Summary:

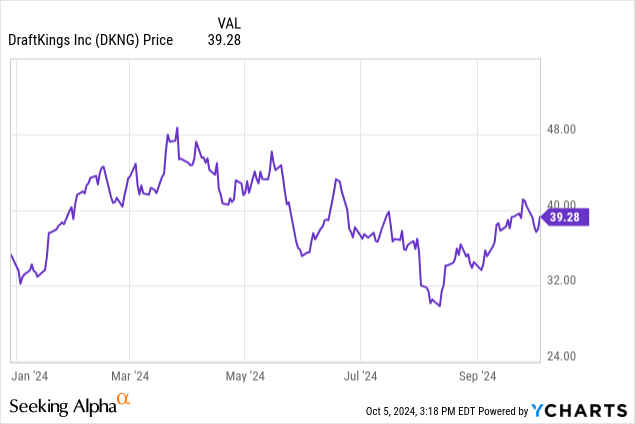

- I’m downgrading DraftKings to a neutral rating, as the stock remains up more than 15% year to date, despite new risks that have emerged on the horizon.

- The state of Illinois raised its tax rates on gambling, and DraftKings notes that other states could soon follow suit.

- The company plans to impose a surcharge on these high-tax states, which could siphon away player interest – adding to an already difficult macro environment.

- The stock already trades at an expensive ~20x FY25 adjusted EBITDA, and that’s against a lofty profit outlook for next year.

bluecinema/E+ via Getty Images

For much of its history, DraftKings (NASDAQ:DKNG) has been a digital media and internet company that has both benefited from and wrangled with government regulation, much in the same way that Uber (UBER) and Airbnb (ABNB) did as well in their own respective industries. The classic “move fast and break things” approach has worked well for DraftKings so far, as the company is live in a large chunk of the United States (save for major holdouts like California and Texas) and has hit $5 billion in annual revenue.

But now a new risk looms. The State of Illinois, one of DraftKings’ core large markets, just raised its tax rates on gambling. This shows that while DraftKings has benefited from new states legalizing online betting, the company also has such to lose from regulation and tax laws going against the company’s favor.

Shares of DraftKings are still up ~15% this year, though the stock has reeled in the wake of its Q2 earnings print where it announced the impacts of the new tax structure. In my view, this is a risk investors should be paying more attention to.

I last wrote a bullish note on DraftKings in May, when the stock was still trading above $40 per share. At the time, I had cheered the company’s fantastic growth rates, its improving customer acquisition costs, and tailwinds from new state legalizations as a reason to keep buying the stock.

Now, however, my confidence in the stock is shaken, and I’m downgrading DraftKings to a rating of neutral. I now see a more balanced bull and bear case for this stock over the next three to four quarter timeframe.

Still on the bright side for this company are these positive drivers:

- Large addressable market in the U.S. alone for sports betting, and an even bigger market for iGaming. Today, DraftKings’ sports betting is live in only roughly half of the U.S. population. Major states like California and Texas are still major holdouts; the sum of the remaining states have some form of legalization legislation in the works.

- Immense profitability at scale. Once legal in a given area, DraftKings continues to build audience share and gain more traction on marketing reinvestment, allowing these older and more mature markets to become tremendously profitable. The company sees over $2 billion of adjusted EBITDA opportunity within its existing states alone in the long run, and more than $6 billion of additional opportunity if the remainder of states legalize.

However, these positives are counterbalanced by two key risks as well:

- The company has a huge reliance on fickle government decisions that dominate its future. A lot of the company’s present valuation is based on the hopes of expansion to other states and territories beyond the U.S. In addition to this, Illinois’ recent decision to substantially increase the taxes on gambling activity also shows the company’s susceptibility to political whims, even if it has a plan (to raise fees on customers) to address them.

- Macro risks may put consumers in a more wary state to be gambling their budgets away. We continue to hear rumblings of an incoming recession in the U.S.. Businesses like retail and restaurants are reporting that customers are delaying purchases and trading down to cheaper alternatives; B2B businesses are also slowing down their own purchases in response. Against this backdrop, few people may be willing to gamble.

In my view, it’s a good time to lock in gains on DraftKings and invest in more value-oriented names instead.

Illinois may be the first domino in states raising taxes on gambling activity

In DraftKings’ most recent shareholder letter, the company described that prior to this quarter, only two states had tax rates (New York and Pennsylvania) on gambling that was over 20%, which the company considers to be the fair standard for the industry. Vermont followed, but this was a relatively smaller market. More recently, the state of Illinois recently boosted its tax rate to a level that the company believes will be detrimental to the company’s earnings.

The company is also open about its fear that this trend may play out in other states. Per the Q2 shareholder letter:

However, over the past several months, we have seen a shift to tax rates over 20% in certain competitive markets, including a recent significant tax increase in Illinois. We now must consider the prospect that some states may choose to tax the industry at a rate that is in excess of what we can absorb while still generating a reasonable profit margin and remaining competitive against the pervasive illegal market that pays no taxes at all.”

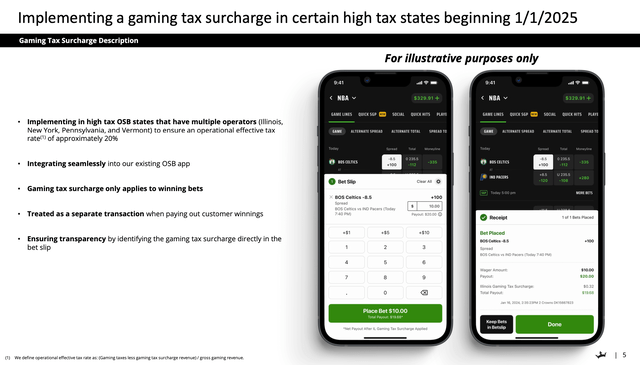

To get ahead of this potential spate in tax rate increases, the company is planning to enact, beginning January 1 of 2025, a gaming tax surcharge on its customers who play in states that have a tax rate of >20%. The company has provided little detail on how this surcharge is to be implemented, other than that it will likely be a “low to mid-single digit percentage” of a customer’s Net Winnings. This new surcharge will go live in all four of these states with a tax rate above 20% (New York, Pennsylvania, Vermont, and Illinois).

DraftKings tax response (DraftKings Q2 earnings deck)

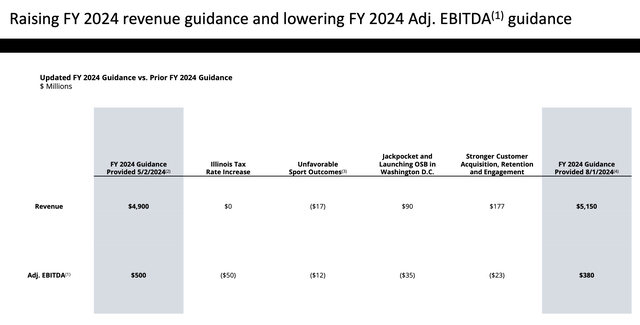

Meanwhile, for this year, management is planning to absorb these costs, leading the company to revise its adjusted EBITDA forecast downward by -24%, from a prior $500 million view to $380 million now. The impact of Illinois’ tax rate increase alone was -$50 million.

DraftKings FY24 outlook (DraftKings Q2 earnings deck)

Also worth noting in this guidance update is the fact that DraftKings raised its revenue guidance by $250 million, or 5%, versus its prior outlook: with $177 million of this driven by stronger customer acquisition and activity. However, we notice as well that the revenue upside is translating to $23 million of adjusted EBITDA downside, compounding the losses from the Illinois tax policy change: indicating that DraftKings’ customer acquisition efficiency trends may be changing. While we initially applauded CAC rates declining, we don’t like the implication here that DraftKings is spending more aggressively to chase growth.

Impacts in 2025 and beyond

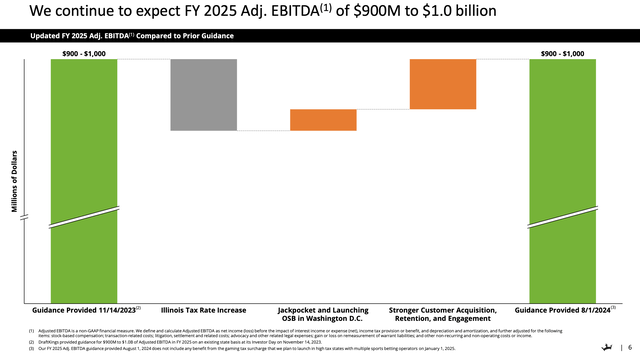

For 2025, DraftKings has merely stated that it is still expecting $900-$1 billion in adjusted EBITDA for the year, which at the high end would represent nearly a tripling of profits versus this year. Management additionally noted that there’s potential further adjusted EBITDA upside from the new gaming tax surcharge to be enacted on January 1 that hasn’t yet been baked into the forecast.

DraftKings FY25 adjusted EBITDA outlook (DraftKings Q2 earnings deck)

The company hasn’t given a revenue guidance behind this $1 billion adjusted EBITDA figure, but to me, this outlook is quite rosy. On the Q&A potion of the Q2 earnings call, CEO Jason Robins noted that the 2025 outlook already captures current strong trends that the company is seeing (key points bolded below):

So when you kind of put all that together next year, we do expect to get a little bit more revenue, because we’ll need that to offset — in order to make the math work that’s needed to offset the Illinois gaming tax increase. So that’s kind of how you get to the $900 million to $1 billion. And then any additional upside beyond that Illinois gaming tax amount would be either revenue driven or from the impact of the fee that we’re instituting in those four states.”

And then as far as the potential for hot customer acquisition next year, that can always happen. Right now, we feel we’ve built in some degree of the increased trends we’re seeing. And obviously, a lot of that will depend on if there’s more state launches and things like that. So, I think, you could sort of think of this as a same state basis type of thing again. And obviously, if there’s more state launches next year and more customer acquisition investment, then that might change things a bit. But that just means bigger numbers longer term over the following year.“

To me, the possibility of tripling profits next year is optimistic for a number of reasons. First, we’ve already seen in the FY24 guidance update that increased revenue from stronger player trends did not necessarily translate to a boost in adjusted EBITDA expectations. Second, the current strength the company may be seeing now may be offset by worsening macro headwinds that cast a pall over consumers’ willingness to bet their savings. Third, the company had no major state launches this year, beyond launching Washington D.C. (a relatively small market) in July.

But perhaps most importantly: there’s a huge potential that the new tax-related surcharges and fees may anger players, especially in important markets like New York. The decision to pass on some of the new taxes to players may be needed to offset the additional cost burden, but this will have an unknown, potentially large impact on customer retention next year once the new fees take effect.

Valuation and key takeaways

Even if we believe the $900-$1 billion adjusted EBITDA figure is attainable, DraftKings already trades at an elevated multiple against that goal. At current share prices near $39, DraftKings trades at an $18.92 billion market cap. After we net off the $815.9 million of cash and $1.26 billion of debt on DraftKings’ most recent balance sheet (note: the company’s acquisition of Jackpocket ate into its cash balances, as will its recent announcement to buy back up to $1 billion in stock), the company’s resulting enterprise value is $19.36 billion.

Against the $950 million midpoint of the company’s adjusted EBITDA guidance for FY25, the company trades at 20.4x EV/FY25 revenue: quite a steep multiple, especially when I think there’s plenty of risk to DraftKings’ ability to hit that target.

With all of this considered, I no longer have as much conviction in DraftKings’ ability to keep rallying. This has become a “show me” stock: I need to see evidence of greater adjusted EBITDA leverage, in addition to strong customer retention and addition trends (both now, and after the 2025 surcharges take place) before I’m willing to pay a premium again for this name.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.