Summary:

- Airbnb is a wonderful business that has run into some short-term struggles, which has impacted the price.

- Airbnb connects guests with hosts for short-term rentals, with over 8 million listings.

- Despite the recent stock drop, international growth and expansion into new segments offer long-term potential.

- Strong fundamentals, a founder-led business, and fortress balance sheet make Airbnb an attractive investment option.

Klaus Vedfelt

Investment Thesis

Airbnb (NASDAQ:ABNB) is a platform that connects guests looking for short-term rental stays with hosts who are willing to offer the respective accommodations. In Airbnb’s most recent quarter, they surpassed over 8 million listings on their platform as they continue to grow internationally and eye expansion into new consumer segments. Although Airbnb has suffered following the release of their Q2 results, I believe the fundamental business is extremely strong, as Airbnb still has a long runway of growth through their international expansion and expansion into new consumer segments. Moreover, Airbnb’s platform requires a minimal amount of capital expenditures to maintain.

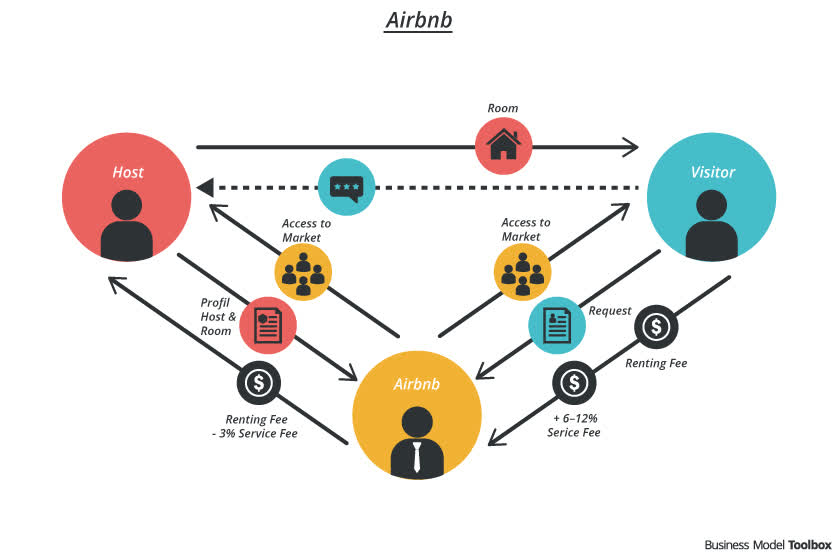

Airbnb Business Model (Business Model Toolbox)

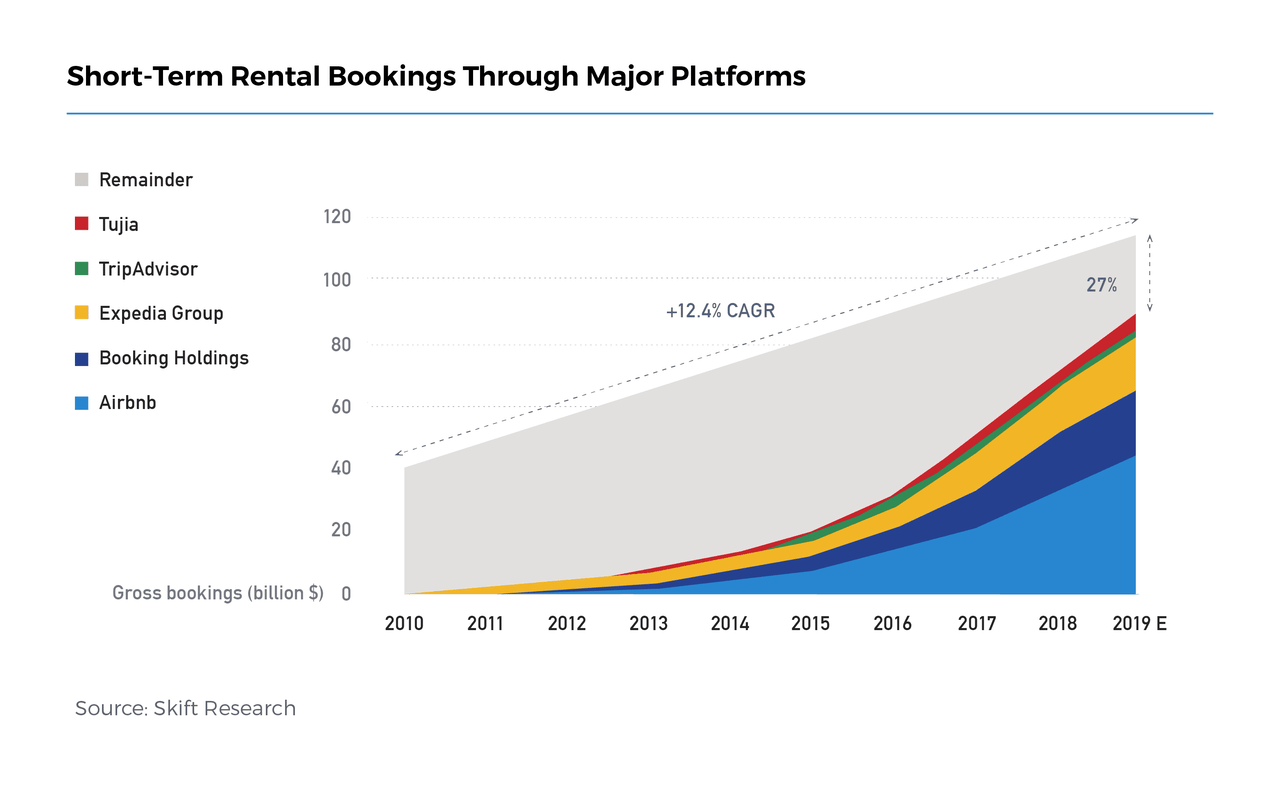

Airbnb’s network effect of amassing a tremendous number of hosts on their platform also creates a massive competitive advantage over their competitors, such as Expedia’s Vrbo (EXPE), because of the significantly better experience on a platform with more hosts. In addition, the short-term rental industry is still relatively new, with Airbnb being founded in 2007 and the platform reaching 1 million listings in 2011. The unreliability and lack of trust that is oftentimes associated with Airbnb will slowly dissipate, allowing Airbnb to take further market share from hotels. Brian Chesky, on many of the Airbnb earnings calls, repeatedly states that for every Airbnb check-in, there are 9 hotel check-ins, representing how, if Airbnb simply creates a scenario where out of 10 vacation guests, 2 or 3 of them choose Airbnb, their business can massively expand.

STR Growth + Market Share (Skift Research)

Another phenomenal component of Airbnb’s business is its ability to make additional money on its clients’ payments. When a guest initially reserves their Airbnb, they pay Airbnb that money upfront, yet Airbnb pays the hosts the money when the guest checks in. As a result, lead times on Airbnb bookings allow them to invest their guests’ money during the lead times and generate interest income (Airbnb generated over $800 million in interest income in the TTM). Airbnb also possesses a pristine balance sheet, with over $11 billion in cash and just $2 billion in convertible debt at a capped call price of over $360 a share. Airbnb is also able to generate a significant amount of cash, with them producing about $4.3 billion in free cash flow in the TTM, representing approximately a 41% free cash flow margin.

Lastly, although Airbnb does face competition from the likes of Vrbo and Booking, their first-mover advantage is instrumental as it allows them to capitalize on the network effect of their platform. Overall, I believe Airbnb has large long-term upside from these levels.

Recent Struggles

In their latest quarter, Airbnb’s stock suffered a large fall as a result of their Q2 results. Although the results were largely positive for the current quarter, the outlook was weaker than expected. In Airbnb’s Q2 release, they noted that they are seeing shorter lead times on bookings globally and signs of slowing US demand. Shorter lead times on bookings are bad for two reasons: not only is it a signal of slowing demand and consumer uncertainty about whether or not they want to/can travel far in advance, but shorter lead times also mean Airbnb has less time to capitalize on the period between when guests pay for their stay and check in.

A major headwind that Airbnb can face is shorter lead times, lower interest rates, and weakening demand, all of which can impair their free cash flow abilities. In my opinion, the biggest weakness in Airbnb’s business is the discretionary nature of the travel industry, which makes the business very susceptible to economic downturns.

Airbnb also guided for revenues to be between $3.67 billion and $3.73 billion for Q3, which represents growth of 8% to 10% YoY. Although Airbnb is evidently still growing, their growth rates have slowed down to the high single digits or low double digits, representing how this business may not warrant the premium multiple of a growth business anymore. Even with these recent struggles, I believe Airbnb still has a very compelling investment case, and if the stock continues to come down more, it is an opportunity to buy a great business at a great price.

Growth Opportunities

Airbnb has many growth opportunities which can allow them to continue expanding their business long into the future.

International Expansion

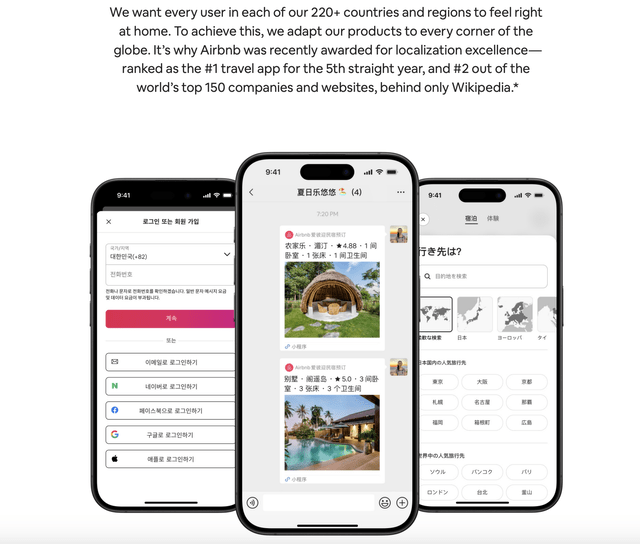

First, the growth opportunity where the benefits will be seen in the near future is the continued implementation of Airbnb’s international expansion. In their latest quarter, Airbnb noted how Latin America and Asia Pacific continue to be their fastest-growing regions. In the latest quarter, Airbnb generated $1.3 billion in revenue within North America (9.7% YoY growth), $1.048 billion in Europe, Middle East, and Africa (11.3% YoY growth), $185 million in Latin America (13.4% YoY growth), and $207 million in Asia Pacific (9.17% YoY growth). Evidently, there is strong growth across all regions throughout the world, but if Airbnb is able to successfully establish itself in under-penetrated markets and build up a strong base of hosts, it will have a strong competitive advantage over other competitors in the region.

Airbnb international platform (ABNB investor relations)

Moreover, many of their under-penetrated regions are already extremely popular travel destinations for US tourists. Furthermore, it’s outstanding that Airbnb has achieved a large scale of revenue from just US travel so far, considering how popular international travel is as well. Consumers are also more likely to deviate towards Airbnb for short-term rentals internationally as they are already familiar with the name, thereby helping Airbnb with its international expansion.

One hurdle that Airbnb faces with international expansion is the inherent uncertainty with staying in a random place in another country relative to doing so domestically. Individuals are already hesitant to use Airbnb because of the uncertainty domestically, yet that same uncertainty and reliability is further jeopardized internationally. As a result of these concerns, it leads me to believe that widespread adoption, both domestically and internationally, will still take many years to achieve due to the relatively new nature of the short-term rental industry in comparison to hotels. However, as time progresses and consumers become more familiar with short-term rentals, Airbnb is poised to dominate where people stay for vacations.

Take Rate Expansion + Advertising

Currently, Airbnb has a relatively modest take rate, which could be expanded in the future when the business further matures or Airbnb is able to better compete on prices with hotels. Currently, Airbnb charges a 3% service fee for hosts and a 14% fee for guests. Although Airbnb’s current take rates are reasonable and likely won’t be raised in the near future, which management has noted in earnings calls, once the short-term rental industry further matures, take rate expansion for both guests and hosts provides another avenue for Airbnb to grow.

The most critical element that would allow Airbnb to do this is the fact that if a host wants to list a short-term rental, Airbnb is the place to be due to the familiarity consumers have with Airbnb and the large number of hosts already on the platform. With these inherent advantages, Airbnb has reinforced its moat and pricing power.

Building off take rate expansion, another longer-term vision for accelerating growth is allowing hosts to advertise on Airbnb. Similar to how Amazon allows its sellers to advertise, Airbnb could allow its hosts to pay for advertising space as well, which opens up a completely new high-margin revenue stream. Advertising has been vaguely talked about in the past, but it is likely in the distant future due to Airbnb’s emphasis on the consumer experience and the negative impact advertising may present to it. In addition, advertising adds a commercial element to the platform, as larger hosts with multiple properties would be the primary users of such a service, which would be a negative factor for Airbnb as much of the strict regulation regarding short-term rentals has been a result of the commercialization component of residential properties.

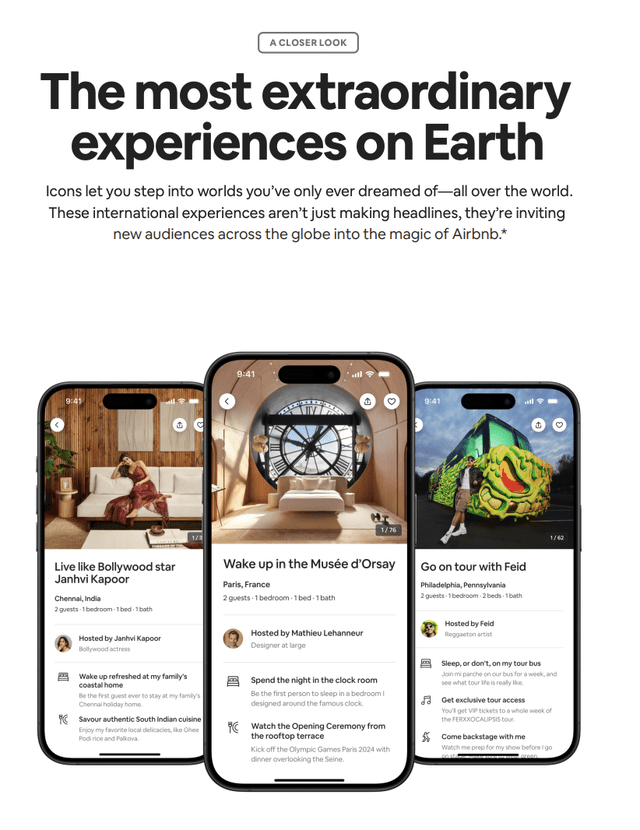

Segment Expansion

Another one of the largest growth avenues for Airbnb is moving beyond its core business and into other segments, especially long-term stays, which are rapidly growing and face less regulation. In their latest quarter, management spoke about potential new verticals and product launches: “So, the new Airbnb … will be about a lot more than short-term rentals. It’s going to be about long-term stays. It’s going to be our guest services, host services, and many new offerings.” The new segments will include a host marketplace, travel-related services for guests, and potential sponsored listings, all of which provide great growth avenues.

ABNB experiences (ABNB investor relations)

Fortress Balance Sheet

Furthermore, Airbnb’s balance sheet is also phenomenal, representing how they are well capitalized and ready to take advantage of potential future opportunities. Airbnb has $11.2 billion in cash & ST investments, with only $2 billion in debt. Airbnb’s $2 billion in debt is convertible debt with a 0.2% effective interest rate and an initial conversion price of $288, which is a ≈120% premium to its current price. Airbnb has also begun repurchasing its shares, as they have bought back $3.4 billion worth of stock in the TTM and have another $5.3 billion authorized in their share repurchase program.

Strong Margins + Capital Light Business

Airbnb has phenomenal margins. Airbnb’s gross margins are roughly 83% and in the TTM Airbnb generated $10.5 billion in revenue and $4.3 billion in free cash flow (FCF), representing a 41% FCF margin. Airbnb’s large FCF margins are due to the inherently low costs of its business (simply taking a fee on both sides of every transaction) while also generating interest on the capital they receive between when guests book their stay and when they check in (≈$800 million investment and interest income in the LTM). In terms of capital spend, Airbnb’s business has close to zero capital requirements, which has led to less than $50 million in capex spend over the past few years.

Valuation

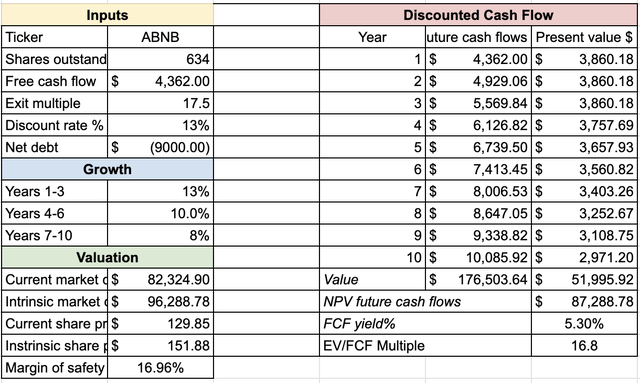

Essentially, Airbnb is an ≈$82 billion business, maintaining an $11 billion cash pile with just $2 billion in low-interest convertible debt, and $4.3 billion in cash flow, representing an EV/FCF of 17 in the LTM – a wonderful business at a fair price. For my valuation, I build out a discounted cash flow model. For their growth rates, I assumed they grow at 13% for the next 3 years as they expand into new segments and capitalize on international expansion, and then their growth rates slow down to 10% and 8% over the next 7 years as the market becomes more saturated and more competition continues to emerge. I used an exit multiple of 17.5 as I believe Airbnb is an above-average business in terms of their economic moat, growth prospects, and first-mover advantage. Lastly, I used a 13% discount rate to build in a margin of safety and because I want to beat the market when buying an individual stock.

ABNB DCF Model (Rasoli Research: Seeking Alpha)

Overall, although there is not a large margin of safety built in when buying the stock at current levels, due to the wonderful nature of Airbnb’s business a large margin of safety may not be required to buy the stock.

Risk Factors

Although there is significant upside with an investment in Airbnb and many positives, there are also significant risks that can jeopardize the investment thesis. For instance, Airbnb faces significant regulatory hurdles, as some cities believe that an influx in short-term housing supply is artificially suppressing supply for long-term rentals within areas that are already struggling with housing shortages. Such concerns have led to cities like New York placing heavy restrictions on Airbnb, making it very hard to operate there. Although such concerns have been proven false, as rent prices have continued to surge even with a ban on Airbnb, continued regulation could pose a threat.

Furthermore, there is also emerging competition from the likes of VRBO and Booking. However, I believe these threats are nothing to be worried about, as their percentage of unique listings compared to Airbnb is extremely low. When hosts first list a short-term rental, they almost always list on Airbnb first, after which they may list their property on one of Airbnb’s competitors as well. This has led to platforms such as Booking and VRBO having very few unique listings compared to Airbnb, forcing them to compete on price and spend large amounts of capital on advertising.

Final Thoughts

Overall, Airbnb is a phenomenal business which maintains major competitive advantages over its emerging rivals. Furthermore, they possess numerous avenues to accelerate their revenue growth in the long run and have many growth levers to pull over the foreseeable future. Overall, although their growth has slowed down in the short term, I believe Airbnb will be able to re-accelerate revenue growth and the threat of regulation and their competitors won’t have a significant impact on their business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABNB over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.