Summary:

- The Chinese government’s stimulus measures have seen Alibaba’s stock move from deeply unloved and undervalued to highly speculative and fairly valued.

- The options market shows investors are scrambling to gain upside exposure, which is often the sign of a Gamma squeeze and may indicate the rally is nearing an end.

- Valuations have doubled from their lows, with P/E ratio rising from 9x to 15x and the FCF yield dropping from 13% to 6.6%, which is no longer particularly attractive.

- Selling call options on Alibaba allows investors to capitalize on high implied volatility, offering high income for those willing to miss out on further capital gains.

Robert Way

Alibaba Group Holding Limited (NYSE:BABA) has risen almost 60% since my buy recommendation in February, with the barrage of Keynesian economic stimulus measures announced over recent weeks triggering a huge market squeeze. With earnings and free cash flows having declined over the past 8 months, BABA’s multiples have doubled, significantly undermining the case for owning the stock on valuation grounds. I have opted to sell call options to take advantage of the spike in implied volatility, as significant further upside seems unlikely.

Chinese Tech Stocks Were Ripe For A Squeeze

The Chinese stock market has been under pressure amid the country’s deflationary macroeconomic conditions, weighed down in large part by the ailing property market. Technology stocks in particular were pricing in extremely week long-term growth, with valuations near record lows, while options markets had been very subdued. Investors were heavily positioned for further stagnation.

Against this backdrop, interest cuts, reserve requirement cuts, and further measures aimed at supporting the property market, had huge bang for their buck in terms of their impact on the stock market. Alibaba’s stock price has been no exception, rising 30% over the past two weeks. As is often the case following large stock rallies, option traders are now paying up handsomely to speculate on further upside. It is likely that stimulus measures triggered a Gamma squeeze, with those selling call options being forced to buy the stock to reduce their exposure, further pushing up the price in a self-fulfilling nature. While there is no telling how long this could go on, the fact that the ratio of call volatility to put volatility is at record highs may be a sign that the fuel for further upside is running out.

BABA Call Vol Vs Put Vol (Bloomberg)

Valuations No Longer Particularly Attractive

With this in mind, I am happy to take profit. Not only has sentiment improved markedly, which should be seen as a contrarian signal, but the valuation argument I made in February no longer holds. My main point was that at the valuations which prevailed at the lows, growth was no longer needed for investors to generate strong long-term returns.

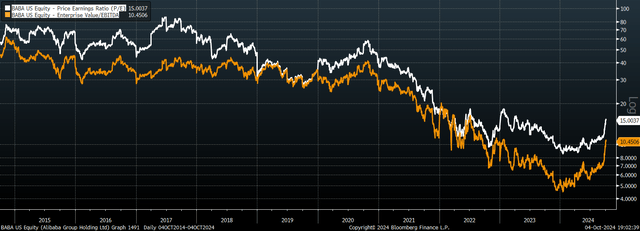

This is no longer the case. The trailing PE ratio is now 15x, up from around 9x in February, while the FCF yield has fallen to 6.6% from 13%. While these figures still leave the stock cheap from a historical perspective, it is no longer clear-cut value given the slowdown in sales growth and the long-term issues plaguing the Chinese economy.

BABA PE Ratio & EV/EBITDA Ratio (Bloomberg)

Note that one of the reasons I was so bullish on BABA 8 months ago was the fact that the low market capitalisation combined with a positive net cash position meant that the stock’s enterprise value was extremely low. The rise in market cap, together with the slight deterioration in its net cash position, has seen BABA’s enterprise value double over this period. The EV/EBITDA ratio has also doubled, rising from around 5x to above 10x today.

Using High Volatility To Generate Income

For investors like me who believe that the lows are in for BABA but upside will be limited, selling call options makes a lot of sense. The price of 1 month 25 delta call options on the stock is now around 60%, which is in the 95th percentile of readings over the past year. At the time of writing, a November 15 call option on BABA at the current stock price of $113 trades at $7, for a return of over 6% in just over a month. This covered call strategy still leaves investors exposed to downside in the event of a sharp reversal, and any continued upside will be given up. However, such extremely high income is likely to see this strategy outperform.

This is a similar strategy employed by the YieldMax Option Income Strategy ETF, which allows investors without direct access to option markets to generate option income. While the ETF has of course underperformed the stock itself over the past few weeks amid the melt up, high implied volatility means that we would need to see a continued melt up in the stock for this strategy to underperform. Similarly, high implied volatility means that for holders of covered calls to lose money, we would have to see a sharp decline in the stock.

Summary

The stimulus-driven rise in Chinese equities has completely shifted the outlook for Alibaba’s stock, both in terms of market sentiment and valuations. From being deeply unloved and undervalued, the stock has seen a surge in speculative interest and valuations, suggesting that a neutral outlook is now warranted. However, with high levels of implied volatility, a covered call strategy offers investors a way to lock in high income in exchange for missing out on potential further upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.