Summary:

- Walmart has consistently failed to show significant earnings growth over the last 3 years and the company’s margins are at historically low levels.

- Walmart’s international business remains insignificant, and the company hasn’t been able to drive any significant growth outside of the US for several years.

- The Stock is overvalued using a number of metrics.

Justin Sullivan

Successful companies don’t always make good investments. A good stock has to offer either solid capital gains or income, and many companies that have strong, but mature brands simply can’t deliver. Supposed value without growth or consistent income isn’t enough, and companies that fail to sustain the earnings that the market and investors need to have sustained capital returns won’t be good investments.

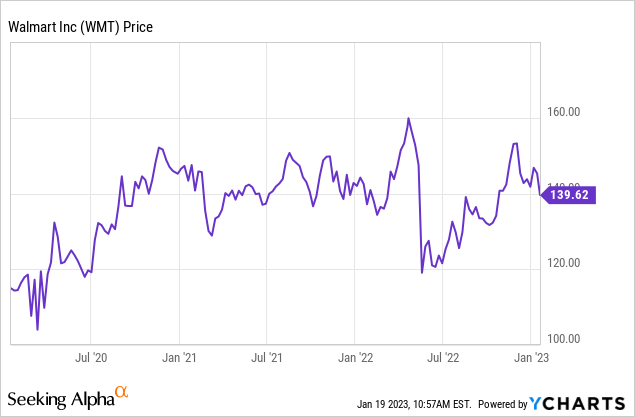

Walmart Inc. (NYSE:WMT) has taken significant market share over the last several years in the current inflationary market, and the stock has had a good run since price began to rise significantly in early 2021.

Still, even with the company’s earnings growth and market share gains in the current more favorable economic conditions, the stock hasn’t been able to offer investors any significant capital gains or income over the last 3 years.

Walmart was a $150 dollar stock in January of 2021, and the company is a $140 stock today.

The main problem that Walmart continues to have is that this, as a mature company, management has been consistently unable to drive any significant earnings growth even in the current favorable economic environment to justify the premium multiple of nearly 22x expected forward earnings. Walmart simply cannot generate the earnings growth or cash flow to justify the current premium valuation, and the company also currently yields just 1.59%. Recent dividend growth has been minimal as well.

Walmart’s earnings have been predictably impressive in the current more favorable inflationary environment where consumers have traded down. Management has still not been able to drive consistent and significant earnings growth. Walmart recently reported third quarter earnings of $1.50 a share, this compares to earnings of $1.45 a share in the third quarter of last year. Analysts are expecting the company to earn $1.50 a share in the fourth quarter of this year, Walmart earned $1.53 a share in the fourth quarter of last year. Earnings growth was zero when adjusted for the company’s large buyback.

A Picture of the Walmart Logo (Getty Images)

Walmart’s earnings have flatlined even in the current more favorable environment where the company has taken consistent market share over the last several years as consumers have looked to trade down. The main issue Walmart is having is that discounts are putting pressure on the company’s margins. Even though management continues to report impressive same store sales growth, it isn’t translating to the bottom line. Walmart’s third quarter earnings report again showed impressive same store sales growth for the full year of 8.2%, but adjusted operating increased by just 3.9%. Management’s use of discounts and the promotion of lower end products resulted in the company reporting that the consolidated gross profit rate decline by 89 basis points. Walmart’s margins remain at close to the lowest level’s the company has seen in over a decade at 1.49%. Over the last 12 years, the company’s net margins have ranged from 3.89% to 1.02%

Walmart’s international division also isn’t driving any significant earnings growth. The company showed net sales of just $25 billion overseas, despite reporting overall net sales of the $152 billion. Management recently reported in the third quarter that international sales grew by $1.7 billion in constant currency for the full year, but just 200 million adjusted for forex fluctuations. Walmart’s as consistently struggled to show any significant international earnings growth, and revenues overseas still make up less 18% of the company’s overall sales.

This stock is also not cheap when looking at a number of metrics. Walmart trades at nearly 23x likely 2023 earnings, 12.65x forward EBITA, and 14.64x forward cash flow. The average valuation with the retail consumer sector is 19x forward earnings, 11.64x forward EBITA, and 14.02x forward cash flow. Walmart is also trading at a premium valuation to the stock’s 5-year average as well. Over the last 5 years, Walmart has historically traded at 11.78x forward EBITA and 13.11x forward cash flow.

Strong brands and impressive companies can’t always generate significant growth. Walmart as consistently been unable to grow earnings per share at even a mid-single digit rate in the current favorable operating environment, and the company’s earnings per share is negative adjusted for the massive buybacks that management continues to increase even though these initiatives have offered no tangible income or overall returns to shareholders over the last 3 years. The current yield is just 1.59%. While this company continues to show impressive sales and market share gains, management is simply unable to drive any consistent or significant earnings growth in the US or overseas. Walmart’s earnings do not justify the current valuation premium.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.