Summary:

- Palantir continues to grow and execute well, but the share price has also surged to all-time highs.

- In this article, I consider whether an investment in PLTR stock can still produce above-market returns.

- Overall, I am downgrading Palantir from strong buy to buy.

Michael Vi

Palantir Technologies (NYSE:PLTR) continues to grow, but the share price has also climbed rapidly. Therefore, in this article, I revisit my strong buy rating for PLTR stock from earlier in the year, and consider if there is still upside potential left. My analysis suggests that the upside for PLTR stock has diminished significantly, although the strength of Palantir’s commercial business could still potentially lead to above-market returns over the coming years. Overall, I am downgrading Palantir from strong buy to buy.

My Previous Rating Of Palantir

I last wrote about Palantir in February in the article “Palantir Doesn’t Need Heroics To Justify Its High Valuation.” At the time, the stock was trading at $24 and the company’s market cap was around $50 billion. I had argued that although Palantir’s valuation seemed high at first glance, the company’s high operating leverage suggested that it could more than justify its valuation with even moderate revenue growth over the coming years.

My projections for Palantir had assumed that 70% of new revenues would be booked as (non-GAAP) operating profits over the next few years. With this assumption in place, I had estimated that, in 5 years, Palantir would justify its valuation of $50 billion with even modest revenue growth of 15% per year. Moreover, I had argued that if Palantir could achieve a growth rate of 25-30%, then it could achieve a valuation of $100-$150 billion in 5 years (or a share price of $48-72).

Given this analysis and the significant upside potential, I had rated Palantir stock a strong buy.

The Snowball Is Rolling

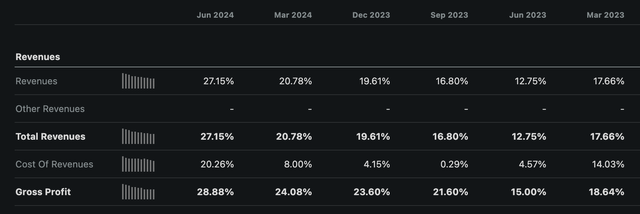

Since my last article, Palantir has reported results for Q1 2024 and Q2 2024, and provided guidance for Q3 2024. The company has performed very well, and revenue growth has accelerated to the 25-30% range, where I saw significant upside for Palantir stock. The figure below shows this development over Q1 and Q2.

Palantir revenue growth (year-over-year) (Seeking Alpha)

For Q3, the company has guided revenue of $697-701 million, which would represent year-over-year growth of 24.8-25.6%. And then for Q4, Palantir’s full-year guidance implies revenue of $728.6-740.6 million, which would represent year-over-year growth of 19.8-21.7%. And so it seems that Palantir’s growth rates have expanded compared to when I last covered the company.

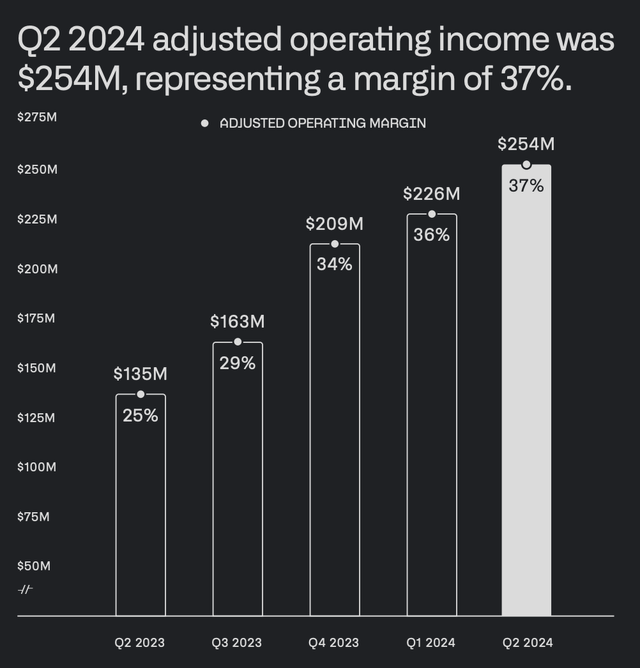

Over the first two quarters, operating leverage came in slightly below my projection. Compared to Q4 2023, in Q2 revenue was $69.7 million higher and non-GAAP operating profit was $45 million higher (see figure below). This means that 64.6% of incremental revenue found its way to non-GAAP operating profits over the first two quarters.

Palantir non-GAAP operating profit (Palantir Q2 2024 earnings presentation)

Overall, I would say that Palantir has performed very well over the last couple of quarters in terms of growing revenues and operating profits.

Is There Enough Upside Here?

Although Palantir’s growth has accelerated to a solid clip, the problem, of course, is that the share price has skyrocketed about 60% since my last coverage and is now hovering close to the $40 mark.

Given Palantir’s current position, it seems quite possible that it could achieve the 25-30% growth rate over the next few years that would justify a share price (in 4.5 years) of $48-72. But if one pays $40/share today, then the return in 4.5 years would only be 20-80%. In this case, Palantir’s performance would not be significantly more than what one may expect (on average) from investing in the indices over this duration.

Moreover, although demand for enterprise AI is booming, even maintaining 25-30% revenue growth for multiple years is not a trivial task, especially as Palantir’s revenue base keeps growing over the coming quarters and years (requiring larger and larger absolute growth in revenue each year to sustain that 25-30% rate).

There is, however, one major caveat here. It is possible that Palantir’s growth rates could continue to accelerate further over the coming years if the company’s commercial business continues to perform as impressively as it has recently. We all know that interest in enterprise AI is very high and growing rapidly, with firms in many different industries investing in and adopting AI. If these trends persist, then it is possible that Palantir’s revenue growth could further accelerate.

At the moment, the performance of Palantir’s commercial is quite impressive. In Q2, Palantir’s commercial business grew 33% year-over-year and 3% sequentially. Within its commercial segment, Palantir’s US commercial business is even more impressive. It grew at 55% year-over-year and 6% sequentially, with US commercial customer count growing 83% year-over-year and 13% sequentially.

Currently, Palantir’s commercial business represents about half its overall revenues, with the US commercial segment representing about a quarter of Palantir’s overall revenues. If rapid growth in these segments continues, then they should come to represent an even larger proportion of Palantir’s revenues over time (since Palantir’s government business is growing less quickly at 24% year-over-year in Q2). If so, Palantir’s faster growth in its commercial segment, and especially in its US commercial segment, could pull up the company’s overall growth rate in the coming quarters and years.

Of course, continued strong performance by Palantir’s commercial business is not a certainty. But currently interest in enterprise AI is very high, so it does seem like a legitimate possibility for the short and medium terms. If this possibility materializes, then it is possible that Palantir could reach a higher stock price than my previous $48-72 range and generate significant above-market returns for investors.

Overall Verdict

Based on the above analysis, I would say that the upside potential for Palantir has decreased substantially compared to earlier in the year. There is a good chance that returns for investors over the next few years may not be significantly above market returns. However, if Palantir’s commercial business continues to perform strongly, which is very much possible, then Palantir could still generate outsized returns over the coming years. Hence, overall, I am downgrading Palantir stock from strong buy to (a somewhat lukewarm) buy. I also wonder if waiting for a better entry point may be the prudent choice for investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.