Summary:

- SolarEdge Technologies reported Q2 2024 results largely in line with the disclosures made in conjunction with the company’s $300 million convertible notes offering in June.

- While revenues were up by almost 30% sequentially, gross margin remained negative and the company continued to burn sizeable amounts of cash.

- Cash flow remains a crucial issue as the company is facing a $347.5 million convertible notes maturity next year.

- On the conference call, management projected further gradual improvement, but Monday’s abrupt CEO resignation adds more uncertainty to an already weak story.

- Given these issues and with Q3 likely being a kitchen sink quarter in order to clean up things for the incoming CEO, I am reiterating my “Sell” rating on SEDG stock.

romaset

Note:

I have covered SolarEdge Technologies, Inc. (NASDAQ:SEDG) or “SolarEdge” previously, so investors should view this as an update to my earlier article on the company.

SolarEdge Technologies Q2 Earnings & Q3 Guidance:

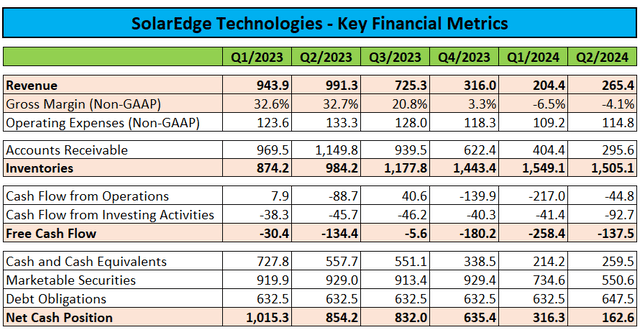

Earlier this month, SolarEdge Technologies reported Q2 2024 results largely in line with the disclosures made in conjunction with the company’s $300 million convertible notes offering in June:

Company Press Releases / Regulatory Filings

Revenues were up by almost 30% sequentially but still down 73% on a year-over-year basis as in contrast to the United States, channel inventories in Europe will take more time to normalize.

We are encouraged by our second quarter top line results which saw sequential revenue growth of 30% and an 18% growth in sell through of our solar products by our distributor customers (…)

While we expect undershipping to continue in the third quarter, we believe the momentum in our underlying business and the actions we are taking to gain market share and address new growth segments will enable a return to higher revenue levels once inventories are cleared in the first half of 2025.

Gross margins remained in negative territory and while accounts receivable decreased further, SolarEdge continued to burn substantial amounts of cash.

With proceeds from the recent 2029 2.25% convertible notes offering mostly used for the partial repurchase of the company’s 2025 0.00% convertible notes, liquidity benefits remained limited.

During Q2, the company also utilized $17 million in cash for the repurchase of approximately 250,000 shares at an average purchase price of $68.70 (!) per share.

SolarEdge finished the quarter with $810.1 million in cash and liquid investments and $647.5 million in debt. Subsequent to quarter-end, the company issued another $37 million in 2029 convertible notes due to initial purchasers exercising the overallotment option.

In the press release, the company also provided guidance for the third quarter:

- Revenues to be within a range of $260 million to $290 million

- Non-GAAP gross margin in a range of negative 3% to positive 1%, including approximately 560 basis points of net IRA manufacturing tax credit

- Non-GAAP operating expenses in a range of $111 million to $116 million

On the conference call, management also stated expectations for negative free cash flow between $70 million and $90 million with another reduction anticipated for Q4.

Free cash flow is projected to turn positive in the first half of 2025 which is basically an imperative for the company as SolarEdge will have to repay the remaining 347.5 million in 2025 convertible notes by the end of Q3 2025.

Adding insult to injury, management also warned of potential impairment charges in the third quarter:

(…) in light of the decline in our stock price and as a result of our market capitalization, we intend to conduct an in-depth evaluation of the book value of our assets in the third quarter to determine whether impairment of certain items is required. We will give an update on this impairment testing on our next earnings call and in our Form 10-Q for the third quarter.

While shares plunged to new multi-year lows below $20 in reaction to the company’s results and outlook, the stock has recovered alongside the general market in recent weeks. On Friday, SolarEdge’s shares jumped by 15% on renewed hopes for interest rate cuts.

SolarEdge CEO Resignation

The rally continued in Monday’s pre-market session as investors seemingly cheered the surprise resignation of SolarEdge’s long-standing CEO Zvi Lando:

SolarEdge Technologies (…) announced that Zvi Lando has stepped down as SolarEdge’s Chief Executive Officer. The Company’s Board of Directors has initiated a search for a new CEO with the support of a leading global executive search firm, and has appointed Ronen Faier, previously Chief Financial Officer, to serve as Interim Chief Executive Officer, effective today. Zvi Lando will remain a member of the Board of Directors. He will also serve as an advisor to the management team to support the leadership transition.

In conjunction with this transition and as part of the Company’s CFO transition plan, the Board of Directors has appointed Ariel Porat, formerly the Company’s Senior Vice President of Finance, to serve as Chief Financial Officer, effective today.

At the opening, shares briefly eclipsed $31 but quickly reversed course thus erasing most of Friday’s gains by midday.

At least in my opinion, an abrupt CEO resignation is almost always a cause for concern, particularly with the company’s business expected to recover going into 2025. But with the board of directors apparently having demanded a quick change at the helm, SolarEdge’s Q3 results and medium-term outlook might turn out to be weaker than expected.

With the former CFO taking over on an interim basis, I would expect Q3 to be a kitchen sink quarter with massive impairment charges and cash usage at or even above the high end of expectations.

Given the 2025 convertible notes maturity, cash flow remains an all-important issue for the company. For my part, I wouldn’t be surprised to see new management coming to market with an equity offering should the company’s cash flow trajectory not turn out as projected.

Bottom Line

SolarEdge Technologies reported Q2 2024 results largely in line with its late June preannouncement. While revenues and cash flows are expected to improve gradually over the next couple of quarters, the company continues to operate in a challenging market environment.

While improved sentiment and renewed hopes for near-term interest rate cuts have resulted in shares recovering from recent multi-year lows, I consider Monday’s abrupt CEO resignation a cause for concern.

At least in my opinion, new management will likely use the Q3 report to clean up legacy issues which could result in substantial goodwill, equipment, and bad debt impairment charges.

Depending on the company’s cash flow performance, an equity raise might also be in the cards.

Given these uncertainties, I am reiterating my “Sell” rating on SEDG shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.