Summary:

- AMD’s Q2 earnings surpassed expectations, but its revenue growth of 9% YoY pales compared to Nvidia’s 122%, highlighting AMD’s weaker industry position.

- AMD’s financials show operating leverage with improved margins, but mounting inventory and lower R&D spending compared to Nvidia are concerning.

- There are three screaming pieces of evidence suggesting that the stock is highly likely overvalued.

- Despite AMD’s competitive weaknesses, its stock price has doubled since January 2023, potentially buoyed by Nvidia’s performance and strong investor support.

Pavel Byrkin

Investment thesis

My previous bearish thesis about AMD’s stock (NASDAQ:AMD) might seem mistaken as the stock has gained 5% since July. On the other hand, it is common when short-term price movements do not align with fundamental developments.

There are three strong indications of AMD’s substantial overvaluation: sky-high valuation ratios, the discounted cash flow model [even with aggressive assumptions], and extremely aggressive insider selling from Lisa Su over the next few months. Meanwhile, AMD’s recent financial performance and financial position might seem impressive without context. On the other hand, when we bring the company’s biggest rival in the AI chips race, Nvidia (NVDA), AMD looks quite weak to compete. Mounting inventories is still a big problem for the company, which is not easing as inventory levels are still extremely high relative to revenue’s historical context. All in all, I believe that a stock like AMD does not deserve such a premium that it currently trades at and give it a “Strong Sell” rating.

Recent developments

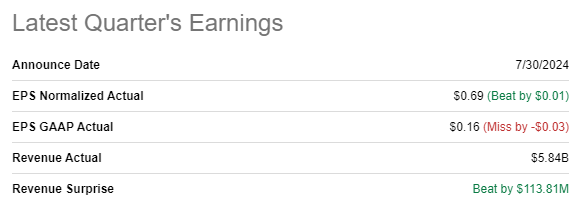

AMD shared its latest quarterly earnings on April 30, surpassing consensus and adjusted EPS estimates. Revenue growth accelerated in Q2, climbing up by almost 9% YoY. While this might be impressive, I want to emphasize that Nvidia’s (NVDA) revenue grew by 122% YoY. I think that the massive gap in revenue growth pace speaks volumes about AMD’s weak positioning in the industry compared to NVDA. The adjusted EPS expanded from $0.58 to $0.69 YoY.

Seeking Alpha

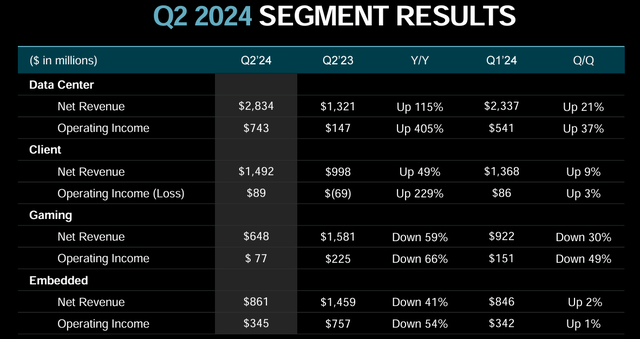

A good sign is that AMD demonstrated operating leverage during the quarter. The non-GAAP gross margin expanded YoY from 50% to 53%. The non-GAAP operating margin also improved YoY, from 20% to 22%. Data Center revenue soared by 115% YoY, but it was dragged down by big dips in Gaming and Embedded segments. I am not mentioning growth in Client segment because it still recovers from the big dip of 2022-2023.

AMD’s latest earnings presentation

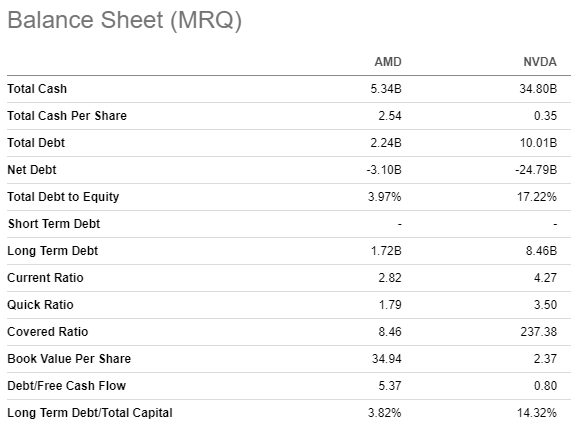

AMD ended Q2 with a solid $5.34 billion cash pile and quite low debt levels. Since AMD competes with NVDA in the most thriving Data Center niche, I want to bring its competitor’s balance sheet to the context. NVDA’s cash pile as of the latest reportable date was more than six times higher compared to AMD. NVDA’s debt levels are also quite insignificant compared to its multi-trillion market cap.

I am emphasizing this as AMD’s apparent competitive weakness because competing in terms of technological edge requires vast investments. For example, Nvidia invested $10 billion on developing its brand-new Blackwell GPU.

Seeking Alpha

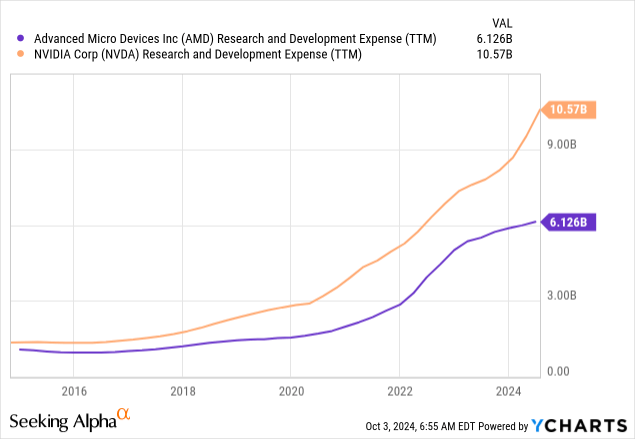

With such a big gap in terms of the financial power, it will be extremely difficult for AMD to compete. AMD’s TTM R&D spending is around 40% lower compared to Nvidia’s. Moreover, the below chart clearly shows that the gap is expanding rapidly. Therefore, AMD is extremely unlikely to beat Nvidia in the technological field.

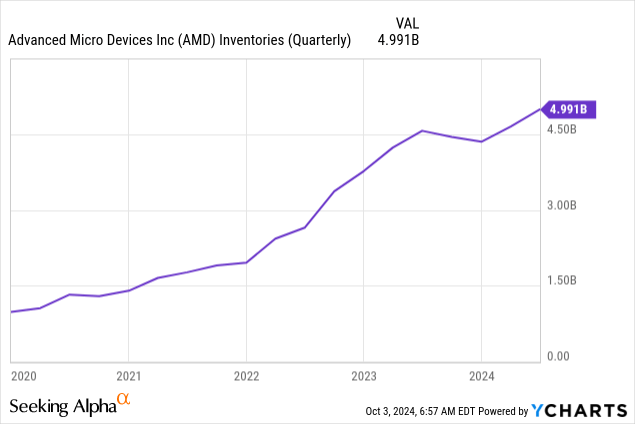

There is another big problem with AMD’s balance sheet, which is the mounting inventory. AMD’s $23.3 billion TTM revenue is very close to the FY2022 $23.6 billion revenue. Despite revenue being almost flat between these two timeframes, AMD’s inventory has increased significantly since 2022. Mounting inventory is a fundamental problem for investors because it ties up capital that could be used elsewhere and may indicate potential overproduction or declining demand for products. This situation can lead to increased storage costs and potential write-downs if the inventory becomes obsolete, negatively impacting the company’s financial health and investor returns.

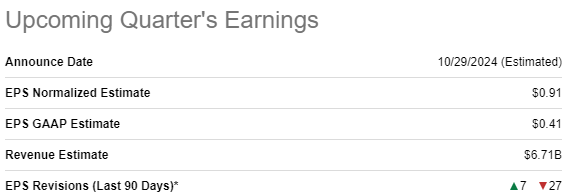

It appears that Wall Street analysts share my pessimistic stance, which I see from the expectations around AMD’s upcoming earnings release, which is scheduled for October 29. There were massive 27 downward EPS revisions over the last 90 days. On the other hand, revenue growth is expected to accelerate to 15.7% YoY. This growth rate looks insignificant compared to an 81.6% quarterly revenue growth projected for Nvidia, though.

Seeking Alpha

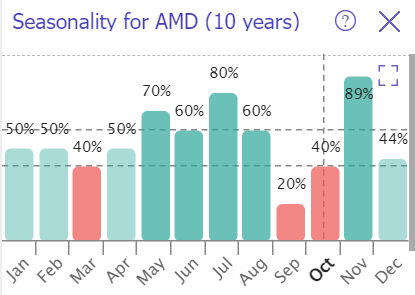

Seasonality trends appear unfavorable for AMD in October, with the stock achieving gains in only 40% of cases over the last ten years. On the other hand, November has historically been the most successful month for the stock with an 89% success rate. Thus, potential gains in November might outweigh any weakness experienced in October.

TrendSpider

To conclude, AMD’s fundamentals look impressive only in isolation. When the major rival in the AI chips race is brough to the context, AMD seems poorly positioned to compete.

Valuation update

AMD gained almost 63% over the last 12 months, delivering much better performance compared to the broader U.S. market. On the other hand, AMD’s rally in 2024 is well behind the S&P 500 with a 10% YTD growth. An “F” valuation grade from Seeking Alpha Quant suggests that the current valuation ratios are significantly higher than the sector median and historical averages.

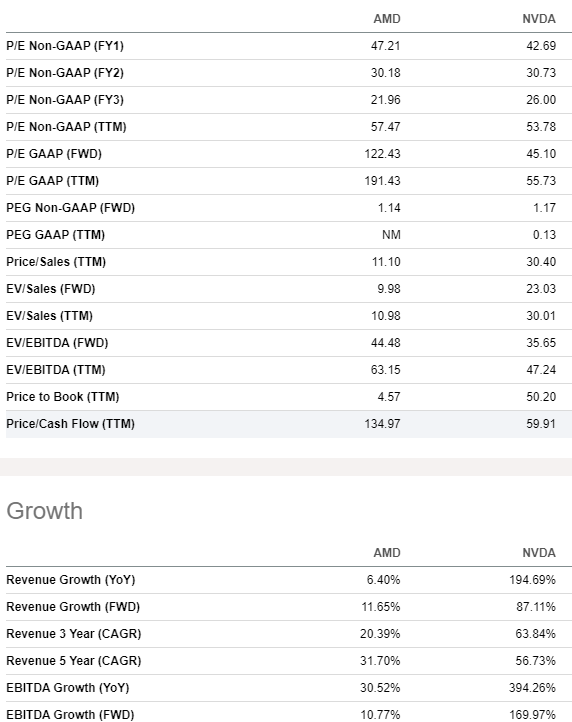

Another factor that underscores AMD’s overvaluation is the comparison of its valuation ratios to Nvidia’s. As we see, most of the ratios are comparable and some of AMD’s multiples are even higher compared to NVDA. This looks unfair to me because AMD’s growth across key P&L metrics is not even close to NVDA.

Seeking Alpha

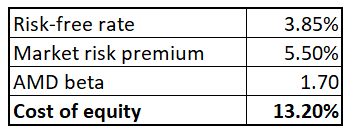

I hope that the DCF model will help me to solidify my position about AMD’s overvaluation. Let me figure out the discount rate first. AMD’s cost of equity is 13.2%, according to the CAPM calculations below. All variables are easily available on the Internet.

Author’s calculations

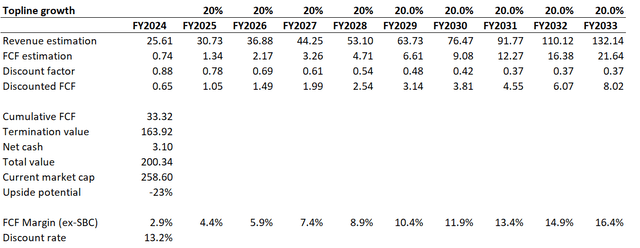

Since I have a bearish opinion about AMD, my DCF model should be aggressive. Therefore, I project an aggressive 20% revenue CAGR with the base year suggested by consensus. The base year FCF margin assumption is conservative at 2.9% because this one relies on TTM level ex-stock-based compensation [ex-SBC]. To balance a conservative FCF assumption for the base year, I incorporate a 150 basis points yearly expansion.

Author’s calculations

Even with a massive 20% revenue CAGR and aggressive FCF margin expansion assumption, the business’s fair value is 23% lower than the current market cap. I want to emphasize once again that all assumptions that I have used are extremely aggressive.

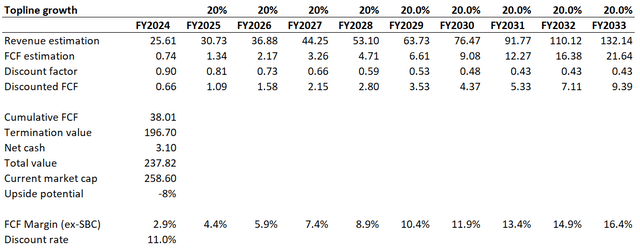

Some might argue that a 13.2% discount rate is too high, and this might be true in light of the Fed’s monetary policy softening. On the other hand, the stock remains overvalued even with a much softer 11% discount rate.

Author’s calculations

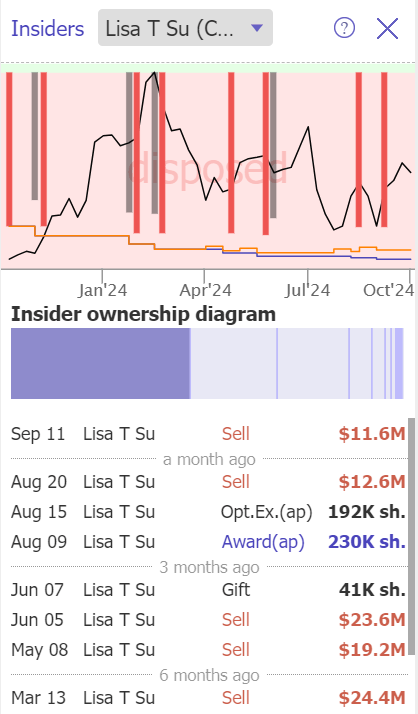

Another factor that might point to overvaluation is insider activity. As we see, there were no insider buys over the last 12 months, which is an indication that the valuation is not considered attractive by insiders. Moreover, Lisa Su, the CEO has been selling the stock aggressively in 2024 with total insider selling worth more than $100 million. This looks quite significant compared to her $765 million net worth.

TrendSpider

To conclude, there are three strong pieces of evidence that AMD is overvalued: the multiples, the discounted cash flow model, and aggressive insider selling.

Risks update

It is not always obvious how the market will respond to earnings announcement. AMD potentially can deliver a pretty mediocre Q4 performance, while Lisa Su may reveal another eye-popping chip release that threatens NVDA’s. Having said that, there’s a possibility that earnings release could be a rally for the stock price, even though financial results will not be stellar. Moreover, analysts from BofA are quite bullish ahead of the company’s AI event on October 10.

AMD is one of the 10 best performing stocks over the last 10 years with 5,777% share price growth. A lot of people who got in AMD a decade back are now all that much richer because of it. Therefore, there’s no doubt that the stock is extremely well supported with its huge fan base who are ready to endure the market and will buy when the dust settles. That can only strengthen the stock even more, even at the moment it’s overpriced. If that does occur, then my thesis won’t live long.

Despite AMD’s weak competitive position against Nvidia, its stock price rose more than 2x since Jan 2023, and I think the most dramatic part of AMD’s upbeat reaction had something to do with the big surge in NVDA. That being said, a fresh rally in NVDA could propel AMD share price higher, even if AMD’s fundamentals do not improve with it.

Bottom line

To conclude, AMD still looks like a sell. I have outlined three robust pieces of evidence suggesting that the stock is highly likely overvalued. My analysis suggests that given AMD’s weak positioning against NVDA, the stock does not deserve such a premium.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.