Summary:

- Taiwan Semiconductor posted yet another strong quarter with an optimistic guidance. The company generated revenues and EPS of NT$673.5 billion and NT$9.56, representing a year-on-year growth of 40.07% and 36.38% respectively.

- Structural demands for advanced chips will continue to serve as tailwinds for TSM; more importantly, shortages for advanced chips persists while demand from AI training and inference continues to grow.

- TSM will maintain its technological lead as competitors such as Intel and Samsung continue to face problems, positioning TSM to be a major beneficiary of the current AI investment supercycle.

- TSM will continue to benefit from subsidies across the world as governments attempt to localize semiconductor manufacturing.

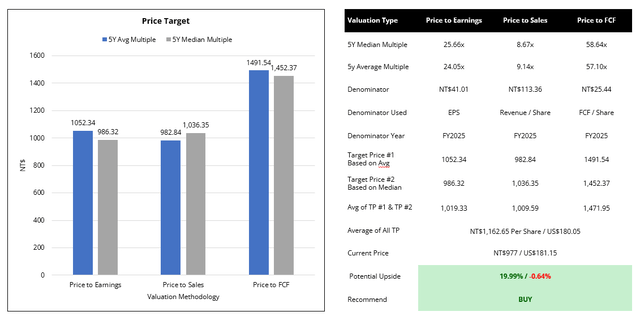

- Valuation analysis suggests that TSM’s ADS in the United States is fairly valued. However, shares listed in Taiwan offer a potential upside of 19%, presenting a unique arbitrage play for sophisticated investors.

Monty Rakusen

Introduction

Taiwan Semiconductor (NYSE:TSM) has benefited from the huge surge in semiconductor demand due to the exponential growth of the Artificial Intelligence industry. Even though the company’s financial performance stagnated in 2023, TSM’s has continuously surpassed expectations in 2024. Ever since December 2022, the company’s share price has increased by more than 143%. Like many investors, I am curious to know whether the company can: (1) continue to sustain its growth trajectory and (2) provide further upside opportunity.

My analysis suggests that TSM’s ADS listed in the United States is currently fairly valued; much has already been priced in. However, an upside potential of 19% exists in the shares listed in Taiwan, providing an attractive arbitrage opportunity for investors. In addition, my analysis suggests that TSM is well positioned to further capitalize the AI investment supercycle. In this report, we will investigate some of these reasons why TSM will continue to succeed as the world’s most important foundry.

Latest Developments

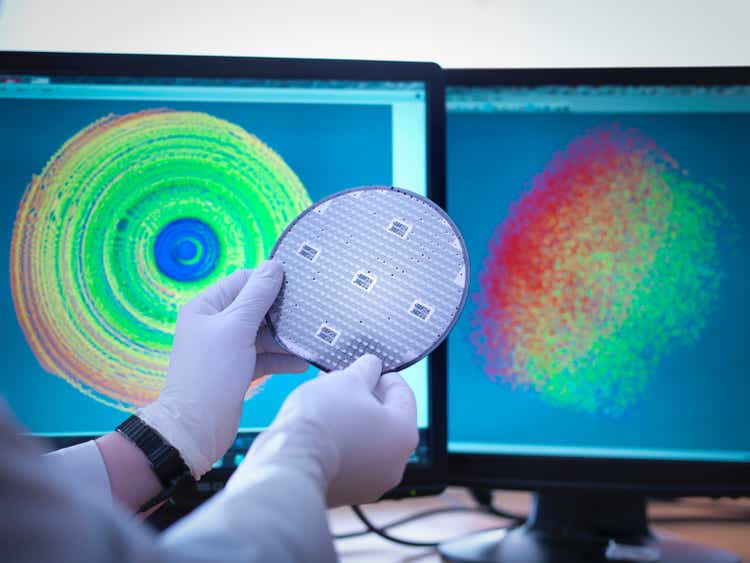

3Q24 Guidance (TSM Quarterly Results)

In TSM’s latest 2Q24 earnings release, the company has posted yet another round of outstanding results, generating revenues of NT$673.51 billion; on a year-on-year and quarter-on-quarter basis, the company’s revenue has surged by 40.07% and 13.60% respectively. The continued growth of TSM’s revenue is primarily due to a strong demand in the company’s advance nodes (i.e., 3nm and 5nm processes). Currently, more than 67% of the total wafer production revenue comes from advanced processes. In addition, the high-performance computing segment of the company has contributed more than 50% of the company’s total revenue. All of these suggests that the company is successfully capitalizing on the current AI/ML investment supercycle.

In terms of margins, TSM has also improved on a sequential basis. Gross margin has improved to 53.17% from 53.07% last quarter; Operating margin has improved to 42.55% from 42.02% last quarter due to a relatively lower spending in R&D and SG&A. In 2Q24, the company has posted an EPS of NT$9.56, representing a year-on-year and quarter-on-quarter growth of 36.38% and 9.89% respectively.

Based on the latest guidance, TSM’s management continues to be optimistic about the company’s performance. The company’s management expects TSM generate revenues between NT$728 billion and NT$754 billion representing an 8% to 12% quarter-on-quarter growth; Gross profit is likely to fall between the range of 53.50% to 55.50% while operating margin is expected to fall between 42.50% to 44.50%.

Structural Demands Will Continue To Serve As Tailwind For TSMC

TSM is well positioned to enjoy continued growth in the next three years as demand from key industries will continue to serve as tailwinds. Currently, the company derives its revenue from: (1) High Performance Computing, (2) Smartphones, (3) Digital Consumer Electronics, (4) Internet of Things and (5) Automotive.

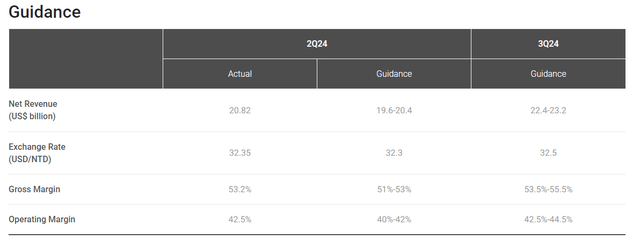

Author’s Illustration: Global IoT, EV Sales, and Electronics Market Outlook (Statista, Prescedence, Bloomberg, Vodafone)

Many of these industries that TSM is exposed to will continue experiencing strong growth, translating to a further demand in chips. For example, market research from various sources suggests that the Internet of Things market and global unit sales for Electronic Vehicles are estimated to grow at a CAGR of 23% and 21% on average. The continued advancement of these industries will further boost the demand for advance chips that will ultimately benefit TSM; for example, more sophisticated automotive semiconductor chips will be required to help improve battery management, enhance driver assistance systems, and improve other infotainment services.

More importantly, there is a huge supply and demand imbalance in the high-performance computing segment. Based on the latest earnings call, TSM is experiencing capacity overload related to high-performance computing. This is not surprising given that we are still in the early stages of Artificial Intelligence and our models have only just achieved multi-modal capabilities such as “listening” or “seeing”. Moreover, based on Meta’s CEO, the small step-up from a Llama 3 model to Llama 4 model will require more than 10x in computational power.

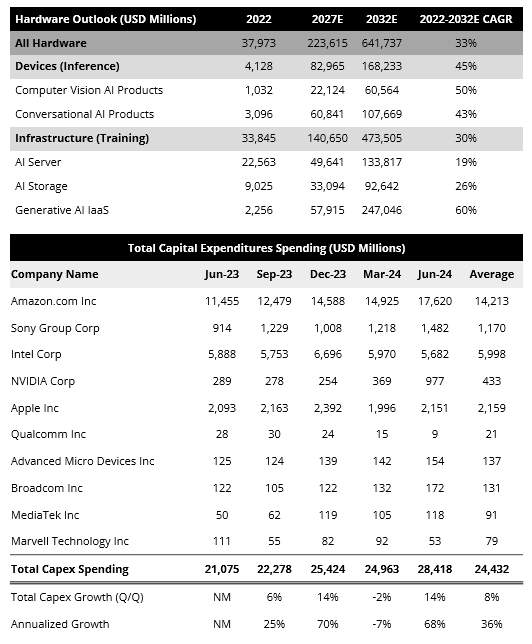

Author’s Illustration: AI Hardware Outlook & Capex Spending (Bloomberg, Company Filings)

It remains a huge challenge to estimate the capacity and demand required from AI/ML related training in the next couple of years. However, technology companies are already attempting to frontload their investments into AI/ML related infrastructure to meet their requirements. If we look at TSM’s top 10 customers, total capital expenditures have been growing at an average of 8% quarterly for the past 5 quarters, validating that there is a persisting demand for higher-performance computational resources.

Apart from model training, there is also an emergence of an AI inference market. As more consumers begin to utilize AI/ML models for their everyday tasks, we will see a huge drain in computational resources, suggesting that more advanced chips will be required to serve consumer around the world.

Moreover, manufacturers today are integrating AI capabilities locally; more advanced chips are required to be on consumer end devices to support these capabilities, shortening the product replacement cycle. For example, Apple’s iOS 18 and Samsung Galaxy AI will utilize on-device processing and a large-language model running locally instead of in the cloud, solving the problems of latency and privacy. However, previous generation phones with less advanced chips will most likely be unable to support these capabilities. Based on a recent analysis of the Generative AI market, Bloomberg expects the AI inference market to grow at a CAGR of 45% between 2022 and 2032.

TSM Will Maintain Its Lead In Advance Nodes In The Short-Run

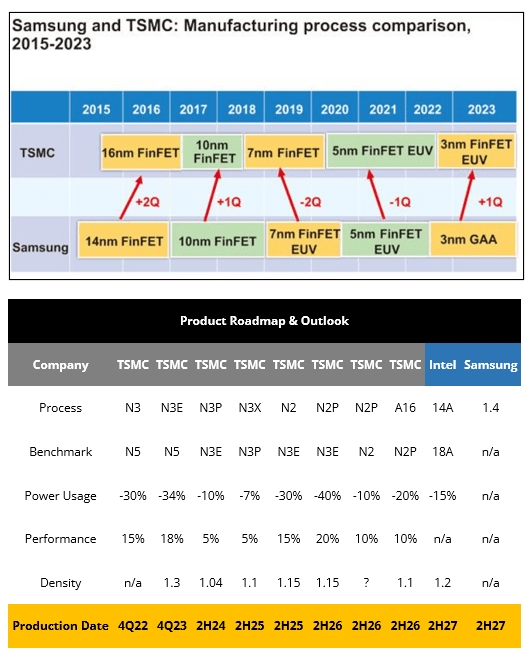

It is important to highlight that there are currently no other companies better positioned than TSM to enjoy the tailwinds from the huge demand for advance chips. Currently, TSM is the market leader for advanced nodes and holds a market share of approximately 90%. In addition, the company is on track to release new products in the next two years. Based on the latest earnings call, the company’s management expects to start volume production for its 2nm and 1.6nm processes in 2025 and 2026 respectively. Samsung and Intel are TSM’s closest competitors. However, both Samsung and Intel are facing a slew of problems recently.

TSM’s Product Roadmap (Digitiomes Asia, Trendforce)

Samsung, TSM’s biggest competitor, is currently facing multiple problems in relation to its advanced nodes. For technologies below the 3nm process, Samsung’s yield is merely less than 50% as compared to 70% in TSM. Moreover, the yield of Samsung’s new 3nm GAA technology is only around 20%, making it unfit for volume production. Recently, the company has also withdrawn their workface from its plant in Taylor, Texas due to ongoing issues with its yield for the 2nm processes. It is estimated that the timeline for Samsung’s 2nm volume production has been pushed back to 2026.

As for Intel, the company is facing multi-faceted problems such as potential liquidity constraints and deteriorating sales; all of these issues will continue to distract the company’s ambition to be a global foundry giant. The irony is that Intel had announced that it will not use its own 2nm process and will likely outsource to TSM. Moreover, Broadcom’s engineers have publicly stated that Intel’s new 18A nodes is not ready for volume production.

With the ongoing problems plaguing both Intel and Samsung, it is likely that TSM will continue to maintain its technological lead in the short-term and benefit by capturing a majority of the demand coming from the current AI investment supercycle.

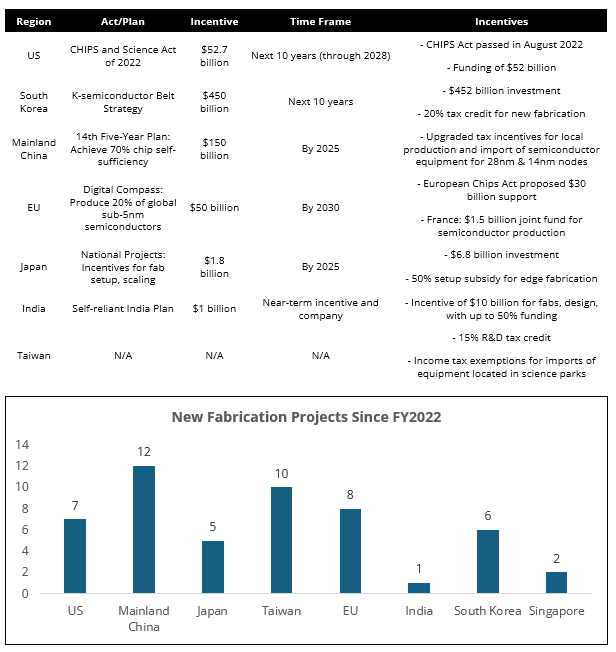

Primary Beneficiary Of Government Grants

Due to the growing importance of semiconductors for technological advances and the persisting geopolitical uncertainty across the world (e.g. US-China Relations, Issues Around South China Sea, China-Taiwan), major governments across the world are attempting to localize semiconductor manufacturing. As of today, the major countries and regions such as the United States, China, EU, and more have already enacted policies that will provide more than $705.5 billion in incentives for localized semiconductor manufacturing and ancillary projects.

Government Subisidies for Semiconductor Projects (Ernst & Young)

TSM has already received billions of dollars in subsidies across the world. In April 2024, the company won $6.6 billion in state subsidies and $5.5 billion in loans to expand its US chip manufacturing in Arizona. In August 2024, the company was granted more than $5.4 billion in state aid to build a new semiconductor facility in Dresden, Germany together with Bosch, NXP, and Infineon. TSM has also enjoyed benefits in Asia; the company revealed that it has received $1.9 billion in subsidies from China and Japan after receiving $1.46 billion in 2023 and $216 million in 2022.

Currently, the US-China economic decoupling is still in its early stages. Geopolitical tensions across the world remain escalated and preparation is underway for a potential conflict in the APAC region. It is likely that governments across the world will continue to be aggressive in localizing semiconductor manufacturing to prevent a supply chain dislocation; As a leader of advance manufacturing, TSM is incentivized to be more ambitious in terms of global expansion and well positioned to benefit from these subsidies.

Valuation: Potential Upside Will Come from Arbitrage

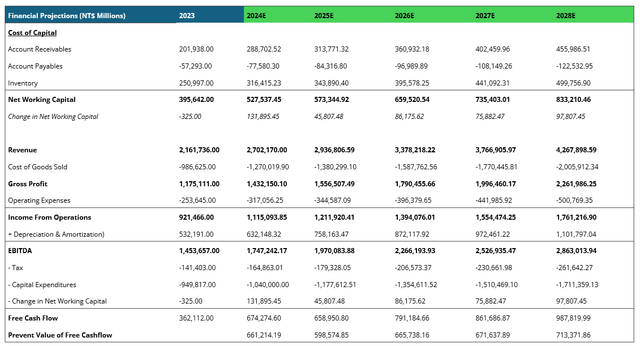

Free Cashflow Projections (Author’s Projections)

My forecast for TSM’s performance in FY2025 is based on the following assumptions: (1) revenue will grow by 25% in 2024E and eventually deteriorate to 8.68%, (2) gross margins will deteriorate to 53% in 2024E due to new fabrication plants coming online while other margins maintain, and (3) the company will not do an equity raise or other financing due to its strong cashflow profile. My results suggest that for FY2025, the company will generate an Earnings per Share of NT$41.01, Sales Per Share of NT$113.36, and Free Cashflow Per Share of NT$425.44.

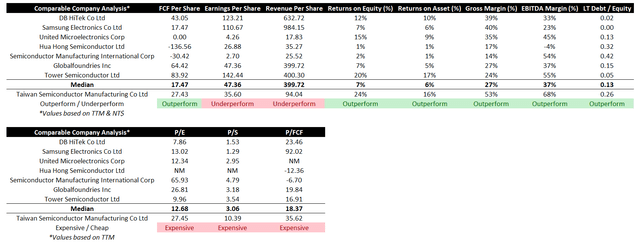

Comparable Company Analysis (Company Filings, ValueInvesting.io)

It is important to highlight that my comparable company analysis of TSM’s current valuation metrics such as price/earnings, price/sales, and price/FCF suggests that the company is relatively more expensive. However, given TSM’s current lead in advanced processes and its outperformance against the industry’s median on important operating and efficiency metrics such as Gross Margins, EBITDA Margins, and Returns on Equity (%), I believe that TSM commands a premium on its multiples.

P/E, P/S, P/FCF Valuation (Author’s Projections)

To value TSM, we have applied TSM’s 5Y median and 5Y average price/earnings, price/sales, and price/FCF multiples on the forecasted FY2025 per share data. We then average all of these values to derive a target price of NT$1,162.65 for its ordinary shares listed in Taiwan and $180.05 for its ADS listed in the United States. Our valuation analysis suggests that ADS listed in the United States is fairly valued; however, a potential upside of 19% exists in its shares listed in Taiwan. More sophisticated investors can arbitrage between these two exchanges, taking a long position in Taiwan and a short position in the United States. Please note that the ordinary shares to ADS conversion is 5:1.

Investment Risks

Geopolitical tensions will continue to serve as the company’s largest risk. Currently, the company has more than 90% of its production is in Taiwan. If relations between China and Taiwan escalate and result in a full-blown invasion, TSM’s operations will be severely affected. TSM has shown that it is willing to self-destruct its machines should there be an invasion, rendering the company not only useless but also worthless. Moreover, intelligence has revealed that China is on track to invade Taiwan by 2027. Unless TSM is able to quickly diversify its operations out of Taiwan before an invasion, it is likely that most of the TSM’s operations will be rendered invalid, making it hard for the company to turnaround and regain its manufacturing capacity in a short-period of time.

Closing Remarks

In conclusion, there are multiple reasons why TSM will continue to succeed in the next half of a decade. Structural demand, technological leadership, and government incentives will continue to support TSM. However, TSM is also in a precarious situation and is highly sensitive to geopolitical developments; investors who are interested in TSM must look beyond the fundamentals and monitor world developments that may potentially affect the outlook of the company. Finally, although the share price of TSM in the United States is fairly valued, providing little to no upside in the short-run, there is an attractive arbitrage opportunity for more sophisticated investors to tap on. Investors to intend to capitalize on the arbitrage opportunity should not overlook any currency risks; hedging any potential currency fluctuations using currency forwards or swaps will be wise.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.