Summary:

- Visa presents a long-term buying opportunity due to its strong fundamentals, despite current headwinds from a Department of Justice lawsuit.

- The company’s solid year-over-year performance and strategic partnerships are expected to drive double-digit earnings growth over the next five years.

- Visa’s robust dividend growth and share buyback program provide additional incentives for investors, supported by strong free cash flow.

- Despite potential volatility from the DOJ lawsuit, Visa offers significant upside potential with over 27% capital appreciation expected in the next 24 months.

- As a result of present headwinds, I anticipate Visa’s share price trading sideways with the potential for increased volatility until clarity is provided.

z1b

Introduction

When great opportunities present themselves in the stock market, it’s best for investors with a long-term outlook to take advantage. Especially when high-quality stocks present opportunities. One stock in particular I think presents such opportunity for long-term investors is credit card behemoth Visa (NYSE:V).

Due to headwinds the company is currently facing from the U.S. Department of Justice, now may be a great time to buy or add if you’re a current shareholder. In this article I discuss the company’s headwinds, financials, and why this dip presents a great long-term opportunity.

Last Coverage

It’s been a while since I covered one of my all-time favorite dividend stocks in Visa. I assigned them a buy rating this past February in an article titled: Strong Growth Shows Why This Is A Dividend Stock To Buy.

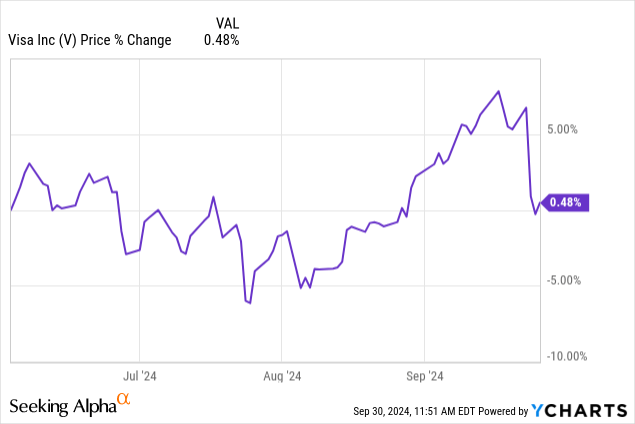

Visa was trading at $284 at that time, but due to headwinds from the DOJ, which Ill touch more on later, their share price has shown some weakness recently.

As a result, the stock is down 3.51% in comparison to the S&P who is up roughly 13%. During my thesis I touched on the company’s strong earnings growth during the first quarter of the fiscal year that saw top and bottom line growth of 10.5% and 8.4% respectively.

With the stock then trading at a price-to-earnings below their 5-year average of 32x at the time, I thought Visa offered a compelling buying opportunity, especially for those with a long-term outlook.

This led me to a price target of $356 using the Discounted Cash Flow method. Moreover, I still think Visa can reach this over the longer term once headwinds abate.

Headwinds

Before news broke of Visa being sued, their share price was up nicely around 5.5% to roughly $292 a share until the decline on the negative news. As a fairly new shareholder, I added to my position as their share price fell to around $269 a share before rebounding slightly to $275 a share where it trades at the time of writing.

The lawsuit claims Visa is using its dominance, size, and scale advantages in the debit card market to take advantage of customers, forcing them use their networks.

In my opinion, nothing will likely come from this, but due to some investors being spooked by the negativity, shares of Visa are likely to trade rangebound until we receive more clarity regarding the lawsuit. And this is a good opportunity to pick up shares.

Solid Performance YoY

Despite headwinds from the lawsuit as well as financially constrained consumers, Visa’s performance through three quarters in 2024 has been solid.

The company is also likely to see tailwinds from declining interest rates, which will likely result in an increase in payment volumes and transactions over the next 6 – 12 months.

Visa reported their Q3 earnings this past July with a decent earnings report. It wasn’t their best performance as earnings were in-line with analysts’ estimates and a slight miss on revenue by $20 million.

EPS of $2.42 was only up a penny from the first quarter and down $0.09 from the previous quarter. Their bottom line suffered a 1.5 point drag from currency exchange rates and half a point drag from Pismo, a banking and technology credit card platform.

Revenue continued an upward climb on a sequential basis from $8.63 billion in Q1 to $8.9 billion in Q3. This rose slightly from $8.8 billion in the previous quarter, which is why I thought Visa delivered a solid earning report.

Year-over-year through three quarters Visa’s performance has been even better with earnings up double-digits at more than 14%. This stood at $7.34 vs $6.43 through three in 2023.

Revenue almost saw near double-digit growth as well, up 9.7% from $24 billion to $26.33 billion through three. In the chart below you can see the company’s EPS & revenue they brought in during each quarter in comparison to the previous year.

Author chart created via V’s financial information

Partnerships Will Be Key Drivers For Future Growth

Below you can see Visa is anticipated to see double-digit earnings growth over the next 5 years with an average growth rate of 13.39%. And while this could be seen as exuberant, I think the company’s strategic partnerships will be a key driver for growth going forward, likely resulting in strong, double-digit growth.

NatWest, a U.K. based company, launched a Visa Travel Reward credit card after signing a partnership with the behemoth in 2023. They also extended partnerships in Romania, Czech Republic, Korea, Latin America, India, and the U.S. with an extended agreement with Wells Fargo & Company (WFC).

Additionally, they signed an agreement with India-based company Tata Digital, a digital app to connect Indian consumers across education, healthcare, leisure, digital, and financial services. This is a huge move and sets up Visa for strong future growth since India is the second most populous country behind China.

Room For Strong Dividend Growth

Partnerships, along with strong earnings growth and frequent buybacks will likely ensure solid dividend growth for the foreseeable future. Going off the company’s history, Visa should be announcing a dividend increase this month. I expect a new quarterly dividend run rate in a range of $0.57 – $0.60 going forward.

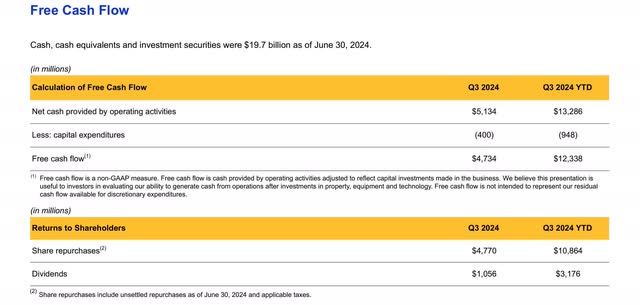

Additionally, V had $18.9 billion remaining on their current repurchase program and bought back $4.8 billion during their latest quarter. Share repurchases through 3 quarters totaled $10.9 billion. And this is likely to continue as management is likely taking advantage of their recent decline in share price.

So far Visa has brought in $12.338 billion in free cash flow and paid $3.176 billion in dividends, giving the company ample room for double-digit increases that are likely to continue for the foreseeable future.

Long-Term Upside Despite Downside Risk

Currently, Visa trades below their 5-year average of more than 31x earnings with a forward P/E of 27.75x. And although this is well-above the sector median’s 11.94x, peer Mastercard’s (MA) forward P/E sits well-above Visa’s at nearly 34.5x. Visa sits in between Mastercard and American Express’s (AXP) 20.5x at the time of writing.

And over the long-term, I think Visa offers good upside despite downside risk from the DOJ lawsuit. As previously mentioned, I expect Visa’s price to trade sideways while experiencing some volatility.

Moreover, if additional negative news regarding the current lawsuit comes about, I suspect the company may see further downside. But looking through a long lens, Visa offers more than 27% capital appreciation over the next 24 months.

Bottom Line

As a result of Visa’s high-quality business model, strong fundamentals, and double-digit earnings growth potential going forward, I think they are a must-buy on the current dip.

Additionally, they have long-term capital appreciation potential and are likely to see tailwinds from lower interest rates going forward as these will likely result in increased payment volumes and transactions over the next 12 – 24 months.

And although the lawsuit from the U.S. Department of Justice still lingers, causing increased volatility and their share price to trade sideways for the time being, I maintain a buy rating for Visa.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.