Summary:

- Despite a slight delivery miss, Tesla’s Q3 results show strong growth, with Model 3 and Model Y deliveries driving overall year-over-year sales up by 6%.

- Market pessimism overlooks Tesla’s innovation roadmap, including autonomous driving and energy storage, which I believe still offer significant upside potential.

- Tesla’s valuation appears high by traditional metrics, but a sum-of-the-parts analysis reveals undervaluation. I believe we have 13% upside in shares.

- Risks from Chinese competition and geopolitical tensions exist, but Tesla’s strategic moves and China’s economic recovery provide a positive outlook for demand.

BING-JHEN HONG/iStock Editorial via Getty Images

Investment Thesis

Despite an initial selloff last week due to the deliveries announcement, Tesla (NASDAQ:TSLA) shares have jumped by 7.75% since my last coverage, out-pacing the market’s return of 5.26%.

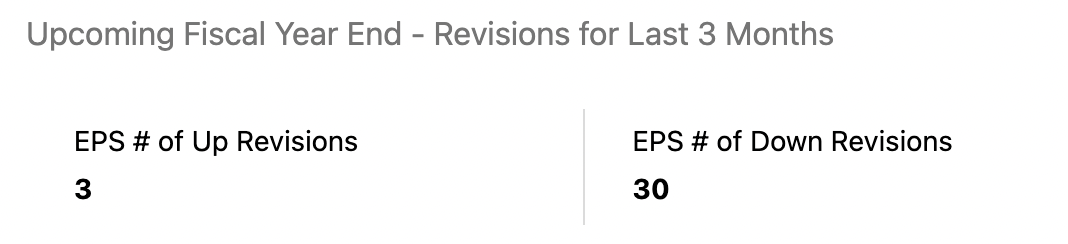

Yet even with the solid upward price action, market sentiment still seems too pessimistic due to 30 separate downward earnings revisions.

EPS Revisions (Seeking Alpha)

Tesla’s slightly lower-than-expected Q3 delivery numbers of 462,890 have renewed investor concerns that we may be near “peak EV demand” in the US. I disagree. I think under the hood (no pun intended) there was a lot to like in this report. Coupled with the upcoming robotaxi day on October 10th and I think there is still a lot of upside here.

I am still bullish on the EV giant even after the most recent delivery data. In my view, the pessimism surrounding earnings revisions and the slight delivery miss fails to consider Tesla’s larger innovation roadmap, which includes autonomous driving and energy storage solutions. In the meantime, Tesla really honed in on selling the right types of vehicles this past quarter (the next generation ones).

Given this, I continue to be a strong buy on shares.

Why I’m Doing Follow-up Coverage

In my last coverage on Tesla after their Q2 results, I noted that the EV company booked record revenues despite concerns over lower margins (and overall street pessimism).

Earlier last week, Tesla shares sold off after the company reported slightly lower-than-expected Q3 delivery numbers, missing analysts’ forecasts by about 1,000 vehicles. In my view, this market reaction completely misses the point. The company delivered more than 460,000 vehicles, which pushed year-over-year sales upward. And, if we dive deeper, this really was a minor shortfall overall, especially considering that the vehicles which needed to perform well, such as the Model 3 and Model Y, accounted for nearly 95% of the total deliveries. These vehicle beat by a total of about 4,000 units.

I think the market’s reaction appears overly focused on the small miss in deliveries (on mainly older units) rather than Tesla’s real strategy. Tesla’s long-term plan is to prioritize high-volume models with an emphasis on affordability. Their goal is to put as much of their hardware in as many garages across the US and the globe. Then new software tools will make each car an even bigger opportunity to upsell software to.

With the highly anticipated Robotaxi event coming soon, I think this pessimism is overdone. The event should prove the company’s investments in autonomous technology are finally paying off. In my view, the slight delivery miss will not affect Tesla’s overall growth as they continue to expand into new areas like autonomous driving.

Deliveries Deep Dive

Tesla’s stock fell sharply after the company missed its Q3 delivery estimates, dropping as much as 3.5% initially last week. Deliveries came in slightly below Wall Street’s expectations, with analysts forecasting 463,893 vehicles. Some independent estimates were even higher, such as the aggressive 470,000 from Barclays and UBS, and another independent analyst estimating 472,000 deliveries (meaning the whisper number was even higher than the actual mean estimate).

To be clear, Tesla’s stock was on a tear, gaining 32.21% in Q3, on the back of the company’s strength of their more affordable Model 3 and Model Y vehicle lines, which further stressed the challenge in sustaining margins while ramping up volume to new records.

Analysts have been concerned about increasing competition, particularly in China, where companies like BYD continue to pressure Tesla’s market share. The market is clearly more saturated than it’s been before. Is Tesla holding up to the new competition?

I think the answer is a resounding yes. Deliveries were still a 6% increase year-over-year, and now the company is seeing much higher take rates on these new cars for software services like FSD 12. This is a big reason I think the pessimism here is misplaced. FSD 12 (as I wrote about late last year) is already giving millions of Tesla car owners the ability to experience their car radically differently. The upcoming Robotaxi event will add to this value proposition through even better autonomous driving tech.

Production numbers offer additional insight into Tesla’s operations and tell me the company is firing on all cylinders (in an ironic pun). The company produced 469,796 vehicles in Q3, up by 9.1% compared to the previous quarter.

While the company does not break out Cybertruck numbers (and these are technically hidden in the category that missed along with the Model X, S, Semi and the Cybertruck) I’m not concerned about demand here. Much like the Model 3 in 2017/2018, it takes a while for this to ramp up.

In my opinion, I think the delivery miss was more an indication of a mismatch in logistics vs slower-than-expected demand.

Tesla is clearly more focused on the mass-market appeal of Model 3 and Y now (and this makes sense).

Put it this way: you can only sell one FSD 12 subscription per car. And given that software revenue is a big part of the future of Tesla’s margins and growth, wouldn’t you rather sell more lower priced vehicles today (with maybe slightly lower margins) to pick up the software revenue later?

FSD 12 costs $99.99/month. After 12 months you’re adding $1200 to the lifetime revenue from the vehicle for Tesla.

After 5 years this is an additional $6,000. This is a high margin software product so this mainly flows right down to the bottom line.

Valuation

For anyone who has been following the EV maker’s stock, Tesla’s valuation often appears inflated based on traditional valuation metrics. Their forward P/E ratio sits at 109.27, which is 537.83% higher than the sector median of 17.13.

Anyone who wants to buy Tesla stock based on traditional valuation multiples is either ruled out here, or has to take a different approach to valuing the company. I tend to take the latter.

Despite these seemingly high multiples, I still think Tesla shares are undervalued when factoring in a sum-of-the-parts (SOTP) analysis.

Previously, I broke down Tesla’s value not just by their electric vehicle business, but also by emerging segments such as energy storage, autonomous driving, and future robotaxi potential. I really think these ventures hold greater long-term value.

If we revisit my prior SOTP analysis, which included estimates for Tesla’s autonomous vehicle market share, energy business, and AI initiatives like Optimus, I projected a base case valuation of $655 billion. Then in July, I factored in Tesla’s ability to capture about 50% of the expected $160 billion robotaxi market by 2030, giving the company an additional market cap upside of approximately $225 billion. This brought Tesla’s overall potential valuation to roughly $880 billion, compared to their current market cap of about $798.92 billion. Assuming shares converge on that valuation, this would’ve implied potential upside of around 10.14% from current levels given my August valuation estimate.

What I want to focus on with this estimate however, is that I think we really had some solid growth inside the auto business with deliveries this quarter especially if we look at Model 3 and Model Y volume growth.

Personally, before this delivery report I valued the aggregate of the auto business at roughly $455 billion of the total of $880 billion. Now, I think we should see another 5% bump here in valuation. I think this report de-risks a good part of the middle price-range EV demand globally. It shows that this group has not exhausted their dreams to drive a Tesla and therefore are pushind sales to accelerate.

If we add 5% of $455 billion to the total valuation we get a blended valuation of $902.75 billion. This new SOTP valuation implies about 13% upside in shares.

Risks

Chinese demand remains a key part of Tesla’s growth story. The East Asian country is the world’s largest adopter of EVs and it’s also where Tesla faces the biggest head winds from a weaker consumer and much more stiff competition.

In fact, Tesla has been able to keep its margins relatively competitive despite a global slowdown in EV demand, due in large part to the scale and lower production costs in China.

The newest risk to this mix are the increasing geopolitical tensions between the West and China over Taiwan. Tesla has actually already asked their suppliers to look for ways to build components and parts outside of both China and Taiwan by as early as 2025. Tesla’s China demand could be at risk if we see tensions heat up, but Musk & Co. is trying to remove the supply chain risk. I think this is pragmatic and reflects how he operates.

I think Elon Musk has done a fantastic job managing Tesla’s relationships in China. Musk carefully incorporated China’s industrial goals along with expanding Tesla’s presence in the region, which has helped mitigate political risks. Tesla China has also offered 0% interest rate loans for up to 5 years to lure demand. This seems to be helping.

Add to this the recent signs of a recovery in the Chinese economy and I think this offers a positive backdrop for consumer demand. After a sluggish performance earlier this year, China’s economy has shown signs of stabilizing, with increased government support aimed at boosting consumer spending. I wrote about this last week on copper miner Freeport-McMoRan who is also heavily exposed to China. I think the stimulus efforts in China this time around will prove to be more durable. This will make the consumer healthier (and should help Tesla).

As I mentioned before, earnings revisions really do not indicate the market is fully pricing in a stronger Chinese consumer. Tesla’s EPS estimates have been revised down 30 times downwards in recent months.

In essence, I think Tesla is doing the right stuff to get more Model 3’s, Model Y’s, and the new Cybertruck into consumers’ hands, even if margins are a little smaller right now. Their software sales should pick up, this will fundamentally change the business.

For me, this is why deliveries were not bad at all.

Bottom Line

Tesla’s recent delivery numbers, while slightly below aggressive estimates, were far from disappointing when analyzed more closely. Their delivery numbers in Q3 still represented roughly 6% year-over-year growth. The bulk of the deliveries were made up of the Model 3 and Model Y which is what the company needs to be pushing for anyway. I think the recent selloff offers a favorable entry point for investors with strong tailwinds ahead, such as the robotaxi event. I still think Tesla is a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.