Summary:

- SolarEdge Technologies faces challenges with the CEO departure, Chinese competition, and inventory issues, despite promising smart energy technology and strong sell-through demand.

- The company under-shipped end-user demand by ~$275 million in Q2, with inventory clearing expected to extend into early 2025.

- The stock only trades at 0.5x sell-through sales, so investors should monitor the situation closely, looking for a turn.

husein signart/iStock via Getty Images

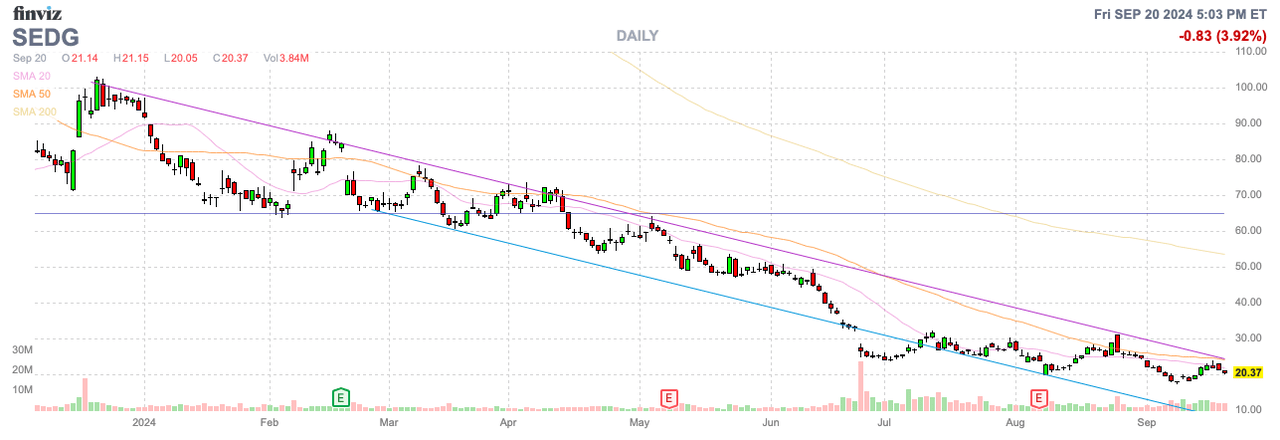

The solar sector recently got good news with a large 50 bps interest rate cut by the U.S. Fed, but the SolarEdge Technologies, Inc. (NASDAQ:SEDG) story appears grim to Wall St. The smart energy company recently saw the CEO quickly depart and Chinese competitors appear a big problem in very negative signs for the business. My investment thesis remains Neutral on the stock.

Big Negatives

The biggest negative is that CEO Zvi Lando stepped down as CEO a couple of weeks after the Q2’24 earnings report. The solar company had just again lowered expectations for future results far below consensus estimates.

SolarEdge has long promised the market of a scenario where quarterly demand was actually $400 to $500 million, when reported sales were struggling in the $200 million range. The company saw sales rebound in Q2 to $265 million, but SolarEdge again didn’t hike revenues to the actual sales projections due to lingering inventory issues.

The CEO that quickly built SolarEdge into a $300 stock, in part due to the benefits of Covid, is now jumping off the ship with the stock at $20. The company now has an interim CEO in Ronen Faier leaving the business in flux without a full-time CEO.

The other big negative news is that Jefferies actually downgraded the stock to Sell, with only a $17 price target. Analysts Dushyant Ailani and Paul Zimbardo suggest the recent RE+ solar industry event highlighted further inventory issues, along with severe competition from China.

The combination doesn’t signal a quick turnaround for SolarEdge, though interest rates were originally listed as one of the detrimental reasons for the slowdown in solar demand.

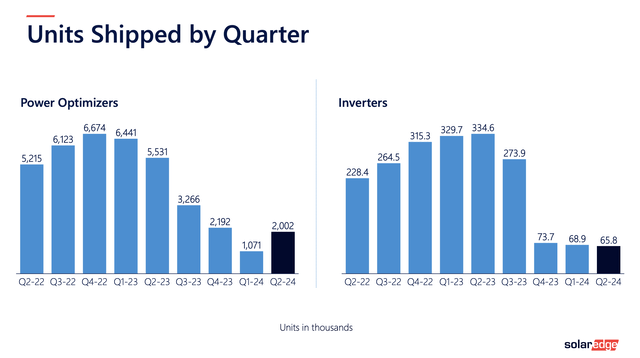

The smart energy company again saw weak sales with crucial solar system inverters. SolarEdge shipped 65.8K units in Q2, below the prior quarter levels. The company shipped over 300K inverter units for 3 consecutive quarters back starting in Q4’22.

Source: SolarEdge Tech. Q2’24 presentation

The company only saw reported sale growth via a rebound in power optimizers. SolarEdge doubled the units shipped in Q2 to 2 million.

Under Shipping Demand

The biggest issue is that SolarEdge continues to vastly under ship demand. The smart energy company reported sell-through for Q2 of ~$520 million, up 18% from the March quarter, leading to the company under shipping end-user demand by ~$275 million.

The odd part here is that actual demand in this range would be a good indication for the management team. The SolarEdge CEO shouldn’t be forced out in a disruptive scenario just due to short-term inventory issues with European distributors not surprisingly looking to over compensate by lowing inventory levels below prior norms.

On the Q2’24 earnings call, SolarEdge now ex-CEO Zvi Lando made the following statement:

In Europe, the clearing process will likely extend into the early part of 2025 due to the above-mentioned slower recovery and changing inventory holding behavior of distributors in the European markets who are targeting lower levels of days on hand compared to past practices.

What matters is the end user demand dynamics, with the company reporting the following quarterly numbers:

- Q3’24E: ~$275M, $200M+ under shipped

- Q2’24A: $265M, $275M under shipped

- Q1’24A: $200M, $250M+ under shipped

- Q4’23A: $316M, ~$200M under shipped

The big question is whether consumers in the West really want solar inverters and other smart energy products made by Chinese companies. Any systems controlling the power for a house or business is going to want smart energy controls from U.S. firms without risk of Chinese control, spying and cybersecurity attacks.

SolarEdge forecast a Q2’25 sales target in the $550 million range when the inventory clearing ends. The company continues to release new products and expand into battery storage, supporting even higher sales figures.

Though one odd part of the SolarEdge strategy was to offer discounts up to the high-single digit range, which doesn’t match as much with the premise that the issue is inventory clearing, especially in Europe. The company ended the quarter with 519 days of inventory amounting to ~$1.5 billion, further complicating the story, especially considering SolarEdge has new products like the 330-kilowatt inverter and the commercial battery requiring the production of new inventory.

The company has $814 million in cash and should be able to improve the cash flow position by monetizing the large inventory balance. Management forecasts another $70 to $90 million cash burn in Q3 turning towards breakeven levels at year-end with an estimate for ~$100 million in cash burn prior to turning cash flow positive in early 2025.

In essence, SolarEdge has the sell-through demand and new smart energy products to warrant a higher stock. The issue is the sudden CEO departure, along with questions on Chinese competition and lingering inventory problems.

Takeaway

The Key investor takeaway is that investors should continue monitoring the situation at SolarEdge Technologies. The company has promising smart energy technology and sell-through sales equal a stock valuation of 0.5x sales.

As long as the sudden CEO departure wasn’t indicative of further problems under the surface, I believe SolarEdge will quickly turn into a buy. Ultimately, though, the stock isn’t likely to rally until early in 2025 when the inventory issue fully corrects and the company can finally return to reporting normal shipments and sales.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market in September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.