Summary:

- Airbnb reported great third quarter results with high growth rates for the top and bottom line.

- Despite hints for a slowdown of growth in the coming quarters, we can be confident about the long-term growth potential of Airbnb.

- Not only can Airbnb take additional market share and improve its margins further, the economic moat – based on network effects – should also lead to stable growth in the future.

- While we should be cautious about the negative effects a recession might have, Airbnb can be seen as slightly undervalued.

stockcam

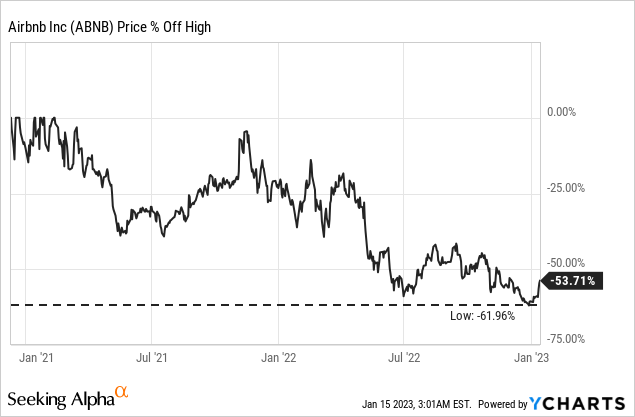

In my last article about Airbnb, Inc. (NASDAQ:ABNB), I already turned bullish on Airbnb as the stock declined from about $200 to $104 at the time of writing and the business improved. And now the stock is trading even slightly lower, and the business continues to improve – two aspects that should make us “more” bullish at this point. So, let’s take another look at Airbnb and determine if the stock is a clear buy right now or if we even have a bargain on our hands. And we start with the great third quarter results the business reported.

Quarterly Results

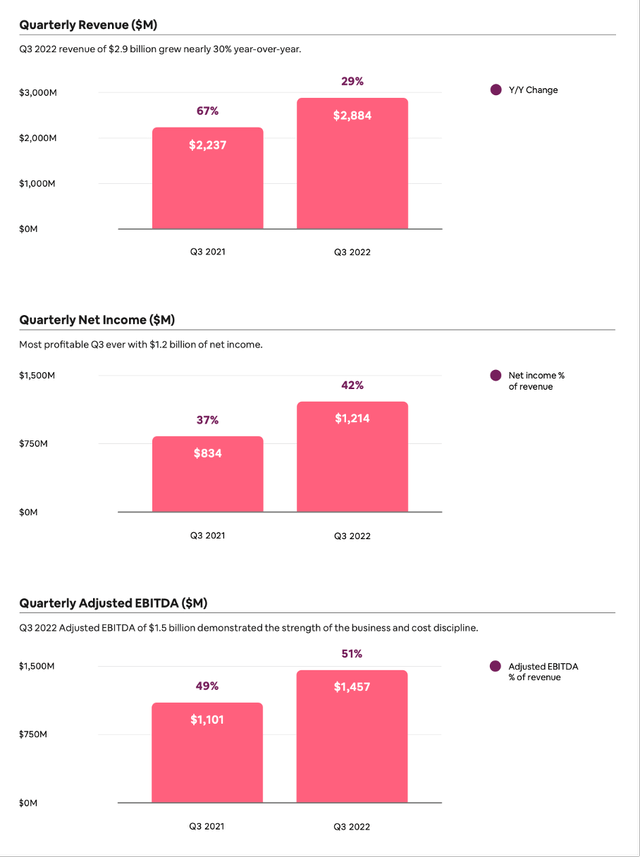

At the beginning of November 2022, Airbnb reported third quarter results for fiscal 2022 and the company did not only beat revenue estimates but also estimates for earnings per share. Revenue increased from $2,237 million in Q3/21 to $2,884 million in Q3/22 – resulting in 23.4% year-over-year growth. And while income from operations increased 41.2% year-over-year from $852 million to $1,203 million, diluted earnings per share even increased 46.7% year-over-year from $1.22 in Q3/21 to $1.79 in Q3/22. And finally, free cash flow even increased from $529 million in the same quarter last year to $960 million this quarter – resulting in 81.5% year-over-year growth.

Airbnb Q3/22 Shareholder Letter

When looking at additional data for the third quarter of fiscal 2022, Airbnb reported 99.7 million nights and experiences booked in Q3/22. While this is resulting in 25% year-over-year growth, the number this quarter was lower than in the previous two quarters. Airbnb could also grow its gross booking value (GBV) by 31% year-over-year, but once again reported lower numbers than in the previous two quarters. And gross booking value per night or experience was $156.44 compared to $149.15 in the same quarter last year.

When looking at the previous year, Airbnb also reported better numbers in Q2/21 than in Q3/21, but aside from gross booking value per night and experience, the numbers in the third quarter were better than in the first quarter.

New Hosts vs. Recession: Supply vs. Demand

Don’t get me wrong, Airbnb reported great results, but I also see the first signs for a slowdown. And as we are headed for a global recession (in my opinion), such a slowdown is not surprising. While the economy is still “intact” – low unemployment and only very limited layoffs so far – the huge problem in 2022 was the high inflation rate. It forced people to spend higher amounts on everyday items and as a consequence some might cut spending on leisure for example. People might travel less or go on vacation only for one week instead of two.

On the other hand, Airbnb is seeing the number of new hosts on Airbnb growing with a high pace. It seems like people are more interested in earning extra income through hosting – a trend Airbnb also witnessed in its first few years as the business was founded during the Great Financial Crisis. Especially in countries with high inflation rates, Airbnb is seeing strong growth rates of new hosts. And Airbnb is especially focusing on attracting new hosts by making it very easy for millions of people “to Airbnb” their homes (as part of the “Winter Release”).

But we should not get too optimistic about a growing number of hosts. While more and more hosts might turn to Airbnb to generate additional income in economic challenging times, we also need the people on the other side that are booking vacations and experiences and actually spending money. And chances are high that people will reducing spending during a recession.

Network Effects And Economic Moat

In the next few quarters – especially when the economy is entering a recession – the new hosts will not have much positive effect for Airbnb. However, it could be good for Airbnb’s business in the long run. After a potential recession, Airbnb could profit from additional hosts as it will strengthen the company’s network effects. In my first article about Airbnb, I already mentioned the economic moat around the business, which is mostly based on network effects. And these network effects are getting stronger and stronger with every new “dot” that is added to the network. And every additional dot on the supply side (host) as well as on the demand side (customer) will help and strengthen the network.

Airbnb’s economic moat is mostly based on network effects, but not just network effects. The company also has a well-known brand and in 2022, the company took the 54th spot on the list of most valuable brands in the world (according to Interbrand). And Airbnb will profit from its brand name as it can function as a short-cut and new customers might choose Airbnb as they are familiar with the brand and the brand name will lead to additional customers Airbnb might otherwise not have gotten.

Due to Airbnb’s short history (especially as a listed company), we don’t have a lot of performance metrics. We especially don’t have these metrics over a long time and stability and consistency are important characteristics for companies with a wide economic moat. And to judge that we need data for at least 10 years. But we can see the first hints and characteristics of a great business. Not only did Airbnb reported a return on invested capital of 21.20% in fiscal 2021, we also see a rather stable (or even improving) gross margin over the last five years. And Airbnb has extremely low capital expenditures, which is also a great sign for a high-quality business.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Gross Margin |

74.72% |

76.34% |

75.10% |

74.07% |

80.71% |

And Airbnb was also able to report a constantly improving operating margin in the last few years – which is also a good sign. But like I said, the data we have so far is not enough for a clear statement about a wide economic moat as we need at least 10 years of data in my opinion.

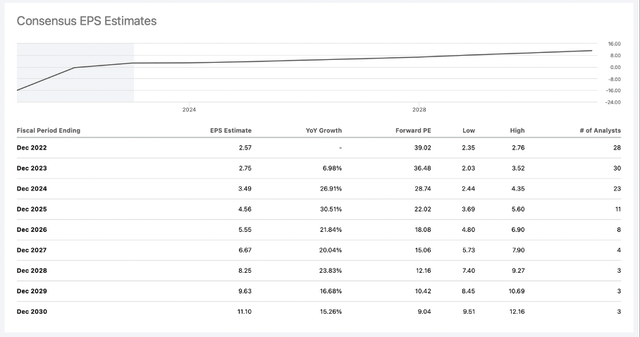

Growth

And the economic moat Airbnb most likely has around its business will also contribute to stable growth over the years to come. When looking at analysts’ estimates for the years to come we also see rather low growth rates for fiscal 2023 (consensus is 7% growth for earnings per share) – as analysts are probably also accounting for a potential recession in 2023. For the years following fiscal 2023, analysts are quite optimistic and expect a CAGR of 20% for the years between fiscal 2022 and fiscal 2030. Of course, growth rates will slow down over time.

Estimates for Airbnb (Seeking Alpha)

And although I can imagine – at least in theory – that Airbnb can grow 20% annually for the next decade, we must look at the different contributors and ask where that high growth rate might come from.

A first driver of growth is the underlying market, and it seems like most analysts assume mid-single digit growth rates for the next decade (or until 2030). One study is expecting the global vacation rental market to grow with a CAGR of 5.3% until fiscal 2030 and another study is seeing growth at an annual rate of 5.8% until fiscal 2030. And while these two studies assume more or less similar growth rates for the years to come, we can also find studies that estimate a CAGR of 12.4% from fiscal 2022 to fiscal 2031 for the global vacation rental market. In my opinion, mid-single digit growth is a realistic assumption for the years to come.

And for Airbnb we can not only assume that the company will be able to grow in-line with the overall market, but it might also be able to take market shares from its competitors. Airbnb has a market share of 20% and while this is already a rather high market share it is certainly possible to increase its market share in the years to come. Overall, I would assume that Airbnb will be able to increase its top line in the high-single digits in the next 5-10 years (on average). Analysts are even more optimistic and see Airbnb’s revenue growing in the double-digits. And we certainly can make the case for even higher growth rates for Airbnb’s top line. Aside from taking market shares from competitors, Airbnb can also grow its top line by taking higher fees and charging either the host or the guest higher fees. And while 15% already seems high, we should not forget that many other businesses take much higher fees (Apple (AAPL) is charging 30% in its app store). And with the network effects getting stronger and stronger and Airbnb becoming more dominant, it is also in a better position to raise its fees in the years to come.

Airbnb can also grow by expanding its business into new areas – this is a typical way how business can grow. For example, Airbnb expanded into “experiences” a few years ago. And management is still focusing more and more on expanding experiences (statement from last earnings call):

With regards to Experiences, to answer your question very simply, the great thing about Experiences is we don’t have to have very much incremental investment to make this work. It’s really just a matter of incorporating Experiences more into our existing marketing and incorporating Experiences more into our existing products. So I don’t think you will see that in the P&L from a cost perspective next year at all.

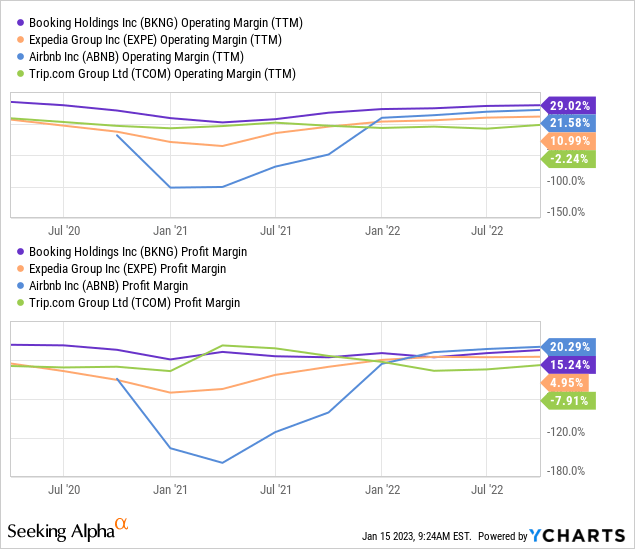

But Airbnb can not only grow by improving its top line over time. Like most other business, Airbnb can grow by lowering its expenses and therefore improve its margins. On the one side, Airbnb constantly improved its margins in the last few years and it seems likely for Airbnb to continue on that path. On the other hand, Airbnb already has a rather high operating margin when looking at the company’s peers and therefore we must ask the question how much higher the margins can be. I personally see Airbnb being able to improve its margin further as the business model seems to be built for high margins.

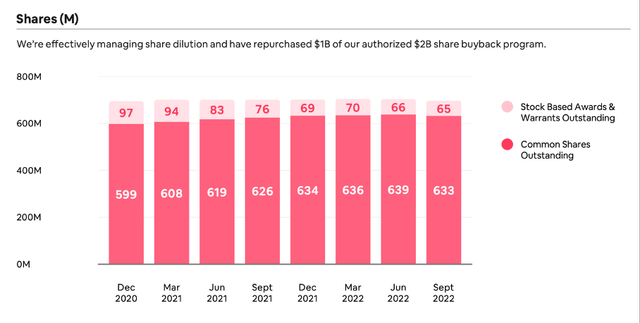

And finally, Airbnb can grow by lowering the number of outstanding shares. Over the last few quarters, the number of outstanding shares has been rather stable, but due to extremely low capital expenditures, Airbnb is generating huge amounts of free cash flow. And the company could use the generated cash to buy back shares (unless it finds better ways to use the cash). And with its current free cash flow, the company can also buy back about 5% of outstanding shares annually right now.

Airbnb Q3/22 Shareholder Letter

And when looking at the company’s balance sheet, we also see $7,524 million in cash and cash equivalents as well as $2,104 million in short-term marketable securities (on September 30, 2022). Those $9.6 billion in very liquid assets are enough to repurchase about 15% of outstanding shares. Of course, we should not ignore $1,986 million in long-term debt on the balance sheet, but even when subtracting that amount $7,642 million in very liquid assets remain.

Overall, growth rates of 20% seem achievable when combining the growth of the underlying market, gaining market shares, raising fees, lowering costs, and using share buybacks – but I would not calculate with such high growth rates to be honest.

Intrinsic Value Calculation

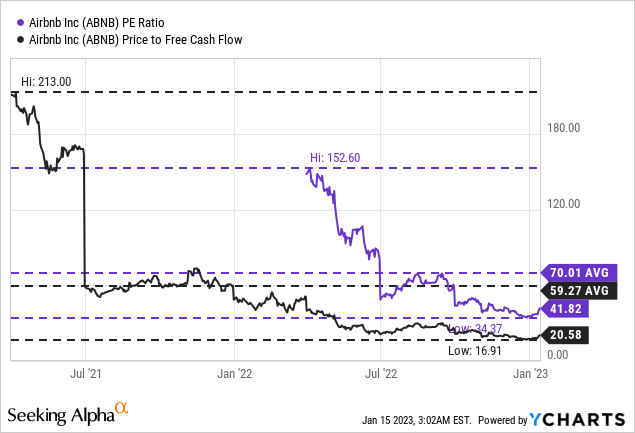

Airbnb might be a great business with the potential for rather high growth in the years to come and a wide economic moat around its business. However, to be also a great investment, the company must trade for the right price. And when looking at the price-earnings ratio of 42, Airbnb does not really appear cheap enough for a good investment. And the fact that the P/E ratio constantly declined over the last few quarters does not help much.

When looking at the price-free-cash-flow ratio instead, the picture gets a little different. Right now, Airbnb is trading for 20 times free cash flow and for a company that seems to be able to grow with a solid pace, a valuation multiple of 20 seems reasonable.

As always, I will also use a discount cash flow calculation to determine an intrinsic value for Airbnb. As basis for such a calculation, we can use the free cash flow of the last four quarters which was $3,328 million. And when calculating with a 10% discount rate and 680 million outstanding shares, Airbnb must grow its free cash flow only slightly above 5% in the years to come and until perpetuity. And a growth rate in the mid-single digits seems more than reasonable for Airbnb.

I have only one major issue with this calculation that is implying that Airbnb is undervalued. The free cash flow of $3,328 million is extremely high and I don’t know if that is a sustainable amount and a basis for a calculation. It is not only more than twice as high as the reported net income of $1,629 million in the last four quarter, it would also mean that more than 41% of revenues are ending up as free cash flow. And I am fully aware that Airbnb is not a capital-intensive business, but these would be impressive metrics. When taking the net income of the last four quarters as a basis (instead of the free cash flow), Airbnb must grow 13% annually for the next ten years followed by 6% till perpetuity to be fairly valued right now. Considering the growth rates that are possible (see section above), growth in the low-to-mid teens seems also possible and therefore Airbnb can be called at least fairly valued.

Conclusion

When looking at the business the way it presents itself right now, I am rather bullish about Airbnb. But I personally will not buy the stock at this point as the stock might decline lower in my opinion. And a leisure company is also belonging in the category of businesses I don’t want to buy on the eve of a potential global recession. Especially as I don’t know how Airbnb will perform during a recession: During the Great Financial Crisis Airbnb was just founded and the 2020 recession was probably not representative for the performance of Airbnb during a “normal” recession.

But we can’t ignore that Airbnb is trading for a reasonable price-free-cash-flow ratio and 5% annual growth also seems achievable for the business (also assuming the current free cash flow is sustainable). So, I would rate Airbnb as a cautious “Buy” once again as I see upside potential.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.