Summary:

- Snowflake is facing budget competition from GenAI, leading to a ~40% stock decline, prompting a $2.5B share buyback and $2.3B convertible senior notes issuance.

- The zero-coupon convertible bonds, maturing in 2027 and 2029, offer cheap liquidity and minimal dilution, contingent on a +40% stock rally from $112.50.

- Snowflake aims to use the bond proceeds for share buybacks and strategic acquisitions, enhancing its competitive edge and product innovation in the GenAI space.

- Despite Q2 underperformance, Snowflake’s double-digit growth and TAM expansion support a Buy rating, with a projected 33-35% upside and minimal dilution impact.

Klaus Vedfelt

Investment Thesis

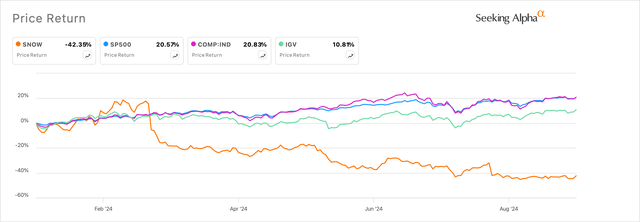

Data analytics cloud software giant Snowflake (NYSE:SNOW) continues to be caught in the crosshairs of the software versus GenAI budget rivalry, which has caused many software stocks to become laggards in 2024.

Many software companies continue to lag the broader markets as GenAI captures a larger share of the enterprise CIO’s budgets, leaving companies such as Snowflake fighting for more budget dollars.

With Snowflake’s stock down ~40% for the year, management has decided to act on a couple of fronts in addition to ramping up their product innovation efforts.

Exhibit A: Snowflake continues to lag the market significantly in 2024 (Seeking Alpha)

On one hand, management has announced a new $2.5 billion share buyback program to return capital to shareholders, while on the other hand, the company recently privately issued $2.3 billion in convertible senior notes due 2027-2029.

The private issuance of the senior notes does look dilutionary at first. But a deeper analysis shows that investors would still be able to benefit from the issuance of notes, as I explained below. The debt issuance will enable the company to better compete for its market leadership, as I had explained in my previous coverage on Snowflake.

I continue to recommend Snowflake as a Buy.

The $2B Debt Issuance & Its Impact On Snowflake

Last month, Snowflake announced that the company would follow through with its debt issuance process of raising $2 billion in senior notes that would mature between 2027 and 2029.

Per the company, these notes are designed to be convertible bonds with zero coupon payments, which is actually a rare feat for the company to achieve given that the current interest rate environment can fetch at least 4-5% in the bond markets. Right out of the gate, the company incurs almost no interest expenses that would have, otherwise, depressed Snowflake’s earnings per share available to its shareholders and reduced the company’s valuation premium.

Snowflake will issue these convertible bonds in two cohorts: the first billion dollars of convertibles mature in October 2027 and the remaining billion dollars of convertibles mature in October 2029, assuming none of these bonds are converted, redeemed, or repurchased at an earlier date.

The structure of Snowflake’s bonds stipulates that its bondholders will get shares in Snowflake’s stock only if the company’s stock rallies over 40% since the price of Snowflake’s stock on September 24, 2024, which was $112.50 per share at close on that day. In that case, bondholders are allocated ~6.35 shares for every $1000 principal of 2027 and 2029 notes. I estimate the consolidated impact from the dilution in 2029 to be ~12.7-15 million shares, which may dilute Snowflake’s current shares outstanding of ~332 million by an additional 3.5-4.5% down the road.

In my opinion, this is a sharp move by Snowflake’s long-standing CFO, Mike Scarpelli, giving the company access to relatively cheap liquidity in a moderate interest rate environment. The company has mentioned they will utilize the capital to finance another half a billion dollars’ worth of share buyback programs, on top of the $2.5 billion share buyback program that was announced during the Q2 FY25 earnings call last month.

Moreover, investors must note that the company still has another half a billion dollars’ worth of dry powder remaining to buy back shares from a previous buyback program, which must be utilized by March next year.

In addition to share buybacks, Snowflake also plans to utilize the proceeds from its convertible bond issuance to finance “acquisitions or strategic investments in complementary businesses or technologies,” something that is required to stave off competition from peers such as Databricks.

I had noted in my previous coverage on Snowflake’s Analyst Day this year as to how I was encouraged by the company’s product innovation and product roadmap that was getting stronger and aligning the company as a GenAI-focused data services company. I mentioned how the company’s products, such as Iceberg, Unstructured Data, etc., were designed for heavy query usage, ideal for large models to query Snowflake data.

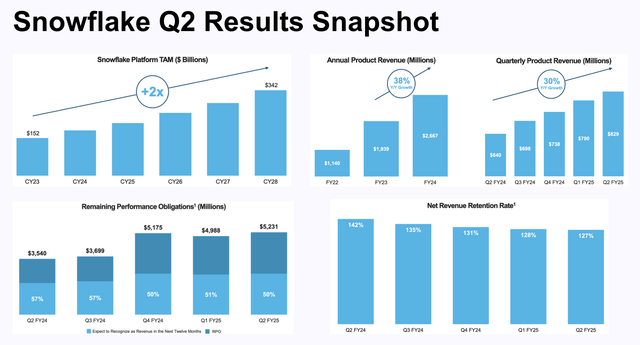

The company’s Q2 results failed to pack the punch that market participants were looking for, but the company is still posting a strong double-digit growth rate in excess of 25% with a superior net retention rate supported by continued market penetration and TAM expansion.

Exhibit B: Snowflake’s Q2 snapshot reveals strong double digit growth rates. (Company Presentations)

Snowflake continues to trade at a discount

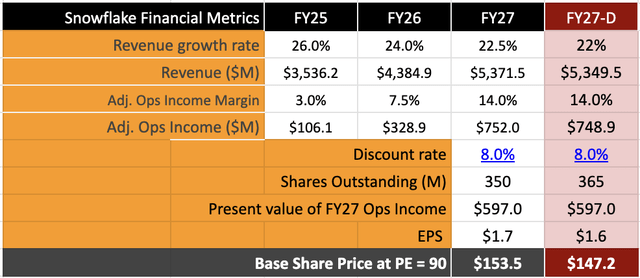

I expect Snowflake to post 24-26% CAGR growth rates in sales through FY27. Note that these growth rates do not factor in any deeper penetration from the company’s slew of products that will be launched over the next 12 months. So these are conservative growth estimates.

Snowflake is guiding for operating margins to drop to 3% this year, but I see them expanding next year again, which should boost the value proposition for Snowflake’s stock. The CAGR growth rates in adj. operating income is expected to be near ~50% CAGR levels.

I had assumed a discount rate of 8% and a share dilution rate of 2.5%. But I expect an additional 3.5% in dilution in case Snowflake’s stock crosses the $157.50 level and trades above that for at least 20 days, as pointed out earlier.

Exhibit D: Snowflake’s Valuation Shows Upside Despite the Issuance of $2B in Debt (Author)

Given the +45% CAGR growth rates in its adj. earnings through FY27, Snowflake should command an earnings premium of ~90x, which implies 33-35% upside from current levels. Given the upside that I expect, I do not believe there would be any dilutionary effects from the convertible bonds that Snowflake issued. However, if investors are still interested in understanding the impact, one can observe how the impacts are minimal based on these growth assumptions.

Risks & Other Factors To Be Aware Of

The total convertible bonds issued by Snowflake could go up to a maximum of $2.3 billion due to the additional caveats that the company has in place through the process. Snowflake has granted the bondholders that participate in the bond buying process the options to purchase an additional $300 million in principal, and those options need to be exercised within two weeks since the original bonds were issued on September 24. That would push the company’s share dilution towards the upper end of the 12.7–15 million range I had specified earlier.

Moreover, if Snowflake’s stock trades above certain price levels, over and above $250, consistently for 20 trading days out of a 30-day trading calendar month, then the company will be forced to buy back some or all of its convertible bonds plus any interest it decides to pay its bondholders. On that note, the company has mentioned that although the bonds issued are zero-coupon bonds, the company may decide to pay some interest to bondholders, which it hasn’t specified at this time.

Takeaway

I do not see material risk from the issuance of the convertible bonds that Snowflake has issued, and assuming that the company continues its efforts to sustain high levels of product innovation while expanding TAM, I do not have any reason to believe Snowflake’s growth rates will be affected.

I reiterate my Buy rating on Snowflake.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.