Summary:

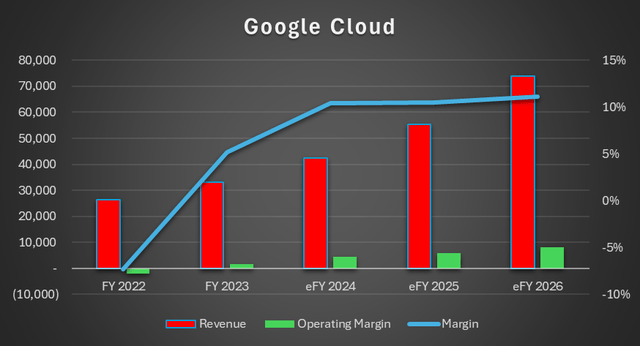

- Google’s cloud growth is strong but lags in profitability compared to peers. Scaling data center capacity may improve margins.

- Google’s AI integration in search, cloud, and advertising enhances productivity and profitability, with significant growth in Google Cloud and YouTube ad revenue.

- Google’s Vertex AI and Mandiant security integration strengthen its cloud offerings, appealing to developers and enterprises leveraging AI applications.

Boy Wirat

Google (NASDAQ:GOOG) has experienced reinvigorated growth across its segments as demand for GenAI has brought new life to the search platform. Google’s cloud niche is primarily with applications developers with 90% of AI applications being developed on Google’s cloud platform. Despite this stranglehold, Google’s cloud profitability significantly lags peer hyperscalers, suggesting that Google has yet to reach scale or runs at a higher cost. Despite the lower margins, Google’s cloud growth remains strong and may accelerate as Google scales its data centers. I recommend GOOG shares with a HOLD rating with a price target of $177/share at 15.27x eFY25 EV/EBITDA.

Google Operations

Google is heavily entrenching itself into the AI space in both the firm’s operations and search services as well as through their cloud platform for customers. Google is differentiating their cloud service offerings with their own AI models for customers to leverage with their own private data sets in order to execute a faster ramp-up. Though Google doesn’t offer as robust of enterprise service offerings in the cloud as Microsoft (MSFT) Azure, Google’s platform offers a strong product offering that may be appealing to applications developers and those seeking to leverage AI applications at the enterprise level.

One of the features Google offers users is Vertex. Vertex AI is Google’s training and inferencing platform for AI applications that allows users to collaborate using a common toolset. One of the features that Google has brought into the mix is the grounding feature, which provides the firm with data that can be tied to customers’ data sets to ensure accuracy.

One defining factor is Google’s integration of acquired Mandiant as an extra security layer on its cloud platform, considering that security is one of the biggest concerns for CIOs when migrating to cloud platforms. Having this extra layer for remediation adds a substantial safety net as breaches in today’s environment are expected. The dynamic for security posture hasn’t necessarily shifted away from a strong security posture, but rather, has an added emphasis on data resiliency. Given that Google is the largest search engine by scale, it is only appropriate that Mandiant has the capabilities of collecting threat intelligence for its own security AI models so as to prioritize threat mitigation.

Accordingly, management believes that 90% of the AI unicorns run on Google’s cloud for training and inferencing. Given that Google’s cloud platform supports open-source development, this has made Google an appropriate platform to host AI application development.

Google’s cloud is also heavily leveraged by the automotive OEMs for automotive development and for outward-facing autonomous call centers. On the testing side, Ford Motor Company (F) is using GenAI models in Google’s cloud to develop LLMs to help develop vehicle designs. OnStar is also using GenAI for call trees for its autonomous call center to triage roadside assistance.

Google primarily runs Nvidia (NVDA) H100 GPUs as well as its custom TPU and CPU chips in its data centers and provides consumption-based pricing for compute power. Management noted that the Blackwell platform will be available for cloud customers in early 2025.

The Google Axion Processor is Google Arm-based CPU design specifically for its cloud customers. According to Google, Axion offers 30% improved performance when compared to the fastest competitor in its cloud environment and 50% when compared to x86 CPUs. Axion also provides up to 60% better energy efficiency when compared to the x86 CPU.

Google’s Tensor Processing Unit, or TPU, is Trillium, the 6th generation of Google Cloud TPU. Accordingly, Trillium offers 4.7x improved peak performance per chip as compared to its TPU v5e. Trillium has double the HBM capacity and bandwidth as well as double the inter-chip interconnect bandwidth when compared to its previous iteration. Trillium was developed for scale, allowing for a single pod to contain up to 256 TPUs. Pods can be scaled from there when paired with Titanium Intelligence Processing Units, or IPUs, to allow for customers to leverage tens of thousands of chips in a multi-petabit-per-second data center network.

To support Google’s cloud offerings, the firm is expanding their data centers in Iowa, Virginia, and Ohio, and has developed a new data center and cloud region in Malaysia.

Google’s Gemini GenAI offering has scaled significantly with 1.5mm developers using Gemini for development. Google has scaled the accessibility of Gemini across search, workspace, and messages and is working to improve capabilities for Gmail and Google Photos for generative searches.

Google has also incorporated AI across its business offerings with 30 new advertising features to help advertisers more seamlessly create campaigns. This includes enhanced image editing tools to simplify the editing process. The firm has also enhanced its bidding tools for advertisers that are said to provide improved profitability as opposed to being revenue-oriented products.

YouTube is experiencing a strong uplift as advertisers migrate budgets from traditional linear TV to CTV. From an advertiser’s perspective, running ad campaigns on CTV can potentially be more profitable as ads can target the appropriate cohort of consumers when compared to broadcasting ads. I believe that the shift from linear to CTV should provide continued growth improvements for YouTube as viewership continues to dominate the CTV space.

On the device side of the business, Google recently introduced its Pixel 8a that features the Google Tensor G3 chip. This AI smartphone is enhanced with a Gemini-powered AI assistant and provides other AI-powered capabilities for search and images.

Google Financials

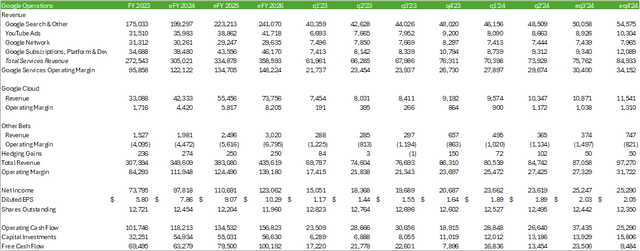

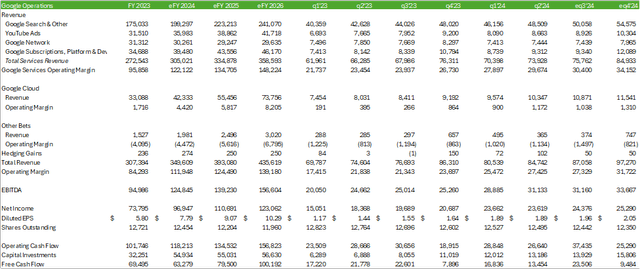

Looking to Google’s financial position, Google Services has experienced a reinvigorated growth rate since FY23 as the firm rolls out additional AI features across its various platforms, including search and YouTube advertising, as well as devices. This has also led to scaled margin improvements as AI has enabled improved productivity and in turn, profitability. Google Cloud has also experienced accelerated growth at 29% in q2’24. I suspect this trend will continue into e2h24 and beyond as Google expands its data center capacity to cater to the continued growing demand for AI applications.

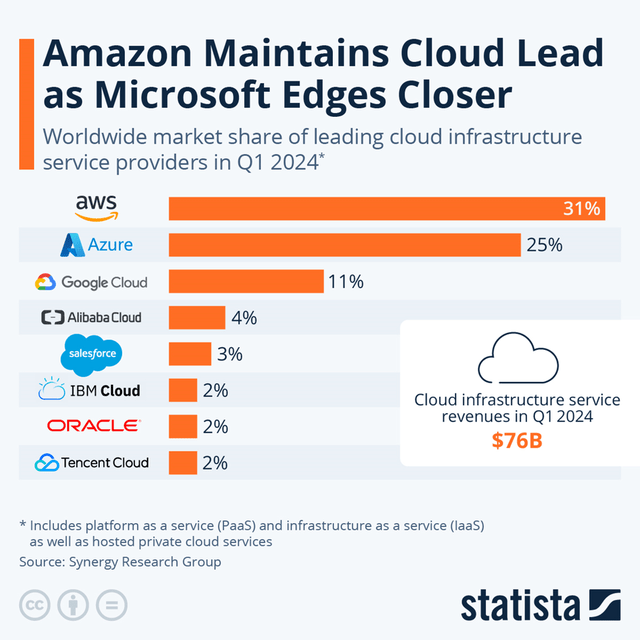

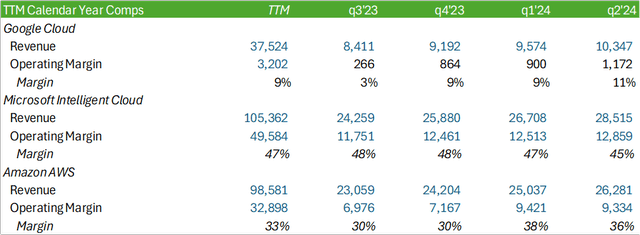

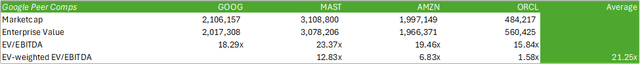

Comparing Google to Microsoft Azure and Amazon AWS (AMZN), Google is far behind in terms of scale and profitability for its cloud platform.

Google also lags in market share; however, Google has been experiencing a similar ramp-up in scale in tandem with the other hyperscalers. Perhaps Google will be a late bloomer and realize scaled operating margins in periods going forward as its data centers are scaled out.

For eq3’24, I’m forecasting Google to generate $87b in revenue with a diluted EPS of $1.96/share. This will translate to $349.6b in revenue and a diluted EPS of $7.79/share for eFY24. I have reason to believe that Google Cloud will remain a high-growth segment and may experience accelerated growth in eFY25 & eFY26 as the firm builds out additional capacity.

I’m forecasting Google Cloud to grow by 28% in eFY24 and accelerate to 31% & 33% in eFY25 & eFY26 on this basis. This assumption in part is driven by Mr. Satya’s comments, CEO of Microsoft, regarding demand outpacing compute supply. If this remains the case for AI applications developers, Google will likely experience a similar upswing growth as new AI-related applications are developed. This in part goes into my capital investment outlay going forward for Google as the firm builds out additional data center capacity to cater to growth.

Google Valuation & Shareholder Value

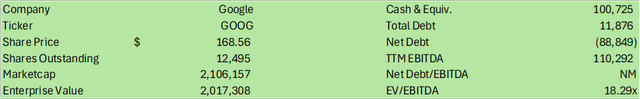

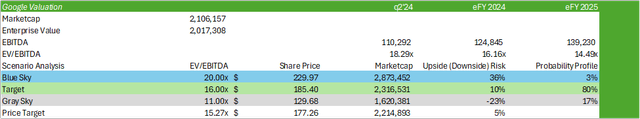

GOOG shares trade close to its historical midpoint at 18.29x TTM EV/EBITDA. GOOG shares trade below its peer average of 21.25x EV/EBITDA at a significant discount.

Though one may suspect that this can provide certain room for mean reversion, I believe the discount is justified given Google’s cloud margins trailing its peer hyperscalers. If Google picks up profitability margins for Google Cloud, I believe shares will have the potential to hold a richer valuation.

Valuing Google using an internal valuation method based on my EBITDA forecast and historical trading premiums, I believe Google shares are appropriately priced for my eFY25 forecast. I rate GOOG shares with a HOLD rating with a price target of $177/share at 15.27x eFY25 EV/EBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.