Summary:

- Wells Fargo’s earnings saw a decline in net interest income due to higher funding costs, despite beating earnings and revenue expectations in its last quarter.

- WFC stock underperformed the S&P 500, returning a loss of 4.29% over the last year, with weak momentum scoring a D+.

- Opportunities include leveraging AI for efficiency, expanding wealth management, and benefiting from falling interest rates and strong stock markets.

- Investors have low expectations but may find Wells Fargo attractive as interest rates fall, and the economy grows, earning WFC stock a buy ahead of the earnings report.

wdstock

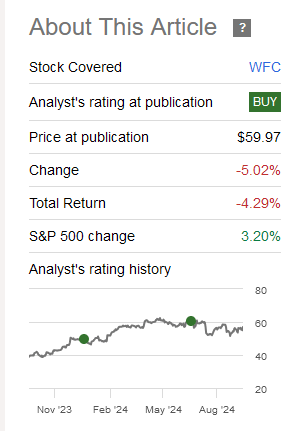

This Friday, October 11, 2024, Wells Fargo (NYSE:WFC) will post third-quarter results. In the last earnings preview posted in July, WFC stock returned a loss of 4.29%, under-performing the S&P 500, which returned 3.2%.

Why did Wells Fargo stock fail to break out above $60 despite beating earnings and revenue expectations?

Seeking Alpha

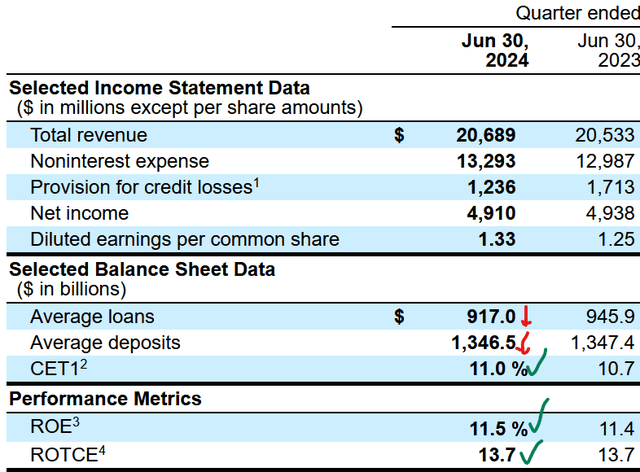

Wells Fargo Q2 2024 Earnings Recap

In Q2, the bank posted revenue of $20.69 billion, up by 0.8% Y/Y. Net interest income fell by 9%, hurt by higher funding costs. Its deposit balance fell slightly to $1.346 billion while customers took advantage of higher-yielding deposit products. Despite average loans also falling in the quarter, Wells Fargo posted a slightly higher CET1 ratio, return on equity (“ROE”), and return on tangible common equity.

The bank commented on the strong capital position in the quarter. Its CET1 ratio of 11.5% is above the minimum 8.9% regulator minimum buffer. To enhance shareholder returns, the bank bought back $6.1 billion of common stock in Q2. Although the repurchase rate will slow, the firm can buy back shares as needed. Wells Fargo recently hiked its dividend by 14.3% to $0.40, yielding 2.80%. This is below that of Citigroup (C), whose stock yields 3.58%. However, it is comparable to the Bank of America (BAC) dividend, which yields 2.59%.

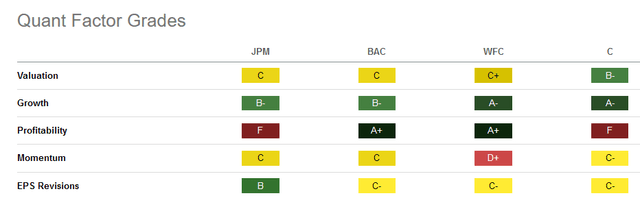

On a total return comparison YTD, WFC stock is up by 15.73%, compared to JPMorgan Chase (JPM) returning 24.17%. Readers may compare the stock grade of WFC stock to its peers. In the scorecard below, Citi offers the best valuation. It has a strong growth grade, which is comparable to that of Wells Fargo stock.

All of the banks mentioned above have weak momentum, with WFC stock scoring the worst with a D+. The weak stock performance could reverse in the week ahead. Wells Fargo needs to demonstrate that its focus on customer service, improved product capabilities, and positive progress across its categories will lift its revenue and profits.

Opportunities

At the Barclays Global Financial Services conference, Wells Fargo said that wage growth offset the cumulative impact of inflation on consumers. Investors will need the bank to post lower delinquencies in the home lending and automotive markets. This would contrast that of Ally Financial (ALLY), which warned that worsening credit conditions increased its auto loan delinquencies and net charge-offs in July and August.

Falling interest rates should decrease the consumer’s demand for a Certificate of Deposits (“CD”). The bank is already seeing savings and CD rates falling.

Strong stock markets should increase consumer flows on the trading side. As the bank expands coverage and strengthens its product capabilities in banking, expect fee and transaction revenues to increase in the upcoming report.

CEO Charlie Scharf said that generative artificial intelligence has several use cases. For example, the firm may apply gen AI in marketing. Additionally, the bank may achieve higher efficiencies on short-term tasks. Customers will benefit from higher service quality, along with a better banking experience. The bank may apply AI solutions in its call center to automate customer queries before they need to speak to a call center representative.

Wealth management is another growth opportunity. In the last few years, the firm built its core advisory program. As staff attrition declined, the number of advisors stabilized. Expect the bank to leverage its retail branch system to upsell advisory services to its affluent client base.

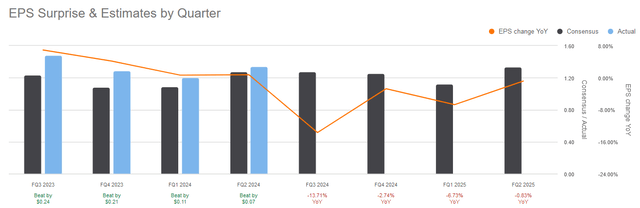

WFC Stock EPS Forecast

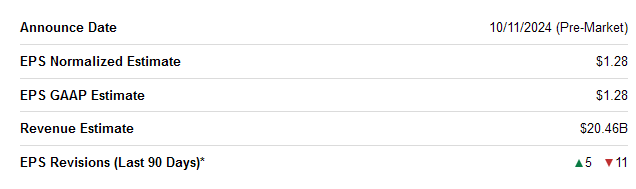

Analysts expect Wells Fargo to post an EPS GAAP of $1.28. This is down sequentially from July’s EPS of $1.33. Similarly, revenue will decline slightly. In the last three months, 11 analysts lowered their EPS revisions on Wells Fargo, while five analysts raised them.

Seeking Alpha

Beyond the current quarter, the bank should post an EPS that is trending higher on a percentage basis (orange line). However, the upcoming quarter marks the low point in EPS growth.

Risks

Net interest income may fall after the Fed cut interest rates by 50 bps. Still, the bank may report stable loan growth and similar deposit levels to previous quarters. That should enable executives to reaffirm their NII guidance.

Customers reflect on the economic uncertainties ahead. However, they are also confident that a soft landing path is probable. In addition, the upcoming election will add to the customer’s confidence level. As a result, this positive sentiment is a catalyst for Wells Fargo’s loan growth.

Your Takeaway

Investors have low expectations for Wells Fargo ahead of its quarterly report. Investors may take advantage of the weak stock price to build a position. As interest rates fall and the economy grows, this bank is an attractive holding for investors seeking exposure to the financial services sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply discounted stocks. Click on the "follow" button beside my name. Get do-it-yourself tips and tricks for free here. Note that the free subscription is a separate stream from following.

- Subscribe to the Free DIY Tier to get a preview of the subscription. Read dozens of articles. This is completely separate from the alerts you get when following me.

- The Basic tier is the second level.

- The Full Service is for readers who want it all, want a helping hand in the markets, and want to chat in the forum with like-minded do-it-yourself investors.