Summary:

- I’m downgrading Palantir to “Sell” despite strong Q2 FY2024 results and continued business expansion, as its valuation and projected EPS numbers mismatch.

- Palantir’s revenue and profitability have surged, but the stock’s price exceeds justified levels, even with the AI-driven growth.

- The stock is trading higher than its 2021 peak, yet forward earnings are much lower, indicating a significant overvaluation.

- Hard to believe it, but Palantir stock is many times more expensive than Nvidia today and will be for at least the next 2 years.

- I don’t think I’ll revise my new rating back up until the company can either show growth rates many times stronger than expected today or the stock falls 30-40% from here. Whichever comes first.

hapabapa

My Thesis Update

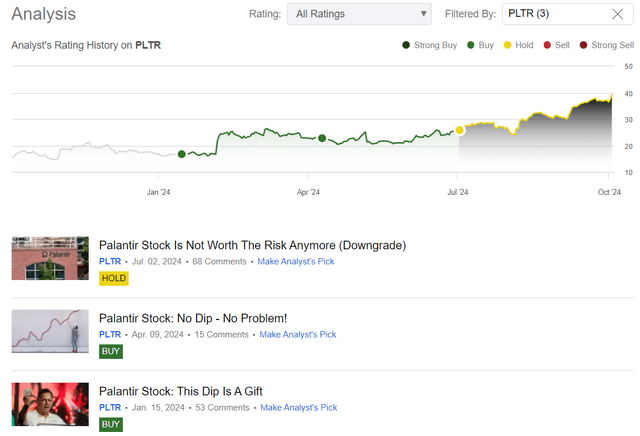

I initiated coverage of Palantir Technologies, Inc. (NYSE:PLTR) stock back in January 2024 with a “Buy” rating, reiterating it 6 months ago on April 9, 2024. Since the publication of my April article, the PLTR stock has managed to grow significantly by July, when I had to downgrade the stock to “Hold” given its widening valuation metrics that couldn’t be explained by the firm’s insufficient growth rates (and even by out-of-consensus bullish expectations). Since then, however, the stock has kept expanding: now PLTR is trading even higher than at the 2021 peak.

Seeking Alpha, Oakoff’s coverage of PLTR stock

Today I’ve decided to make another downgrade as the valuation of the company has become impossible to ignore – the further growth potential of the stock is now under severe threat, despite the obvious signs of the continued expansion of the business thanks to new products and AIP bootcamps.

My Reasoning

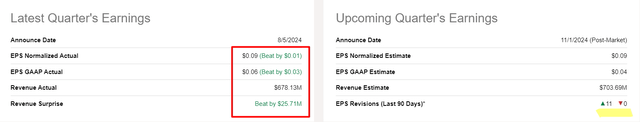

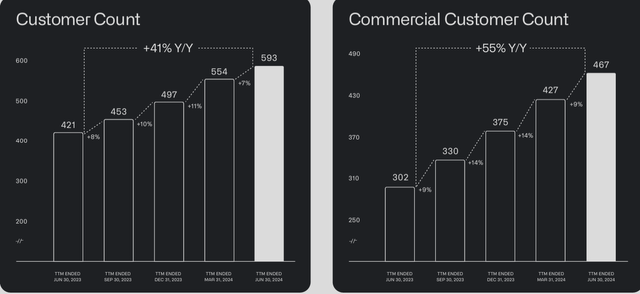

First off, let me begin with good things for Palantir. Their Q2 FY2024 results (reported on August 5) exceeded market expectations as revenue was $678 million (+27% YoY), well above the guidance range at the high end by $29 million and the consensus estimate by ~$25.7 million. The top line started to grow much faster in the previous periods (we saw only +13% YoY growth in Q2 FY2023). Palantir’s sales were driven particularly by the commercial sector in the United States, which has grown 55% compared to 20% growth in the prior quarter and 40% in Q1 FY2024, and the government category with revenue growth increasing again to 23% from 15% in Q2 FY2023, reflecting Palantir’s ability to capitalize on its offerings in the commercial and government spaces in the face of a turbulent macro landscape.

The company’s profitability numbers were just as good, with non-GAAP operating profit advancing 88% to $254 million, including a 37% non-GAAP operating margin, up over 12% compared with a year earlier. That margin growth is indicative of the strong unit economics of Palantir’s business model, which has become increasingly geared toward providing what the market expects (in terms of profitability). Non-GAAP diluted EPS went up to $0.09 from $0.01 Q2 FY2023, and GAAP EPS increased to $0.06 from $0.01, with stock-based compensation (SBC) representing most of the non-GAAP variance.

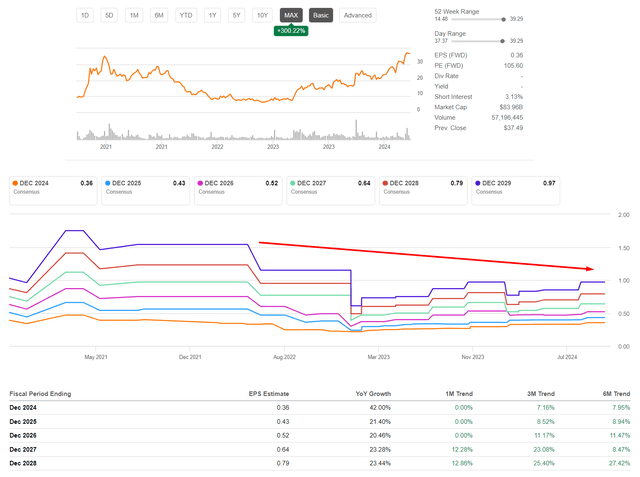

As a result, Palantir beat all Wall Street analysts’ forecasts in Q2, leading to a widespread positive revision of EPS estimates and sales figures for Q3 and beyond:

It should be noted that SBC accounted for 22% of revenue in Q2 FY2024 – still a huge amount in my opinion, so the pressure on diluted shares outstanding will likely remain strong in future periods.

Palantir’s approach to market focuses on a one-stop sales force, selling to high-end use cases. The company has also expanded distribution through sales channels and partnerships with hyperscale cloud providers to increase customer adoption of its platforms – this approach is followed by Artificial Intelligence Platform (aka AIP) “boot camps” or three-day seminars that demonstrate the power of the software and inform customers about the benefits of generative AI tools. Palantir closed 96 +$1 million deals in Q2 FY2024, an increase of 45% quarter-over-quarter, and grew its commercial customers by 55% to 467; net dollar retention was 114% or 3 percentage points higher than Q2 FY2024, indicating loyal customers and increased customer growth.

At the same time, the firm is active in the government space. In May 2024, PLTR won a $153 million production contract from the US Department of Defense to build AI scale-out capabilities. Particularly in Q2, the firm signed a new 5-year, $480 million contract with the Chief Digital and Artificial Intelligence Office (CDAO) to “scale AI/ML capabilities across the US Department of Defense.” Moreover, an agreement with Oracle announced in April promises to double Palantir’s addressable market using Oracle cloud infrastructure, delivering better data analytics to enterprise customers around the world. This partnership should allow Palantir to address the emerging data sovereignty needs and provide the most data analytics value to its clients.

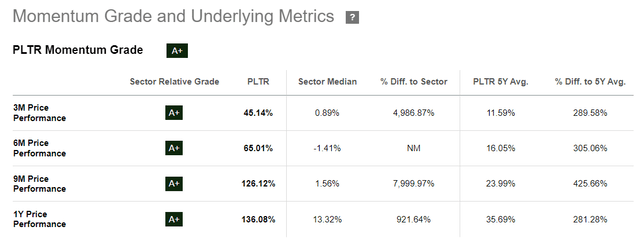

Palantir has increased its full-year revenue forecast again, with over 23% growth at the midpoint of the range. They also raised the FY2024 non-GAAP EBIT margin guidance by ~4% to greater than 35%, demonstrating that they are confident in the long-term strategy and its readiness to navigate the prevailing economic environment. The market welcomed these as Palantir stock kept rising higher, and as of today, the stock has outreached its ATH.

So far, I’ve only covered the positive aspects, but now I’m going to get to the bottom of why Palantir should be given a “Sell” rating.

Yes, PLTR stock and Wall Street expectations (the earnings revisions) are growing by leaps and bounds, fueled by exceptional results and high hopes, but it seems to me that there’s a clear mismatch between the expectations and the price of the stock right before our eyes. If you look at PLTR’s trading history in the past, you’ll see that Palantir traded above $35 at its peak in 2021. Back then, the IPO market in the US was very vibrant and investor belief in the invincibility of the economy was very high. Then came inflation and the Fed’s rate hike led to a massive deflation of valuation bubbles. Palantir’s bubble popped at the time.

I know that the firm managed to reinvent itself since then and the new AI-driven hype train took its prospects to another level. What’s interesting though is that the expectations back in 2021 were much higher than they are today. It might sound controversial because the stock is already trading higher than it was at the 2021 peak, but it’s true – take a look at the factual data provided by Seeking Alpha Premium:

Seeking Alpha, Oakoff’s compilation

So the conclusion I come to is that today Palantir is even more overvalued than it was back then – at the 2021 peak – because its forwarding earnings are much lower than they were then, even taking into account the AIP growth driver.

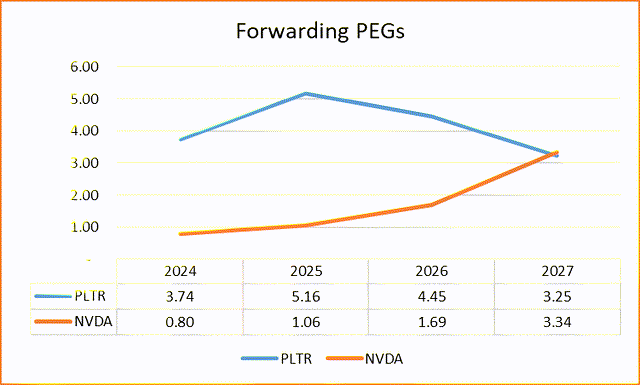

Let’s do a little comparative analysis. If we call Palantir’s moat as wide as Nvidia’s (NVDA) – which isn’t true though, but I’m intentionally leaving that assumption – then their PEGs will probably be relatively close to each other. I’m not even taking the software industry median norms – let’s say Palantir’s “extreme” should be the same as Nvidia’s. But their PEGs will not be the same until the end of 2027, i.e. in 3 years. By then, PLTR stock will be many times more expensive than NVDA:

Oakoff’s work, Seeking Alpha data

Just think about that phrase: Palantir stock is many times more expensive than Nvidia today and will be for at least the next 2 years. Yes, it’s obvious that semiconductor stocks are more cyclicality dependent, but even the stability of SaaS-based revenue growth can’t fully justify such a high premium for Palantir in my opinion. Therefore, I do not think I will revise my new rating back up until the company can either show growth rates many times stronger than expected today or the stock falls 30-40% from here. Whichever comes first.

Based on that, I downgrade PLTR to “Sell” today.

Risks To My Thesis

My downgrade today may be wrong, and I have to warn investors that I’m not calling to open short positions against PLTR – you can get burned by the hot momentum.

One has to consider the larger market sentiment and investor sentiment for AI-based companies – Palantir’s AI focus and recent partnerships make it an early entrant into the rapidly growing AI space and may bring in way higher growth rates than Wall Street can realistically forecast today. So even today’s optimistic forecasts and EPS estimates may be actually underestimated, making it possible for the current stock rally to keep going higher.

In the case that the market continues to put a higher premium on AI-focused stocks, Palantir’s valuation might be less driven by current cash flow than its deemed future growth.

Another issue with my thesis update today is the comparison to Nvidia’s PEG ratio. Nvidia has a dominant position in the semiconductor space, but Palantir is in a different category, with very different growth drivers and market factors, so the analogy may not be appropriate for what makes Palantir different. The firm’s SaaS business model specializes in high-value long-term deals, and their unique capacity to support specialized data analytics across multiple industries. If again – Palantir is able to show continued growth and profit growth, then it will be more attractively priced over time.

Your Takeaway

Despite a number of risks associated with my thesis and the fact that the company remains one of the fastest-growing companies, I believe that the current rally has gone too far. For PLTR to continue to grow, it needs a strong catalyst, and it’s far from certain that it will emerge shortly – the market is already granting a significantly higher premium to its EPS growth expectations than it did a few months ago. But even if we imagine that current expectations rise to the peaks of 2020-2021, when the company went public and immediately became greatly overvalued, the current stock price will still be too high to call PLTR an attractive “Buy” at current levels. The valuation of the company has become absurd to date, so I rate PLTR a “Sell”.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.