Summary:

- Starbucks’ issues started in 2Q24, prompting a turnaround plan. However, recent earnings show efforts are still in the early stages and the company’s performance is still declining year-on-year.

- Starbucks’ issues are unlikely to be short term. My analysis suggests that the company faces a more structural and enduring problem.

- Declining consumer confidence will continue to weigh on demand in the United States, while multiple headwinds will continue to challenge the company’s operations in China.

- Valuation analysis, despite optimistic assumptions, suggests that the stock is trading at a premium in excess of 30%, suggesting that the company is overvalued.

Brett_Hondow/iStock Editorial via Getty Images

Introduction

Starbucks’ (NASDAQ:SBUX) (NEOE:SBUX:CA) recent problems started in 2Q24, where the company’s revenue missed estimates unexpectedly and disappointed global investors. In addition, during that period, same store sales growth has declined by 4% primarily declined by 6% in total transactions. The deterioration was not limited to any specific region or geography.

As a fellow consumer of SBUX, I am curious to understand whether this is merely an idiosyncratic quarter or if it signals a more structural and enduring problem. Unfortunately, my analysis suggests that SBUX faces a deeper problem stemming from a shift in consumer behaviors, poor consumer confidence, and increasing competition and challenges in China. In addition, macroeconomic and geopolitical uncertainty will likely exacerbate these issues. In this report, we will further investigate some of these persisting headwinds that will continue to weigh on SBUX, making it hard for the company to stage a successful turnaround anytime soon.

Significant Efforts Just To Stay Afloat

In 2Q24, after the company’s disappointing quarter, the company embarked on a turnaround plan which consists of: (1) Unlocking Capacity for New Demand & Improve Operating Efficiencies, (2) Attracting New Customers by Focusing in Product Innovation, and (3) Demonstrating the Value of the Starbucks Experience to New Customers. Based on some key indicators presented in the latest earnings call, the management team claimed that the plan is working.

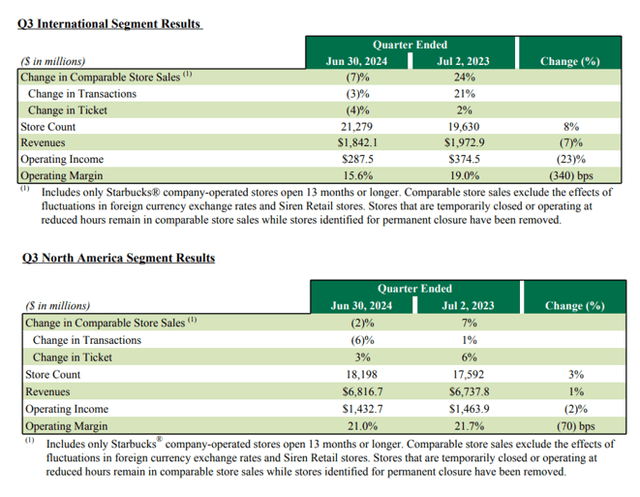

SBUX’s Earnings Release Summary (Press Release 3Q24)

However, top-line results from 3Q24 suggested otherwise, and the company still has much to do. Overall revenues have declined by 1% year-on-year. Same store sales have declined by 3% overall, primarily due to a 5% decline in overall transactions (offset by a 2% increase in average ticket spending). Both North American and International store sales have declined by 2% and 7%, respectively. Operating margins have contracted by 60 bps to 16.7% due to higher marketing related spending and investments into personnel. For the quarter, SBUX has generated earnings per share of $0.93, representing a decline of 6% year-on-year.

Although the company has put in considerable effort, its performance is disappointing and the outlook for the company remains bleak. Despite expecting a 6% increase in global store growth and a capital expenditure of $3 billion, the management team expects same store sales growth for this year to decline slightly.

Consumer Sentiments Will Continue to Weigh on Starbucks Demand

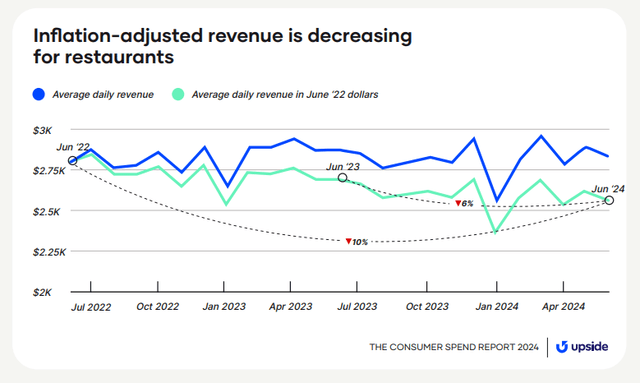

Consumer Spend Report 2024 (Upside)

Clearly, despite considerable efforts, demand for SBUX’s products has deteriorated. This deterioration is primarily due to a huge change in consumer’s spending and confidence.

Based on a recent consumer spending survey by Upside in August 2024, more than 55% of survey participants perceive that the economy is worse than before. Younger consumers less than 24 years old were the most pessimistic about the economy, while consumers above the age of 45 were the most pessimistic about their own financial situation. In addition, more than 58% of the consumers are significantly cutting back on their overall spending. In addition, the latest consumer confidence index has also declined to 98.7 from 105.6 in August 2024, the biggest year-on-year decline in the past three years. According to Dana Peterson, Chief Economist of The Conference Board, consumers were largely pessimistic about future income and the current conditions of the jobs market.

It seems that we are merely at the early stages of a depressed consumer sentiment. To further exacerbate this phenomenon, tensions in the Middle East are likely to continue pressuring global supply chains; the prices of oil and gas are also likely to surge if the Middle East situation worsens. All of these, will likely cause inflation to be stickier, affecting consumer’s confidence and real disposable income; resulting in further headwinds for our beloved coffee chain.

Starbucks Has A Big China Problem

Apart from consumer confidence and geopolitical uncertainty, SBUX faces a big China problem. Currently, China is one of SBUX’s largest portfolio and contributes approximately 10% to 13% of SBUX’s total revenue. As of FY2023, SBUX’s China portfolio represents at least 35% of all the SBUX stores globally.

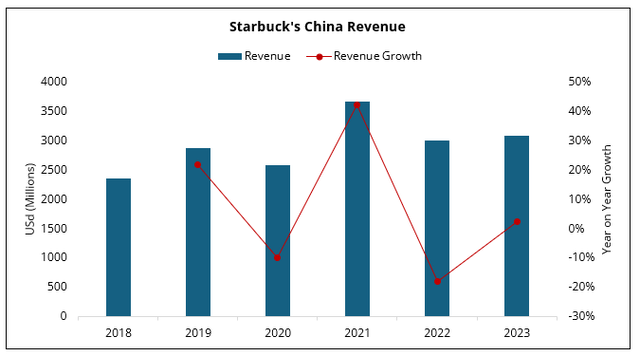

Starbucks China Revenue (Statista)

Unfortunately, 3Q24’s same-store sales growth in China has declined by 14% while average ticket spending has declined by 7%; the decline and deterioration in China is significantly worse than what we have seen in North America and other international stores.

It is also important to note that SBUX’s China performance has been fairly inconsistent over the years, indicating that the company has not really been able to figure out how to capitalize on the huge consumer market in China. Moreover, the issues in China are extremely nuanced and complex. Currently, there are already three major issues in China that will continue to challenge Starbucks.

Firstly, macroeconomic conditions in China are likely to continue to remain weak, affecting consumer’s ability to spend on luxuries like Starbucks. Ever since the strict government policies such as Zero-Covid and the Real-Estate’s Three Red Lines, China’s economy has deteriorated significantly and has yet to really recover. Retail sales and industrial data continue to disappoint investors. The overall unemployment rate remains largely elevated at 5.30%. Moreover, in July 2024, China’s youth unemployment has surged to more than 17%.

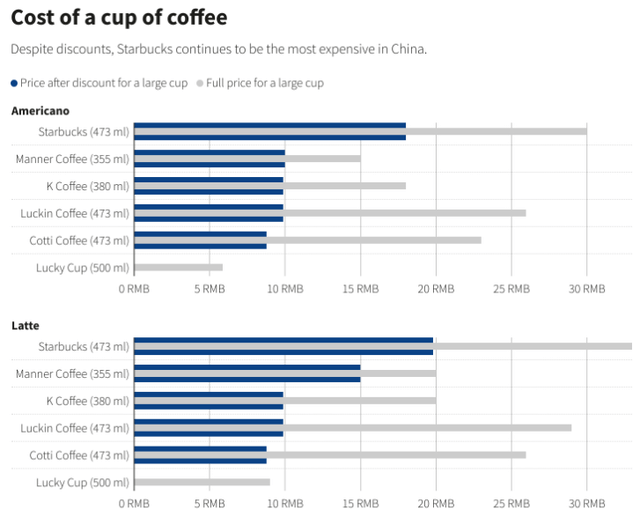

Price of Coffee in China (Reuters)

Secondly, SBUX is facing immense competition in China. In 2023, SBUX lost its lead to Luckin Coffee (OTCPK:LKNCY); the company has outperformed SBUX, generating $3.45 billion as compared to SBUX’s $3.16 billion in China. As compared to other competitors in the Chinese market, SBUX’s prices are also significantly higher, likely affecting the company’s ability to retain customers amidst the backdrop of a poor macroeconomic condition. Although SBUX’s China CEO, Belinda Wong, has stated that the company is not interested in price war and will focus on capturing sustainable growth, it is clear that prices are affecting SBUX’s sales and its current situation is not sustainable either.

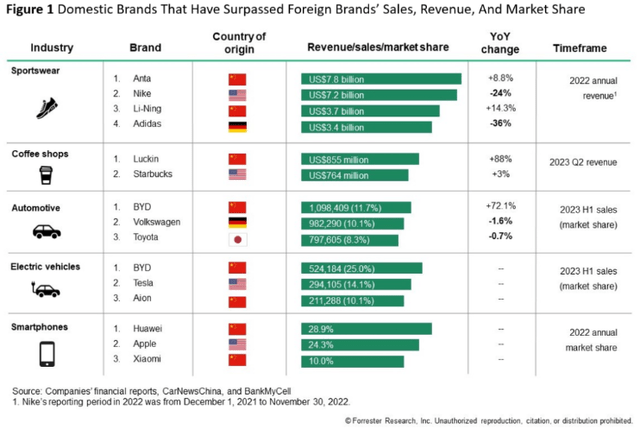

International Brands Dethroned (Forrester Research)

Thirdly, there is a huge shift in consumer behaviors in recent years, primarily due to the rise in nationalism, spurring consumers to choose local brands over international brands. This phenomenon is known as guochao. Global brands such as Nike, Adidas, Volkswagen, and Apple are already affected and have been dethroned. While you and I will pay no heed to the type of coffee we drink on the way to work, the Chinese consumers are probably less enthusiastic about holding a green “American Cup”.

Despite the weakness we have seen in SBUX’s China, the company continues to invest aggressively in China. For FY2024, SBUX will expand the number of China’s stores by another 12%. My fear is that SBUX may be pouring its focus and resources into the wrong cup, giving up significant opportunity costs; SBUX’s deterioration in China is nuanced and complex; it is unlikely that a few quarters of heavy capex will resolve this issue that they are facing in the country. Hopefully, SBUX will not decline like how many American brands did over the past decade in China, leading to an eventual total abandonment of the market.

Valuation

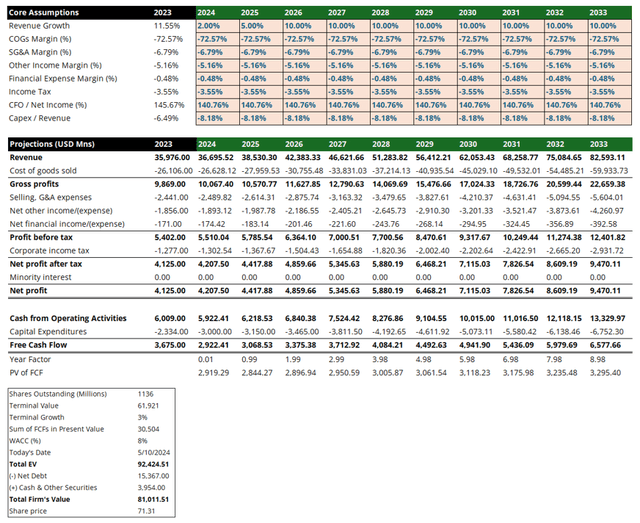

Company’s Valuation (Author’s Projections)

Given that SBUX has been consistently generating FCF, I have conducted a valuation analysis utilizing discounted cashflows with the following assumptions: (1) revenue remains stagnant for FY2024 and eventually normalize to a 10% growth rate, (2) operating margins maintained at current levels without any deterioration, and (3) a terminal growth rate of 3%. Based on these assumptions, which, I believe, are fairly generous given the company’s struggles to maintain growth, the DCF model suggests SBUX’s should be valued at $71.31; in line with the range before SBUX announced a new CEO on 13th August 2024.

Closing Remarks

Despite its efforts to regain growth, SBUX continues to face multiple headwinds. Macroeconomic headwinds, poor consumer sentiments, and further challenges in China will likely continue to affect SBUX’s performance. Although the company has enlisted a new CEO to help turn things around, it remains to be seen whether the company can truly regain its competitiveness. Presently, SBUX’s share price trades at $96.58, representing a premium of more than 30%; while I am more than happy to pay a premium for its Americano, I will most likely steer clear from its shares until I see a larger margin of safety or if there are clear indications that the company can truly fend off these persisting headwinds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.