Summary:

- Energy Transfer and MPLX are one of the largest MLPs players out there.

- Both of them constitute Top 2 in a well-known MLP index.

- While I am bullish on both of these names, in my opinion, one of them is clearly a better pick for income-seeking investors.

- In this article, I compare ET and MPLX side by side, highlighting the key differences that have justified my conclusion.

thexfilephoto

Energy Transfer (NYSE:ET) and MPLX LP (MPLX) are both one of the largest MLPs out there with market cap levels of ~ $45 billion and ~ $55 billion, respectively. These two players constitute also the Top 2 holdings of the most well-known (or popular) midstream ETF – Alerian MLP ETF (NYSEARCA:AMLP). MPLX accounts for 12.9% of AMPL’s asset base, while ET consumes 12.5% of the total exposure.

So, already from this fact alone that both MLPs are strongly capitalized, the initial case might look interesting as in the midstream energy business size plays a crucial role. It is important to avoid single-asset concentration risk as, usually, each investment is quite CapEx intensive, which for smaller MLPs might lead to over cash generation that is depended on just a handful or small set of individual infra assets. Similarly, the larger the midstream footprint is, the higher bargaining power could be exercised when negotiating long-term “cost of service” agreements. On top of midstream-specific aspects, a large-scale business introduces multiple financial benefits such as reduced cost of debt, access to more flexible financing, wider optionality for making accretive M&A moves etc.

In fact, as some of my followers have noticed it from my previous articles on Energy Transfer and MPLX LP, I am bullish on both of them. For more details, see my prior articles on ET and MPLX, here and here, respectively.

However, when it comes to investing for high, durable and steadily growing income at a rate that is above inflation level, one of these giants offers a clearly more compelling investment case. Expressed differently, if one had to choose between ET and MPLX for an inclusion in a durable retirement income-seeking portfolio, the choice would be relatively easy.

There are three distinct aspects that justify this. Let me explain.

Aspect #1 – Valuations

Here, one might immediately question why the valuation aspect is important if the investment objective is to capture attractive and de-risked income streams. Theoretically, it is correct that valuation multiples play an important role when it comes to seeking price appreciation and just, in general, enhancing the total return potential.

Nevertheless, even in the context of yield-driven strategies, the valuation multiples matter. This is because of a simple mathematical nuance, where the level of multiple dictates price, which, in turn, determines the current yield against a specific number of distributions. In situations when multiples are high, it is usually difficult to find decent yields unless the particular company does not use leverage or stick to unsustainable distribution policy to magnify the core yield.

Furthermore, there could be a situation in which a cheaper company has a lower multiple and lower yield in relation to a higher yielding company that trades at higher multiples. Here the reason usually lies in the earnings distribution policy, which for lower yielding alternative are most likely more supportive for the future growth.

So, looking at MPLX and ET, it is clear that ET is in a better position:

- ET trades at EV/EBITDA of 8.3x.

- MPLX trades at EV/EBITDA of 10.0x.

This leads to a premium for MPLX at around 20%. From the current distribution yield perspective, the difference is not that notable – i.e., ET yielding 7.8%, which is ~ 30 basis points above the level offered by MPLX. Yet, as articulated above and not surprisingly, the earrings distribution profile is more conservative for ET, which implies both higher margin of safety and healthier future funding mix (i.e., heavier reliance on equity).

Aspect #2 – Cash flows

From the cash flow perspective, both MLPs could be considered truly defensive, which is what is necessary for being included in a durable retirement income portfolio.

For example, in MPLX’s case, the cash flows stem from two inherently stable business segments: 1) logistics & storage, and 2) gathering & processing. In all cases, there is some level of volumetric risk involved, but the risks of a significant decline and unfavorable price volatility are well-mitigated through long-term bankable offtake agreements.

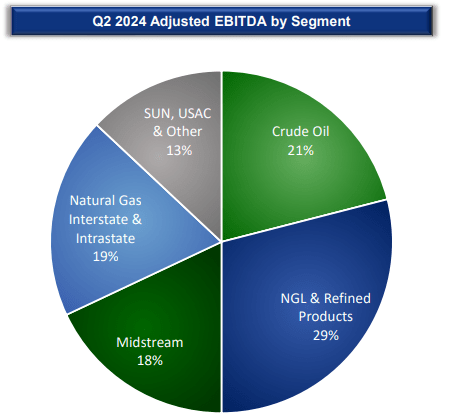

However, for ET, the situation looks even better. ET has divided its business into five somewhat evenly distributed segments, where all of them also embody defensive properties that warrant cash flows stability going forward.

ET Investor Presentation

The key advantage for ET in this context is the fact that ~ 90% of the EBITDA generation in linked to “cost of service” agreements, through which ET has automatically locked in minimum project IRR levels that produce positive cash generation (which is sufficient to justify final investment decisions).

Speaking of the cash flows, it must also be noted that ET enjoys higher amounts of retained liquidity that could be directed towards incremental growth, debt optimization, increased distributions or buybacks. Based on H1, 2024 annualized distributable cash flow levels and Q2, 2024 distributions, the distribution coverage level for ET lands at 1.9x. For MPLX, the relevant statistic is 1.6x.

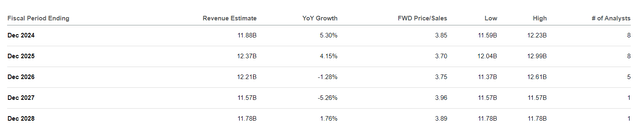

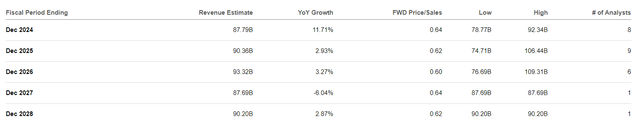

Finally, and this is actually quite surprising given the difference in the multiples, the consensus estimates for the revenue generation indicate a far more enticing trajectory for ET than for MPLX. The charts below capture this nicely.

Revenue estimate for MPLX:

Seeking Alpha

Revenue estimate for ET:

Seeking Alpha

Aspect #3 – Capital structure

As mentioned before, the capital structures are very strong for both of these businesses, especially considering the inherently defensive characteristics of the cash flows. As of Q2, 2024, the leverage ratio for MPLX was at 3.4x. For ET, the leverage ratio ending Q2, 2024 was slightly higher at 3.9x, which is still conservative, and below the target capital structure range of 4.0x to 5.0x.

Moreover, if we look deeper into how the debt is structured, we will notice well-laddered maturity profiles with the lion’s share of outstanding principal being linked to fixed rate coupons, which, in turn, facilitate cash flow predictability, while mitigating the interest rate risk.

Here I would give an extra point for MPLX since it has lower leverage. Yet, considering ET’s distribution coverage, which leaves higher surplus liquidity amounts in the system and the more attractive growth outlook, I would certainly not deem this as a huge relative disadvantage.

The bottom line

All in all, MPLX and ET are both great businesses, providing juicy yields that are underpinned by durable cash flows and well-capitalized balance sheets. I see definitely a case for including both names in an investment portfolio.

However, if the question is which one of them carries a better risk and return profile for the retirement income investors to put a heavier emphasize on when allocating capital, it would for sure be Energy Transfer.

Energy Transfer has lower multiple, more conservative distribution profile and more attractive cash flow structure that make it an excellent case for truly predictable current income generating asset.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.