing the big issue of cash burn and struggling to find every six months or so new injections of liquidity. As far as this issue goes on, no matter what the product may be and how technologically advanced it is, Nikola doesn’t offer an investment-grade profile for my portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.