Summary:

- Patience in investing often pays off; PayPal’s stock rose 16.5% since my ‘strong buy’ rating in March, outperforming the S&P 500.

- PayPal’s Q2 results showed significant growth: revenue up 8.2%, active accounts increased, and payment transactions hit a record high.

- Strong financial performance: net income grew, operating cash flow turned positive, and EBITDA expanded, leading to increased earnings guidance for the year.

- PayPal stock remains undervalued, with attractive growth, strong cash flow margins, and innovative initiatives like cryptocurrency support and partnerships with Amazon and Adyen.

fotostorm

One thing that I have learned about investing over the years is that patience often pays off. As much as I would love to see every investment achieve significant upside in a short window of time, that’s just not the way the world usually works. But every once in a while, a decision I make will turn out quite nicely. One example of this can be seen by looking at PayPal Holdings (NASDAQ:PYPL), a massive player in the payment processing industry. Back in March of this year, I upgraded the stock from a ‘buy’ to a ‘strong buy’. Since then, shares have shot up by 16.5% while the S&P 500 is up only 9.3%. However, it was not smooth sailing during that window of time.

You see, from the time that article was published until a subsequent article was written about it reaffirming my ‘strong buy’ rating on the company in early July of this year, the stock had actually dropped by 10.1% while the S&P 500 jumped 4.3%. However, I maintained my bullishness, acknowledging investor pessimism but stating that the company was a strong prospect. Since then, shares are up a whopping 32.1%. By comparison, the S&P 500 is up only 4.2%. So far, things are going nicely. Looking at the picture with new data, it is clear that the stock is not as cheap as it was back then. However, I would argue that shares still justify a ‘strong buy’ rating at the moment.

Some great developments

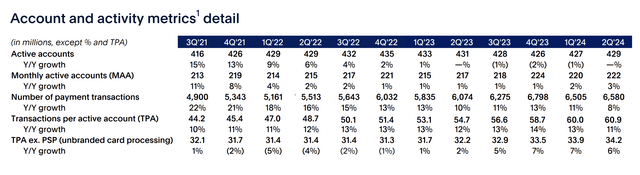

Fundamentally speaking, PayPal continues to prove itself to be a great business. Consider the results the company achieved for its most recent quarter, which would be the second quarter of the 2024 fiscal year. Revenue for this time was $7.89 billion. That’s an increase of 8.2% compared to the $7.29 billion the company reported just one year earlier. There were a few different contributors to this increase on a year-over-year basis. One of the problems with PayPal that had negatively impacted investor sentiment was the fact that, after peaking at 435 million active accounts in the final quarter of 2022, that number dropped consistently quarter after quarter until bottoming out at 426 million in the final quarter of last year.

Seeing any sort of decline in activity from users would be justifiably concerning. Fortunately, the company did see a slight increase to 427 million by the first quarter of this year. But it wasn’t until the second quarter when this one small uptick became a trend. During the quarter, the company reported 429 million active accounts. This shows a return of users to the company’s ecosystem. And with the number of monthly active accounts hitting 222 million, which would be the highest it has ever had if we ignore the 224 million achieved in the final quarter of 2023, it’s clear that the company is alive and well.

There are, of course, other factors that have added to this top line growth. As an example, we need only look at the number of payment transactions. During the quarter, the company boasted 6.58 billion transactions. This compares to the 6.07 billion reported the same time one year earlier. In addition to this, on a year-over-year basis, the number of transactions per active account through from 54.7 to 60.9. The reading in the second quarter of this year marked the highest in the company’s history. So in addition to more people using the service, those who are using it are using it more than ever.

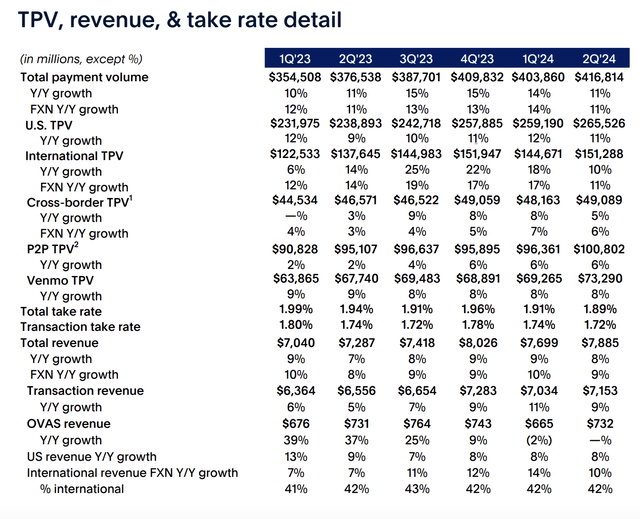

This activity has spurred an increase in total payment volume. In the second quarter of the year, the company processed $416.81 billion worth of payments. In addition to being 10.7% above the $376.54 billion reported one year earlier, it also marks the highest in the company’s history. What’s really exciting about this to me is that the growth has come from year over year improvements across all of its major categories. US and international total payment volumes increased by 11.1% and 9.9%, respectively. Cross-border total payment volume grew by 5.4%. Total payment volume for peer-to-peer activities popped up by 6%, while for Venmo alone the increase was 8.2%.

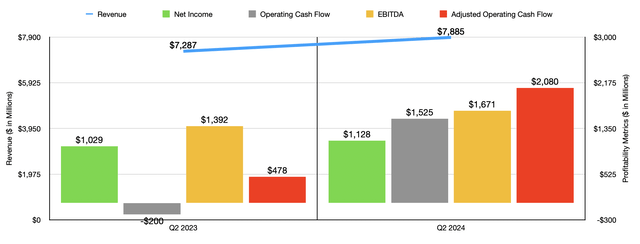

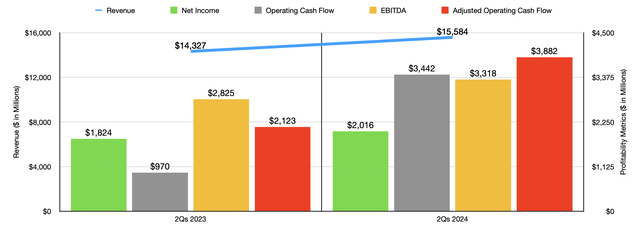

With the increase in revenue has also come higher profits and cash flows. Net income grew from $1.03 billion to $1.13 billion. Operating cash flow went from negative $200 million to positive $1.53 billion. If we adjust for changes in working capital, we get a similarly impressive jump from $478 million to $2.08 billion. And finally, EBITDA for the company expanded from $1.39 billion to $1.67 billion. In the chart above, you can see results for the first half of 2024 compared to the same time of 2023. As was the case in the second quarter alone, the first half of this year in its entirety looks quite solid.

Because of the strong performance the company achieved during the second quarter, management has even increased guidance for this year. When they announced results for the first quarter, they said that earnings per share would probably be around $3.65. That’s down from the $3.84 per share generated in 2023. But now, earnings guidance has been pushed higher to between $3.88 and $3.98. That would imply net profits, at the midpoint, of about $4.69 billion. If we annualize the results achieved so far for this year, we would get adjusted operating cash flow of $7.23 billion and EBITDA of $6.40 billion.

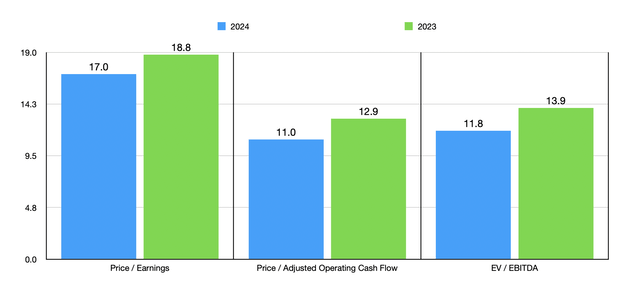

Using these estimates, we can see in the chart above how shares are currently valued. Especially when talking about the cash flow multiples, these are levels that I would associate with a firm that is teetering between being undervalued and being fairly valued. In most cases, I would probably lump it into the low end of the fair value range. But we are talking about an industry leader with attractive growth and strong cash flow margins. We are also talking about a business with a net cash position of $3.89 billion that has been actively engaged in buying back stock. In fact, during the first half of this year, management repurchased 49 million shares for $3 billion. If you compare the $61.30 that the company paid for these shares, on average, to where the stock is today, that’s an extra $812.4 million that the business has created for its investors solely through share buybacks. And with another $7.9 billion of capacity under its current buyback program, it’s almost certain the firm will continue to repurchase shares for the foreseeable future.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PayPal Holdings | 17.0 | 11.0 | 11.8 |

| Automatic Data Processing (ADP) | 30.1 | 27.0 | 19.3 |

| Fiserv (FI) | 30.9 | 20.0 | 14.8 |

| Fidelity National Information Services (FIS) | 61.4 | 11.1 | 13.4 |

| Global Payments (GPN) | 18.6 | 11.7 | 10.5 |

| Paychex (PAYX) | 28.5 | 25.4 | 19.4 |

When you add all of this together, I do think that the stock is worthy of being considered undervalued. But it’s not undervalued only on an absolute basis. It’s also cheap compared to similar businesses. In the table above, I compared it to five such firms. On a price to earnings basis and on a price to operating cash flow basis, PayPal ended up being the cheapest of the group. And even on an EV to EBITDA basis, I found that only one of the five companies was cheaper than our candidate.

Another reason why I remain very optimistic about the enterprise is because management has a history of innovating and initiating certain growth opportunities. Personally, I believe that cryptocurrency is mostly worthless. However, on September 25th of this year, the company announced that it will now enable business accounts to buy, hold, and sell cryptocurrency. Earlier in September, the business also announced a partnership with e-commerce giant Amazon (AMZN). Effective immediately, for certain brands, the ability to pay on Amazon using PayPal will be available. This is specifically for Amazon Prime users. Next year, this initiative will expand to enable Prime members to make the Buy with Prime available across all participating merchant websites.

This is an although. In August of this year, PayPal launched a new checkout solution called Fastlane. This particular solution will allow faster checkout using PayPal. In essence, this is achieved by having customers enter their payment details once. From that point on, they can check out with a single click for any place that offers Fastlane. Recently announced partnerships with Adyen and Fiserv will involve more significant distribution of Fastlane.

Takeaway

As you can see, PayPal is a large, robust, and rapidly growing business. The firm has finally shown that it can turn itself around, and management continues to innovate. Add on top of this how cheap shares are, both on an absolute basis and relative to similar enterprises, and I do believe that maintaining it as a ‘strong buy’ makes sense right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!