Summary:

- Exxon Mobil’s breakout from a two-year trading range, driven by rising oil prices due to Middle East tensions and Chinese stimulus, signals potential continued gains.

- The company’s fair value is estimated at $140 per share, with potential for further growth from Permian Basin and Guyana developments, and continued increases in crude pricing.

- Exxon Mobil’s dividend is well-covered and likely to increase, supported by higher oil prices and efficient cost management.

- Risks include potential declines in oil prices and higher-than-expected capital expenditures, but current conditions favor continued upward movement in Exxon Mobil’s stock.

Lanier

Exxon Mobil Corporation (NYSE:XOM) recently broke out of its two-year trading range, and there is some reasonable likelihood that this current move higher should continue. After declining along with oil prices and the broader energy sector this summer, shares have since reversed course. Most of the change in pricing is due to increased hostility in the Middle East, but also due to the fact that Chinese stimulus efforts support greater economic activity. Given that Middle East tensions are continuing, and the company just broke out of this long-term trading range, I believe Exxon Mobil is likely to move higher in the near term.

Last month, I wrote that Exxon Mobil offered reasonable valuation and a well-covered dividend, with the potential to grow in coming years if oil and gas prices could stay flat or increase. Further, it appeared as though Exxon Mobil shares had traded down to support, and that there was also another level of strong support a few percent lower, both of which indicated Exxon Mobil had a strong margin of safety and presented a reasonably strong value at risk.

Since then, oil and Exxon Mobil bottomed, and then Exxon Mobil and crude pricing both substantially firmed up. WTI light sweet crude oil moved from the mid $60s to the mid $70s per barrel. Despite this significant increase in pricing, crude oil still remains close to its 12-month lows, indicating the potential for this recent price increase to continue.

WTI 1-year daily candlestick chart (FINVIZ.com)

If existing Middle East tensions continue, which appears reasonably probable for at least a few weeks to months, there is good reason to expect oil pricing to continue to move higher throughout that time frame. Moreover, it appears reasonably likely that WTI crude now has strong support at around $70 per barrel and is unlikely to go below that level without either a brokered peace in the Middle East or a decline in global economic activity.

Recent Chinese stimulus should also support increasing oil prices. If Chinese economic activity increases, Chinese demand for petroleum should also increase. The fact that this is occurring simultaneously with Middle East tensions should combine to propel oil prices higher, and potentially into the $80s. Both these catalysts to higher prices are recent events, and their full effect has probably not yet occurred. Therefore, they have the potential to act as continuing tailwinds to higher pricing in the near term.

It should be noted that even within the last year, WTI crude traded at or above $80 per barrel for multiple months, and spent most of its time between $75 and $85, where WTI crude is only now returning to the bottom of that trading range. Therefore, oil prices could move higher from here and still be lower than they were a year ago, even though the global risk profile appears to be worse. Worsening tensions in the Middle East should support oil prices moving higher and back into that recent trading range, and potentially propel a move to higher levels than that.

Fueled by this recent change in oil pricing, Exxon Mobil shares are now making new all-time highs. If spiking crude oil continues, so should further highs for Exxon Mobil. This could be the case even if Exxon Mobil’s earnings report in late October or early November is lackluster, as the report is backward looking and will include the benefit of recent oil price appreciation. In the first week of October, Exxon Mobil disclosed in an SEC filing where it indicated that lower liquids pricing likely reduced its Q3 upstream earnings by $600 million to $1 billion, and weaker refining margins also could reduce a similar amount from forthcoming earnings. This report did not appear to hurt share valuations, as the company has since continued higher and into all-time high territory.

Exxon Mobil reported Q2 2024 earnings in early August, and its quarterly EPS came in at $2.14. The report was strong and came in about 5-6% above Wall Street’s high end of expectations for it to come in between $1.98 and $2.03. Upstream production came in at 4,358 kboe/d and liquids production of 2,984 kboe/d were both above expectations by around four percent. Also, Exxon Mobil’s cash capital expenditures were $6.24 billion, which was below consensus expectations for capital expenditures of slightly over $6.4 billion.

While all four of Exxon Mobil’s primary segments were profitable, the company’s strength came through upstream, where it earned slightly over $7 billion, and well above Wall Street’s estimate for about $6-6.4 billion. This was a significant beat by XOM’s largest segment, whose earnings were roughly 10% greater than expectations. Energy products brought in about $946 million, which was 20-25% below expectations, and chemical products brought in about $779 million, which was roughly 13% below expectations. Specialty products performed in line with or slightly below expectations, bringing in $750 million in earnings in Q2 2024.

Also last quarter, Exxon Mobil closed on its sizable acquisition of Pioneer Natural Resources. The all-stock purchase for about $60 billion significantly increased Exxon Mobil’s Permian Basin production to about 1.3 million barrels of oil equivalent per day. With Pioneer’s assets, the Permian Basin now accounts for roughly one-third of Exxon Mobil’s total upstream production.

Given the heightened global uncertainty at the moment, this increased domestic output makes the company’s asset base appear safer, and in particular, less likely to be disrupted by conflict or an absence of rule of law. Exxon Mobil already planned to further develop the company’s Permian Basin production through increased development of Pioneer’s assets. Exxon Mobil’s Permian Basin production could grow by 10% per year for the next three to four years, and possibly to a greater extent. Exxon Mobil anticipates the company’s Permian Basin assets to yield about 2 million barrels of oil equivalent per day by 2027.

Last year, Exxon Mobil indicated that its cost of running wells in the Permian Basin was lower than Pioneer’s, and estimated this differential may result in a 15 percent cost synergy. If this turns out to be accurate, Exxon Mobil has the potential to increase upstream production and margins over the next several years. Margins will also be driven by energy pricing, but recent higher pricing should support this.

In addition to the Permian Basin, Exxon Mobil’s profitability should benefit from bringing online production out of Guyana. Precise timing on the ramping of this production is still relatively uncertain, but Exxon Mobil is likely to provide updates to their capital expenditures there, as well as updated earnings guidance in December, if not earlier and during the investor conference call after they provide their next quarterly earnings report.

It is likely that Exxon Mobil will provide a conservative estimation. Exxon Mobil previously guided that it has capped its spending to $20-$25 billion per year through 2027. This guidance was provided prior to current plans regarding Permian Basin development. Nonetheless, it is unlikely that even if Exxon Mobil opts to quickly ramp up its Permian Basin production that expenditures will surpass 30 billion. Exxon Mobil’s total capital expenditures are likely to be less than $28 billion in each of the next two years, and still potentially under the prior $25 billion estimate.

If Exxon Mobil keeps its spending in line, the company’s dividend appears safe and may even increase. If Exxon Mobil can complete its Permian Basin goals for production, achieve 15% cost synergies over Pioneer’s prior costs, as well as successfully ramp production out of Guyana, the company appears capable of covering the existing dividend even if energy prices halved from current levels. Moreover, if energy prices can maintain current levels, or increase from here, the dividend is reasonably likely to grow.

I continue to believe Exxon Mobil shares have a fair value of about $140 per share, and that this value should increase if the company’s Guyana business ramps efficiently, or if its specialty products and refining production margins can outperform. This value estimate is predicated on Exxon Mobil forecasting 2025 EBITDA of at least $85 billion, and presuming a conservative fair value estimate for Exxon Mobil at around a 7.5x EBITDA. Continued hostility in the Middle East has the potential to push oil pricing and Exxon Mobil’s valuation to significantly higher levels than this.

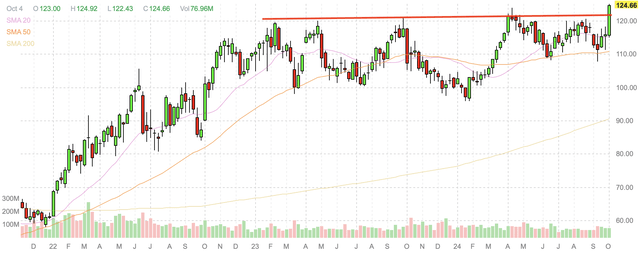

Exxon Mobil shares appear to have broken out of a tight trading range where they were stuck over the last several months. This range was likely due to weakening oil pricing, as well as Exxon Mobil’s digesting the Pioneer acquisition.

Exxon Mobil daily candlestick chart (FINVIZ.com)

This is not just a breakout from a spring high, but from a level that acted as upside resistance over the last two years. Exxon Mobil bounced off of this price three times in 2023, and then again earlier this year. Therefore, this increase through resistance represents a strong move higher off of a long-term basing and reasonably tight trading range where Exxon Mobil has been stuck over the last two years.

Exxon Mobil weekly candlestick chart (FINVIZ.com with red line by Zvi Bar)

Going forward, Exxon Mobil appears likely to move higher on this clear breakout from its two-year trading range and above a level of resistance that gave the company difficulty on multiple prior occasions. Exxon Mobil now has many tailwinds that should support it in the near term, including its own development of Guyana and the Permian Basin assets it obtained from the Pioneer acquisition.

Moreover, continued Middle East tensions and the potential for them to worsen in the near term should support oil prices and potentially spike them considerably higher. Exxon Mobil should follow such a move, and this could result in a considerably higher value for the company. Further, recent Chinese stimulus is likely to support global demand for petroleum in 2025 and into 2026, which also bodes well for Exxon Mobil.

Exxon Mobil also has a history of reducing its total share count through regular share repurchasing plans. Since the merger of Exxon and Mobil, about 25 years ago, the company has reduced its share count from about seven billion shares, down to 4.1 billion at the end of 2023. Exxon Mobil’s share count increased with the all-stock acquisition of Pioneer to 4.44 billion last quarter, but the company is likely to get this number down over the coming quarters and years.

Exxon Mobil’s future repurchasing plans could be at least partially influenced by the forthcoming presidential election, where the current administration instituted a one percent tax on share repurchases, and this tax could be increased, repealed, or maintained depending upon the election’s results. In either case, it appears likely that Exxon Mobil will buy back between $15-$20 billion in shares over the next year, as this is in line with what it has recently done.

Risks

Exxon Mobil is at the whim of capricious lower commodity prices, and while this is helping valuations increase at the moment, the opposite could certainly come into effect. Reasons for oil and gas pricing to decline would include a brokered peace in the Middle East, as well as a reduction to global demand for petroleum. Neither of these risks seems likely in the near term. The primary cause of demand destruction would likely come from Asia, but recent Chinese stimulus should support this demand.

Another risk to Exxon Mobil is the potential for its capital expenditures to be higher than the company’s guidance. This could be due to greater costs related to either Guyana or the Permian Basin, and potentially both. There also remains some uncertainty regarding a dispute between Chevron Corporation (CVX) and Exxon Mobil over Hess’ 30% stake in Guyana. Exxon Mobil claims it has a right of first refusal to the stake. This issue is likely fully priced into the equity, but shares could face temporarily declines following the release of negative news. The market appears to be anticipating Chevron will prevail, so there is also the possibility that Exxon Mobil benefits from a determination that is more friendly to it than expected.

Conclusion

Exxon Mobil just broke out of a long-term trading range where shares have been stuck for about two years. I believe Exxon Mobil’s fair value is still roughly 10-15% above the all-time highs the company is now making. If oil prices increase from current levels, Exxon Mobil’s fair value should also increase.

Since oil prices are spiking due to continued tension in the Middle East, Exxon Mobil presents a significant value at risk that stands to benefit from continuing increases to oil and gas pricing. Further, even if oil pricing does not increase, Exxon Mobil has the potential to revalue higher on the strength of its growing Permian Basin production, among other growth initiatives. Also, Exxon Mobil’s dividend is well covered, and has the strong potential to increase with higher oil pricing. Therefore, I believe Exxon Mobil will continue to move higher on the strength of this recent breakout.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.