Summary:

- Palantir Technologies has seen a remarkable 73.73% gain, outperforming the S&P 500, driven by strong earnings and revenue beats, and upwardly revised guidance.

- U.S. government and commercial sector revenues exceeded expectations, with notable growth in U.S. business revenues, contributing to Palantir’s impressive performance.

- Despite elevated valuation concerns, the market remains unconcerned, but co-founder Peter Thiel’s significant stock sales may trigger profit-taking activities.

- I am downgrading my outlook to a “hold” due to potential downside risks if PLTR fails to meet high expectations and recent stock sales by insiders.

hapabapa

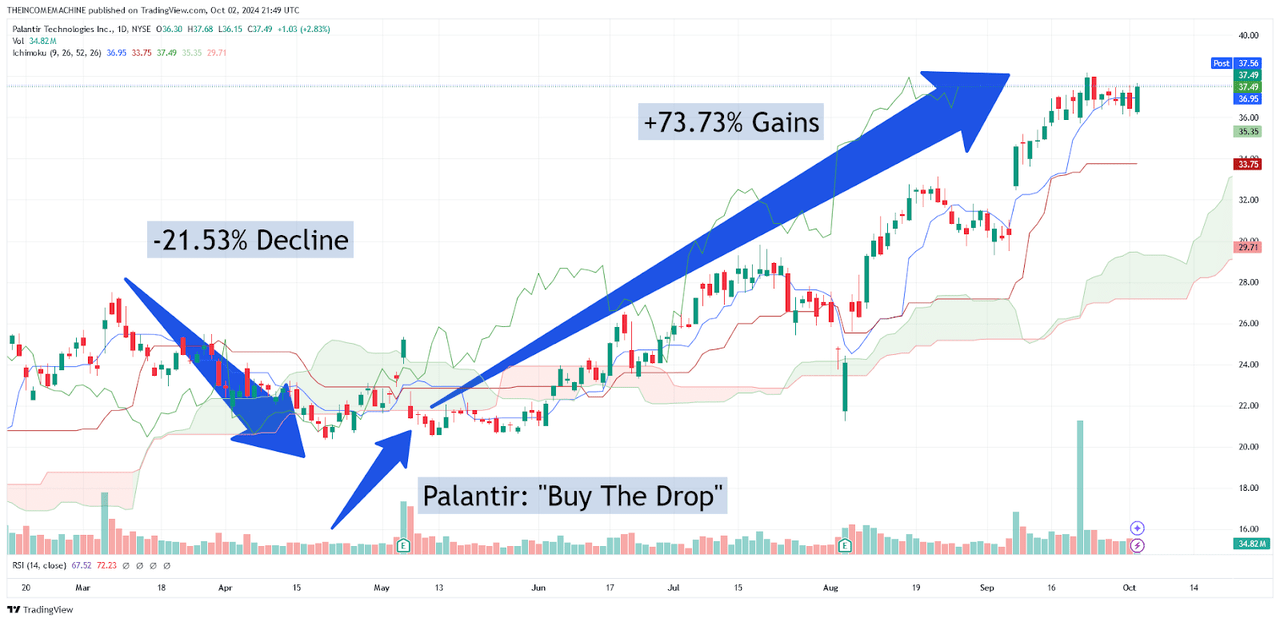

When I last covered Palantir Technologies (NYSE:PLTR) on May 8th, 2024 with “Palantir: Buy The Drop”, the stock had experienced declines of -21.53% over the prior two-month period. Since then, the stock has seen incredible rallies and is currently showing gains of 73.73% while the S&P 500 lags far behind with gains of just 10.58% during the same period of time. Overall, I find this sustained outperformance to be quite impressive because it has become abundantly clear that the market is already showing early signs of rotating away from some of the heavy exposure to artificial intelligence investments that had characterized prior trading periods.

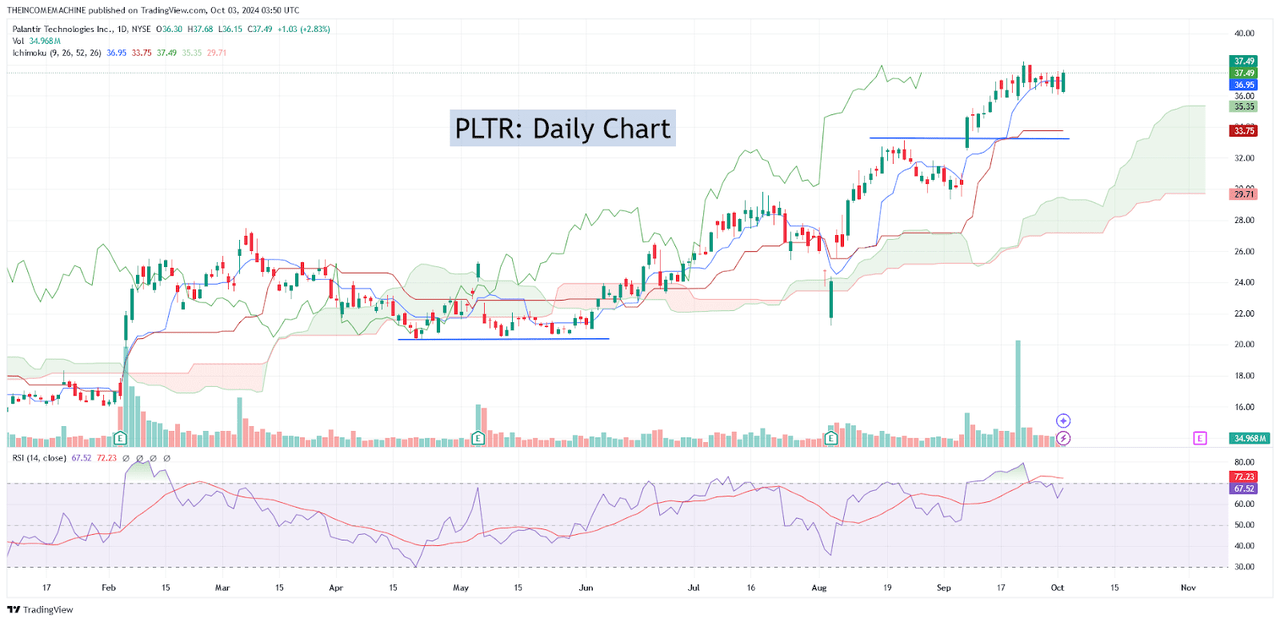

PLTR: Substantial Gains Following “Buy” Recommendation (Income Generator via TradingView)

For the second quarter period, Palantir recorded outperforming beats in both earnings and revenue while revising guidance figures higher for the full-year period. On the earnings side, Palantir reported $0.09 per share (which surpassed consensus estimates calling for $0.08 per share and achieved annual growth rates of 80%). Revenues for the period posted at $678 million (which surpassed consensus estimates of $653 million and indicated annual growth rates of 27%).

Palantir: Q2 Earnings Performance (Palantir Earnings Presentation)

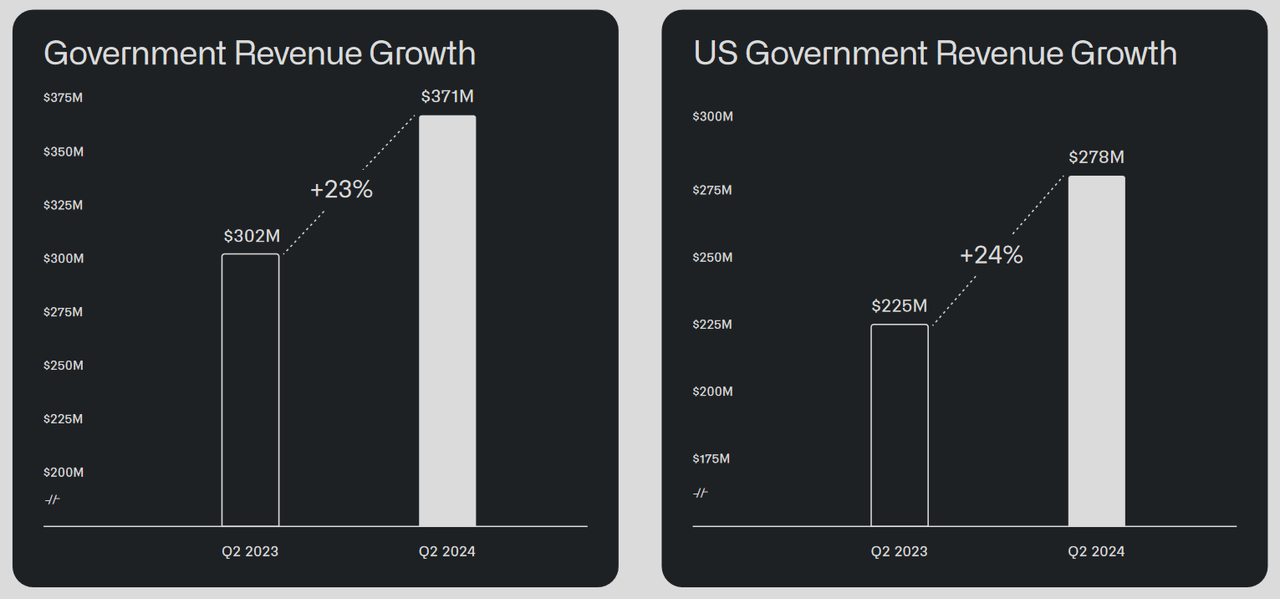

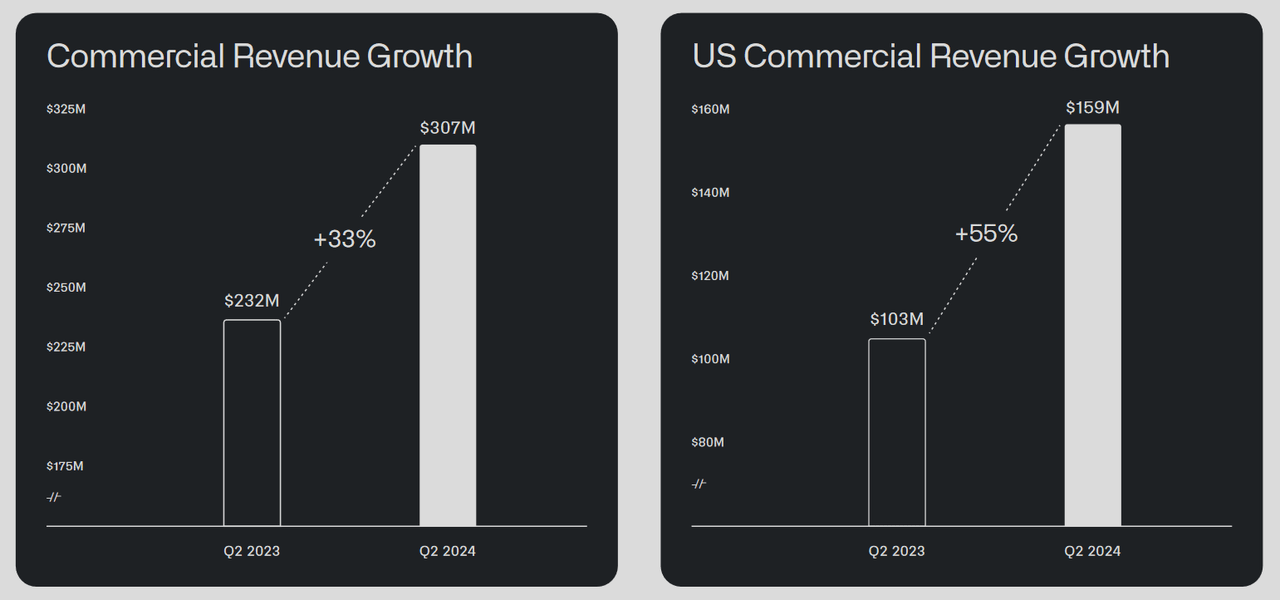

Government revenues showed annualized gains of 23% and beat expectations of $349 million (coming in at $371 million). Meanwhile, revenues from the commercial sector showed annualized gains of 33% and beat expectations of $306 million (coming in at $307 million). Revenue growth from U.S. businesses was even more impressive (coming in at $159 million and showing annualized gains of 55%).

Palantir: Q2 Earnings Performance (Palantir: Earnings Presentation)

For investors, we have seen positives in the market’s bullish response (PLTR is currently showing YTD gains of over 126%) and this is notable because this is not exactly typical of the widespread reactions to earnings releases that have been seen throughout the technology sector in recent months. Obvious examples of negative trends following technology earnings can be found in the significant share price declines that followed earnings reports from artificial intelligence heavyweights NVIDIA (NVDA) and Broadcom (AVGO). In both of those instances, market selling pressure was substantial (and long-lasting), with NVDA share prices falling from prior highs above $131 all the way to eventual depths of $100.95 before stabilizing. In Broadcom’s case, the market’s bearish post-earnings sell-off resulted in the formation of a sizable downside price gap on the daily charts, which forced share prices below the $135 level before buyers re-entered the market and finally sparked an upside reversal.

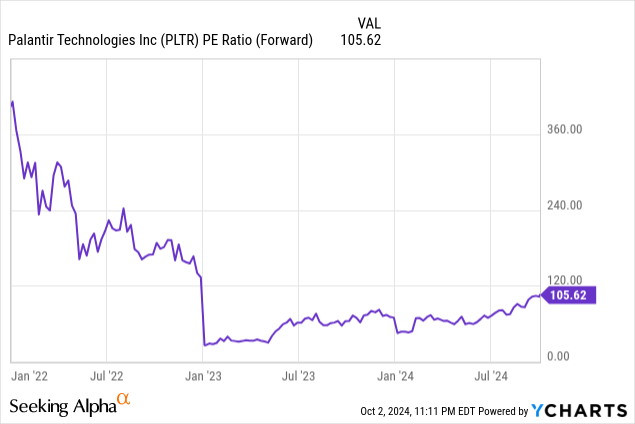

Palantir: Forward Price-Earnings Valuation (YCharts)

Perhaps some of this Palantir optimism has been stoked by the company’s recent inclusion in the S&P 500 – and this event has actually been described as a “moment of validation” for Palantir’s longer-term story. Undoubtedly, share prices have seen very little in the way of selling pressures since Palantir was added to this benchmark stock index. However, at this stage, the real question that should be asked is whether all of this bullish enthusiasm can continue with PLTR trading at such elevated valuation levels. I do feel as though Palantir’s heightened forward price-earnings metric is a topic that has already been covered quite extensively on this and other platforms, so I will not focus substantially on this issue in this update.

However, we can see that over time this metric has actually fallen quite sharply before stabilizing at the beginning of last year. Given the consistency that we have now seen in this metric for an extended period of time, it does not appear to me that the market is showing much concern with respect to these specific prospects for overvaluation. Overall, I think that if we were going to see significant sell-offs in reaction to changes in Palantir’s forward price-earnings metric, we would have seen them already. As a result, if the market is willing to shrug off these forward valuation levels as being insignificant (despite the seemingly constant analyst coverage addressing this metric), I will not be viewing this specific characteristic as a reason for bearish concern in my own PLTR positions.

PLTR: Daily Price Chart (Income Generator via TradingView)

One issue that has caught my attention, however, is the news that co-founder Peter Thiel has recently sold $600 million in shares (bringing his total PLTR sales this year to roughly $1 billion). Obviously, these are substantial stock sales, and I wonder if this will start to inspire a broader range of profit-taking activities amongst investors near term. If we combine this activity with the fact that share prices themselves have started to form a clear top on the daily price charts, scenarios start to emerge which might justify taking profits near current levels.

Specifically, the price levels I am watching here can be found at $33.13 (the stock’s price high from August 22nd, 2024) and $20.60 (which is the triple-bottom support zone that was formed between April 19th and May 29th). Essentially, these two price levels define my bullish-bearish pivot points when viewed from the perspective of the daily time frame. As long as share prices are able to hold above the August 22nd highs, the broader structure remains positive. However, a break below the triple-bottom support zone near $20.60 could lead to an acceleration in downside price momentum that would lead to a more bearish outlook, in my view.

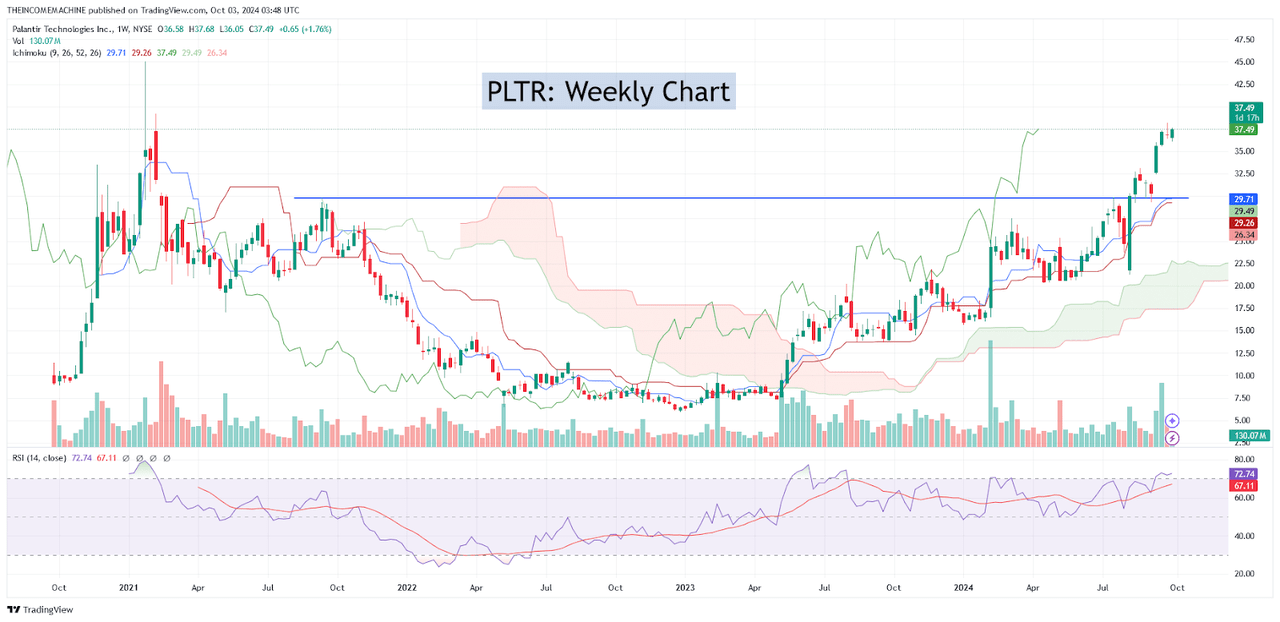

PLTR: Weekly Chart (Income Generator via TradingView)

To find the midpoint of my pivot analysis, we actually need to move out into the longer-term price history. Using the weekly charts, we can see that the stock’s price highs from mid-September 2021 rest just below the 30-mark ($29.29). PLTR has held below this level for most of its history, but recent trend activity does suggest that this level should be viewed as a “neutral” pivot, rather than an outright “bearish” price region. One other point that should be noted when viewing these two time frames is the fact that the weekly chart is actually trading in overbought territory (as measured by the relative strength index, with a reading of 72.74). However, the daily chart has not yet reached these extreme levels (where the relative strength index is currently showing a safer reading of 67.52).

Of course, this difference here is quite telling because these divergences suggest that shorter-term trend activity could be in danger of developing into a deeper reversal to the downside. Already this year, we have seen multiple upward revisions in Palantir’s guidance figures – and if the company fails to deliver on these expectations, it seems increasingly likely that we might finally see a post-earnings market reaction that is much more bearish in nature. Since we have already seen this type of activity in other parts of the technology sector (for example, Nvidia and Broadcom), it stands to reason that Palantir might not be completely immune to the same type of sell-off if the company fails to meet consensus estimates going forward.

Is this an example of a company (or a stock) that is flying too close to the sun? Do recent stock sales from Palantir founding members tell us anything about the current vulnerability of share prices while they trade at these elevated levels? Can this company continue to maintain its extreme forward price-earnings valuation without any instances of substantial near-term decline? I think that these are all questions that investors should be asking themselves when making the decision to consider taking profits in longer-term PLTR positions, and this is why I am downgrading my outlook on this stock to a “hold” stance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.