Summary:

- SNOW’s meltdown continues, attributed to the decelerating topline growth trend and impacted profit margins, as the management intensifies their AI growth efforts.

- This is significantly worsened by the recent $2B convertible note offering by September 2025, since the ongoing share repurchases have not been able to offset the elevated SBC expenses.

- Given the FWD P/E non GAAP valuations of 190.41x and FWD PEG non-GAAP ratio of 3.89x, SNOW remains extremely expensive compared to its peers.

- Combined with the lack of bullish support, we believe that the stock is likely to further trend downwards before growth materializes and a bottom is found.

tiero

SNOW’s Minimal Growth Investment Thesis Remains Overly Expensive Here

We previously covered Snowflake (NYSE:SNOW) in June 2024, discussing the stock’s lack of bullish support despite the growing customer count and expanding top-line in FQ1’25.

With part of the headwinds attributed to the lower customer retention rate and declining remaining performance obligation, along with the uncertain AI monetization, we had believed that there might be more uncertainty in its intermediate term prospects – resulting in our Hold (Neutral) rating then.

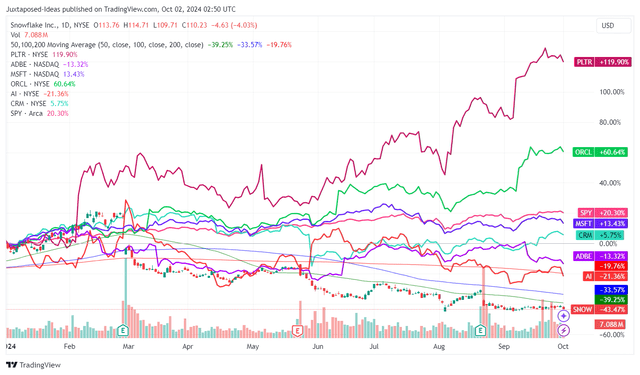

SNOW YTD Stock Price

Trading View

Since then, SNOW continues to underperform its SaaS peers with it losing -15.2% of its value, compared to the wider market at +4.2%. It is apparent by now that bullish support has yet to materialize, worsened by the market wide rotation in July/ August 2024.

Perhaps part of its headwinds is attributed to the change in its go-to-market strategy from a subscription-based pricing model to consumption-based, in an effort to drive “meaningful revenue (growth) overtime.”

The sudden change in market sentiments and pricing model are not surprising indeed, given SNOW’s moderating Net revenue retention rate of 127% (-1 points QoQ/ -15 YoY) and decelerating revenue growth trend at +5% QoQ/ +29.5% YoY.

This is compared to FQ2’24 revenue growth by +8.5% QoQ/ +37.3% YoY and FQ2’23 levels of +18.2% QoQ/ +83.1% YoY.

As a result of its maturing growth profile, we can understand why the market has opted to discount SNOW’s prospects for now, despite the double beat FQ2’25 earnings call and the raised FY2025 guidance.

For reference, the cloud-based data platform reported FQ2’25 revenues of $829.3M (+5% QoQ/ +29.5% YoY), adj gross profit margins of 76% (-1 points QoQ/ -2 YoY), and adj EPS of $0.18 (+28.5% QoQ/ -18.1% YoY).

The mixed results undoubtedly bring further questions to SNOW’s near-term prospects, with it temporarily well balanced by the growing multi-year Remaining Performance Obligations [RPO] of $5.2B (+4% QoQ/ +48.5% YoY), thanks to “two nine-figure deals (knocked down) in the quarter.”

The latter implies its ability to drive new adoptions despite the market pessimism, with FQ2’25 bringing forth 510 customers with TTM product revenue greater than $1M (+5.1% QoQ/ +26.8% YoY) and 736 of Forbes Global 2000 customers (+3.8% QoQ/ +15.1% YoY).

These developments implies that SNOW’s headwinds from the increased “movement of data out of Snowflake” into the open-source Iceberg Table formats may not be as severe as expected, given the relatively stable gross margins (compared to FY2021 levels of 70%) and growing RPO thus far.

While the higher GPU related costs, ongoing R&D, and marketing investments continue to trigger impacted operating margins of 5% in the latest quarter (+0.5 points QoQ/ -3.4 YoY), we believe that these efforts are likely to be top/ bottom-line accretive in the intermediate term.

If anything, SNOW has already hinted at the growing AI adoption, with over 2.5K accounts using Cortex (Snowflake’s AI) on a weekly basis (+333.3% QoQ) despite only being publicly available since May 2024.

At the same time, the management already aims to release new features, Cortex Search and Cortex Analysts, by FQ3’24 – with it potentially driving new growth opportunities.

Furthermore, readers must note that SNOW has moderately raised their FY2025 guidance, with revenues of $3.35B (+25.9% YoY) albeit with underwhelming adj gross margins of 75% (-3 points YoY) and adj operating margins of 3% (-5.6 points YoY).

With the management expecting Cortex to be meaningfully accretive from FY2026 onwards, we expect FY2025 to be a trough year indeed.

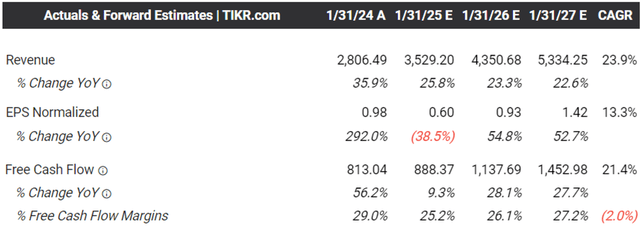

The Consensus Forward Estimates

Tikr Terminal

The same quiet optimism is already observed in the consensus forward estimates, with SNOW expected to generate expanded bottom-line growth from FY2026 onwards.

Unfortunately, here is where the good news end.

Despite having zero debts and robust balance sheet with a net cash position of $3.22B as of FQ2’25 (-8.7% QoQ/ -14.1% YoY), the management has decided to take on a $2B convertible note offering by September 2025, which is expected to be used to “repurchase up to $575.0 million of shares” and/ or “acquisitions or strategic investments.”

Despite having repurchasing $1.79B worth of shares over the LTM (+278% sequentially), SNOW’s shares outstanding has continued to grow to 334.07M (+6.74M YoY), with the ongoing share retirement unable to balance the company’s elevated Stock-Based Compensations and share dilution.

Despite the meltdown observed in its stock prices, insiders continue to sell $213.91M worth of shares (+10.2% sequentially) as well, with it naturally contributing to the growing pessimism in its prospects along with shareholder equity erosion.

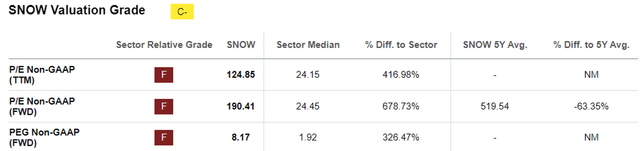

SNOW Valuations

Seeking Alpha

Lastly, it is undeniable that SNOW remains extremely expensive at FWD P/E non GAAP valuations of 190.41x compared to the sector median of 24.45x.

Even when taking into account the projected expansion in its adj EPS from H1’24 annualized levels of $0.64 to the consensus FY2026 estimates of $1.42 at an accelerated CAGR of +48.9%, the eye-watering FWD PEG non-GAAP ratio of 3.89x can not be ignored indeed.

SNOW’s premium valuations also seem unreasonable when comparing against the sector median at FWD PEG non-GAAP ratio of 1.92x and the SaaS/ generative AI peers, including Oracle (ORCL) at 2.14x, Microsoft (MSFT) at 2.46x, Adobe (ADBE) at 1.64x, and Salesforce (CRM) at 1.67x – with it offering interested investors with a minimal margin of safety, aside from Palantir (PLTR) at 4.36x.

So, Is SNOW Stock A Buy, Sell, or Hold?

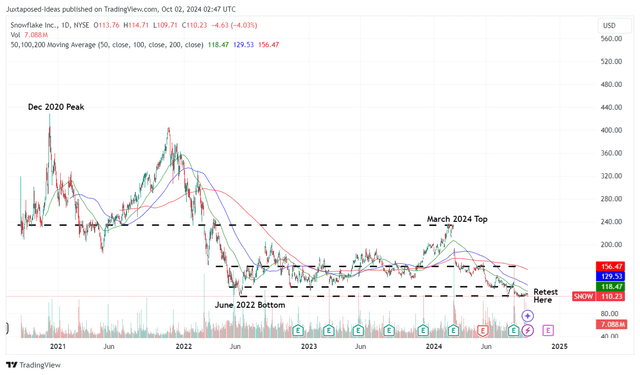

SNOW 4Y Stock Price

Trading View

And it is for these reasons we can understand why SNOW’s meltdown has yet to end, with the stock continually trading below its 50/ 100/ 200 day moving averages after the steep pullback in March 2024.

Given the lack of bullish support, we believe that the June 2022 bottom of $110s is likely to be breached with the stock potentially further trending downwards before growth materializes and a bottom is found.

While short interest has moderated by the time of writing, we maintain our belief that there remains a minimal margin of safety at current levels, especially given the ongoing shareholder equity erosion and the uncertain AI monetization.

As a result of the unattractive risk/ reward ratio, we are reiterating our Hold rating for the SNOW stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.