Summary:

- Merck is a blue-chip stock, but that doesn’t mean I want to own it here. The risk of loss is too high, based on several metrics I track.

- Technical indicators and charts suggest high risk for MRK, with the stock repeatedly breaking down and showing negative trends.

- MRK’s current dividend yield and price-to-sales ratio indicate it’s expensive and not a good buy at present.

- MRK remains on my watchlist, awaiting a lower-risk buying opportunity, but it’s a strong sell given its current high-risk profile.

Sundry Photography

My previous article “featured” a set of 11 stocks out of the 30 in the Dow Jones Industrial Average that have earned zero returns over periods of a few years to a quarter-century. These are not penny stocks. They are blue chips. And that serves as a reminder to me (and perhaps to other, like-minded investors) that when it comes down to it, investing in stocks is not a 2-way street.

We humans tend to fall in love with stocks. Often it is either because we have had profitable experiences with them, or in the case of young companies or those deeply out of favor, we see reason for optimism when others may be less aware, or less willing to dive in and risk capital.

My YARP™ dividend stock portfolio likes Dow Industrials stocks. But not this one

My 40-stock portfolio that I have written about here several times recently favors the stocks in the Dow with strong yields. However, it doesn’t matter what the stock is, or how blue a chip it happens to be. If it doesn’t pass some tests I apply quite consistently, it doesn’t fit in the portfolio. Instead, as with MRK, it stays on my watchlist, which is 35 stocks I’d like to own “at a price” but that price is not yet a reality. And of course, since I stick to 40 stocks at most, if a stock does not merit replacing one I own, that’s also a “no” for me.

Merck (NYSE:MRK) is far from being a new kid on the block. It was a high-growth company back around the time of the dot-com bubble, and like a tech stock (which it is not), it flew high, then crashed hard. And while I don’t see the risk being as high as it was then, I don’t think it has been higher since that time, 24 years ago.

As always, I come back to my mantra on stocks: anyone can go up in price at any time. Where one stock differs from another is in how much risk one is taking to own it.

MRK could find a way to rally for any of several reasons, including “tagging along” if there’s another leg higher in the broad stock market, or if healthcare stocks suddenly become safe havens again. But I’ll pass on that potential here. I think the risk is historically high, for a range of technical and quantitative reasons described below.

The case against MRK

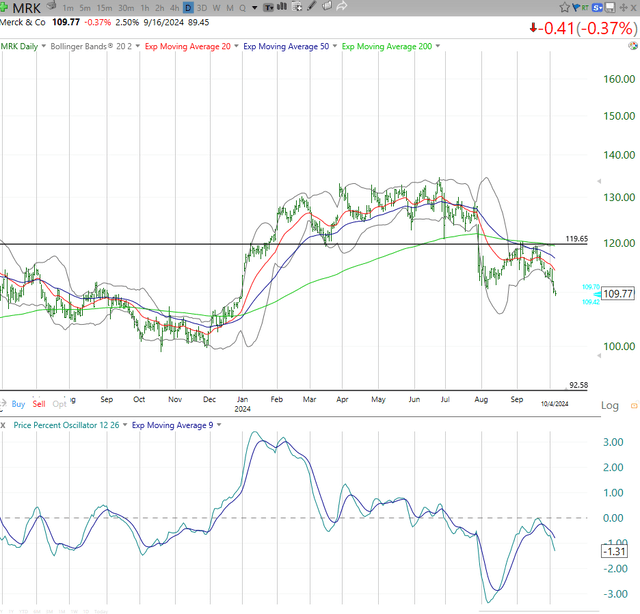

I often save the technical charts for last. But here, I want to start with them, since they ooze risk to me. This is the daily. Not only is the stock obviously falling (you don’t need to have 44 years of stock charting under your belt as I do to see that), it is also breaking down repeatedly. First, to the March 2024 lows, and then below that. And that 20-day moving average (red line, top part of chart) is now rolling over again. That is as good a short-term sign that something is up as any.

TC2000 (SungardenInvestment.com)

The bottom of the chart above shows a similar “rolling over” pattern in the PPO indicator I favor for my stock work. Furthermore, it is rolling over while rejecting a move above the 0.00 line. Sort of like it came close but then failed at the goal line.

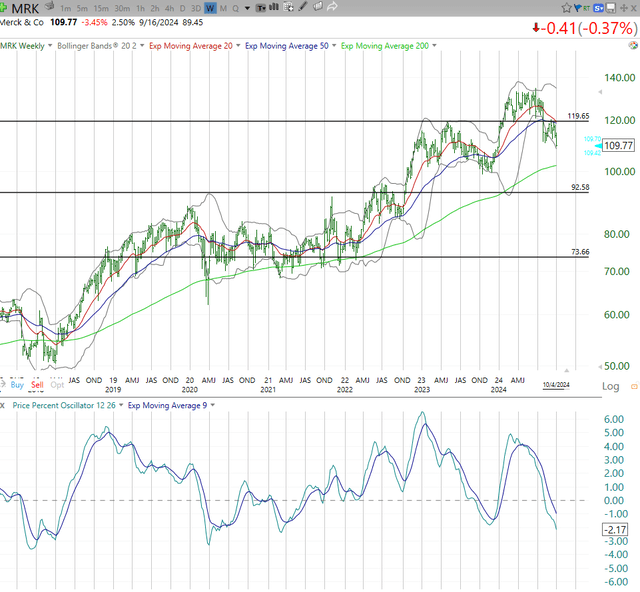

The weekly chart below is more of the same. Except that the PPO trend is poised to enter new low territory. It is already negative, and getting worse.

None of this automatically spells doom. I don’t invest that way. I don’t include 100% or 0% possibilities, as I don’t think they exist in investing. And if they do, there’s always a first time. Risk management is all about that in modern markets, with things happening to stocks that we have not seen in the past. Earnings reactions have become a casino game. And “great companies” can be terrible stocks if bought just when they were at peak popularity.

So in MRK, I see a very low probability of strong gains for a while, until the bad stuff noted above is worked off. That could take some time. And still, if someone asked me “is there a chance that MRK can go up 10%, 20% or more before it falls by that much” I’d say, of course. But that’s not a chance I intend to take. There are too many other stocks to consider, including the many I currently own, which avoid the need for chasing or taking on risk in the face of pictures that look like these.

TC2000 (SungardenInvestment.com)

YARP analysis: very high risk

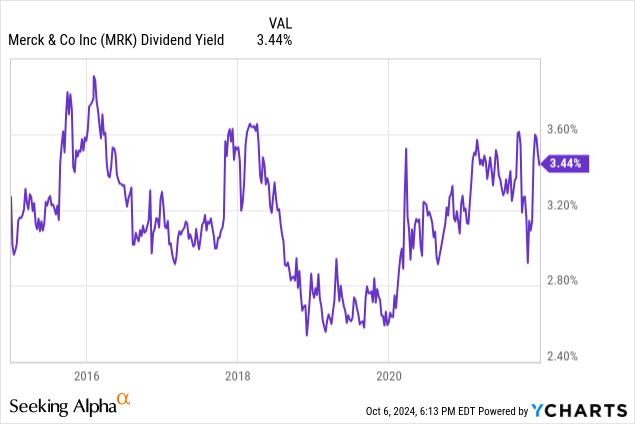

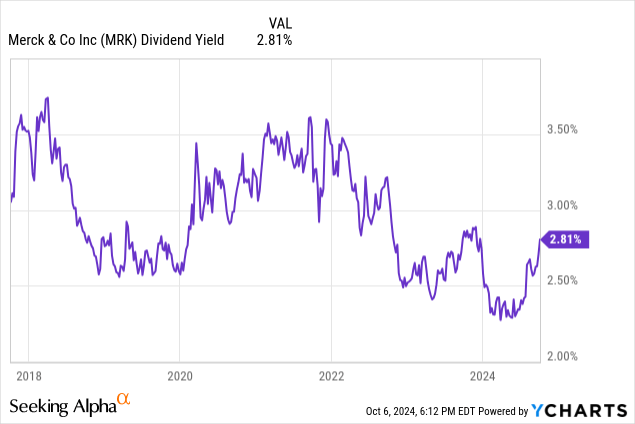

Here is when MRK was a buy based solely on my Yield at Reasonable Price statistic, which will formally carry a registered trademark later this month. This runs through the fourth quarter of 2022. The 7-year through that time saw MRK in a dividend yield range of about 2.6% and 3.8%. As 2022 ended, the yield was toward the top of that range, but showing signs of dropping from that peak. That implies not only a positive-trending stock price, but also that it could be climbing back from the top of the yield/bottom of the price range.

MRK moved about 60% higher in price within under 2 years.

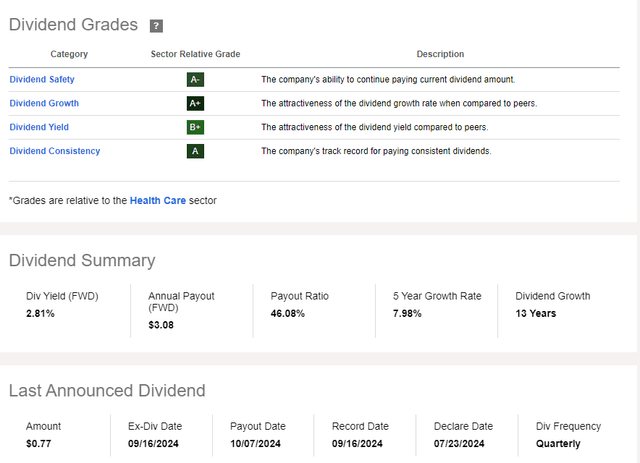

And now it looks as shown below. The opposite picture, with dividend yield moving up from the bottom of the 7-year range. That’s a high-risk YARP scenario. Again, no guarantees. Just very high risk. I code that “red” in my 5-color scale (green is highest, then blue, gray, yellow, and red as highest risk).

2.8% is not a great yield “on cost” to enter MRK. Not historically, not now.

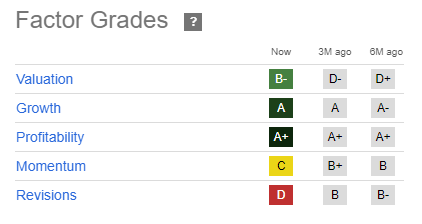

It is on my watchlist because at some point I expect it to be very buyable. But who knows when that will be? Profitability gets an A+ grade, and that plus the growth grade tell me that this is not a matter of not wanting to own MRK. It is more that I’d like to have a chance to buy it well south of here.

Seeking Alpha

Is that at $100 a share? $85 a share? Lower? I won’t know until we get there, and my process signals me that risk is low compared to reward potential.

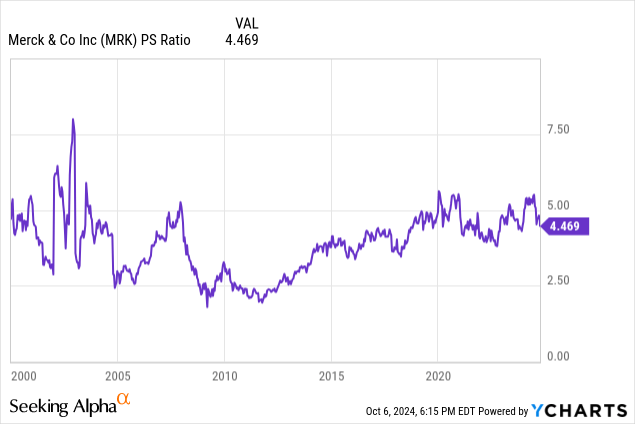

This Price-to-sales ratio confirms my analysis above. Expensive!

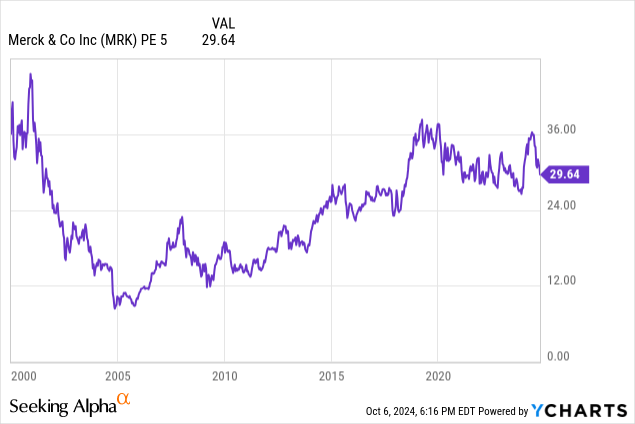

So too does this smoothed PE ratio (5 years of trailing earnings).

The dividend is solid. I just want a “solid” 3%+ yield when I buy in.

Conclusion

MRK is a watchlist name, not an “own it now” name for me. And a strong sell given that ominous-looking chart set.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.