Summary:

- Based on its Q3 guidance and comments about Q4, Nvidia seems poised to outperform my previous end-of-year projection from the start of the year.

- In this article, I provide an updated projection for Nvidia exiting the year.

- Overall, I maintain a strong buy rating for NVDA stock.

BING-JHEN HONG

Nvidia Corporation’s (NASDAQ:NVDA) rapid growth continues, and the company seems poised to exceed my expectations for the end of this fiscal year. Therefore, in this article, I am providing an upward revision of my end-of-year financial projection for the company. Below I discuss the rationale for this revision.

Overall, I maintain a strong buy rating for NVDA stock.

My Previous End-Of-Year Projection For Nvidia

At the start of Nvidia’s current fiscal year in February, I had projected the following (non-GAAP) financial figures for Nvidia’s fourth quarter (ending in January 2025):

- Revenue: $35 billion

- Net profit margin: 50%

- EPS: $0.70 ($2.8 run-rate)

At the time, my projection was significantly higher than analysts’ estimates, but I had contended that it would turn out to be more accurate. Now that we have earnings results for the first two quarters, as well as guidance for Q3, it appears that my projection was still a little conservative.

Strong Q2 Results And Q3 Guidance

In Q2, Nvidia reported the following (non-GAAP) results:

- Revenue: $30.04 billion

- Net profit margin: 56.4%

- EPS: $0.68 ($2.72 run-rate)

On the earnings call, Nvidia management reported that “customers continue to accelerate their Hopper architecture [GPU] purchases,” and guided further growth in Q3. For Q3, the company projected the following (non-GAAP) figures:

- Revenue: $32.5 billion, plus or minus 2%

- Gross margin: 75.0%, plus or minus 50 basis points

- Operating expenses: $3.0 billion

- Other income: $350 million

- Tax rate: 17%, plus or minus 1%

We can use these figures to determine the implied net profit margin and EPS. I will use the same diluted share count as in Q2 (24.85 billion shares).

- Revenue: $31.85-$33.15 billion.

- Gross profit: $23.73-$25.03 billion

- Operating profit: $20.73-$22.03 billion

- Net income: $17.29-$18.80 billion

- Net profit margin: 54.3%-56.7%

- EPS: $0.70-$0.76 ($2.80-$3.04 run rate)

As readers can see, at the midpoint, Nvidia’s implied non-GAAP EPS for Q3 is $0.73, or a run rate of $2.92/year. This already exceeds my previous expectations about where Nvidia would be at the end of Q4.

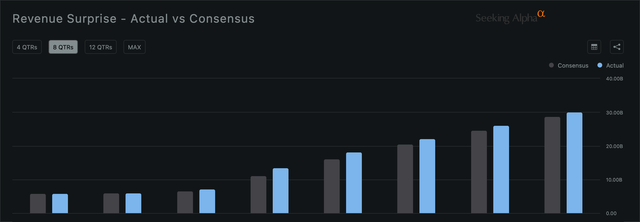

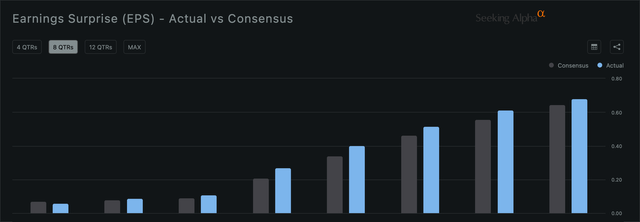

Moreover, it seems likely that Nvidia could slightly beat this figure, given that the company seems to have been sandbagging revenue and EPS guidance for a few quarters now. As shown in the figure below, Nvidia has beaten consensus analysts’ estimates (which track guidance pretty closely) every quarter since the AI boom started. During the last four quarters, Nvidia has beaten on revenue by more than $1 billion each quarter, and beaten on EPS by at least $0.04 each quarter. As such, it seems plausible that we could see revenue around $33.5 billion and EPS around $0.77 ($3.08 run rate) in Q3.

Nvidia revenue surprise (Seeking Alpha) Nvidia earnings surprise (Seeking Alpha)

Q4 Seems Likely To Be A Strong Quarter

Nvidia’s Q4 is a little trickier to estimate, primarily because the company will start shipping its next-generation Blackwell GPUs that quarter. Over the next few quarters, Blackwell sales should tend to cannibalize Hopper sales, but the timing and magnitude of this cannibalization remains to be seen.

In my opinion, it doesn’t seem likely that Hopper sales will decline due to cannibalization in Q4. There are a few factors that point in this direction:

- Nvidia is still adding Hopper capacity, as evidenced by the growth guided for Q3.

- Nvidia’s H200 production only started ramping in Q2, and ramps tend to continue for multiple quarters.

- As long as Nvidia has some Hopper backlog to work through, a decline in new orders for Hopper GPUs wouldn’t immediately translate to a decline in Hopper sales.

Whether Hopper sales might continue to increase in Q4 remains an open question. CFO Colette Kress was noncommittal when directly asked whether Hopper sales would increase from Q3 to Q4, and provided the following response:

We believe our Hopper will continue to grow into the second half. We have many new products for Hopper, our existing products for Hopper, that we believe will start continuing to ramp, in the next quarters, including our Q3 and those new products moving to Q4. So let’s say Hopper therefore versus H1 is a growth opportunity for that.

Unfortunately this is not the clearest guidance about whether Hopper sales will grow sequentially in Q4 (Nvidia tends to provide guidance for only one quarter at a time). Therefore, to be conservative, I will assume that Hopper sales will remain flat, and that Nvidia’s total revenues excluding Blackwell will be $33.5 billion in Q4.

Blackwell revenues will be on top of this $33.5 billion. Nvidia management stated that they “expect to ship several billion dollars in Blackwell revenue” in Q4. I am going to assume that “several billion” means somewhere between $4-6 billion. It could mean a little more, maybe around $7-8 billion, but I would see that as a positive surprise and will assume the more conservative $4-6 billion figure for now. With that, we arrive at total Q4 revenues of $37.5-39.5 billion.

Next, we come to margins. In the Q&A on the last earnings call, CFO Colette Kress was also asked about Q4 gross margins. When asked if Q4 margins would be in the 71%-72% range, she responded:

I’m not in the same number that you are there. We don’t have exactly guidance, but I do believe you’re lower than where we are.

She also stated that for the full year, Nvidia expects about 75% gross margins. If we use the midpoints from Nvidia’s Q3 guidance and the midpoint of my revenue estimate above ($38.5 billion), then running the calculator leads to the conclusion that Q4’s gross margin should be about 72.6%. This aligns with what CFO Colette Kress stated as well. So let’s say a 2.4 percentage point decline in gross margin going from Q3 to Q4. If we assume for simplicity that net profit margin for Q4 will drop by the same 2.4 percentage points, then we arrive at a Q4 net profit margin of 51.9%-54.3%.

Now we can formulate a complete projection for Q4. I will use the same diluted share count as in Q2 (24.85 billion shares).

- Revenue: $37.5-39.5 billion.

- Gross margin: 72.6%

- Net profit margin: 51.9%-54.3%

- Net income: $19.5-$21.4 billion

- EPS: $0.78-$0.86 ($3.12-$3.44 run rate)

This is 11-23% higher than my previous projection of $2.80 run-rate EPS exiting the fiscal year.

My New Price Target

Nvidia often hovers around 30-40x run-rate earnings, and is around the high end of that at the moment. I tend to be a bit conservative, so I am going to use a 35x multiple. This would imply that Nvidia’s stock price should be at $109-$120 exiting the year. This is an increase of 17-29% over my previous end-of-year price target of $93.

Conclusion

Based on my analysis, I would say that Nvidia is currently about fairly valued relative to where the company will likely exit the year. But then I expect Nvidia to keep growing beyond that point in 2025 as Blackwell ramps production throughout the year. When that happens, the share price should also appreciate.

It is currently unclear exactly how much growth investors should expect next year (even Wall Street analysts seem quite unsure, with revenue estimates for next year differing by as much as $90 billion, ranging from $135 billion to $223 billion). But I feel confident saying two things. First, demand for AI compute is still extremely high, and given that demand for Hopper is still growing, it seems like a good bet that demand for Blackwell will be very strong (Nvidia CEO Jensen Huang recently stated that “demand for Blackwell is insane”). Second, in my opinion, there is no real competition for Blackwell. I have written about this in more detail before, here and here. And so conditions are favorable for Nvidia to grow substantially in 2025.

Hence, although I am not sure exactly how much growth to expect next year, I think that it will be a large amount — and in my opinion, there is a good chance that Nvidia will exceed $200 billion revenue next year (perhaps by a solid margin). Consequently, even though I am not sure exactly what next year will look like, I still feel confident saying what I have been saying for more than a year now: that investors should be patient and let Nvidia grow. There is no very compelling reason to jump ship at the moment.

Overall, Nvidia remains a strong buy for me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.