Summary:

- Alibaba is poised to benefit significantly from China’s massive stimulus program, which is set to boost its e-Commerce, logistics business and delivery business.

- The stimulus package is geared chiefly towards easing lending restrictions and spurring consumer spending.

- The program improves Alibaba’s attractiveness, promising continued upside momentum for its share price.

- Alibaba’s shares are undervalued with a P/E ratio of 11.6X, offering a substantial earnings yield of 9%.

maybefalse/iStock Unreleased via Getty Images

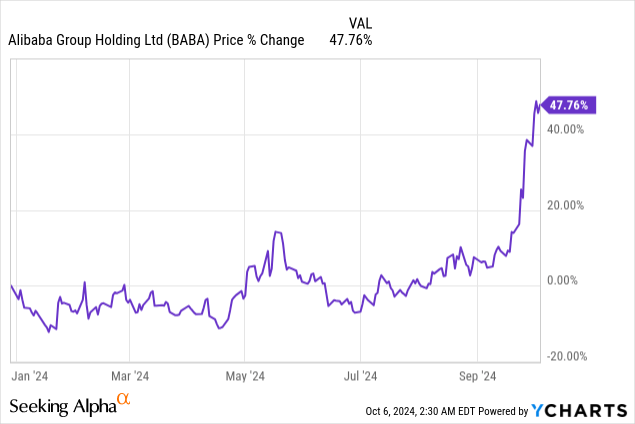

Alibaba (NYSE:BABA) is set to be a major beneficiary of China’s massive stimulus program which is meant to promote economic growth, lending and consumer spending. With Alibaba recently breaking out to the upside, I believe the benefits of the stimulus plan could soon be reflected in Alibaba’s financials, especially in its large e-Commerce and logistics businesses. Shares of Alibaba are still undervalued and the price of the e-Commerce platform’s shares does not reflect their fair value. With China now ready to splurge and put billions of dollars into its economy, I believe Alibaba’s breakout momentum is set to continue.

Previous rating

Alibaba’s shares were a strong buy for me in my last work in August because of the e-Commerce firm’s enormous free cash flow: High Safety Margin. Alibaba generated a ton of free cash flow which gave the e-Commerce company a significant lever to push for stock buybacks and return more cash to shareholders through dividend payments (both regular and non-regular). Given that China is now becoming more aggressive with its stimulus packages, I believe Alibaba’s core e-Commerce and logistics business Cainiao are set to be major beneficiaries.

China’s stimulus plan will be a good for Alibaba’s core businesses

Commerce makes up the bulk of Alibaba’s growing operating portfolio. Although the company has made an effort in recent years to restructure its business and diversify its revenue streams, Alibaba is still very much dependent on its e-Commerce operations to drive revenue and earnings growth.

China announced a major stimulus plan in September that will most likely see a lot of Chinese Yuan find their way into the bank accounts of Alibaba’s businesses. According to a report from CNBC, China pursues a 3-part stimulus plan including:

- Lowering the reserve requirement ratio by 50 basis points. Further, China will cut 7-day repo rate by 0.2 PP as a tool to spur lending and support the economy

- China will also try to take pressure off of the property market by cutting mortgage costs

- The government is set to announce cash transfers to low income households in a bid to boost spending.

In a nutshell, China is going to spur lending and lower borrowing costs as a means to support consumer spending indirectly while cash transfers to low income household are meant to directly benefit consumers at the lower end of the social-economic income pyramid. These people tend to spend government subsidies immediately which helps to stimulate the economy.

Alibaba, as one of the largest e-Commerce firms in the country is obviously set to benefit from increases in consumer spending. Taobao and Tmall represent 43% of Alibaba’s revenues (before consolidations and eliminations) and accounted for almost all of Alibaba’s EBITA in the last quarter. In fact, the e-Commerce business to a large extent finances the losses of other growth segments, such as Local Services or Digital Media & Entertainment (DM&E)

| in RMB Mn | Taobao and Tmall Group | AIDC | Cainiao | Cloud | Local Services | DM&EG | Others | Total |

| Revenue | ¥113,373 | ¥29,293 | ¥26,811 | ¥26,549 | ¥16,229 | ¥5,581 | ¥47,001 | ¥264,837 |

| Revenue Share | 43% | 11% | 10% | 10% | 6% | 2% | 18% | 100% |

| EBITA | ¥48,810 | ¥-3,706 | ¥618 | ¥2,337 | ¥-386 | ¥-103 | ¥-1,263 | ¥46,307 |

| EBITA Share | 105% | -8% | 1% | 5% | -1% | 0% | -3% | 100% |

(Source: Alibaba)

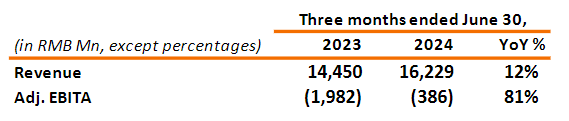

Therefore, Alibaba has a number of catalysts going forward as far as its earnings and free cash flow are concerned. Specifically, I expect increases in gross merchandise value at Taobao/Tmall and higher order values for the company’s e-Commerce platforms. Further, the Local Services Group, which includes delivery brands like Amap and Ele.me (Alibaba’s delivery brands), is set for an acceleration of growth. The Local Services Group is already seeing strong order and revenue growth which the stimulus package could accelerate. The stimulus package could also be a catalyst for LSG to finally turn a profit as Alibaba has made considerable progress in the last year reducing the segment’s losses.

The LCS segment is not yet profitable, but could soon be, and the segment sees one of the third-strongest top line growth in the June quarter, after Alibaba International Digital Commerce Group/AIDC (+32% Y/Y) and Cainiao (+16% Y/Y). The Local Services Group, together with the main domestic e-Commerce business as well as Cainiao, are worth keeping an eye on as China’s spending packages materialize.

Alibaba

Alibaba’s valuation

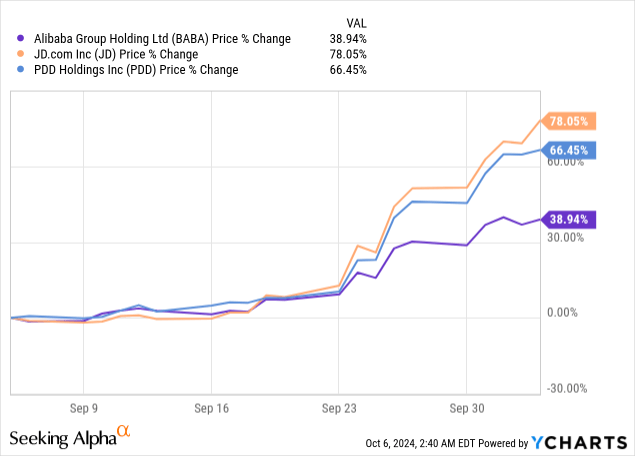

Valuations of Chinese e-Commerce companies have surged lately and Alibaba is not the exception. JD.com (JD) has seen a one-month return of more than 78% while PDD Holdings (PDD) generated a 66% return. Alibaba has been lagging behind — in my opinion, undeservedly so — with a 39% price surge.

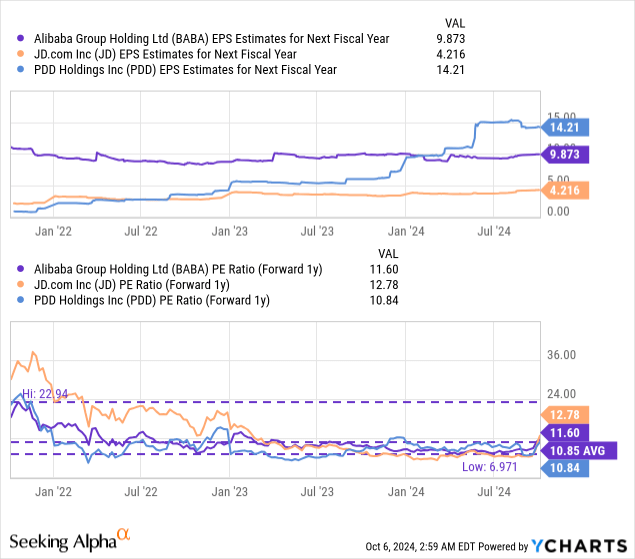

Despite the surging valuations, Alibaba’s shares are still cheap and trade at a P/E ratio of 11.6X which translates to an earnings yield of a massive 9%. JD.com and PDD Holdings, which owns the Temu e-Commerce website that is seeing fantastic growth, are trading for similarly low P/E ratios of 12.8X and 10.8X. I recommended both JD.com — Great Bang For The Buck — as well as PDD Holdings: 9X P/E, Strong Growth, High Safety Margin in July.

All three e-Commerce companies have seen positive share price momentum in the last month, indicating that sentiment towards the China e-Commerce sector as a whole is in the process of improving. The industry group average P/E ratio is still a very low 11.7X, however.

In my last work on the e-Commerce firm, I said that I saw a fair value for Alibaba in the neighborhood of $121. This calculation was based off of a long-term historical valuation average of 13.0X and a consensus estimate of $9.32 per-share for next year. Since consensus estimates have risen lately, in part because of China’s massive stimulus actions, I am raising my fair value estimate for Alibaba to $128 per-share (using the same multiplier and a consensus EPS estimate of $9.87).

This is a dynamic value, however, and it may rise together with an increase in consensus EPS estimates, and it seems very likely to me that Alibaba could see a broad revision of estimates in the coming weeks. If Alibaba is benefiting, as I expect, from broad-scale fiscal stimulus that benefits the company’s direct-to-consumer businesses, I can see a longer-term revaluation to a 15X P/E ratio. At a current EPS consensus average of $9.87, this would imply a fair value up to $148 per-share.

Risks with Alibaba

Alibaba remains e-Commerce centered, meaning the company’s consolidated top line will be influenced by no other segment more than e-Commerce and its associated logistics business, Cainiao. What would change my mind about Alibaba is if the company were to see continual top line pressure, especially in the Taobao and Tmall segment, or if its operating margins were to contract. There is also a risk that the stimulus package fails to stimulate Alibaba’s core business and that the announced programs will not reinvigorate China’s economy.

Final thoughts

It was a golden month for Alibaba, as news about a massive stimulus package all of a sudden made Chinese e-Commerce companies much more attractive again to investors. While U.S. investors have been pretty much sitting on the sidelines with regard to Chinese e-Commerce companies, there are very good reasons to invest here: China’s stimulus package is set to benefit the largest e-Commerce platform in the country, which is Alibaba. The cash handouts and easing lending restrictions should boost Alibaba’s core e-Commerce business, which is responsible for almost all of the company’s profits. Domestic e-Commerce, logistics and the Local Services Group are three businesses that could specifically benefit from China’s stimulus program, which, together, represent 59% of the company’s revenue.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, JD, PDD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.